Chapter Dive

China’s XR Development 101: How Chinese Tech Giants are Navigating Towards the Metaverse

Chinese tech giants are massively investing in virtual reality and in the technologies that are building up the Chinese metaverse.

Published

3 years agoon

By

Jialing Xie

Virtual, Augmented, and Mixed Reality technologies are blurring the lines between the real and digital worlds and are powering the metaverse. Chinese tech giants are at the forefront of the latest developments on the mainland market, including XR, that are making the metaverse possible. Time for a round-up of what China’s key players are focusing on and which virtual initiatives are already live.

2021 is the year in which the concept of ‘metaverse’ has blossomed. In March of last year, the hugely successful online multiplayer game and game creation system Roblox went public with a market value of over $41 billion at the time, earning its reputation as the world’s first metaverse IPO.

Following the release of the 2021 sci-fi comedy Free Guy – which is set in a fictional metaverse-like video game, – and Facebook’s rebranding to ‘Meta’ last fall, ‘metaverse’ became one of the hottest buzzwords on the internet.

The term metaverse is actually decades old. In the 1981 novel True Names, the American computer scientist Vernor Steffen Vinge already envisioned a virtual world that could be accessed through a brain-computer interface, and the term ‘metaverse’ was first mentioned in the 1992 Snow Crash science fiction novel by Neal Stephenson.

Now, 5G, AI, VR, Blockchain, 3D modeling, and other new technologies converged on the concept of the metaverse industry are seeing an explosive growth in China.

At the recent 20th Party Congress, it became clear once again that the digital economy is key in China’s long-term strategies, with Chinese leader Xi Jinping promoting digitalization as one of the new “engines” of future growth.

About Metaverse (元宇宙) in China

In Chinese, ‘metaverse’ is referred to as yuányǔzhòu (元宇宙), which is a literal translation of ‘meta-verse’ – meaning ‘transcending universe’ (超越宇宙). Chinese tech sources also describe the year 2021 as “the metaverse year” (元宇宙元年).

Metaverse is a collective, shared virtual realm that can interact with the real world and where people can interact with each other and the spaces around them. There is not just one single metaverse – there can be many digital living spaces referred to as the ‘metaverse.’

Metaverse is a fluid concept or virtual experience that is still developing and due to the differences in cyber regulations, digital ecosystems, and strict control on online information flows, the Chinese metaverse will unquestionably be very different from the metaverse spheres that companies such as Facebook are working on.

The metaverse is made possible through a wide range of technologies including AI, IoT, Blockchain, Interaction Technology, computer games, and network computing. XR is key to the rise of the metaverse. XR, or Extended Reality, is an umbrella term for a range of immersive technologies including VR (Virtual Reality 虚拟现实), AR (Augmented Reality 增强现实), and MR (Mixed Reality 混合现实). A 2020 Deloitte report suggests that the global XR market consists of mainly VR technologies (48% of market share), followed by AR (34%) and MR (18%).

In December of 2020, Tencent’s CEO Ma Huateng (马化腾) announced the concept of the “All-real Internet” (全真互联网) in a special internal publication regarding the company’s growth and major changes. Ma proposed that the deep integration of the virtual and real world, the “All-real Internet,” is the future opportunity to focus on as the next stage of the (mobile) internet. Although there are some subtle differences, Ma’s idea of the “All-real Internet” overlaps with the concept of the metaverse.

The metaverse, XR, and related technologies are not just a hot issue for Chinese tech companies, they are also an important theme for Chinese authorities. The 20th Party Congress was by no means the first time for China’s leadership to stress the country’s focus on the latest digital innovations. In October 2021, President Xi Jinping also spoke about evolving China’s digital economy during the 19th CPC Central Committee. He asserted that one of the focal points within the development strategy of China’s digital economy is the further integration of digital technologies and real-world economies.

This idea was further clarified in the outline of the 14th Five-Year Plan issued by the State Council at the end of 2021, which listed VR and AR as one of the seven key industries of China’s digital economy along with cloud computing, IoT, AI, and others.

Subsequently, many local governments incorporated metaverse (“元宇宙”) and related relevant terms into their respective 14th Five-Year Plans. For example, Shanghai authorities stated it will focus on the further developments of industries related to quantum computing, 3rd-gen semiconductors, 6G communications, and metaverse.

Here, we will provide an overview of XR industry development in present-day China, going over the key players Baidu, Alibaba, and Tencent (BAT) along with the younger Chinese tech giant ByteDance. We provide an overview of what they are investing in, what their respective strategies are when it comes to XR, and give examples of the kind of initiatives that they have already launched. To limit the scope of this article, we have left out Netease, Huawei, Bilibili, and some other relevant Chinese players for now (we might still make a part two later on!).

Key Players and Strategies

▶︎ BAIDU

As one of the leading artificial intelligence (AI) and internet companies in the world, Baidu specializes in internet and AI-related products and services. Baidu is mostly known as China’s number one search engine, but its ambitions go far beyond that. “We want to be like Amazon Web Services (AWS) for the metaverse,” Ma Jie (马杰), vice president at Baidu, recently said.

The company has taken a special interest in building the infrastructure to support metaverse-related projects, deviating from the strategies that focus more on the XR-related content development and distribution that you see at Tencent or Bytedance.

What’s Happening?

Investments

◼︎ iQiyi (爱奇艺), one of China’s top media streaming platforms (sometimes also referred to as the ‘Chinese Netflix’), released its all-in-one virtual reality headset ‘Adventure Dream’ in December 2021 powered by Snapdragon XR2. Baidu owns 53% of iQiyi and holds more than 90% of its shareholder voting rights.

Research & Development

◼︎ Baidu launched the ‘Baidu VR Browser’ on July 15, 2016, becoming China’s first browser powered by webVR technology.

Xirang

◼︎ In 2017, Baidu launched ‘Baidu VR’ platform, which is now offering a wide range of VR-related software and hardware products and services, including the Baidu VR Headset, VR Creation Center, AI app, and XiRang (希壤), which is referred to as China’s “first metaverse platform.”

What’s Live?

Retail

◼︎ In 2018, Baidu VR and UXin Limited, a Chinese online used car marketplace, jointly developed VR 360° interior panoramas that put viewers in the driver’s seat to see how interior details come together and to better understand the details of each vehicle such as scratches, wheels and engine models.

◼︎ Baidu’s ‘Meta Ziwu’ (元宇宙誌屋Meta ZiWU), a virtual space within XiRang, hosts various fashion shows for international brands. In August of 2022, Italian luxury fashion house Prada livestreamed its Fall 2022 collection within the interactive realms of ‘Meta Ziwu,’ and so did Dior, the French fashion house which has also launched its first-ever metaverse exhibition “On the Road” (在路上) via Meta Ziwu.

Social Networking

◼︎ In late 2021, Baidu launched its metaverse project XiRang (希壤, ‘the land of hope’) as “the first Chinese-made metaverse product.” In December, Baidu held ‘Baidu Create 2021′, a three-day annual developers’ conference in a virtual world generated by the XiRang platform, hosting 100,000 people on one set of servers at the same time. Baidu’s Vice President Ma Jie, also Head of the Metaverse XiRang project, shared that the main goal behind this project is to lay the infrastructure of the metaverse by providing developers and content creators with the tools to build their metaverse projects.

Chinese architect Ma Yansong (马岩松), founder of MAD architects, also works together with Meta Ziwu as a virtual architect.

