China Brands, Marketing & Consumers

When Ad Breaks Get Weird: Branded Content in Chinese TV Dramas Is Ruining It For the Viewers

China’s ubiquitous inserted ad marketing is alienating viewers from their favorite TV drama characters.

Published

7 years agoon

WHAT’S ON WEIBO ARCHIVE | PREMIUM CONTENT ARTICLE

Ad breaks can be annoying, but when it’s the main character of your favorite historical drama promoting the latest smartphone, it can actually ruin the viewer experience. In recent online discussions, China’s ubiquitous ‘Inserted Ad Marketing’ (中插广告), that goes beyond product placement, is being attacked by netizens and media.

A 2017 Ad Age article on the high levels of branded content in China’s online TV argues that Chinese viewers generally do not mind embedded marketing. They have allegedly become so used to to all kinds of branded distractions in TV shows, dramas, and films, that it is just “another part of the entertainment” (Doland 2017). But recent discussions on Chinese social media signal that the general sentiments regarding inserted sponsored content are changing.

On January 6, Chinese author Ma Boyong (@马伯庸, 4.5 million followers) posted an article on Weibo in which he criticized the phenomenon of inserted ad content in Chinese television series, saying the marketing style often does not suit the characters and is making the actors less credible.

Although Ma does not oppose to embedded marketing per se, he argues it hurts the credibility of TV dramas and the viewer’s experience when it does not blend in with the style of the TV drama and its characters.

One of the TV dramas where the sponsored segments ‘hurt’ the show, according to Ma, is Mystery of Antiques (古董局中局, 2018) that is based on one of the author’s novels. The actor Qiao Zhenyu (乔振宇), who plays the leading role, allegedly “looks like a fool” because of the inserted ad.

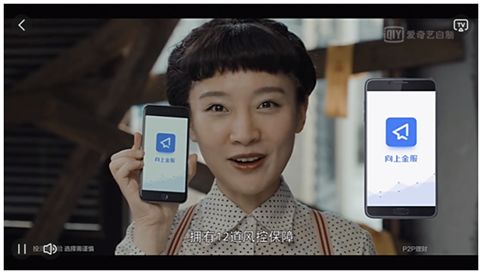

The type of advertising, that is central to this recent discussion, goes beyond product placement; it is the type of ad that appears inside (online) TV shows in which the actors, in character, straightforwardly promote a certain brand and product, sometimes in a scene dialogue (‘storyline ads’), but also often while looking directly into the camera (see example here or here, Chinese term: zhōngchā guǎnggào 中插广告).

The hashtag ‘Ma Boyong Roasts Inserted Ad Marketing’ (#马伯庸吐槽中插广告#) had received more than 50 million views on Weibo by Sunday night, with the overall majority of people supporting the author’s stance.

“Finally someone says this,” one commenter said: “When it just started out, it was new, and I could endure it, but now it just really annoys me.” “It is really disruptive,” others agree.

A New Kind of Money-Making Machine

China’s history of TV advertisement is not a long one; it wasn’t until 1979 that China’s first TV commercial was aired. Since then, the industry has blossomed, and branded content has become ubiquitous; the first TV drama incorporating product placement was broadcasted in 1991 (Li 2016).

Product placement is known as a powerful marketing tool since it is inescapable, has a long shelf life, is inexpensive, and unobtrusive (Huan et al 2013, 508). But as China’s product placement has been turning into ‘branded entertainment’ within the settings of the show, it is losing its ‘unobtrusiveness.’

Unsurprisingly, this is not the first time this type of advertising receives criticism. In 2017, various Chinese media, such as People’s Daily, noted the rise of inserted product ads, stating that TV dramas were “shooting themselves in the foot” with these ad campaigns.

China’s popular ‘inserted ad breaks’ remind of the weird and obvious product placement mocked in The Truman Show (1998).

When the protagonist of a dynastic costume drama suddenly promotes a new smartphone app during an inserted ad break, he falls out of character, and the entire drama loses credibility. Do you remember those weird ad breaks in the famous American movie The Truman Show? Even Truman did not fall for that!

Cartoon by People’s Daily

In China, this particular type of advertising can be traced back to the 2006 TV drama My Own Swordsman (武林外传), in which the characters suddenly turn to the camera in promoting a “White Camel Mountain” medicinal powder (watch the famous segment here).

