China Digital

The Rise of Pear Video (梨视频): Making Short News Videos Trending on Chinese Social Media

Pear Video (梨视频) is the new kid on the block in the pool of China’s many digital news platforms.

Published

7 years agoon

Pear Video (梨视频) is the new kid on the block in the pool of China’s many digital news platforms. Its rise is noteworthy as it comes at a time when authorities are strengthening regulations on the media sharing ‘non-official’ news videos. Does Pear Video show the way China’s new media is going?

Over the past few months, the promotion and popularity of Chinese video news platform Pear Video (梨视频) has been exponentially growing on China’s various social media platforms. Its rise is noteworthy, especially after Chinese authorities announced new regulations concerning the sharing of ‘unofficial’ online news videos in December of 2016.

According to The Guardian, the new regulations block public (media) accounts on platforms such as WeChat and Weibo from (re)posting “user-generated audio or video” (Haas 2016).

Chinese media sources (e.g. Sina News) reported that these regulations are specifically about user-generated news that focuses on current politics “and such.”

Short videos have become an increasingly popular tool in the world of Chinese media, with short news video platforms like Kanka News (@看看新闻) having thousands of followers on Chinese social media.

WHAT IS PEAR VIDEO?

“China’s leading short news video platform.”

Pear Video calls itself “China’s leading short news video platform” (梨视频是中国领先的资讯短视频平台). With an app and ultra-short informative news clips, it is a digital video platform that is specifically aimed at mobile users.

The company was established in September 2016. It was founded by Qiu Bing, former CEO of Chinese media outlet The Paper. In its official description on its website and Facebook, it states that it has received an investment of over one hundred million RMB (±14.4M$) by China Media Capital, and that its team consists of over 200 members, allegedly producing 200 news videos every day.

The company also states that its team members come from media companies such as, among others, The Paper (澎湃) and the Shanghai Media Group.

Pear Video’s clips often, even daily, make it to the top trending lists of Sina Weibo, recent examples being the video about a pet dog killed by a local guard, a clip on pole-dancing girls at a Taiwanese official funeral, or the report about a man injured during the anti-Japanese protests of 2012.

Pear Video mainly focuses on society, entertainment, and tech news. Besides the more local news, Pear Video also reports on international news, such as developments regarding Trump and Jack Ma, or more marginal news that has become trending in Europe or America.

Pear Video currently has a fanbase of 340.000 on its official Weibo account, but since they are also active on WeChat, their own app, Facebook, YouTube, and other social media platforms, the company currently has a reach of millions – and is growing explosively.

The formula is clean and simple: Pear Video brings news in short edited clips, usually less than a minute, showing news footage and audio with bold captions that explain the background and news value often accompanied by music. The news is easy to digest, very contemporary, and with its trendy design is especially appealing to China’s younger generations.

On Sina Weibo, Pear Video broadcasts its videos through short-video app Miaopai, that partnered up with Weibo in 2013 for easy audiovisual content sharing on the Sina platform.

BEHIND PEAR VIDEO

“The face of commercial media and the heart of Party media.”

In many ways, the launch of Pear Video is similar to the 2014 launch of The Paper, a newspaper directed at China’s younger generations. In 2015, Tabitha Speelman wrote about this new Chinese web-based media outlet in Foreign Policy, calling it a “smarter, sexier” form of state media that adhered to government calls for more “proactive” and “effective” ways of bringing news in a changing media environment.

David Bandurski, editor of the China Media Project, wrote an insightful piece about The Paper in 2016, in which he quoted former Southern Weekly journalist Fang Kecheng in saying that The Paper “has the face of commercial media, and the heart of Party media.”

Bandurski linked the launch of The Paper to China’s new “internet management path” that became apparent at the Wuzhen Summit. Unsurprisingly, its initial funding of 100 million RMB (±14M$) came from the Shanghai United Media Group (SUMG): a state-owned media group. “Propaganda 2.0”, is how the Economist called it.

Seeing the launch of The Paper in the same light as Pear Video – a fresh, new, cross-media 21st-century news platform – it seems that the two media platforms are walking a similar path in making China’s ‘official’ news more appealing to younger audiences.

But there is one slight difference. Although Pear Video’s team also comes from The Paper and from the state-run Shanghai United Media Group, its funding comes from China Media Capital (CMC), a private equity and venture capital firm headed by Li Ruigang. Although not state-owned, it is nevertheless a company that is also backed by the state.

In July of 2016, China’s media regulators called for a development of more powerful media organizations to make more of an impact, not just within but also outside of China, to compete with foreign ones. According to Patrick Frater (Variety 2016), the need for more influential media meant a growing government support for private-sector companies, like China Media Capital.