▶︎ALIBABA

Founded in 1999, Alibaba is one of the world’s largest e-commerce and cloud computing companies in Asia Pacific. Its massive success in e-commerce also established Alibaba’s leading position in artificial intelligence and other key technologies that have supported e-commerce, as well as in the future of metaverse.

As one of the biggest venture capital firms and investment corporations in the world, Alibaba struck several deals with prominent XR companies including Magic Leap and Nreal to gain footing in the Extended Reality industry.

As for R&D, Alibaba’s ambition in becoming the world’s fifth-largest economy led to a strong emphasis on technological research and XR-focused innovation and the founding of DAMO Academy.

Within the field of XR, Alibaba primarily focuses on two aspects: underlying technology solutions (e.g. cloud computing) and XR application in its own core business model (e-commerce).

What’s Happening?

Investments

◼︎ In February 2016 and October 2017, Alibaba led the investment rounds in Magic Leap, an augmented reality firm headquartered in Florida.

◼︎ In March of this year, Alibaba led a $60 million investment round of Beijing-based augmented reality glasses maker Nreal. Nreal, founded in 2017, has since launched two AR glasses for the Chinese market: Nreal X for developers and content creators and Nreal Air for regular consumers. Nreal Air glasses have been released in Japan and the UK in February and May of this year. In addition to AR glasses, Nreal also cooperated with iQiyi, China Mobile Migu, Weilai, and Kuaishou to develop AR content.

Research & Development

◼︎ In March 2016, Alibaba announced its own VR research lab, GM LAB ( ‘GnomeMagic’ Lab), which aims to power its e-commerce platform and other subsidiary businesses such as the VR content production for its film and music platforms.

◼︎ Alibaba registered several metaverse-related trademarks, including “Ali Metaverse.”

◼︎ In 2021, Alibaba’s DAMO Academy, a global research program in cutting-edge technologies, launched ‘X Lab’ that focuses on research in key areas related to the metaverse industry, including quantum computing, XR, and xG Technology. Tan Ping (谭平), the former Head of XR Lab, shared several of their ongoing projects at the time. One example he mentioned is the virtual character Xiaomo (小莫), who is very versatile and can, among other things, convert textual information into sign language to enable smoother communication for the hearing impaired.

Xiaomo by Alibaba can turn spoken text into sign language.

‘X Lab’ is also experimenting with making history come alive through virtual initiatives. Recently, Alibaba’s cloud gaming platform Yuanjing made it possible for visitors at their Alibaba Cloud’s Apsara conference to virtually visit the Xi’an Museum and check out its artifacts via mobile phone or laptop, or to have an immersive experience of the Tang dynasty’s imperial palace complex, powered by automatic 3D space creation and visual localization technology.

What’s Live?

eCommerce

◼︎ In November 2016, Alibaba launched the Mobile BUY+ feature in Taobao mobile apps in light of its annual Single’s Day Global Shopping Festival. With VR headsets and the app, China-based Taobao shoppers could experience shopping in-store at Target, Macy’s, or Costco in the US and other malls located in countries such as Japan and Australia.

◼︎ As Alibaba constantly keeps innovating its e-commerce landscape, its research institute DAMO Academy, in collaboration with its licensing platform Alifish, rolled out an XR-powered marketplace on Alibaba’s e-commerce platforms Tmall and Taobao for its November 2022 Single’s Day festival that allows consumers to visit virtual shopping streets and shop for merchandise as their own customizable avatars.

Entertainment

◼︎ In 2021, Alibaba led a $20 million Series A financing round of DGene, a virtual reality and immersive entertainment developer. Among others, DGene creates digital influencers or can even recreate historical figures based on its AI-driven technologies.

Dong Dong was launched as the first virtual brand ambassador for the Winter Olympics in 2022.

◼︎ For the Olympic Winter Olympics in 2022, Alibaba launched Dong Dong, a digital persona developed by Damo Academy using cloud-based digital technologies. Dong Dong was able to engage with fans and online viewers through livestreams, respond to questions in real time, and she even hosted online talkshows.

▶︎TENCENT

As a multinational technology and entertainment conglomerate with the highest-grossing revenue in the world, Tencent has the financial resources to gain an upper hand in technological innovation through acquisition and investment. In 2021 alone, Tencent made a total of 76 investments in Gaming, accounting for 25.2% of Tencent’s total investment throughout the year – a 9.3% increase compared to 2020. Tencent is now the biggest gaming company in the world.

Tencent also ramped up the company’s total headcount working in R&D department by 41%, accounting for 68% of its total workforce in 2021.

Although XR is used to create immersive experiences in different industries including healthcare, manufacturing, or education, its primary fields are still gaming and social – which just so happen to be Tencent’s main focus areas. It is therefore perhaps unsurprising that Tencent, as the country’s Gaming & Social giant, has made XR part of its core business.

What’s Happening?

Investments

◼︎ In 2012, Tencent made an investment in Epic Games, the owner of Unreal Engine which powers well-known video games such as Fortnite, purchasing approximately 40% of the total Epic capital, making it the second largest shareholder. Epic Games’ major businesses span across RT3D game engine (Unreal), in-house developed games (Fortnite), and platform games. This investment is one of the reasons why Tencent conquered a leading position in the metaverse realm when it comes to games.

◼︎ As early as 2014, Tencent already tapped into the VR market by investing in social VR platform AltspaceVR, which was later acquired by Microsoft in 2017.

◼︎ In May 2019, Tencent and Roblox announced a joint venture in which Tencent holds a 49% controlling stake.

◼︎ In September of 2021, Tencent became the new investor behind Beijing-based VR game developer Vanimals (威魔纪元), known for its flagship games Undying and Eternity Warriors VR.

◼︎ In November 2021, Tencent joined the $82M Series D fundraising of Ultraleap, the world leader in mid-air haptics and 3D hand tracking. Ultraleap’s hand-tracking platform has been built into multiple platforms including Qualcomm’s XR and VR devices.

◼︎ In March 2022, Tencent invested in the Chinese AR glasses manufacturer SUPERHEXA (蜂巢科技) holding 7.3% of its shares.

Research & Development

◼︎ In 2015, Tencent announced its avant-garde VR Project ‘Tencent VR,’ a plan consisting of building its own VR games and releasing Tencent Virtual reality software development kits (VR SDKs) to support other VR game developers.

◼︎ As of September 2021, Tencent applied for registration of nearly 100 trademarks related to the metaverse, including “Tencent Music Metaverse” (腾讯音乐元宇宙).

◼︎ In June 2022, Tencent officially set up its XR department led by its Interactive Entertainment Division (IEG) game developer NExT Studios. During Tencent’s annual gaming conference SPARK 2022, the Head of IEG, Ma Xiaoyi (马晓轶), shared Tencent’s ambitions in charting all segments of the VR industry in the next 5 years, from developer software tools and SDKs to VR hardware, to consumer-facing content.

◼︎ NExT Studios, which is the youngest studio within the Tencent Games family, has partnered with the Shenzhen-based FACEGOOD, a 3D content generation technology company that is focused on building metaverse infrastructure.

What’s Live?

Gaming

◼︎ At ChinaJoy 2019, the largest gaming and digital entertainment exhibition across Asia, Tencent launched its cloud gaming solution on its WeGame client, allowing users to play several games instantly without a download. In December of that year, Tencent Games and global leader AI hardware & software leader Nvidia announced a new partnership to launch the START (云游戏) cloud gaming service for PC and console titles.

