China Digital

Trump’s TikTok Ban Goes Trending on Weibo (and on TikTok)

“Did Trump buy up the trending lists?”, some Chinese web users wonder.

Published

4 years agoon

First published

Just days after TikTok released a statement saying it would open its algorithms, President Trump announced that the app would be “banned from the United States.”

Trump reportedly said he would take action as soon as Saturday, August 1st, using emergency economic power or an executive order. The move comes at a time of China-US escalating tensions.

TikTok has recently fallen under scrutiny in the U.S. over security and data concerns, but also raised concerns in Australia, India, Japan, and Europe.

TikTok is the international version of Douyin (抖音), a short video media app owned by China’s young tech giant Bytedance (字节跳动). The app allows users to create, edit, and share short videos as well as live streams, often featuring music in the background.

Earlier this week, TikTok CEO Kevin Mayer released a statement addressing recent security concerns regarding the popular short video app due to its Chinese origins.

“We are not political, we do not accept political advertising and have no agenda – our only objective is to remain a vibrant, dynamic platform for everyone to enjoy,” Mayer wrote.

In the statement, titled “Fair competition and transparency benefits us all,” Mayer announced the launch of a Transparency and Accountability Center for TikTok’s moderation and data practices where, as he wrote, “experts can observe our moderation policies in real-time, as well as examine the actual code that drives our algorithms.”

Since its launch in 2016, Douyin has grown to be one of China’s most popular apps. In early 2020, the Chinese version of the app had amassed some 400 million daily active users.

The app also became an international success shortly after launching its overseas version, and especially after it acquired popular video app Musical.ly, merging the app with its own platform in 2018 under the TikTok brand name. In the first quarter of this year, Tik Tok became the most-downloaded app worldwide. In the US, the app has some 80 million users.

Various media previously reported that Microsoft was exploring to purchase the video-sharing app from its parent company.

Both news items, the alleged selling of TikTok and the newly announced ban, entered Weibo’s top trending list on Saturday afternoon, Chinese local time, under the hashtags “Trump Will Order ByteDance to Sell TikTok’s U.S. Business” (#特朗普将命令字节跳动出售TikTok美国业务#) and “Trump Will Ban TikTok’ from Operating in America” (#特朗普将禁止TikTok在美国运营#).

The American ban on TikTok also went trending on Douyin, the Chinese TikTok, where state media accounts such as China Daily posted a video of Trump talking about the possible Tik Tok ban accompanied by ominous music.

“Did Trump buy up the trending lists?”, one commenter wondered.

“Perhaps he doesn’t know he became trending on China’s TikTok himself now,” one TikTok user wrote.

On Weibo, responses to the American TikTok news developments are mixed, but a majority of web users express amazement that a possible ban on the Chinese app could occur in the world’s premier free-market economy.

“Haha, a free market economy?!”, many Weibo users wrote: “It’s time to revise Western economic textbooks.”

“Political interference in markets, it’s what Trump does best,” others wrote.

Many web users comment that by banning TikTok, Trump would do what China did years ago. American social media platforms such as Facebook and Twitter have been blocked in China since 2009.

Some users suggest that it would be better for TikTok to be banned in the U.S. than being sold (“If it’s banned, the ban could always be lifted again”), while others think selling is the better option (“Bytedance could at least still earn money by selling”).

Weibo blogger Lin Huijie (蔺会杰) – founder of the Aigupiao app – also posted about the recent developments, writing:

“Today, Trump has officially launched an attack on TikTok, which will either be banned or be forced to sell to Microsoft. We can’t actually say anything about this; after all, we already blocked several American software a decade ago. But as part of their “contain China” strategy, America banning Tik Tok is similar to how it encircles and suppresses Huawei. As a 5G leader, Huawei has broken through the U.S.-controlled technological highlands, while Tik-Tok has broken through the American monopoly on global social networks.”