The establishment and rising popularity of Pear Video coincides with both the official call for more media giants – CMC financed Pear Video within months after this call – and the announcement of new media regulations on the sharing of ‘non-official’ news, after which the big state media outlets like People’s Daily (nearly 50 million followers on Weibo) also started sharing Pear News video on its official account on a daily basis.

People’s Daily now posts Pear Video news content on a daily basis.

Popular news accounts like Sina Video (@新浪视频) also shares their videos, and other short video news accounts such as Weila Video (@微辣Video) or Yishou Video (@一手视频) now seem to have merged with Pear Video and only post Pear Video content on their accounts, making their audience grow even bigger.

With so many official media sharing Pear Video content, and their videos making it to the Sina Weibo top trending lists on a daily basis, it is apparent that the Pear Video cross-media platform has the full support of China’s cyberspace authorities.

THE FUTURE OF CHINESE NEWS MEDIA

“This is the mobile social media generation that rather watches the news than read it – making short videos all the more influential.”

“Short news videos may be a new weapon in the spread of new media,” People’s Daily wrote in September of 2016, the month of Pear Video’s launch. The article notes that in the era of “mobile government”, the public has increasingly higher demands when it comes to taking in information.

“Simple information release no longer meets the needs of users”, the article says, advocating that media should adapt to a new audience that is mobile and wants to take in information through short, insightful videos.

Tsinghua University’s media specialists also stress the importance of short mobile videos for the future of media in China, as becomes apparent in a lecture that was also posted on the Chinese government website.

China’s younger generations are the mobile generation, the ‘bowed head clan‘ (smartphone addicts), who consume the news through their smartphone and are less inclined to watch television news.

They are also used to staying the same app to do multiple things; apps such as WeChat and Weibo are not just where they talk with friends, but also where they play games and watch the news – preferably served to them in short ‘bites.’

Furthermore, the lecture states, it is the mobile social media generation that rather watches the news than read it – making short videos all the more influential.

It is this audience that is the present-day and future media consumer of China. The widespread support for short video platforms like Pear Video and their explosive popularity shows that China’s future official media is mobile, short, and audiovisual. It has a fresh look and a clean layout – it is propagated news in your hands, just a click away. The rise of Pear Video just shows how juicy new Chinese media can be.

– By Manya Koetse

Follow on Twitter or Like on Facebook

Many thanks to those providing input on this article.

Any remarks or ideas about this article? Please leave a comment.

What’s on Weibo is an independent blog. Want to donate? You can do so here.

References / Further Reading:

Bandurski, David. 2016. “Reading THE PAPER.” Medium / China Media Project (July 7) https://medium.com/china-media-project/reading-the-paper-d15ec241652f#.bu6wblsui [6.1.16].

Frater, Patrick. 2016. “China Wants More Media Giants.” Variety (July 18) http://variety.com/2016/biz/asia/china-wants-more-media-giants-1201816245/ [13.1.16].

Haas, Benjamin. 2016. “China restricts sharing of ‘unofficial’ videos on Social Media.” The Guardian (Dec 20) https://www.theguardian.com/world/2016/dec/21/china-restricts-sharing-of-unofficial-videos-on-social-media [5.1.16].

Speelman, Tabitha. 2015. “Story image for looking for sexier state media? There’s an app for that.” Foreign Policy (Dec 15) http://foreignpolicy.com/2015/12/15/smarter-sexier-chinese-state-media-pengpai-paper/ [6.1.16].

©2016 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya Koetse is the founder and editor-in-chief of whatsonweibo.com. She is a writer, public speaker, and researcher (Sinologist, MPhil) on social trends, digital developments, and new media in an ever-changing China, with a focus on Chinese society, pop culture, and gender issues. She shares her love for hotpot on hotpotambassador.com. Contact at manya@whatsonweibo.com, or follow on Twitter.

China Arts & Entertainment

Going All In on Short Streaming: About China’s Online ‘Micro Drama’ Craze

For viewers, they’re the ultimate guilty pleasure. For producers, micro dramas mean big profit.

Published

3 weeks agoon

March 26, 2024By

Ruixin Zhang

PREMIUM CONTENT

Closely intertwined with the Chinese social media landscape and the fast-paced online entertainment scene, micro dramas have emerged as an immensely popular way to enjoy dramas in bite-sized portions. With their short-format style, these dramas have become big business, leading Chinese production studios to compete and rush to create the next ‘mini’ hit.

In February of this year, Chinese social media started flooding with various hashtags highlighting the huge commercial success of ‘online micro-short dramas’ (wǎngluò wēiduǎnjù 网络微短剧), also referred to as ‘micro drama’ or ‘short dramas’ (微短剧).