◼︎ Following the Sino-American joint venture with Roblox in May 2021, Tencent officially launched the Chinese version of Roblox (罗布乐思) topping the App Store free game list in July of 2021.

Social Networking

◼︎ In November 2021, Tencent led a $25 million Series A funding in the British developer Lockwood Publishing best known for the metaverse app Avakin Life, which allows users to create 3D characters and socialize in the virtual community.

◼︎ During the Lunar New Year in February 2022, Tencent’s instant messaging software QQ launched a new feature called “Super QQ Show” (超级QQ秀), which is an upgrade of its ‘QQ Show’ service that’s been running since 2003. Super QQ Show allows users to create their own 3D avatars and use them in an interactive context. It added AI face recognition and rendering. The platform is an interesting one for brands. Fast-food chain KFC even has its own restaurant in this virtual world.

Visiting KFC in the Super QQ Show.

◼︎ In the summer of 2022, the Tencent-backed app developer company Soulgate Inc., which operates the social networking app Soul, applied to be listed on the Hong Kong Stock Exchange. Tencent is the largest shareholder holding 49.9% of the shares. Soul is a virtual social playground with the mission of “building a ‘Soul’cial Metaverse for young generations” where users can connect with other users through the virtual identity they develop in the app. The majority of its users, nearly 75%, belong to Gen-Z.

Entertainment

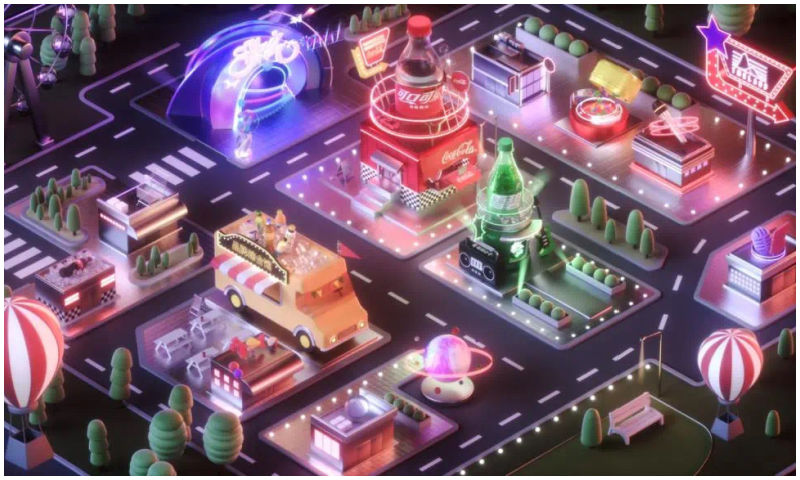

◼︎ On New Year’s Eve of 2021, Tencent Music Entertainment (TME) Group launched China’s first virtual social music platform TMELAND, where users can create their own avatars and interact with each other through their “digital identity.” It’s worth mentioning that TMELAND was powered by the ‘Hybrid Edge-Cloud Platform Solution’ developed by XVERSE (元象科技), which was founded by a former Tencent executive committed to building a one-stop shop for 3D content development.

Coca Cola zone in TMLAND.

Recently, Coca-Cola partnered up with TMELAND to open a new metaverse zone, accessible via the TMELAND mini-programme on WeChat.

▶︎BYTEDANCE

Known as “the world’s most valuable startup,” the Bytedance success story started with the algorithm-powered Toutiao (头条 ‘Headlines’) in 2012, a news and content platform that personalizes content for each user based on their own preferences. The Bytedance app TikTok (Douyin in China) conquered the world as one of most successful Chinese apps internationally.

Bytedance is a social networking leader, but is also focused on its in-house development in VR/AR. By 2021, Bytedance had completed at least 76 investment events, more than the previous two years combined.

From ByteDance’s activities in the XR industry, the company seems to have its strategy primarily focused on hardware, content development, and distribution across gaming, social networking, and entertainment industries.

What’s Happening?

Investments

◼︎ As early as 2018, Toutiao (Bytedance’s core product) acquired VSCENE (维境视讯) a Beijing-based solution provider for VR Live streaming.

◼︎ In July 2020, Bytedance participated in Series A funding of Seizet (熵智科技), an industrial automation company that provides a 3D industrial camera and software.

◼︎ In February 2021, Bytedance invested in Moore Threads (摩尔线程), a company that specialized in visual computing and artificial intelligence fields. In November last year, Moore Threads announced it has developed China’s first domestic full-fledged graphic processing unit (GPU) chip. Along with 5G communications, Wi-Fi 6, cloud computing, and chip technology, GPU is considered one of the main infrastructure technologies of the metaverse.

◼︎ In August 2021, ByteDance acquired Chinese VR hardware maker & software platform Pico for approximately $771 million to support its long-term investment in the VR ecosystem. By the end of Q1 2022, Pico is estimated to hold a 4.5% share of the global VR market, following Meta which is the dominant global player (90%). This year, Bytedance has set a higher sales target for Pico headsets to reach 1.6 million device output. To meet its VR industry goals, Bytedance is investing more into promotion and hiring more staff for Pico to catch up with or even surpass Meta’s Quest.

◼︎ In June 2022, ByteDance acquired PoliQ (波粒子), a team specialized in making virtual social platforms that allow users to interact with one another using their self-invented avatars in the virtual world. Jiesi Ma, the founder of PoliQ, is appointed to lead the VR Social department at ByteDance.

Research & Development

◼︎ To boost its entire VR ecosystem, Pico is engaging in more partnerships with Hollywood’s major film studios and leading streaming media companies in China (iQiyi, Youku, Tencent Video, Bilibili, and so on). In July 2022, Pico hosted Pico WangFeng@VR Music + Drifting Fantasy concert which leveraged 3D 8K VR Live Streaming technology to create a “magical” and immersive visual musical experience. By wearing Pico’s VR headsets, the audience can enjoy Wang’s performance from 5 different angles and as close as a meter away.

What’s Live?

Gaming

◼︎ On February 22, 2021, Bytedance released its game development and publishing brand Nuverse (朝夕光年). To date, Nuverse has launched several successful games through APAC and the western markets including “Burning Streetball” (热血街篮), “Houchi Shoujo” (放置少女), “Ragnarok X: Next Generation” (RO仙境传说:新世代的诞生), “Mobile Legends: Bang Bang”, and “Warhammer 40,000: Lost Crusade.”

◼︎ In April 2021, Bytedance put another US$15 million into Chinese Roblox competitor Reworld (代码乾坤), a platform for creating game worlds and playing games using the company’s own simulation engine.

Social Networking

◼︎ In September 2021, Bytedance launched its avatar app Pixsoul in Southeast Asian markets and Brazil. Users can create personalized avatars and use them to socialize.

◼︎ In January 2022, Bytedance launched a beta version of its virtual social app “Party Island” (派对岛) where users can make friends with people sharing similar interests and hang out with avatars in various virtual settings such as parks and movie theaters. However, the app was reportedly removed from app stores again and its date of relaunching is unknown.

Entertainment

◼︎ In September 2021, TikTok introduced its creator-led NFT collection titled “TikTok Top Moments” where TikTok will feature a selection of culturally-significant TikTok videos from some of the most beloved creators on the platform. Powered by Immutable X, users can ‘own’ a moment on TikTok that broke the internet and trade the TikTok Top Moments NFTs.

Li Weike, image via Pandaily.