Lin further writes that in the mobile internet era, social media platforms are powerful tools to shape public opinion and are a way for the US to “rule the world.” With China gaining more influence in the English-language social media world, American soft power would be reduced. Lin suggests that the banning of TikTok is merely a strategic move to limit China’s power.

Some commenters compare the banning of TikTok to what recently happened to the closure of the Chinese consulate in America and the American consulate in China; if the American Facebook and Twitter are blocked in China, then the Chinese TikTok gets blocked in the US.

“[But] it’s not that China doesn’t allow these platforms to be used,” one person responds: “It’s that they require these services to be based in China and to accept government supervision.”

Despite the major interest in the recent developments concerning TikTok in America on Weibo, there are also those who hope for less eventful days: “Would it be possible for Trump to not go trending every single day?”

This story is still developing.

Read more about articles about Sino-US relations here.

By Manya Koetse

Follow @WhatsOnWeibo

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2020 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya Koetse is the founder and editor-in-chief of whatsonweibo.com. She is a writer, public speaker, and researcher (Sinologist, MPhil) on social trends, digital developments, and new media in an ever-changing China, with a focus on Chinese society, pop culture, and gender issues. She shares her love for hotpot on hotpotambassador.com. Contact at manya@whatsonweibo.com, or follow on Twitter.

China Arts & Entertainment

Going All In on Short Streaming: About China’s Online ‘Micro Drama’ Craze

For viewers, they’re the ultimate guilty pleasure. For producers, micro dramas mean big profit.

Published

4 weeks agoon

March 26, 2024By

Ruixin Zhang

PREMIUM CONTENT

Closely intertwined with the Chinese social media landscape and the fast-paced online entertainment scene, micro dramas have emerged as an immensely popular way to enjoy dramas in bite-sized portions. With their short-format style, these dramas have become big business, leading Chinese production studios to compete and rush to create the next ‘mini’ hit.

In February of this year, Chinese social media started flooding with various hashtags highlighting the huge commercial success of ‘online micro-short dramas’ (wǎngluò wēiduǎnjù 网络微短剧), also referred to as ‘micro drama’ or ‘short dramas’ (微短剧).

Stories ranged from “Micro drama screenwriters making over 100k yuan [$13.8k] monthly” to “Hengdian building earning 2.8 million yuan [$387.8k] rent from micro dramas within six months” and “Couple earns over 400 million [$55 million] in a month by making short dramas,” all reinforcing the same message: micro dramas mean big profits. (Respectively #短剧爆款编剧月入可超10万元#, #横店一栋楼半年靠短剧租金收入280万元#, #一对夫妇做短剧每月进账4亿多#.)

Micro dramas, taking China by storm and also gaining traction overseas, are basically super short streaming series, with each episode usually lasting no more than two minutes.

From Horizontal to Vertical

Online short dramas are closely tied to Chinese social media and have been around for about a decade, initially appearing on platforms like Youku and Tudou. However, the genre didn’t explode in popularity until 2020.

That year, China’s State Administration of Radio, Film, and Television (SARFT) introduced a “fast registration and filing module for online micro dramas” to their “Key Online Film and Television Drama Information Filing System.” Online dramas or films can only be broadcast after obtaining an “online filing number.”

Chinese streaming giants such as iQiyi, Tencent, and Youku then began releasing 10-15 minute horizontal short dramas in late 2020. Despite their shorter length and faster pace, they actually weren’t much different from regular TV dramas.

Soon after, short video social platforms like Douyin (TikTok) and Kuaishou joined the trend, launching their own short dramas with episodes only lasting around 3 minutes each.

Of course, Douyin wouldn’t miss out on this trend and actively contributed to boosting the genre. To better suit its interface, Douyin converted horizontal-screen dramas into vertical ones (竖屏短剧).

Then, in 2021, the so-called mini-program (小程序) short dramas emerged, condensing each episode to 1-2 minutes, often spanning over 100 episodes.

These short dramas are advertised on platforms like Douyin, and when users click, they are directed to mini-programs where they need to pay for further viewing. Besides direct payment revenue, micro dramas may also bring in revenue from advertising.