Although that scene was for entertainment purposes only (the product was non-existent), it became reality in 2013, when the TV series Longmen Express (龙门镖局) first started using this kind of ‘creative’ advertising. Many online dramas then followed and started to use these inserted ads, especially since 2015 (Beijing Daily 2017). The promoted products are often new apps or money lending sites.

In the beginning, many people appreciated the novel way of advertising, and as the online video industry rose, so did the price of such advertisements. In a timeframe of roughly two years, their price became ten times higher. These type of ‘ad breaks’ have become an important and relatively easy money-making machine for drama productions (Beijing Daily 2017). In 2016 alone, Chinese TV drama productions made 800 million rmb (±116 million USD) through this marketing method – a figure that has been on the rise ever since.

The V-Effect: From Vips to Verfremdung

In China’s flourishing online streaming environment, one of the problems with inserted ad campaigns is that even ‘VIP members’ of popular video sites such as iQiyi cannot escape them, nor ‘skip’ them, even though they pay monthly fees to opt out of commercials (similar to YouTube Premium).

“The reason I signed up for a VIP membership is to avoid ads, and now we get this,” many annoyed netizens comment on Weibo.

Although that is one point that many people are dissatisfied with, the biggest complaint on social media regarding the inserted ad phenomenon is that it breaks down audience engagement in the show they are watching, and alienates them from the character, which is also known as verfremdungseffekt, distancing effect, or simply the ‘V-effect,’ a performing arts concept coined by German playwright Bertolt Brecht in the 1930s.

The “direct adress” of Frank Underwood in House of Cards is one of the reasons the show became such a hit.

The Brechtian “direct address” technique, one of the characteristics that made the American TV series House of Cards so successful, is employed to “break the fourth wall” – the imaginary wall between the actors and audience – and serves a clear purpose: it makes viewers less emotionally attached to the characters and the narrative, it makes them more conscious and less likely to ‘lose themselves’ in the show they are watching, and is meant to provoke a social-critical audience response.

But this is exactly the faux pas China’s ubiquitous ‘creative inserted ads’ make in letting popular TV drama characters promote a new app or soda; it is not meant to provoke a social-critical response, it is meant to advertise a product. But by alienating audiences from the show for a commercial and non-meaningful purpose, they actually reach the opposite effect of what their marketing objective is. Audiences become annoyed, less engaged, and ‘exit the show’ (in Chinese, the term ‘出戏’ [disengage from the performance] is used).

“These kind of ads make the entire drama seem so low,” a typical comment on Weibo says. “What can we do? As long as people pay for it, they’ll do it,” others say.

Despite the recent attack on China’s ‘branded entertainment,’ there is no sign of a change in these marketing techniques. Perhaps, if critique persist, this might change in the future. For now, disgruntled viewers turn to social media to vent their frustrations: “These ads completely make me lose interest in the story, they need to be criticized. I’m happy someone stood up to say it.”

By Manya Koetse

Follow @whatsonweibo

References

Beijing Daily (北京日报). 2017. “创意中插广告泛滥,唯独缺了创意” [The Overflow of Creative Inserted Ads, Only They’re Lacking Creativity] (in Chinese). Beijing Daily, Oct 18. Available online http://bjrb.bjd.com.cn/html/2017-10/18/content_183998.htm [Jan 6th 2019].

Doland, Angela. 2017. “China’s online TV pushes product placement to crazy levels. Even crazier: Viewers don’t mind.” Ad Age, May 16. Vol.88(10), p.0030.

Huan Chen , En-Ying Lin , Fang Liu & Tingting Dai. 2013. “‘See Me or Not, I Am There’: Chinese White-Collar Moviegoers’ Interpretation of Product Placements in Chinese Commercial Movies.” Journal of Promotion Management, 19:5, 507-533.

Li, Hongmei. 2016. Advertising and Consumer Culture in China. Cambridge: Polity Press.

Spotted a mistake or want to add something? Please let us know in comments below or email us.

©2019 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

China Brands, Marketing & Consumers

Hasan Piker’s China Trip & the Unexpected Journey of a Chinese School Uniform to Angola

Hasan Piker’s controversial China tour, a Chinese school uniform resurfaces in Africa, a new winter hotspot, why Chinese elites ‘run’ to Tokyo, and more.