◼︎ In January 2022, ByteDance bought a 20% stake in Hangzhou Li Weike Technology Co., Ltd. (Li Weike, 李未可). The company aspires to build China’s first AI+AR-powered glasses that connect users with the virtual idol Li Weike, a digital character built by the company to help users with various tasks and essentially provide users with social and emotional support.

By Jialing Xie and Manya Koetse

Follow @WhatsOnWeibo

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get unlimited access to all of our articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2022 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Jialing is a Baruch College Business School graduate and a former student at the Beijing University of Technology. She currently works in the US-China business development industry in the San Francisco Bay Area. With a passion for literature and humanity studies, Jialing aims to deepen the general understanding of developments in contemporary China.

Chapter Dive

The Fake Patients of Xiangyang: Hospital Scandal Shakes Welfare System Trust

Han Futao’s explosive report on fake patients and systemic abuse has triggered a heated online debate over hospital malpractices, the fragility of the welfare system, and the vital role of investigative reporting.

Published

2 weeks agoon

February 15, 2026By

Ruixin Zhang

In early February, as China settled into the quiet anticipation of the Chinese New Year, one of the country’s leading investigative journalists, Han Futao (韩福涛), dropped a bombshell report that sent shockwaves of anger across the country.

Han Futao is known for breaking massive scandals. In 2024, he exposed how tank trucks that delivered chemical products also transported cooking oil, without being cleaned. That food safety scandal sparked waves of outrage and prompted a high-level official investigation, leading to criminal charges for those involved.

In his latest explosive report, published by Beijing News (新京报), Han has turned his lens to malpractice in China’s hospital sector. His investigation led him to Xiangyang, in Hubei province, a city with more than twenty psychiatric hospitals, cropping up on every corner “like beef noodle shops” over recent years.

Recruiting Patients

Han found that multiple private psychiatric hospitals lure people in under the guise of free care, promising treatment for little or no cost, along with medication and daily expenses. Some even dispatched staff to rural villages to recruit “patients.”

Troubled by the unusual marketing procedures of these psychiatric hospitals, Han went undercover at several facilities as a caregiver, and sometimes posing as a patient’s family member, only to expose a disturbing reality.

Except for a handful of genuine patients, these hospitals were filled with healthy people who actually received no treatment. Many were elderly citizens swayed by the promise of “free care,” checking in with the hope of finding a free retirement home.

When Han, posing as a patient’s family member, spoke to a hospital manager at Xiangyang Yangyiguang Psychiatric Hospital (襄阳阳一光精神病医院), the director enthusiastically pitched their “free hospitalization” by saying medical fees were completely waived and promising the potential patient a great stay: “Lots of patients stay here for years and don’t even go home for Chinese New Year!”

Meanwhile, the hospitals’ own staff, including caregivers, nurses, and security guards, were also officially registered as patients, complete with admission and hospitalization procedures.

The motive was simple: insurance fraud (骗保 piànbǎo). In China, even after state medical insurance covers part of psychiatric care costs, patients are typically still responsible for a co-pay. These hospitals, both in Xiangyang and in the city of Yichang, exploited the financial vulnerability of those unwilling or unable to pay, using the lure of free accommodation to attract the misinformed. Once admitted, the hospitals used their identities to fabricate medical records and bill the state for non-existent treatments.

According to internal billing records, medication accounted for only a small fraction of patients’ costs. The bulk of the charges came from psychotherapy and behavioral correction therapy, which often leave little material trace and, in these cases, were never actually provided. Many of these hospitals even lacked basic medical equipment and qualified personnel.

Staff were essentially manufacturing invoices, generating around 4,000 yuan (US$580) in fraudulent charges per patient each month, with most funds diverted from the National Healthcare Security Administration (NHSA).

With each patient yielding thousands of yuan, profitability became a numbers game: the more bodies in beds, the higher the revenue. This perverse incentive gave rise to a specialized workforce of marketers who recruited ordinary people from rural areas, developing sales pitches and establishing referral-based kickback chains, offering bonuses of 400 ($58) to 1,000 yuan ($145) for every new “patient” successfully brought in.

To stay under the radar, hospitals periodically discharged patients on paper to avoid scrutiny from insurance auditors, only to readmit them immediately, or never actually let them leave at all. One story involved a patient who was discharged seven times, each time being readmitted on the same day he was “discharged.”

Day after day, the national medical insurance fund, built on the collective contributions and trust of the entire population, was drained through these calculated deceptions.

From Patients to Prisoners

Han uncovered more. Even more harrowing than the scale of the medical insurance fraud was the condition of those trapped inside. To maximize profit margins, these hospitals slashed costs to the bone. Living conditions were terrible: wards overcrowded, beds crammed side-by-side, and daily activities and food substandard at best.

The hospitals treated their patients more like profit-generating assets than human beings. Patients were subjected to a strict regime: they were forced to follow rigid schedules, restricted to designated zones, and faced physical violence if they did not comply.

During Han’s undercover research, he witnessed the horrific sight of patients being tied to a bed for not following orders, with some patients allegedly being restrained for up to three days and three nights.

Photo by Han Futao, in Beijing News, showing a hall filled with beds at the Yichang Yiling Kangning Psychiatric Hospital, where more than 160 people were housed in just one ward. The lower photo, also by Han Futao, shows elderly “patients” kept in their wheelchairs all day at Xiangyang Hong’an Psychiatric Hospital.

Some patients, despite technically being the ones receiving care, were forced to perform manual labor for the staff. They scrubbed pots, cleaned wards, mopped latrines, and moved supplies. Others even had to take on nursing tasks for fellow patients, such as feeding, bathing, and changing clothes, all in exchange for a few cents to buy a cigarette. Their personal freedom and quality of life were virtually non-existent.

Escape was also difficult. The hospitals had no intention of releasing their cash cows. Rarely was a patient discharged on the scheduled date. To ensure long-term residency, many hospitals confiscated patients’ phones and cut off contact with their families.

Some individuals spent nearly ten years in these prison-like conditions; some even died there. Meanwhile, those truly suffering from mental illness received no real treatment, often seeing their condition worsen or developing deep-seated trauma toward psychiatric care.

Fragile Public Trust in Welfare-Related Institutions

In China, there is a common belief that if you spot one cockroach in the room, there are already a hundred more hiding. As the story has gone viral over the past two weeks, netizens pointed out that Xiangyang and Yichang were likely not the only cities using such predatory tactics to cannibalize the national treasury. Han’s investigation struck a deeper nerve, and public anxiety over the security of social insurance once again bubbled to the surface.

China’s national health insurance is a cornerstone of the broader social insurance system and a vital part of life for nearly every citizen. It is generally divided into two categories: Employee Medical Insurance and Resident Medical Insurance. Employers are legally, at least in theory, required to contribute to the employee scheme, typically 6% to 9% of a worker’s salary. Non-employees, such as farmers, students, and freelancers, usually pay for Resident Insurance out of pocket, currently costing around 400 yuan ($58) annually. Under the employee scheme, inpatient reimbursement rates are roughly 80% to 85%; after approximately 25 years of contributions, members enjoy lifelong coverage without further payments. The Resident Insurance, however, offers significantly lower protection.

This system was designed as a fundamental safety net to alleviate the fear of falling into poverty due to illness or being left destitute in old age. For young Chinese job seekers, whether a company pays into social security used to be a non-negotiable criterion. However, as scandals shaking the foundation of this system have become more frequent, the mindset of the youth is shifting: Is it even worth paying into anymore?