‘Losers’ Striking Back

You might wonder what could possibly unfold in a TV drama lasting just two minutes per episode.

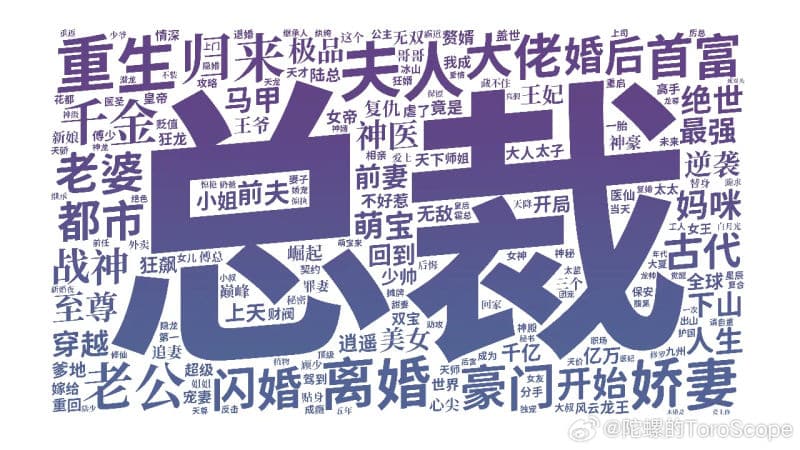

The Chinese cultural media outlet ‘Hedgehog Society’ (刺猬公社) collected data from nearly 6,000 short dramas and generated a word cloud based on their content keywords.

In works targeted at female audiences, the most common words revolve around (romantic) relationships, such as “madam” (夫人) and “CEO” (总裁). Unlike Chinese internet novels from over a decade ago, which often depicted perfect love and luxurious lifestyles, these short dramas offer a different perspective on married life and self-discovery.

According to Hedgehog Society’s data, the frequency of the term “divorce” (离婚) in short dramas is ten times higher than “married” (结婚) or “newlyweds” (新婚). Many of these dramas focus on how the female protagonist builds a better life after divorce and successfully stands up to her ex-husband or to those who once underestimated her — both physically and emotionally.

One of the wordclouds by 刺猬公社.

In male-oriented short dramas, the pursuit of power is a common theme, with phrases like “the strongest in history” (史上最强) and “war god” (战神) frequently mentioned. Another surprising theme is “matrilocal son” (赘婿), the son-in-law who lives with his wife’s family. In China, this term is derogatory, particularly referring to husbands with lower economic income and social status than their wives, which is considered embarrassing in traditional Chinese views. However, in these short dramas, the matrilocal son will employ various methods to earn the respect of his wife’s family and achieve significant success.

Although storylines differ, a recurring theme in these short dramas is protagonists wanting to turn their lives around. This desire for transformation is portrayed from various perspectives, whether it’s from the viewpoint of a wealthy, elite individual or from those with lower social status, such as divorced single women or matrilocal son-in-laws. This “feel-good” sentiment appears to resonate with many Chinese viewers.

Cultural influencer Lu Xuyu (@卢旭宁) quoted from a forum on short dramas, explaining the types of short dramas that are popular: Men seek success and admiration, and want to be pursued by beautiful women. Women seek romantic love or are still hoping the men around them finally wake up. One netizen commented more bluntly: “They are all about the counterattack of the losers (屌丝逆袭).”

The word used here is “diaosi,” a term used by Chinese netizens for many years to describe themselves as losers in a self-deprecating way to cope with the hardships of a competitive life, in which it has become increasingly difficult for Chinese youths to climb the social ladder.

Addicted to Micro Drama

By early 2024, the viewership of China’s micro dramas had soared to 120 million monthly active users, with the genre particularly resonating with lower-income individuals and the elderly in lower-tier markets.

However, short dramas also enjoy widespread popularity among many young people. According to data cited by Bilibili creator Caoxiaoling (@曹小灵比比叨), 64.9% of the audience falls within the 15-29 age group.