Published

3 months agoon

November 21, 2025

🌊 Signals — Week 47 (2025)

Part of Eye on Digital China, Signals highlights slower trends and online currents behind the daily scroll. This edition was sent to paid subscribers — subscribe to receive the next issue in your inbox.

Welcome to another edition of Eye on Digital China. Different from the China Trend Watch (check the latest one here if you missed it), this edition, part of the new Signals series, is about the slower side of China’s social media: the recurring themes and underlying shifts that signal broader trends beyond the quick daily headlines. Together with the deeper dives, the three combined aim to give you clear updates and a fuller overview of what’s happening in China’s online conversations & digital spaces.

For the coming two weeks, I’ll be traveling from Beijing to Chongqing and beyond (more on that soon) so please bear with me if my posting frequency dips a little. I’ll be sure to pick it up again soon and will do my best to keep you updated along the way. In the meantime, if you know of a must-try hotpot in Chongqing, please do let me know.

In this newsletter: Hasan Piker’s controversial China tour, a Chinese school uniform in Angola, a new winter hotspot, discussions on what happens to your Wechat after you die, why Chinese elites rùn to Tokyo, and more. Let’s dive in.

- 💰 The richest woman in China, according to the latest list by Hurun Research Institute, is the “queen of pharmaceuticals” Zhong Huijuan (钟慧娟) who has accumulated 141 billion yuan (over 19 billion USD). Women account for over 22% of Chinese billionaires (those with more than 5 billion RMB), underscoring China’s globally leading position in producing wealthy female entrepreneurs.

- 🧩 What happens to your WeChat after you die? A user who registered for NetEase Music with a newly reassigned phone number unexpectedly gained access to the late singer Coco Lee’s (李玟) account, as the number had originally belonged to her. The incident has reignited debate over how digital accounts should be handled after death, prompting platforms like NetEase and Tencent to reconsider policies on long-inactive accounts and take stronger measures to protect them.

- 📱 Although millions of viewers swoon over micro-dramas with fantasy storylines where rich, powerful men win over the “girl next door” through money and status, Chinese regulators are now stepping in to curb exaggerated plots featuring the so-called “dominant CEO” (霸道总裁) archetype, signaling stricter oversight for the booming short drama market.

- ☕ A popular Beijing coffee chain calling itself “People’s Cafe” (人民咖啡馆), with its style and logo evoking nationalist visual nostalgia, has changed its name after facing criticism for building its brand – including pricey coffee and merchandise – on Mao era and state-media political connotations. The cafe is now ‘Yachao People’s Cafe’ (要潮人民咖啡馆).

- 👀 Parents were recently shocked to see erotic ads appear on the Chinese nursery rhymes and children’s learning app BabyBus (宝宝巴士), which is meant for kids ages 0–8. BabyBus has since apologized, but the incident has sparked discussions about how to keep children safe from such content.

- 🧧The 2026 holiday schedule has continued to be a big topic of conversation as it includes a 9-day long Spring Festival break (from February 15 to February 23), making it the longest Lunar New Year holiday on record. The move not only gives people more time for family reunions, but also gives a huge boost to the domestic travel industry.

Hasan Piker’s Chinese Tour & The US–China Content Honeymoon

Livestreamer Hasan Piker during his visit to Tiananmen Square flag-rising ceremony.

It’s not time for the end-of-year overviews just yet – but I’ll already say that 2025 was the US–China ‘honeymoon’ year for content creation. It’s when China became “cool,” appealing, and eye-grabbing for young Western social media users, particularly Americans. The recent China trip of the prominent American online streamer Hasan Piker fits into that context.

This left-wing political commentator also known as ‘HasanAbi’ (3 million followers on Twitch, recently profiled by the New York Times) arrived in China for a two-week trip on November 11.

Piker screenshot from the interview with CGTN, published on CGTN.

His visit has been controversial on English-language social media, especially because Piker, known for his criticism of America (which he calls imperialist), has been overly praising China: calling himself “full Chinese,” waving the Chinese flag, joining state media outlet CGTN for an interview on China and the US, and gloating over a first-edition copy of Quotations from Chairman Mao (the Little Red Book). He portrays China as heavily misrepresented in the West and as a country the United States should learn from.

Hasan Piker did an interview with CGTN, posing with Li Jingjing 李菁菁.