Recent years have seen a steady stream of corruption scandals involving the embezzlement of social security funds.

Despite the authorities’ firm stance and high-profile punishments, 2025 was still marked by reports of officials — including the insurance bureau’s finance head — misappropriating funds to play the stock market. A June 2025 report even alleged that 40.6 billion yuan (US$5.8 billion) in national pension funds had been misappropriated or embezzled by local governments.

In one surreal case from Shanxi, a CDC employee’s records were doctored 14 times to create an absurd history of “starting work at age 1 and retiring at 22,” allowing them to pocket 690,000 yuan ($100,000) in pension while still drawing a salary at a new job.

These stories exposing large-scale abuse of the medical insurance system, combined with the extension of the minimum contribution period for retirement from 15 to 20 years amid a slowing job market and a gradually rising retirement age, are leading netizens to question the necessity of paying into the system. This is reflected in comments such as:

-“First it was 20 years, then 25, then 30. They move the goalposts whenever they want, but the benefits never improve.”

-“I won’t buy anything beyond the bare minimum resident insurance; who knows if there will even be a payout in the future?”

-“With a deficit this large, whether we’ll ever see that money is a huge question mark.”

-“I’m not even sure I’ll live to see 65 anyway.”

Echoes of the Cuckoo’s Nest

In response to Han’s latest exposure, local authorities immediately launched investigations, and state-run media outlets issued sharp criticism. By now, fourteen hospital executives have been criminally detained on suspicion of fraud.

Although the official report, published on the night of February 13, acknowledged that there was widespread medical fraud, with patients remaining hospitalized after recovery or empty beds being registered without any patients there, it said no evidence was found that people without mental disorders were admitted, which was one major finding of Han’s undercover operation.

This led to new questions, because how could fraud, abuse, fake discharges, and official corruption be acknowledged while denying the central allegation: that healthy people were being locked up? And how could people prove they were not mentally ill, while being a patient inside a psychiatric hospital?

Political & social commentator Hu Xijin (胡锡进) wrote on Weibo that, while he applauded Han and his team for exposing the mismanagement at psychiatric hospitals in Hubei, he also saw the report’s conclusions about the patients as a reminder that journalists should exercise caution when making accusations. Some sarcastic commenters suggested that perhaps Han had not sacrificed enough and should have admitted himself as a patient instead.

And so, in a way, the debate has now slowly also shifted – from the initial shock over Han’s report, to the anger and distrust surrounding state institutions and social security abuse, to the role of investigative journalism in China today. “He’s a hero,” some commenters said about Han.

In the end, the entire story is so absurd that some commentators have drawn parallels to One Flew Over the Cuckoo’s Nest (飞越疯人院), where Randle P. McMurphy (Jack Nicholson) fakes insanity to serve his sentence in a mental hospital instead of a prison work farm, only to find out that the endless chain of control and abuse at the psych ward is much more brutal than a prison cell.

The question inescapably becomes who the sane ones actually are.

Meanwhile, the scandal shows that public anxiety about the future and distrust of state institutions tend to rise quickly and deepen slowly with each new controversy. As trust in the national welfare system appears fragile, one sentiment persists: that there is far more to uncover, and that there are far too few Han Futaos to do it.

By Ruixin Zhang

With additional reporting by Manya Koetse

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2026 Eye on Digital China/Powered by Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Chapter Dive

Chinamaxxing and the “Kill Line”: Why Two Viral Trends Took Off in the US and China

We’re at a very complicated time in our online lives. An explainer of “Chinamaxxing,” the “kill line,” and the platform politics behind them.

Published

4 weeks agoon

February 3, 2026

While American TikTok users find themselves in a “very Chinese time” of their lives, Chinese netizens are fixated on the American “kill line.” Beyond the apparent digital divide, both trends reflect shared anxieties and shifting power dynamics between the US and China.

In the first month of 2026, two noteworthy social-media trends, both telling of the times we live in, went viral in the US and China: a China-focused trend in the US and an America-focused one in China.

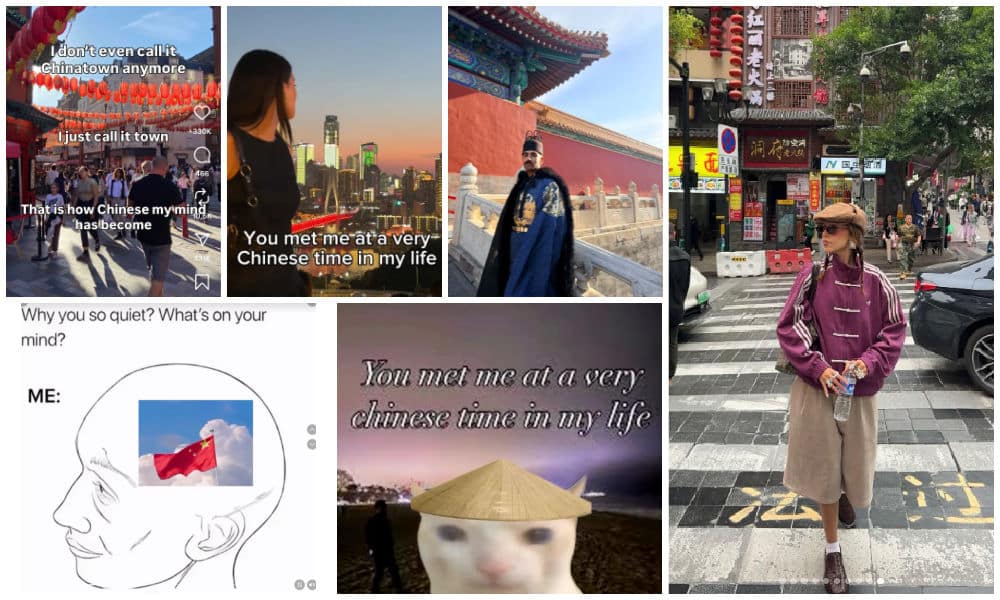

In the US, TikTok videos and Instagram posts showing young people cheerfully portraying themselves as “Chinamaxxing,” or being “in a very Chinese time” of their lives, began popping up across social media.

Meanwhile, in China, posts about the darker side of American society and its so-called “kill line” (斩杀线) dominated trending lists.

In this week’s chapter dive, I’ll explain the stories behind both of these trends and why, despite their very different implications, the dynamics driving them are strikingly similar.

Converting to “Chinese Baddies”

Over the past week, the phrase “Becoming Chinese” (成为中国人 chéngwéi Zhōngguórén) has been gaining traction on Chinese social media. On January 30, the headline “Why ‘Becoming Chinese’ Videos Are Going Viral’ even made it to the number one most popular topic on Chinese platform Toutiao (“成为中国人视频为什么火了”).

