China Arts & Entertainment

The Rising Influence of Fandom Culture in Chinese Table Tennis

The match between Sun Yingsha and Chen Meng in Paris highlighted how the fan culture surrounding Chinese table tennis can clash with the Olympic spirit.

Published

11 months agoon

By

Ruixin Zhang

During the Paris Olympics, not a day went by without table tennis making its way onto Weibo’s trending lists. The Chinese table tennis team achieved great success, winning five gold medals and one silver.

However, the women’s singles final on August 3rd, between Chinese champions Chen Meng (陈梦) and Sun Yingsha (孙颖莎), took viewers by surprise due to the unsettling atmosphere. The crowd overwhelmingly supported Sun Yingsha, with little applause for Chen Meng, and some hurled insults at her. Even the coaching staff had stern expressions after Chen’s win.

This bizarre scene sparked heated discussions on Chinese social media, exposing the broader audience to the chaotic and sometimes absurd dynamics within China’s table tennis fandom.

“I welcome fans but reject fandom culture.”

When Sun Yingsha and Chen Meng faced off in the women’s singles final, the medal was destined for ‘Team China’ regardless of the outcome; the match should have been a celebration of Chinese table tennis.

However, the match held significant importance for both Sun and Chen individually. Chen Meng, the defending champion from the previous Olympics, was on the verge of making history by retaining her title. Meanwhile, Sun Yingsha, an emerging star who had already claimed singles titles at the World Cup and World Championships, was aiming to complete a career Grand Slam (World Championships, World Cup, and Olympics).

[center] Announcement of the Chen (L) vs Sun (R) match by People’s Daily on social media.[/center]

Sun Yingsha has clearly become a public favorite. On Weibo, the table tennis star ranked among the most beloved athletes in popularity lists.

This favoritism among Chinese table tennis fans was evident at the venue. According to reports from a Chinese audience member, anyone shouting “Go Chen Meng!” (“陈梦加油”) was quickly silenced or booed, while even cheering “Come on China!” (“中国队加油”) was met with ridicule. After Chen Meng’s 4-2 victory, many in the audience expressed their frustration and chanted “refund” during the award ceremony. Meanwhile, social media was flooded with hateful posts cursing Chen for winning the match.

For many who were unfamiliar with the off-court drama, the influence of fandom culture on the Olympics was shocking. However, in the world of Chinese table tennis, such extreme fan behavior has been brewing for some time. Even during the eras of Ma Long (马龙) and Zhang Jike (张继科), there were already fans who would turn against each other and others.

This year’s men’s singles champion, Fan Zhendong (樊振东), had long noticed the growing influence of fandom culture. In recent years, he has repeatedly voiced his discomfort with fan activities like “airport send-offs” and “fan meet-and-greets.” Earlier this year, he took to social media to reveal that he and his loved ones were being harassed by both overzealous fans and haters, and that he was considering legal action. He made it clear: “I welcome fans but reject fandom culture.” His consistent stance against fandom has helped cultivate a relatively rational fan base.

“What has happened to Chinese table tennis fans over the years?”

On Weibo, a blogger (@3号厅检票员工) posed a question that struck a chord with many, garnering over 30,000 likes: “What has happened to Chinese table tennis fans over the years?”

In the comments, many blamed Liu Guoliang (刘国梁) for fueling the fan culture around table tennis. Liu, the first Chinese male player to achieve the Grand Slam, retired in 2002 and then became a coach for the Chinese table tennis team. His coaching career has been highly successful, leading players like Ma Long and Xu Xin (许昕) to numerous championships.

Beyond coaching, Liu has been dedicated to commercializing table tennis. Compared to international tournaments in sports like tennis or golf, the prize money for Chinese table tennis players is only about one-tenth of those sports. Fan Zhendong has publicly stated on Weibo that the prize money for their competitions is too low compared to badminton. Liu believes table tennis has significant untapped commercial potential that has yet to be fully realized.