During his livestreaming tour, Hasan, who is nicknamed “lemonbro” (柠檬哥) by Chinese netizens, also joined Chinese platforms Bilibili and Xiaohongshu.

But despite all the talk about Piker in the American online media sphere, online conversations, clicks, and views within China are underwhelming. As of now, he has around 24,000 followers on Bilibili, and he’s barely a topic of conversation on mainstream feeds.

Piker’s visit stands in stark contrast to that of American YouTuber IShowSpeed (Darren Watkins), who toured China in March. With lengthy livestreams from Beijing to Chongqing, his popularity exploded in China, where he came to be seen by many as a representative of cultural diplomacy.

IShowspeed in China, March 2025.

IShowSpeed’s success followed another peak moment in online US–China cultural exchange. In January 2025, waves of foreign TikTok users and popular creators migrated to the Chinese lifestyle app Xiaohongshu amid the looming TikTok ban.

Initially, the mass migration of American users to Xiaohongshu was a symbolic protest against Trump and US policies. In a playful act of political defiance, they downloaded Xiaohongshu to show they weren’t scared of government warnings about Chinese data collection. (For clarity: while TikTok is a made-in-China app, it is not accessible inside mainland China, where Douyin is the domestic version run by the same parent company).

The influx of foreigners — who were quickly nicknamed “TikTok refugees” — soon turned into a moment of cultural celebration. As American creators introduced themselves, Chinese users welcomed them warmly, eager to practice English and teach newcomers how to navigate the app. Discussions about language, culture, and societal differences flourished. Before long, “TikTok refugees” and “Xiaohongshu natives” were collaborating on homework assignments, swapping recipes, and bonding through humor. It was a rare moment of social media doing what we hope it can do: connect people, build bridges, and replace prejudice with curiosity.

Some of that same enthusiasm was also visible during IShowSpeed’s China tour. Despite the tour inevitably getting entangled with political and commercial interests, much of it was simply about an American boy swept up in the high energy of China’s vibrant cities and everything they offer.

Different from IShowSpeed, who is known for his meme-worthy online presence, Piker is primarily known for his radical political views. His China enthusiasm feels driven less by cultural curiosity and more by his critique of America.

Because of his stances — such as describing the US as a police state — it’s easy for Western critics to accuse him of hypocrisy in praising China, especially after a brief run-in with security police while livestreaming at Tiananmen Square.

Seen in broader context, Piker’s China trip reflects a shift in how China is used in American online discourse.

Before, it was Chinese ‘public intellectuals’ (公知) who praised the US as a ‘lighthouse country’ (灯塔国), a beacon of democracy, to indirectly critique China and promote a Western modernization model. Later, Chinese online influencers showcased their lives abroad to emphasize how much ‘brighter the moon’ was outside China.

In the post-Covid years, the current reversed: Western content creators, from TikTok influencers to political commentators, increasingly use China to make arguments that are fundamentally about America.

Between these cycles, authentic cultural curiosity gets pushed to the sidelines. The TikTok-refugee moment in early January may have been the closest we’ve come in years: a brief window where Chinese and American users met each other with curiosity, camaraderie, and creativity.

Hasan’s tour, in contrast, reflects a newer phase, one where China is increasingly used as a stage for Western political identity rather than a complex and diverse country to understand on its own terms. I think the honeymoon phase is over.

“Liu Sihan, Your School Uniform Ended Up in Angola”: China’s Second-Hand Clothing in Africa

A Chinese school uniform went viral after a Chinese social media user spotted it in Angola.

“Liu Sihan, your schooluniform is hot in Africa” (刘思涵你的校服在非洲火了) is a sentence that unexpectedly trended after a Chinese blogger named Xiao Le (小乐) shared a video of a schoolkid in Angola wearing a Chinese second-hand uniform from Qingdao Xushuilu Primary School, that had the nametag Liu Sihan on it.

The topic sparked discussions about what actually happens to clothing after it’s donated, and many people were surprised to learn how widely Chinese discarded clothing circulates in parts of Africa.

Liu Sihan’s mother, whose daughter is now a 9th grader in Qingdao, had previously donated the uniform to a community clothing donation box (社区旧衣回收箱) after Liu outgrew it. She intended it to help someone in need, never imagining it to travel all the way to Africa.