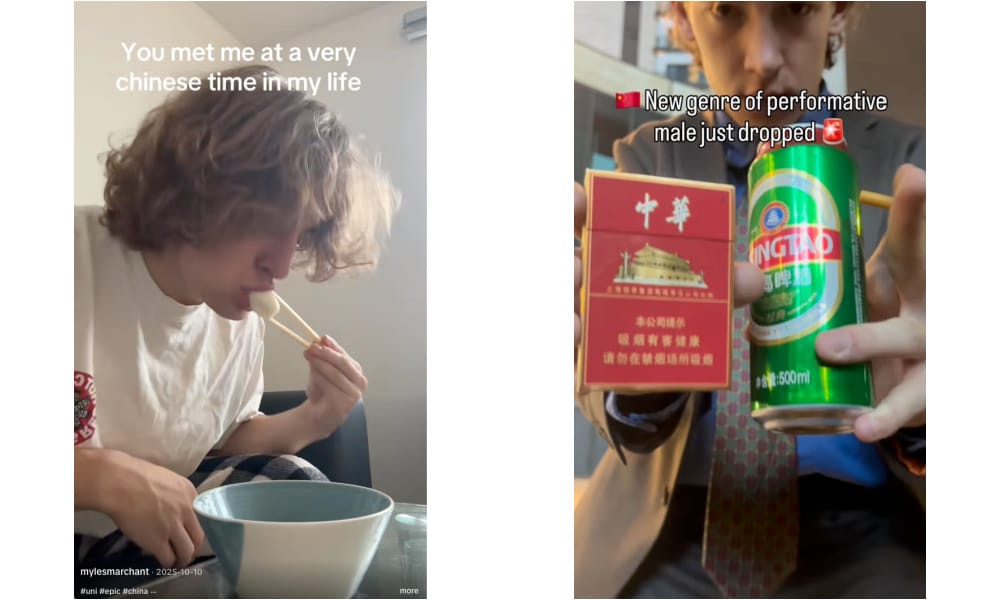

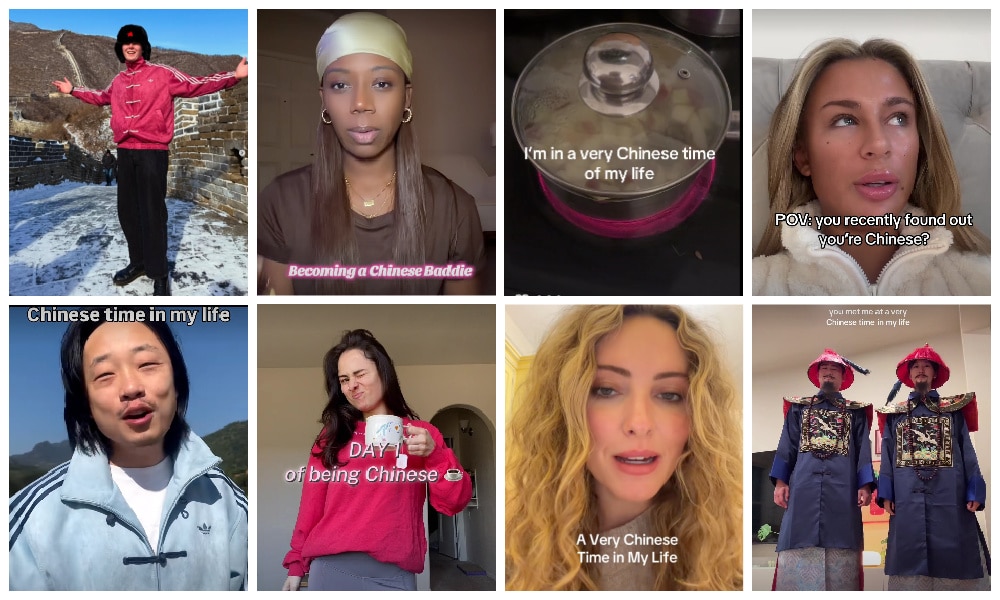

Before reaching China’s social media, the trend had been gaining momentum on TikTok and Instagram for months, with viral videos showing foreigners humorously flaunting their supposedly deep connection to China by doing things like drinking a nice cup of hot water (the solution to everything), using traditional Chinese medicine, sitting in a squatting position while smoking Chinese cigarettes and holding Tsingtao beer, eating noodles or dim sum—all while wearing that popular Adidas “Chinese jacket.”

This is all referred to as “Chinamaxxing” or “Chinesemaxxing”: optimizing life by living in a Chinese-coded way.

Various “very Chinese time” examples (TikTok/Instagram).

The build-up to this moment has actually been underway for several years. In the post-Covid era, China’s global pop culture influence has grown noticeably, driven both by increasingly outward-facing efforts from Chinese companies and state actors, and by a broader shift among younger audiences in the US toward Asia.

As part of this broader shift, several notable online moments have emerged over the past few years, including the viral success of a Chinese pop song in 2022; the 2024 breakout of Black Myth: Wukong; the 2025 “TikTok refugee” phenomenon; Chinese rapper SKAI ISYOURGOD becoming a staple on TikTok; and the widely watched March 2025 China tour of American YouTuber IShowSpeed, followed by a less impactful but still meaningful China visit by American influencer Hasan Piker.

The now-famous line “You met me at a very Chinese time in my life”—inspired by the quote “You met me at a very strange time in my life” from the final scene of Fight Club—first surfaced on X in April 2025. The X account “Perfect Angel” (@girl__virus) then posted the phrase in a tweet that since has gathered over 950,000 views.1

The X post of April 5, screenshotted Jan 30, 2026.

The trend snowballed from there, especially in October 2025. When creator Myles Marchant posted a video of himself eating dumplings while using the phrase, it received nearly 200k likes. Afterward, all kinds of internet users, but particularly American content creators, started using the phrase in videos to show off just how “Chinese” they were.

Myles Marchant and McMungo in their videos.

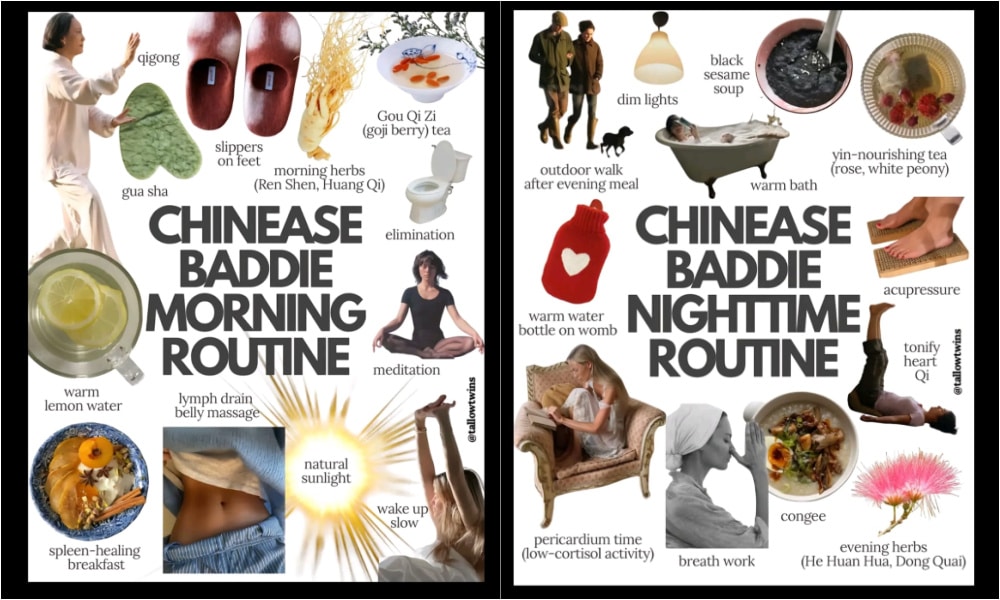

As the meme went viral, from October 2025 through January 2026, it continued to evolve. What began with cigarette smoking and playful performances of “Chinese” behavior has, for many TikTok users, grown into something more. Drawing on Chinese food philosophies and wellness practices, they now present “Becoming Chinese” as a lifestyle trend focused on better energy, health, and skincare.