Under Liu’s leadership, the commercialization of the Chinese table tennis team began after the Rio Olympics, where China won all four gold medals. Viral internet memes like “Zhang Jike, wake up!” (继科你醒醒啊) and “The chubby guy who doesn’t understand the game” (不懂球的胖子) made both the sport and its athletes wildly popular in China.

Seeing the opportunity, Liu quickly increased the team’s exposure, encouraging players to create Weibo accounts, do live streams, star in films, and participate in variety shows. This approach rapidly turned the Chinese table tennis team into a “super influencer” in the Chinese sports world.

While this move has certainly increased the athletes’ visibility, it has also drawn criticism: is this kind of commercialization and celebrity status the right path for China’s table tennis? Successful commercialization requires a mature system for talent selection, team building, and athlete management. However, the selection process in Chinese table tennis remains opaque, the current team-building system shows little promise, and young athletes struggle to break through.

Additionally, athlete management appears amateurish. After watching an interview with Chinese tennis player Zheng Qinwen (郑钦文), a Douban netizen commented that Liu Guoliang’s plan for commercializing athletes is highly unprofessional—relying mainly on their personal charisma to attract attention. The most common criticism is that Liu and the Table Tennis Association should let professionals handle the professional work. Without a solid foundation for commercialization, the current focus on hype and marketing in Chinese table tennis may temporarily boost ticket sales but could ultimately backfire.

“Didn’t you say you want to crack down on fan culture?”

In response to the controversy surrounding the Chen vs. Sun match, the Beijing Daily published an article titled “How Can We Allow Fandom Violence to Disturb the World of Table Tennis?” The article addressed the growing problem of “fandom culture” infiltrating table tennis, a trend that originated in the entertainment world. It highlighted how extreme fan behavior, including online abuse and disruptive actions during matches, harms both the sport and the mental well-being of athletes. While fan enthusiasm is important, the article stressed that it must remain within rational limits.

This article foreshadowed actions taken shortly after. On August 7th, China’s Ministry of Public Security announced an online crackdown on chaotic sports-related fan circles. Social media platforms responded swiftly: Weibo deleted over 12,000 posts and banned more than 300 accounts, while Xiaohongshu, Bilibili, and Migu Video removed over 840,000 posts and banned or muted more than 5,300 accounts.

The campaign against fan culture sparked online debate. Some netizens criticized the official stance on “fandom” as overly simplistic. The Chinese term for “fandom,” 饭圈 (fànquān), contains a homophone for “fan,” referring to enthusiastic supporters of celebrities. In contemporary Chinese discourse, the term is often linked to the idol industry and carries negative, gender-biased connotations, particularly towards “irrational female fans chasing male idols.”

One Weibo post argued that commercialized sports, like football, are inherently tied to fan loyalty, belonging, and exclusivity. Disruptions among fans are not solely due to “fandom” but are often influenced by larger forces, such as capital or authorities. In the table tennis final, even the coaching team’s dissatisfaction with Chen Meng’s victory points to underlying problems beyond fan behavior.

While public backlash against “fandom” in sports often stems from concerns over its toxicity and violence, as blogger Yuyu noted, internal conflicts and power struggles have always existed in competitive sports. Framing these issues solely as “fandom problems” risks oversimplifying the situation and overlooks challenges such as commercialization failures, poor youth development, and internal factionalism within sports teams. The simplistic blame on “fandom culture” is seen by some as a distraction from these real issues, further fueling public frustration.

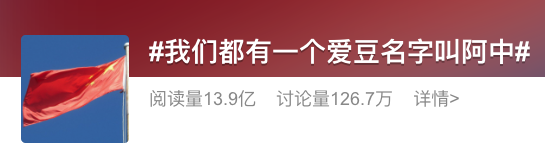

This public frustration is evident in a 2019 Weibo post and hashtag from People’s Daily. The five-year-old post personified China as a young male idol, promoting patriotism through fandom culture with the slogan “We all have an idol named ‘A Zhong’ (#我们都有一个爱豆名字叫阿中#)” [‘A Zhong’ was used as a nickname to refer to a personified China]. This promotion of ‘China’ as an idol with a 1.4 billion ‘fandom’ resurfaced during the Hong Kong protests.