In light of this story, one netizen shared a video showing a local African market selling all kinds of Chinese school items, including backpacks, and people wearing clothing once belonging to workers for Chinese delivery platforms. “In Africa, you can see school uniforms from all parts of China, and even Meituan and Eleme outfits,” one blogger wrote.

When it comes to second-hand clothing trade, we know much more about Europe–Africa and US–Africa flows than about Chinese exports, and it seems there haven’t been many studies on this specific topic yet. Still, alongside China’s rapid economic transformations, the rise of fast fashion, and the fact that China is the world’s largest producer and consumer of textiles, the country now has an enormous abundance of second-hand clothing.

According to a 2023 study by Wu et al. (link), China still has a long way to go in sustainable clothing disposal. Around 40% of Chinese consumers either keep unwanted clothes at home or throw them away.

But there may be a shift underway. Donation options are expanding quickly, from government bins to brand programs, and from second-hand stores to online platforms that offer at-home pickup.

Chinese social media users posting images of school/work uniforms from China worn by Africans.

As awareness grows around the benefits of donating clothing (reducing waste, supporting sustainability, and the emotional satisfaction of giving), donation rates may rise significantly. The story of Liu Sihan’s uniform, which many found amusing, might even encourage more people to donate. And if that happens, scenes of African children (and adults) wearing Chinese-donated clothes may become much more common than they now are.

Laojunshan: New Hotspot in Cold Winter

Images from Xiaohongshu, 背包里的星子, 旅行定制师小漾

Go to Zibo for BBQ, go to Tianshui for malatang, go to Harbin for the Ice Festival, cycle to Kaifeng for soup dumplings, or head to Dunhuang to ride a camel — over recent years, a number of Chinese domestic destinations have turned into viral hotspots, boosted by online marketing initiatives and Xiaohongshu influencers.

This year, Laojunshan is among the places climbing the trending lists as a must-visit spot for its spectacular snow-covered landscapes that remind many of classical Chinese paintings. Laojunshan (老君山), a scenic mountain in Henan Province, is attracting more domestic tourists for winter excursions.

Xiaohongshu is filled with travel tips: how to get there from Luoyang station (by bus), and the best times of day to catch the snow in perfect light (7–9 AM or around 6–6:30 PM).

With Laojunshan, we see a familiar pattern: local tourism bureaus, state media, and influencers collectively driving new waves of visitors to the area, bringing crucial revenue to local industries during what would otherwise be slower winter months.

WeChat New Features & Hong Kong Police on Douyin

🟦 WeChat has been gradually rolling out a new feature that allows users to recall a batch of messages all at once, which saves you the frantic effort of deleting each message individually after realizing you sent them to the wrong group (or just regret a late-night rant). Many users are welcoming the update, along with another feature that lets you delete a contact without wiping the entire chat history. This is useful for anyone who wants to preserve evidence of what happened before cutting ties.

🟦The Hong Kong Police Force recently celebrated its two-year anniversary on Douyin (the Chinese version of TikTok), having accumulated nearly 5 million followers during that time. To mark the occasion, they invited actor Simon Yam to record a commemorative video for their channel (@香港警察). The presence of the Hong Kong Police on the Chinese app — and the approachable, meme-friendly way they’ve chosen to engage with younger mainland audiences — is yet another signal of Hong Kong institutions’ strategic alignment with mainland China’s digital infrastructure, a shift that has been gradually taking place. The anniversary video proved popular on Douyin, attracting thousands of likes and comments.

Why Chinese Elite Rùn to Japan (by ChinaTalk)

Over the past week, Japan has been trending every single day on Chinese social media in light of escalating bilateral tensions after Japanese PM Takaichi made remarks about Taiwan that China views as a direct military threat. The diplomatic freeze is triggering all kinds of trends, from rising anti-Japanese sentiment online and a ban on Japanese seafood imports to Chinese authorities warning citizens not to travel to Japan.

You’d think Chinese people would want to be anywhere but Japan right now — but the reality is far more nuanced.