For these young viewers, short dramas offer rapid plot twists, meme-worthy dialogues, condensing the content of several episodes of a long drama into just one minute—stripping away everything except the pure “feel-good” sentiment, which seems rare in the contemporary online media environment. Micro dramas have become the ultimate ‘guilty pleasure.’

Various micro dramas, image by Sicomedia.

Even the renowned Chinese actress Ning Jing (@宁静) admitted to being hooked on short dramas. She confessed that while initially feeling “scammed” by the poor production and acting, she became increasingly addicted as she continued watching.

It’s easy to get hooked. Despite criticisms of low quality or shallowness, micro dramas are easy to digest, featuring clear storylines and characters. They don’t demand night-long binge sessions or investment in complex storylines. Instead, people can quickly watch multiple episodes while waiting for their bus or during a short break, satisfying their daily drama fix without investing too much time.

Chasing the gold rush

During the recent Spring Festival holiday, the Chinese box office didn’t witness significant growth compared to previous years. In the meantime, the micro drama “I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈), shot in just 10 days with a post-production cost of 80,000 yuan ($11,000), achieved a single-day revenue exceeding 2 million yuan ($277k). It’s about a college girl who time-travels back to the 1980s, reluctantly getting married to a divorced pig farm owner with kids, but unexpectedly falling in love.

Despite its simple production and clichéd plot, micro dramas like this are drawing in millions of viewers. The producer earned over 100 million yuan ($13 million) from this drama and another short one.

“I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈).

The popularity of short dramas, along with these significant profits, has attracted many people to join the short drama industry. According to some industry insiders, a short drama production team often involves hundreds or even thousands of contributors who help in writing scripts. These contributors include college students, unemployed individuals, and online writers — seemingly anyone can participate.

By now, Hengdian World Studios, the largest film and television shooting base in China, is already packed with crews filming short dramas. With many production teams facing a shortage of extras, reports have surfaced indicating significant increases in salaries, with retired civil workers even being enlisted as actors.

Despite the overwhelming success of some short dramas like “I Went Back to the 80s and Became a Stepmother,” it is not easy to replicate their formula. The screenwriter of the time-travel drama, Mi Meng (@咪蒙的微故事), is a renowned online writer who is very familiar with how to use online strategies to draw in more viewers. For many average creators, their short drama production journey is much more difficult and less fruitful.

But with low costs and potentially high returns, even if only one out of a hundred productions succeeds, it could be sufficient to recover the expenses of the others. This high-stakes, cutthroat competition poses a significant challenge for smaller players in the micro drama industry – although they actually fueled the genre’s growth.

As more scriptwriters and short dramas flood the market, leading to content becoming increasingly similar, the chances of making profits are likely to decrease. Many short drama platforms have yet to start generating net profits.

This situation has sparked concerns among netizens and critics regarding the future of short dramas. Given the genre’s success and intense competition, a transformation seems inevitable: only the shortest dramas that cater to the largest audiences will survive.

In the meantime, however, netizens are enjoying the hugely wide selection of micro dramas still available to them. One Weibo blogger, Renmin University Professor Ma Liang (@学者马亮), writes: “I spent some time researching short videos and watched quite a few. I must admit, once you start, you just can’t stop. ”

By Ruixin Zhang, edited with further input by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Brands, Marketing & Consumers

Tick, Tock, Time to Pay Up? Douyin Is Testing Out Paywalled Short Videos

Is content payment a new beginning for the popular short video app Douyin (China’s TikTok) or would it be the end?

Published

5 months agoon

November 18, 2023

The introduction of a Douyin novel feature, that would enable content creators to impose a fee for accessing their short video content, has sparked discussions across Chinese social media. Although the feature would benefit creators, many Douyin users are skeptical.

News that Chinese social media app Douyin is rolling out a new feature which allows creators to introduce a paywall for their short video content has triggered online discussions in China this week.

The feature, which made headlines on November 16, is presently in the testing phase. A number of influential content creators are now allowed to ‘paywall’ part of their video content.