Stories ranged from “Micro drama screenwriters making over 100k yuan [$13.8k] monthly” to “Hengdian building earning 2.8 million yuan [$387.8k] rent from micro dramas within six months” and “Couple earns over 400 million [$55 million] in a month by making short dramas,” all reinforcing the same message: micro dramas mean big profits. (Respectively #短剧爆款编剧月入可超10万元#, #横店一栋楼半年靠短剧租金收入280万元#, #一对夫妇做短剧每月进账4亿多#.)

Micro dramas, taking China by storm and also gaining traction overseas, are basically super short streaming series, with each episode usually lasting no more than two minutes.

From Horizontal to Vertical

Online short dramas are closely tied to Chinese social media and have been around for about a decade, initially appearing on platforms like Youku and Tudou. However, the genre didn’t explode in popularity until 2020.

That year, China’s State Administration of Radio, Film, and Television (SARFT) introduced a “fast registration and filing module for online micro dramas” to their “Key Online Film and Television Drama Information Filing System.” Online dramas or films can only be broadcast after obtaining an “online filing number.”

Chinese streaming giants such as iQiyi, Tencent, and Youku then began releasing 10-15 minute horizontal short dramas in late 2020. Despite their shorter length and faster pace, they actually weren’t much different from regular TV dramas.

Soon after, short video social platforms like Douyin (TikTok) and Kuaishou joined the trend, launching their own short dramas with episodes only lasting around 3 minutes each.

Of course, Douyin wouldn’t miss out on this trend and actively contributed to boosting the genre. To better suit its interface, Douyin converted horizontal-screen dramas into vertical ones (竖屏短剧).

Then, in 2021, the so-called mini-program (小程序) short dramas emerged, condensing each episode to 1-2 minutes, often spanning over 100 episodes.

These short dramas are advertised on platforms like Douyin, and when users click, they are directed to mini-programs where they need to pay for further viewing. Besides direct payment revenue, micro dramas may also bring in revenue from advertising.

‘Losers’ Striking Back

You might wonder what could possibly unfold in a TV drama lasting just two minutes per episode.

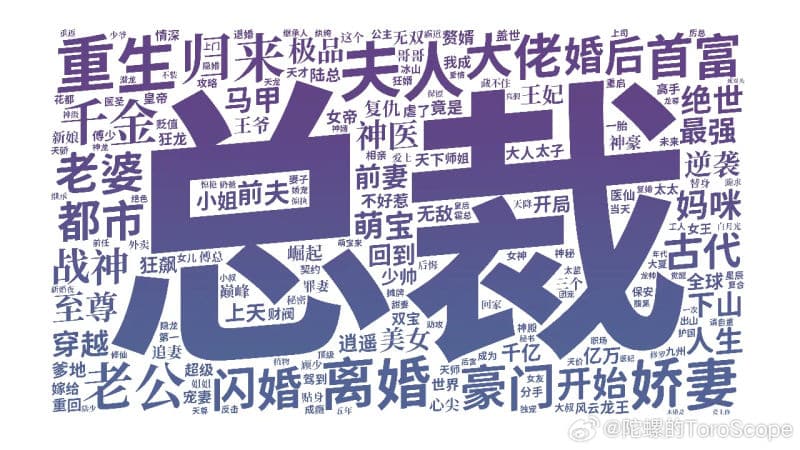

The Chinese cultural media outlet ‘Hedgehog Society’ (刺猬公社) collected data from nearly 6,000 short dramas and generated a word cloud based on their content keywords.

In works targeted at female audiences, the most common words revolve around (romantic) relationships, such as “madam” (夫人) and “CEO” (总裁). Unlike Chinese internet novels from over a decade ago, which often depicted perfect love and luxurious lifestyles, these short dramas offer a different perspective on married life and self-discovery.

According to Hedgehog Society’s data, the frequency of the term “divorce” (离婚) in short dramas is ten times higher than “married” (结婚) or “newlyweds” (新婚). Many of these dramas focus on how the female protagonist builds a better life after divorce and successfully stands up to her ex-husband or to those who once underestimated her — both physically and emotionally.

One of the wordclouds by 刺猬公社.

In male-oriented short dramas, the pursuit of power is a common theme, with phrases like “the strongest in history” (史上最强) and “war god” (战神) frequently mentioned. Another surprising theme is “matrilocal son” (赘婿), the son-in-law who lives with his wife’s family. In China, this term is derogatory, particularly referring to husbands with lower economic income and social status than their wives, which is considered embarrassing in traditional Chinese views. However, in these short dramas, the matrilocal son will employ various methods to earn the respect of his wife’s family and achieve significant success.