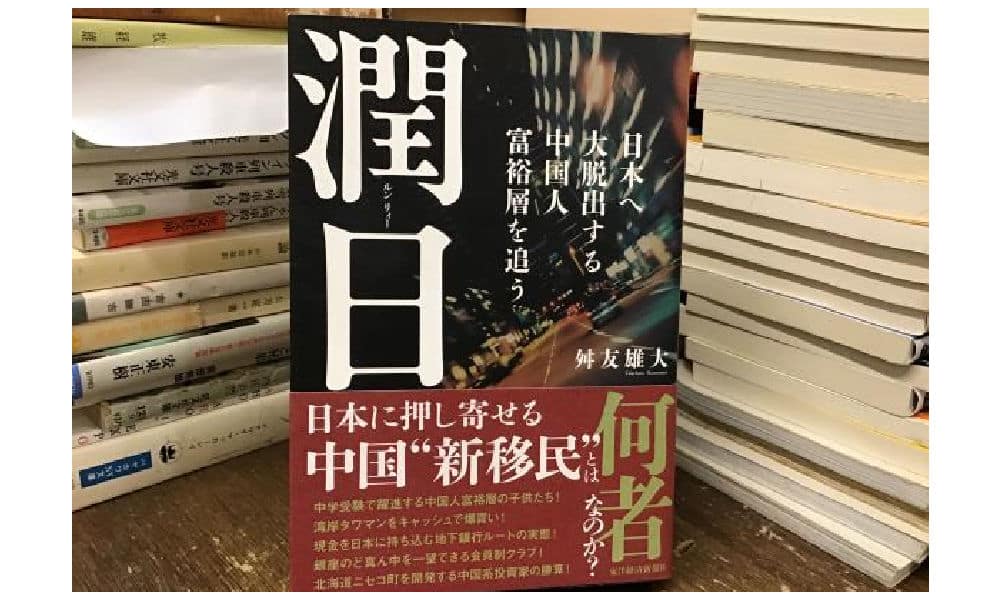

In a recent feature in ChinaTalk, Jordan Schneider interviewed Japanese journalist & researcher Takehiro Masutomo (舛友雄大) who has just published a book about Japan’s new Chinese diaspora, explaining what draws Chinese dissidents, intellectuals, billionaires, and middle-class families to Tokyo.

The book is titled Run Ri: 潤日 Following the Footsteps of Elite Chinese Escaping to Japan (only available in Japanese and Traditional Chinese for now). (The word Rùn 润/潤, by the way, is Chinese online slang and meme expresses the desire to escape the country.)

A very interesting read on how Chinese communities are settling in Japan, a place they see as freer than Hong Kong and safer than the U.S., and one they’re surprisingly optimistic about — even more so than the Japanese themselves.

Thanks for reading this Eye on Digital China Signals. For fast-moving trends and deeper dives, keep an eye on the upcoming newsletters.

And if you just so happen to be reading this without a subscription and appreciate my work, consider joining to receive future issues straight in your inbox.

A small housekeeping note:

This Eye on Digital China newsletter is co-published for subscribers on both Substack and the main site. If you’re registered on both platforms, you’ll receive duplicate emails — so if that bothers you, please pick your preferred platform and unsubscribe from the other.

Many thanks to Miranda Barnes for helping curate some of the topics in this edition.

— Manya

Spotted an error or want to add something? Comment below or email me.

First-time commenters require manual approval.

©2025 Eye on Digital China / What’s on Weibo. Do not reproduce without permission —

contact info@whatsonweibo.com.

China Brands, Marketing & Consumers

House of Wahaha: Zong Fuli Resigns

In the year following her father’s death, Zong Fuli dealt with controversy after controversy as the head of Chinese food & beverage giant Wahaha.

Published

5 months agoon

October 14, 2025

It’s a bit like a Succession-style corporate drama 🍿.

Over the past few years, we’ve covered stories surrounding Chinese beverage giant Wahaha (娃哈哈) several times — and with good reason.

Since the passing of its much-beloved founder Zong Qinghou (宗庆后) in March 2024, the company has been caught in waves of internal turmoil.

Some context: Wahaha is regarded as a patriotic brand in China — not only because it’s the country’s equivalent of Coca-Cola or PepsiCo (they even launched their own cola in 1998 called “Future Cola” 非常可乐, with the slogan “The future will be better” 未来会更好), but also because its iconic drinks are tied to the childhood memories of millions.

Future Cola by Wahaha via Wikipedia.

There’s also the famous 2006 story when Zong Qinghou refused a buyout offer from Danone. Although the details of that deal are complex, the rejection was widely seen as Zong’s defense of a Chinese brand against foreign takeover, contributing to his status as a national business hero.