Douyin is the hugely popular app by Chinese tech giant Bytedance. TikTok is the international version of the Chinese successful short video app, and although they’re often presented as being the same product, Douyin and Tiktok are actually two separate entities.

In addition to variations in content management and general usage, Douyin differs from TikTok in terms of features. Douyin previously experimented with functionalities such as charging users for accessing mini-dramas on the platform or the ability to tip content creators.

The pay-to-view feature on Douyin would require users to pay a certain fee in Douyin coins (抖币) in order to view paywalled content. One Douyin coin is equivalent to 0.1 yuan ($0,014). The platform itself takes 30% of the income as a service charge.

According to China Securities Times or STCN (证券时报网), Douyin insiders said that any short video content meeting Douyin’s requirements could be set as “pay-per-view.”

Creators, who can set their own paywall prices, should reportedly meet three criteria to qualify for the pay-to-view feature: their account cannot have any violation records for a period of 90 days, they should have at least 100,000 followers, and they have to have completed the real-name authentication process.

On Douyin and Weibo, Chinese netizens express various views on the feature. Many people do not think it would be a good idea to charge money for short videos. One video blogger (@小片片说大片) pointed out the existing challenge of persuading netizens to pay for longer videos, let alone expecting them to pay for shorter ones.

“The moment I’d need to pay money for it, I’ll delete the app,” some commenters write.

This statement appears to capture the prevailing sentiment among most internet users regarding a subscription-based Douyin environment. According to a survey conducted by the media platform Pear Video, more than 93% of respondents expressed they would not be willing to pay for short videos.

An online poll by Pear Video showed that the majority of respondents would not be willing to pay for short videos on Douyin.

“This could be a breaking point for Douyin,” one person predicts: “Other platforms could replace it.” There are more people who think it would be the end of Douyin and that other (free) short video platforms might take its place.

Some commenters, however, had their own reasons for supporting a pay-per-view function on the platform, suggesting it would help them solve their Douyin addiction. One commenter remarked, “Fantastic, this might finally help me break free from watching short videos!” Another individual responded, “Perhaps this could serve as a remedy for my procrastination.”

As discussions about the new feature trended, Douyin’s customer service responded, stating that it would eventually be up to content creators whether or not they want to activate the paid feature for their videos, and that it would be up to users whether or not they would be interested in such content – otherwise they can just swipe away.

Another social media user wrote: “There’s only one kind of video I’m willing to pay for, and it’s not on Douyin.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Battle for the Bottom Bed

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

Chengdu Disney: The Quirkiest Hotspot in China

Where to Eat and Drink in Beijing: Yellen’s Picks

The ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

Top 9 Chinese Movies to Watch This Spring Festival Holiday

Party Slogan, Weibo Hashtag: “The Next China Will Still Be China”

From Pitch to Politics: About the Messy Messi Affair in Hong Kong (Updated)

Looking Back on the 2024 CMG Spring Festival Gala: Highs, Lows, and Noteworthy Moments

Two Years After MU5735 Crash: New Report Finds “Nothing Abnormal” Surrounding Deadly Nose Dive

More than Malatang: Tianshui’s Recipe for Success

In Hot Water: The Nongfu Spring Controversy Explained

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

The Benz Guy from Baoding and the Granny Xu Line-Cutting Controversy

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight2 months ago

China Insight2 months agoThe ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

-

China Arts & Entertainment3 months ago

China Arts & Entertainment3 months agoTop 9 Chinese Movies to Watch This Spring Festival Holiday

-

China Media1 month ago

China Media1 month agoParty Slogan, Weibo Hashtag: “The Next China Will Still Be China”

-

China World2 months ago

China World2 months agoFrom Pitch to Politics: About the Messy Messi Affair in Hong Kong (Updated)

Yu Xingwu

August 1, 2020 at 12:37 pm

Just found a spelling mistake in para.5: TikTok CEO is Kevin Mayer, not Kevin Mayers.