Hashtag: “We all have an idol named Azhong” [nickname for China]

Now, after state media harshly criticized fandom culture, netizens have revisited the post, bringing it back into the spotlight. Recent comments on the post are filled with sarcasm, highlighting how fandom is apparently embraced when convenient and scapegoated when problems arise.

Post by People’s Daily promoting China as an “idol.”

“Didn’t you say you wanted to crack down on fan culture?” one commenter wondered.

Chen Meng, the Olympic table tennis champion, has also addressed the fan culture surrounding the 2024 Paris matches. She expressed her hope that, in the future, fans will focus more on the athletes’ “fighting spirit” on the field. True sports fans, she suggested, should be able to celebrate when their favorite athlete wins and accept it when they lose. “Because that’s precisely what competitive sports are all about,” she said.

By Ruixin Zhang

edited for clarity by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Ruixin is a Leiden University graduate, specializing in China and Tibetan Studies. As a cultural researcher familiar with both sides of the 'firewall', she enjoys explaining the complexities of the Chinese internet to others.

China ACG Culture

A Very Short Guide to China’s Most Popular Designer Toys

Published

3 hours agoon

July 6, 2025

In our last article, we’ve determined how Wakuku’s rise is not just about copying & following in Labubu’s footsteps and more about how China is setting the pace for global pop culture IPs. I now want to give you a small peek into the main characters in the field that are currently relevant.

Even if these dolls aren’t really your thing, you’ll inevitably run into them and everything happening around them.

Before diving into the top trending characters, a quick word on the challenges ahead for Labubu & co:

🚩 Bloomberg Opinion columnist Shuli Ren recently argued that Labubu’s biggest threat isn’t competition from Wakuku or knockoffs like “Lafufu,” but the fragility of its resale ecosystem — particularly how POP MART balances supply, scarcity, and reseller control.

Scarcity is part of what makes Labubu feel premium. But if too many dolls go to scalpers, it alienates real fans. If scalpers can’t profit, Labubu risks losing its luxury edge. Managing this dynamic may be POP MART’s greatest long-term challenge.

🚩 Chinese Gen Z consumers value authenticity — and that’s something money can’t manufacture. If China’s booming IP toy industry prioritizes speed and profit over soul, the hype may die out at a certain point.

🚩 The same goes for storytelling. Characters need a solid universe to grow in. Labubu had years to build out its fantasy universe. Cute alone isn’t enough — characterless toys don’t leave a lasting impression and don’t resonate with consumers.

Examples of popularity rankings of Chinese IP toys on Xiaohongshu.

With that in mind… let’s meet the main players.

On platforms like Xiaohongshu, Douyin, and Weibo, users regularly rank the hottest collectible IPs. Based on those rankings, here’s a quick who’s-who of China’s current trend toy universe:

1. Labubu (拉布布)

Brand: POP MART

Creator: Kasing Lung

Year launched: 2015 (independent), 2019 with POP MART.

The undisputed icon of China’s trend toy world, Labubu is a mischievous Nordic forest troll with big eyes, nine pointy teeth, and bunny ears. Its quirky, ugly-cute design, endless possibilities of DIY costume changes, and viral celebrity endorsements have made it a must-have collectible and a global pop culture phenomenon.

2. Wakuku (哇库库)

Brand & Creator: Letsvan, backed by QuantaSing Group

Year launched: 2024 with first blind box

Wakuku, a “tribal jungle hunter” with a cheeky grin and unibrow, is seen as the rising star in China’s trend toy market. Wakuku’s rapid rise is fueled by celebrity marketing, pop-up launches, and its strong appeal among Gen Z, especially considering Wakuku is more affordable than Labubu.