Chinamaxxing, Chinese Baddies, Becoming Chinese, A Very Chinese Time of My Life: Trends on Tiktok.

TikTok creator Missmazz, for example, introduced her morning routine “since recently converting to Chinese”: wearing slippers in the house, doing small jumps to “activate” lymph nodes, and drinking warm water and herbal tea. Creator Ohplsnatagain also shared her “first day of being Chinese,” drinking ginger tea, boiling apples, wearing red, and avoiding cold drinks.

“Chinease” morning and night routines, shared on TikTok by Tallow Twins.

Besides those aspiring to become Chinese, some Chinese creators have expressed their joy about the trend others emerged as online guides to these newly adopted identities and lifestyles. Creators like Emma Peng made a video telling people, “my culture can be your culture,” while others, like Sherry, actively encourage people to become Chinese: “It’s gonna be so fun!”

They have now formed an online community of self-labeled “Chinese baddies,” sharing recipes, morning routines, and tips for being as ‘Chinese’ as possible. On Chinese social media, netizens are humored by the overseas trend, and see it as a sign of just how powerful Chinese cultural confidence has become (“藏在烟火气里的文化自信才最有感染力”).

America’s “Kill Line”

While American social media users have been busy Chinamaxxing, Chinese social media have been feverishly discussing America’s so-called “kill line” (also translated as “execution line,” 斩杀 zhǎnshāxiàn).

The term first went trending in late 2025 after it was coined by the Northern Chinese livestreamer Squishy King (斯奎奇大王), better known by his nickname “Lao-A” (牢A), who is particularly active on Bilibili, the Chinese platform known for its strong anime and gaming subculture.

Lao-A has been livestreaming since 2024 without ever showing his face on camera. Through pure voice narration over images, he became known for casually chatting in livestreams—sometimes lasting over five hours—about a wide range of topics, especially those connected to American society. Lao-A claimed he was a Chinese biomedical student in Seattle who worked part-time as a forensic assistant, handling unclaimed bodies and preparing them for medical education or research.

Profile image of “Lao A”, who never shows his face on streams.

On November 1, 2025, during a stormy Halloween Friday night, Lao-A hosted another one of his five-plus-hour live-chatting streams, in which he spoke about the bad weather and homelessness in the US.

He mentioned how people living on the streets could easily die from a cold or Covid that turns into pneumonia without proper treatment, and how dreadful he felt about the freezing conditions—knowing that on Monday he would see the bodies of people who had died on the streets that very weekend.

According to Lao-A, the unidentified bodies of homeless people would be brought by the police to his school, where they could still generate some value. Drawing comparisons to “harvesting in harsh winter,” he introduced the concept of the “kill line,” borrowing the term from multiplayer/role-playing games such as Hades or League of Legends.

In gaming, a “kill line” refers to the health-point (HP) threshold below which a character can be instantly killed, with no possibility of recovery. Lao-A suggested that the situation of marginalized and homeless people during Seattle’s winter was similarly bleak: their deaths are treated as almost inevitable, even though basic medical care—such as antibiotics—might prevent them.

The way Lao-A spoke about his work and the darker sides of American society spread rapidly through Bilibili’s comment culture and then into wider Chinese social media, especially as he expanded on the topic in other livestreams, where he further discussed poverty in America, from the healthcare system to food assistance programs.

Visuals accompanying a report about Lao-A on the 163.com website.

Lao-A particularly focused on medical bills as a key component of America’s “kill line.” He described how people suffer first and then seek care, only to be further burdened by crushing costs—arguing that the American system drains people at their most vulnerable. An unexpected event such as illness, job loss, or a car breakdown can suddenly disrupt a family’s cash flow, leading to unpaid bills and a collapse in credit scores. Bad credit, in turn, makes it harder to rent housing, pass background checks, or secure affordable insurance, while debts pile up. This downward spiral, he suggested, eventually pushes people past a final execution threshold: too broke, too sick, too depressed, and too far gone to recover, ending in homelessness or addiction and shortening life spans.

Lao-A framed this as a systemic trap created by capitalism: a game mechanic in which the rules are rigged so that once someone falls below the threshold, the system itself kills them. Besides the “kill line,” he introduced other gaming-inspired terms, such as using “Gundam” (高达, after the Japanese model kits) to refer to the bodies he handled, or “slimes” (史莱姆) for decomposed bodies found in sewers.

In some ways, Lao-A’s “kill line” resembles the concept of ALICE (“Asset Limited, Income Constrained, Employed”), a demographic category created by the nonprofit United For ALICE to describe American households that earn above the federal poverty line but still cannot afford basic necessities such as housing, childcare, healthcare, or groceries.

By mid-December 2025, the term and the stories surrounding it had entered the mainstream and began hitting trending lists on Weibo, Toutiao, and Kuaishou.

Cartoon by Chinese state media outlet CRI Online about the killing line. Top texts say: “Thriving economy, America first, America great again.” On the staircase, it says: “Unemployment, unexpected costs, illness.”

As the “kill line” quickly entered China’s online lexicon, it was also embraced and boosted by official media. After earlier coverage, Qiushi (qstheory), the Chinese Communist Party’s most authoritative theoretical journal, published a January 4 commentary arguing that the “kill line” reflects a widespread condition in which Americans’ capacity to withstand risk has been pushed to its limits, while Trump’s MAGA movement fails to work towards a solution as it focuses on cultural identity rather than addressing the economic challenges faced by millions of Americans.

Something that also caused a stir online, is how American media began reporting on the Chinese “kill line” concept. First Newsweek on December 26, followed by The Economist and later The New York Times. The phrase even surfaced at the World Economic Forum in Davos, when a Chinese state-media reporter asked US Treasury Secretary Scott Bessent about the phenomenon.

All of this placed a considerable spotlight on Lao-A himself, whose real identity and personal backstory began to be questioned by internet users. After he was identified as the possibly 30-year-old “Alex Kong 孔” from Daqing, who attended a community college in Seattle, more of his details were leaked online. Lao-A said he feared for his safety and returned to China.

This supposed “escape from America” became a major story on Chinese social media, with Lao-A repeatedly topping trending charts from January 17 onward. Attention peaked around January 22–23, after he joined Weibo and participated in joint livestreams with Chinese professor and prominent nationalist commentator Shen Yi (沈逸), and again around February 1, when he streamed with foreign-policy commentator Gao Zhikai (高志凯). During this period, Lao-A and the dystopian “kill line” narrative completely dominated Chinese online discussions.

Throughout his solo livestreams and collaborative appearances, Lao-A has continued to paint an especially dark picture of American society, describing graphic gang violence, failures in the education system, murky organ-transplant systems and black markets for organ harvesting (claiming that healthy Chinese students who have not used drugs are “very valuable”), and Chinese female students abroad as “ideal hunting targets” for white men—explicitly warning Chinese parents not to send their daughters to study overseas.

By now, “kill line” is a term that pops up all over Chinese social media and is applied to all kinds of news coming from America, from the Epstein files to the Alex Pretti shooting.

Where the “Kill Line” Meets “Chinamaxxing”

On the famous Know your Meme website, the phrase “You Met Me At A Very Chinese Time In My Life” is described as “ultimately meaningless and purposefully absurd.” But it’s actually not.

Both the “Becoming Chinese” trend and the discourse surrounding the “kill line” are shaped by our current media moment and reflect broader, shifting narratives about China, the United States, and global power.