Although storylines differ, a recurring theme in these short dramas is protagonists wanting to turn their lives around. This desire for transformation is portrayed from various perspectives, whether it’s from the viewpoint of a wealthy, elite individual or from those with lower social status, such as divorced single women or matrilocal son-in-laws. This “feel-good” sentiment appears to resonate with many Chinese viewers.

Cultural influencer Lu Xuyu (@卢旭宁) quoted from a forum on short dramas, explaining the types of short dramas that are popular: Men seek success and admiration, and want to be pursued by beautiful women. Women seek romantic love or are still hoping the men around them finally wake up. One netizen commented more bluntly: “They are all about the counterattack of the losers (屌丝逆袭).”

The word used here is “diaosi,” a term used by Chinese netizens for many years to describe themselves as losers in a self-deprecating way to cope with the hardships of a competitive life, in which it has become increasingly difficult for Chinese youths to climb the social ladder.

Addicted to Micro Drama

By early 2024, the viewership of China’s micro dramas had soared to 120 million monthly active users, with the genre particularly resonating with lower-income individuals and the elderly in lower-tier markets.

However, short dramas also enjoy widespread popularity among many young people. According to data cited by Bilibili creator Caoxiaoling (@曹小灵比比叨), 64.9% of the audience falls within the 15-29 age group.

For these young viewers, short dramas offer rapid plot twists, meme-worthy dialogues, condensing the content of several episodes of a long drama into just one minute—stripping away everything except the pure “feel-good” sentiment, which seems rare in the contemporary online media environment. Micro dramas have become the ultimate ‘guilty pleasure.’

Various micro dramas, image by Sicomedia.

Even the renowned Chinese actress Ning Jing (@宁静) admitted to being hooked on short dramas. She confessed that while initially feeling “scammed” by the poor production and acting, she became increasingly addicted as she continued watching.

It’s easy to get hooked. Despite criticisms of low quality or shallowness, micro dramas are easy to digest, featuring clear storylines and characters. They don’t demand night-long binge sessions or investment in complex storylines. Instead, people can quickly watch multiple episodes while waiting for their bus or during a short break, satisfying their daily drama fix without investing too much time.

Chasing the gold rush

During the recent Spring Festival holiday, the Chinese box office didn’t witness significant growth compared to previous years. In the meantime, the micro drama “I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈), shot in just 10 days with a post-production cost of 80,000 yuan ($11,000), achieved a single-day revenue exceeding 2 million yuan ($277k). It’s about a college girl who time-travels back to the 1980s, reluctantly getting married to a divorced pig farm owner with kids, but unexpectedly falling in love.

Despite its simple production and clichéd plot, micro dramas like this are drawing in millions of viewers. The producer earned over 100 million yuan ($13 million) from this drama and another short one.

“I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈).

The popularity of short dramas, along with these significant profits, has attracted many people to join the short drama industry. According to some industry insiders, a short drama production team often involves hundreds or even thousands of contributors who help in writing scripts. These contributors include college students, unemployed individuals, and online writers — seemingly anyone can participate.

By now, Hengdian World Studios, the largest film and television shooting base in China, is already packed with crews filming short dramas. With many production teams facing a shortage of extras, reports have surfaced indicating significant increases in salaries, with retired civil workers even being enlisted as actors.

Despite the overwhelming success of some short dramas like “I Went Back to the 80s and Became a Stepmother,” it is not easy to replicate their formula. The screenwriter of the time-travel drama, Mi Meng (@咪蒙的微故事), is a renowned online writer who is very familiar with how to use online strategies to draw in more viewers. For many average creators, their short drama production journey is much more difficult and less fruitful.

But with low costs and potentially high returns, even if only one out of a hundred productions succeeds, it could be sufficient to recover the expenses of the others. This high-stakes, cutthroat competition poses a significant challenge for smaller players in the micro drama industry – although they actually fueled the genre’s growth.

As more scriptwriters and short dramas flood the market, leading to content becoming increasingly similar, the chances of making profits are likely to decrease. Many short drama platforms have yet to start generating net profits.

This situation has sparked concerns among netizens and critics regarding the future of short dramas. Given the genre’s success and intense competition, a transformation seems inevitable: only the shortest dramas that cater to the largest audiences will survive.

In the meantime, however, netizens are enjoying the hugely wide selection of micro dramas still available to them. One Weibo blogger, Renmin University Professor Ma Liang (@学者马亮), writes: “I spent some time researching short videos and watched quite a few. I must admit, once you start, you just can’t stop. ”

By Ruixin Zhang, edited with further input by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Brands, Marketing & Consumers

Tick, Tock, Time to Pay Up? Douyin Is Testing Out Paywalled Short Videos

Is content payment a new beginning for the popular short video app Douyin (China’s TikTok) or would it be the end?