3. Molly (茉莉)

Brand: POP MART

Designer: Kenny Wong (王信明)

Year launched: 2006 (creator concept); POP MART 2014, first blind boxes in 2016

Molly is a classic trend toy IP, one of POP MART’s favorites, with a massive fanbase and long-lasting popularity. The character was allegedly inspired by a chance encounter with a determined young kid at a charity fundraiser event, after which Kenny Wong created Molly as a blue-eyed girl with short hair, a bit of a temperament, and an iconic pouting expression that never leaves her face.

4. SKULLPANDA (骷髅熊猫)

Brand: POP MART

Creator: Chinese designer Xiong Miao

Year launched: 2018 (creator concept); POP MART 2020

Skullpanda is one of POP MART’s flagship IPs —it’s a goth-inspired fantasy design. According to POP MART, SKULLPANDA journeys through different worlds, taking on various personas and living out myriad lives. On this grand adventure, it’s on a quest to find its truest self and break new ground all while contemplating the shape of infinity.

5. Baby Zoraa

Brand: TNT SPACE

Creator: Wang Zequn, CEO of TNT SPACE

Year launched: 2022, same year as company launch

Baby Zoraa is cute yet devlish fierce and is one of the most popular IPs under TNT SPACE. Baby Zoraa is the sister of Boy Rayan, another popular character under the same brand. Baby Zoraa’s first blind box edition reached #1 on Tmall’s trend toy sales charts and sold over 500,000 units.

6. Dora (大表姐)

Brand: TNT SPACE

Year Launched: 2023

Dora is a cool, rebellious “big sister” figure, instantly recognizable for her bold attitude and expressive style. She’s a Gen Z favorite for her gender-fluid, empowering persona, and became a breakout sucess under TNT when it launched its bigger blind boxes in 2023.

7. Twinkle Twinkle [Star Man] (星星人)

Brand: POP MART

Creator: Illustrators Daxin and Ali

Year launched: In 2024 with POP MART

This character has recently skyrocketed in popularity as a “healing star character” inspired by how stars shine even in darkness. POP MART markets this character as being full of innocence and fantasy to provide some relaxation in this modern society full of busyness and pressure.

8. Hirono (小野)

Brand: POP MART

Creator: Lang

Year launched: In 2024 with POP MART

This freckled, perpetually grumpy boy has a wild spirit combining introversion and playful defiance. Hirono highlights the subtle fluctuations of life, its ups and downs, incorporating joy, sadness, fear, and more – a personification of profound human emotions.

9. Crybaby (哭娃)

Brand: POP MART

Creator: Thai artist Molly Yllom (aka Nisa “Mod” Srikamdee)

Year launched: 2017 (creator concept), 2023 POP MART launch

Like Wakuku, Crybaby suddenly went from a niche IP to a new hot trend toy in 2025. Together with Wakuku, it is called the “next Labubu.” Thai artist Molly Yllom created the character after the loss of her beloved dog. Crybaby is a symbol of emotional expression, particularly the idea that it’s okay to cry and express feelings.

10. Pouka Pouka (波卡波卡)

Brand: 52TOYS

Creator: Ma Xiaoben

Year launched: 2025

With its round, chubby face, squirrel cheeks, playful smile, and soft, comforting appearance, Pouka Pouka aims to evoke feelings of warmth, healing, and emotional comfort.

Other characters to watch: CiciLu, Panda Roll (胖哒幼), NANCI (囡茜), FARMER BOB (农夫鲍勃), Rayan, Ozai (哦崽), Lulu the Piggy (LuLu猪), Pucky (毕奇).

We’re still working on this list!

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China ACG Culture

The Next Labubu: What the Rise of Wakuku Tells Us About China’s Collectible Toy Wave

From ugly-cute rebellion to a new kind of ‘C-pop,’ the breakout success of Wakuku sheds light on Chinese consumer culture and the forces driving China’s trend toy industry.