After the death of Zong, his daughter Zong Fuli, also known as Kelly Zong (宗馥莉), took over.

🔹 But Zong Fuli soon faced controversy after controversy, including revelations that Wahaha had outsourced production of some bottled water lines to cheaper contractors (link).

🔹 There was also a high-profile family inheritance dispute involving three illegitimate children of Zong Qinghou, now living in the US, who sued Zong Fuli in Hong Kong courts, claiming they were each entitled to multi-million-dollar trust funds and assets.

🔹 More legal trouble arrived when regulators and other shareholders objected to Zong Fuli using the “Wahaha” mark through subsidiaries and for new products outside officially approved channels (the company has 46% state ownership).

⚡️ The trending news of the moment is that Zong Fuli has officially resigned from all positions at Wahaha Group as chairman, legal representative, and director. She reportedly resigned on September 12, after which she started her own brand named “Wa Xiao Zong” (娃小宗). One related hashtag received over 320 million views on Weibo (#宗馥莉已经辞职#). Wahaha’s board confirmed the move on October 10, appointing Xu Simin (许思敏) as the new General Manager. Zong remains Wahaha’s second-largest shareholder.

🔹 To complicate matters further, Zong’s uncle, Zong Wei (宗伟), has now launched a rival brand — Hu Xiao Wa (沪小娃) — with product lines and distribution networks nearly identical to Wahaha’s.

As explained by Weibo blogger Tusiji (兔撕鸡大老爷), under Zong Qinghou, Wahaha relied on a family-run “feudal” system with various family-controlled factories. Zong Fuli allegedly tried to dismantle this system to centralize power, fracturing the Wahaha brand and angering both relatives and state investors.

Others also claim that Zong had already been engaged in a major “De-Wahaha-ization” (去娃哈哈化) campaign long before her resignation.

In August of this year, Zong gave an exclusive interview to Caijing (财经) magazine where she addressed leadership challenges and public controversies. In the interview, Zong spoke more about her views on running Wahaha, advocating long-term strategic growth over short-term results, and sharing her determination to not let controversy distract her from business operations. That plan seems to have failed.

While Chinese netizens are watching this family brand war unfold, many are rooting for Zong after everything she has gone through – they feel her father left her in a complicated mess after his death.

At the same time, others believe she tried to run Wahaha in a modern “Western” way and blame her for that.

For the brand image of Wahaha, the whole ordeal is a huge blow. Many people are now vowing not to buy the brand again.

As for Zong’s new brand, we’ll have to wait for the next episode in this family company drama to see how it unfolds.

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Eye on Digital China is a reader-supported publication by

Manya Koetse (@manyapan) and powered by What’s on Weibo.

It offers independent analysis of China’s online culture, media, and social trends.

To receive the newsletter and support this work, consider

becoming a paid subscriber.

Get in touch

Have a tip, story lead, or book recommendation? Interested in contributing? For ideas, suggestions, or just a quick hello, reach out here.

Spring Festival Trend Watch: Gala Highlights, Small-City Travel, and the Mazu Ritual Controversy

Inside Chunwan 2026: China’s Spring Festival Gala

The Fake Patients of Xiangyang: Hospital Scandal Shakes Welfare System Trust

China Trend Watch: Takaichi’s Win, Olympic Tensions, and “Tapping Out”

Spending the Day in China’s Wartime Capital

From a Hospital in Crisis to Chaotic Pig Feasts

Trump, Taiwan & The Three-Body Problem: How Chinese Social Media Frames the US Strike on Venezuela

Hong Kong Fire Updates, Nantong’s Viral Moment & Japanese Concert Cancellations

Chinamaxxing and the “Kill Line”: Why Two Viral Trends Took Off in the US and China

China’s 2025 Year in Review in 12 Phrases

Popular Reads

-

Chapter Dive8 months ago

Chapter Dive8 months agoHidden Cameras and Taboo Topics: The Many Layers of the “Nanjing Sister Hong” Scandal

-

Chapter Dive10 months ago

Chapter Dive10 months agoUnderstanding the Dr. Xiao Medical Scandal

-

China Insight7 months ago

China Insight7 months ago“Jiangyou Bullying Incident”: From Online Outrage to Offline Protest

-

Chapter Dive10 months ago

Chapter Dive10 months agoChina Is Not Censoring Its Social Media to Please the West