Published

5 months agoon

November 18, 2023

The introduction of a Douyin novel feature, that would enable content creators to impose a fee for accessing their short video content, has sparked discussions across Chinese social media. Although the feature would benefit creators, many Douyin users are skeptical.

News that Chinese social media app Douyin is rolling out a new feature which allows creators to introduce a paywall for their short video content has triggered online discussions in China this week.

The feature, which made headlines on November 16, is presently in the testing phase. A number of influential content creators are now allowed to ‘paywall’ part of their video content.

Douyin is the hugely popular app by Chinese tech giant Bytedance. TikTok is the international version of the Chinese successful short video app, and although they’re often presented as being the same product, Douyin and Tiktok are actually two separate entities.

In addition to variations in content management and general usage, Douyin differs from TikTok in terms of features. Douyin previously experimented with functionalities such as charging users for accessing mini-dramas on the platform or the ability to tip content creators.

The pay-to-view feature on Douyin would require users to pay a certain fee in Douyin coins (抖币) in order to view paywalled content. One Douyin coin is equivalent to 0.1 yuan ($0,014). The platform itself takes 30% of the income as a service charge.

According to China Securities Times or STCN (证券时报网), Douyin insiders said that any short video content meeting Douyin’s requirements could be set as “pay-per-view.”

Creators, who can set their own paywall prices, should reportedly meet three criteria to qualify for the pay-to-view feature: their account cannot have any violation records for a period of 90 days, they should have at least 100,000 followers, and they have to have completed the real-name authentication process.

On Douyin and Weibo, Chinese netizens express various views on the feature. Many people do not think it would be a good idea to charge money for short videos. One video blogger (@小片片说大片) pointed out the existing challenge of persuading netizens to pay for longer videos, let alone expecting them to pay for shorter ones.

“The moment I’d need to pay money for it, I’ll delete the app,” some commenters write.

This statement appears to capture the prevailing sentiment among most internet users regarding a subscription-based Douyin environment. According to a survey conducted by the media platform Pear Video, more than 93% of respondents expressed they would not be willing to pay for short videos.

An online poll by Pear Video showed that the majority of respondents would not be willing to pay for short videos on Douyin.

“This could be a breaking point for Douyin,” one person predicts: “Other platforms could replace it.” There are more people who think it would be the end of Douyin and that other (free) short video platforms might take its place.

Some commenters, however, had their own reasons for supporting a pay-per-view function on the platform, suggesting it would help them solve their Douyin addiction. One commenter remarked, “Fantastic, this might finally help me break free from watching short videos!” Another individual responded, “Perhaps this could serve as a remedy for my procrastination.”

As discussions about the new feature trended, Douyin’s customer service responded, stating that it would eventually be up to content creators whether or not they want to activate the paid feature for their videos, and that it would be up to users whether or not they would be interested in such content – otherwise they can just swipe away.

Another social media user wrote: “There’s only one kind of video I’m willing to pay for, and it’s not on Douyin.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

Chengdu Disney: The Quirkiest Hotspot in China

Where to Eat and Drink in Beijing: Yellen’s Picks

Weibo Watch: Burning BMWs

The ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

A Snowball Effect: How Cold Harbin Became the Hottest Place in China

Jia Ling Returns to the Limelight with New “YOLO” Movie and 110-Pound Weight Loss Announcement

Top 9 Chinese Movies to Watch This Spring Festival Holiday

Party Slogan, Weibo Hashtag: “The Next China Will Still Be China”

From Pitch to Politics: About the Messy Messi Affair in Hong Kong (Updated)

Weibo Watch: Frogs in Wells

Looking Back on the 2024 CMG Spring Festival Gala: Highs, Lows, and Noteworthy Moments

Two Years After MU5735 Crash: New Report Finds “Nothing Abnormal” Surrounding Deadly Nose Dive

More than Malatang: Tianshui’s Recipe for Success

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight1 month ago

China Insight1 month agoThe ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

-

China Insight3 months ago

China Insight3 months agoA Snowball Effect: How Cold Harbin Became the Hottest Place in China

-

China Arts & Entertainment3 months ago

China Arts & Entertainment3 months agoJia Ling Returns to the Limelight with New “YOLO” Movie and 110-Pound Weight Loss Announcement

-

China Arts & Entertainment2 months ago

China Arts & Entertainment2 months agoTop 9 Chinese Movies to Watch This Spring Festival Holiday