Published

5 hours agoon

July 6, 2025

Wakuku is the most talked-about newcomer in China’s trend toy market. Besides its mischievous grin, what’s perhaps most noteworthy is how closely Wakuku follows the marketing success of Labubu. As the strongest new designer toy of 2025, Wakuku says a lot about China’s current creative economy — from youth-led consumer trends to hybrid business models.

As it is becoming increasingly clear that Chinese designer toy Labubu has basically conquered the world, it’s already time for the next made-in-China collectible toy to start trending on Chinese social media.

Now, the name that’s trending is Wakuku, a Chinese trend toy created by the Shenzhen-based company Letsvan.

In March 2025, a new panda-inspired Wakuku debuted at Miniso Land in Beijing, immediately breaking records and boosting overall store revenue by over 90%. Wakuku also broke daily sales records on May 17 with the launch of its “Fox-and-Bunny” collab at Miniso flagship stores in Shanghai and Nanjing. At the opening of the Miniso Space in Nanjing on June 18, another Wakuku figure sold out within just two hours. Over the past week, Wakuku went trending on Chinese social media multiple times.

From left to right: the March, May, and June successful Wakuku series/figurines

Like Labubu, Wakuku is a collectible keychain doll with a soft vinyl face and a plush body. These designer toys are especially popular among Chinese Gen Z female consumers, who use them as fashion accessories (hanging them from bags) or as desk companions.

We previously wrote in depth about the birth of Labubu, its launch by the Chinese POP MART (founded 2010), and the recipe for its global popularity in this article, so if you’re new to this trend of Chinese designer toys, you’ll want to check it out first (link).

Labubu has been making international headlines for months now, with the hype reaching a new peak when a human-sized Labubu sold for a record 1.08 million RMB (US$150,700), followed by a special edition that was purchased for nearly 760,000 RMB (US$106,000).

Now, Wakuku is the new kid on the block, and while it took Labubu nine years to win over young Chinese consumers, it barely took Wakuku a year — the character was created in 2022–2023, made its retail debut in 2024, and went viral within months.

Its pricing is affordable (59–159 RMB, around $8.2-$22) and some netizens argue it’s more quality for money.

While Labubu is a Nordic forest elf, Wakuku is a tribal jungle warrior. It comes in various designs and colors depending on the series and is sold in blind boxes (盲盒), meaning buyers don’t know exactly which design they’re getting — which adds an element of surprise.

➡️ There’s a lot to say about Wakuku, but perhaps the most noteworthy aspect is how closely it mirrors the trajectory of POP MART’s Labubu.

Wakuku’s recent success in China highlights the growing appeal and rapid rise of Chinese IPs (beyond its legal “intellectual property” meaning, ‘IPs’ is used to refer to unique cultural brands, characters, or stories that can be developed into collectibles, merchandise, and broader pop culture phenomena).

Although many critics predict that the Labubu trend will blow over soon, the popularity of Wakuku and other Labubu-like newcomers shows that these toys are not just a fleeting craze, but a cultural phenomenon that reflects the mindset of young Chinese consumers, China’s cross-industry business dynamics, and the global rise of a new kind of ‘C-pop.’

Wakuku: A Cheeky Jungle Copycat

When I say that Wakuku follows POP MART’s path almost exactly, I’m not exaggerating. Wakuku may be portrayed as a wild jungle child, but it’s definitely also a copycat.

It uses the same materials as Labubu (soft vinyl + plush), the name follows the same ABB format (Labubu, Wakuku, and the panda-themed Wakuku Pangdada), and the character story is built on a similar fantasy universe.

In fact, Letsvan’s very existence is tied to POP MART’s rise — the company was only founded in 2020, the same year POP MART, then already a decade old, went public on the Hong Kong Stock Exchange and became a dominant industry force.

In terms of marketing, Wakuku imitates POP MART’s strategy: blind boxes, well-timed viral drops, limited-edition tactics, and immersive retail environments.

It even follows a similar international expansion model as POP MART, turning Thailand into its first stop (出海首站) — not just because of its cultural proximity and flourishing Gen Z social media market, but also because Thailand was one of the first and most successful foreign markets for Labubu.

Its success is also deeply linked to celebrity endorsement. Just as Labubu gained global traction with icons like BLACKPINK’s Lisa and Rihanna seen holding the doll, Wakuku too leans heavily on celebrity visibility and entertainment culture.

Like Labubu, Wakuku even launched its own Wakuku theme song.

Since 2024, Letsvan has partnered with Yuehua Entertainment (乐华娱乐) — one of China’s leading talent agencies — to tap into its entertainment resources and celebrity network, powering the Wakuku marketing engine. Since stars like Esther Yu (虞书欣) were spotted wearing Wakuku as a jeans hanger, demand for the doll skyrocketed. Yuehua’s founder, Du Hua (杜华), even gifted a Wakuku to David Beckham as part of its celebrity strategy.

From Beckham to Esther Yu; celebrity endorsements play a big role in the viral marketing of Wakuku.

But what’s most important in Wakuku’s success — and how it builds on Labubu — is that it fully embraces the ugly-cute (丑萌 chǒu méng) aesthetic. Wakuku has a mischievous smile, expressive eyes, a slightly crooked face, a unibrow, and freckles — fitting perfectly with what many young Chinese consumers love: expressive, anti-perfectionist characters (反精致).

“Ugly-Cute” as an Aesthetic Rebellion

Letsvan is clearly riding the wave of “ugly trend toys” (丑萌潮玩) that POP MART spent years cultivating.

🔍 Why are Chinese youth so obsessed with things that look quirky or ugly?

A recent article by the Beijing Science Center (北京科学中心) highlights how “ugly-cute” toys like Labubu and Wakuku deviate from traditional Chinese aesthetics, and reflect a deeper generational pushback against perfection and societal expectations.

The pressure young people face — in education, at work, from family expectations, and information overload — is a red thread running through how China’s Gen Z behaves as a social media user and consumer (also see the last newsletter on nostalgia core).

To cope with daily stress, many turn to softer forms of resistance, such as the “lying flat” movement or the sluggish “rat lifestyle” in which people reject societal pressures to succeed, choosing instead to do the bare minimum and live simply.

This generational pushback also extends to traditional norms around marriage, gender roles, and ideals of beauty. Designer toys like Labubu and Wakuku are quirky, asymmetrical, gender-fluid, rebellious, and reflect a broader cultural shift: a playful rejection of conformity and a celebration of personal expression, authenticity, and self-acceptance.

Another popular designer toy is Crybaby, designed by Thai designer Molly, and described as follows: “Crybaby is not a boy or a girl, it is not even just human, it represents an emotion that comes from deep within. It can be anything and everything! Laughter isn’t the only way to make you feel better, crying can be healing too. If one day, a smile can’t alleviate your problems, baby, let’s cry together.”

But this isn’t just about rejecting tradition. It’s also about seeking happiness, comfort, and surprise: emotional value. And it’s usually not brand-focused but influencer-led. What matters is the story around it and who recommends it (unless the brand becomes the influencer itself — which is what’s ultimately happening with POP MART).

One of the unofficial ambassadors of the chǒu méng ugly-cute trend is Quan Hongchan (全红婵), the teenage diving champion and Olympic gold medallist from Guangdong. Quan is beloved not just for her talent, but also for her playful, down-to-earth personality.

During the Paris Olympics, she went viral for her backpack, which was overflowing with stuffed animals (some joked she was “carrying a zoo on her back”) — and for her animal-themed slippers, including a pair of ugly fish ones.

Quan Hongchan with her Wakuku, and her backpack and slippers during her Paris Olympics days.

It’s no surprise that Quan Hongchan is now also among the celebrities boosting the popularity of the quirky Wakuku.

From Factory to Fandom: A New Kind of “C-pop” in the Making

The success of Wakuku and other similar toys shows that they’re much more than Labubu 2.0; they’re all part of a broader trend tapping into the tastes and values of Chinese youth — which also speaks to a global audience.

And this trend is serious business. POP MART is one of the world’s fastest-growing consumer brands, with a current market value of approximately $43 billion, according to Morgan Stanley.

No wonder everyone wants a piece of the ‘Labubu pie,’ from small vendors to major companies.

It’s not just the resellers of authentic Labubu dolls who are profiting from the trend — so are the sellers of ‘Lafufu,’ a nickname for counterfeit Labubu dolls, that have become ubiquitous on e-commerce platforms and in toy markets (quite literally).

Wakuku’s rapid rise is also a story of calculated imitation. In this case, copying isn’t seen as a flaw but as smart market participation.

The founding team behind Letsvan already had a decade of experience in product design before setting out on their journey to become a major player in China’s popular designer toy and character merchandise market.

But their real breakthrough came in early 2025, when QuantaSing (量子之歌), a leading adult learning ed-tech company with no previous ties to toys, acquired a 61% stake in the company.

With QuantaSing’s financial backing, Yuehua Entertainment’s marketing power, and Miniso’s distribution reach, Wakuku took it to the next level.

The speed and precision with which Letsvan, QuantaSing, and Wakuku moved to monetize a subcultural trend — even before it fully peaked — shows just how advanced China’s trend toy industry has become.

This is no longer just about cute (or ugly-cute) designs; it’s about strategic ecosystems by ‘IP factories,’ from concept and design to manufacturing and distribution, blind-box scarcity tactics, immersive store experiences, and influencer-led viral campaigns — all part of a roadmap that POP MART refined and is now adopted by many others finding their way into this lucrative market. Their success is powered by the strength of China’s industrial & digital infrastructure, along with cross-industry collaboration.

The rise of Chinese designer toy companies reminds of the playbook of K-pop entertainment companies — with tight control over IP creation, strong visual branding, carefully engineered virality, and a deep understanding of fandom culture. (For more on this, see my earlier explanation of the K-pop success formula.)

If K-pop’s global impact is any indication, China’s designer toy IPs are only beginning to show their potential. The ecosystems forming around these products — from factory to fandom — signal that Labubu and Wakuku are just the first wave of a much larger movement.

– By Manya Koetse

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

A Very Short Guide to China’s Most Popular Designer Toys

The Next Labubu: What the Rise of Wakuku Tells Us About China’s Collectible Toy Wave

Jiehun Huazhai (结婚化债): Getting Married to Pay Off Debts

Yearnings, Dreamcore, and the Rise of AI Nostalgia in China

Beauty Influencer Du Meizhu Accused of Scamming Fan Out of $27K

China Is Not Censoring Its Social Media to Please the West

IShowSpeed in China: Streaming China’s Stories Well

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

China Reacts: 3 Trending Hashtags Shaping the Tariff War Narrative

China Trending Week 15/16: Gu Ming Viral Collab, Maozi & Meigui Fallout, Datong Post-Engagement Rape Case

Chinese New Nickname for Trump Mixes Fairy Tales with Tariff War

Strange Encounter During IShowSpeed’s Chengdu Livestream

No Quiet Qingming: From High-Tech Tomb-Sweeping to IShowSpeed & the Seven China Streams

Understanding the Dr. Xiao Medical Scandal

From Trade Crisis to Patriotic Push: Chinese Online Reactions to Trump’s Tariffs

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Media12 months ago

China Media12 months agoA Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

-

China Memes & Viral12 months ago

China Memes & Viral12 months agoThe “City bu City” (City不City) Meme Takes Chinese Internet by Storm

-

China Society9 months ago

China Society9 months agoDeath of Chinese Female Motorcycle Influencer ‘Shigao ProMax’ Sparks Debate on Risky Rides for Online Attention

-

China World11 months ago

China World11 months agoChina at Paris 2024 Olympics Trend File: Medals and Moments on Chinese Social Media