While China’s rise has been a major media theme for years, a lot of Chinese influence had felt invisible for younger generations in the West, even if they were already living, wearing, and consuming “made in China.” More recently, however, China’s soft power narratives have become more visible, with popular culture emerging as a powerful tool.

The changing attitudes toward “made in China,” alongside a growing interest in Chinese tradition and elements of ancient culture, took shape in the late 2010s as China’s domestic cultural confidence increased. This development was partly supported by China’s flourishing livestreaming economy & homegrown e-commerce platforms, as well as more assertive official messaging around the idea of products being “proudly made in China.”

Wang Yibo poses with Anta’s “China” t-shirt in 2021, the year that “made in China” had become cool again.

Younger Chinese consumers in particular—those born after 1995 or 2000—began showing more interest in domestic brands than earlier generations. This trend reflected not just consumer preference, but a stronger identification with Chinese culture and national identity. By 2021, a Global Times survey indicated that most Chinese consumers believed Western brands could be replaced by Chinese ones (75% of respondents agreed that “national products could fully or partially replace Western products“).

By 2025, pop-culture products emerging from this renewed focus on domestically produced goods—often incorporating traditional Chinese aesthetics—began reaching audiences beyond China, finding traction in Western markets as well.

At the same time, the United States experienced significant societal divisions in the aftermath of the 2024 elections, while its global image and cultural influence were affected by the dismantling of traditional US soft power channels.

Together, these developments shaped broader changes in global public opinion, tilting toward a more favorable view of China as “the world’s leading power,” and fueling conversations about a future increasingly framed through a Chinese lens.

This wider geopolitical context forms the backdrop against which the two viral trends discussed here took shape.

–Why these trends took off

🔹 The Decay of the American Dream and Insecurities about China’s Dream

Geopolitical power shifts alone are not enough to explain the virality of both “Becoming Chinese” and the “kill line” discourse. Current socio-cultural dynamics also play a major role.

In both the US and China, people’s sense of security, future, and identity is shifting, and other countries are increasingly used as mirrors, escape routes, or coping mechanisms to process that change. Young working-class Americans under Trump and middle-class Chinese facing “involution” (nèijuǎn 内卷, a seemingly never-ending societal rat race) are questioning their systems, but arrive at opposite conclusions by using each other as contrasts.

🇺🇸 “A projection of what Americans believe their own country has lost”

In a recent article for Wired,”Why Everyone Is Suddenly in a ‘Very Chinese Time’ in Their Lives,” the authors argue that the “very Chinese time” meme is “not really about China or actual Chinese people,” but instead functions as a projection of what Americans believe their own country has lost.2

Rather than offering an accurate depiction of China, the trend relies on stereotyped markers of “Chineseness” to express frustration with US infrastructure erosion, political instability, polarization and, as PhD researcher Tianyu Fang puts it, “the decay of the American dream.”

In this context, China appears as an aspirational contrast—”less as a real place than an abstraction”—through which Americans critique their own realities.

🇨🇳 “Why China is suddenly obsessed with American poverty”

Similarly, in a The New York Times article titled “Why China Is Suddenly Obsessed With American Poverty,” author Li Yuan argues that the “kill line” narrative offers emotional relief to Chinese netizens while also helping to deflect criticism of domestic leadership. As she writes, “the worse things look across the Pacific (…), the more tolerable present struggles become.”3

A related conclusion is reached in an article by The Economist,4 which suggests that the surge in discussion about America’s failures says less about the realities of life in the US than about China’s own anxieties over slowing growth and the fragility of domestic political discourse.

While the “Chinese Dream,” which prioritizes collective effort and national strength, is promoted as part of state ideology, everyday life tells a more sobering story, in which climbing the social ladder seems increasingly out of reach for millions of Chinese facing economic slowdown, high youth unemployment, and a constrained space for criticism.5

Yet as narratives about the perceived failure of the “American Dream” flood Chinese social media, China itself begins to look like the better place—even with all of its own challenges.

Ultimately, both the “Becoming Chinese” and “kill line” phenomena are embedded in collective anxieties about vulnerability and decline, fueling a growing hunger for counter-narratives.

–The stories told

🔹Fantasizing about “the Other”

Those counter-narratives do not need to be realistic. To fulfill their role in channeling perspectives, insecurities, and even a sense of cathartic relief about the present and future, they can’t actually be nuanced. Simplification, exaggeration, and symbolic contrast are precisely what make them effective.

🇺🇸 “Chinese cultural identity as a disposable trend”

In the case of “Becoming Chinese,” the trend is comically fairy-tale–like, suggesting that people of all backgrounds can “turn Chinese” in the blink of an eye. One popular meme even implies that there is no need to “kiss the frog” to meet the prince: simply looking at the frog would already make you Chinese.

Beyond fairy tales, there is also a gaming logic at play in other “Becoming Chinese” memes, with different levels of “Chineseness” to unlock to reach that final mythical state of Being Chinese.

Although this is all tongue-in-cheek, it is also what has made the trend a focal point of criticism recently. Chinese cultural identity is turned into a game, a disposable trend for non-Chinese users. Some Chinese and Chinese-American creators have taken offense at how casually Chinese identity is treated—particularly after being a target of discrimination during the Covid era, only to now become a source of social-media hype.

Others argue that it feels more like appropriation than appreciation, suggesting that “Becoming Chinese” reflects a form of Orientalism: a simplified fantasy of an “exotic” China that mirrors Western desires, anxieties, and power relations rather than the lived realities of Chinese people.

Similar critiques have surfaced on Weibo, especially targeting Chinese-American social-media users. Some commenters accused them of seeking Western validation, framing their participation in the trend as an expression of unresolved insecurities about their own identity.

When confronted with such criticisms, some TikTok users respond defensively. One critical creator shot back at the “dumb comments” in his feed, saying: “Forget meeting you at a very Chinese time in your life—when am I going to meet you at a very intellectual time in your life?”

🇨🇳 “American society as a dystopian game”

The success of Lao-A’s descriptions of America’s dark sides and its “kill line” also lies in how he gamifies social stratification and marginalization. He does not just borrow terms from gaming, but frames society itself as a dystopian game, where reaching certain thresholds means it is simply game over.

While the “kill line” concept has been embraced by netizens and official media alike, the persona of Lao-A has grown increasingly controversial. As criticism mounted over inconsistencies and falsehoods in his stories about America, including his education and alleged “escape,” netizens began questioning how much was factual and how much was Hollywood-inspired: from slimy corpses in Seattle sewers to thriving black markets for organs, cannibalism or gangs beheading victims and hanging their skinned heads like “candied apples” (糖霜苹果).

In a recent livestream, Lao-A finally admitted that around “40 percent” of what he had told was not based on his own experience, with part drawn from borrowed accounts and part outright fabricated.

In a way, the popularization of Lao-A’s stories about the US resembles the wave of reporting about China’s “social credit score” in Western media between 2018 and 2020, when even reputable outlets claimed that the Chinese government was assigning all of its 1.4 billion citizens a personal score based on their behavior, linked to what they buy, watch, and say online. In many ways, those stories fed into Western fears about AI, privacy, and these developments becoming reality in Western societies themselves.

There was some truth in reports about the nascent social credit system in China, but much of the coverage was exaggerated or simply false—much like Lao-A’s stories, which mix real structural problems with a heavy dramatization and elements of fiction. In the end, that distinction matters less than you might expect. Lao-A has by now almost become a myth himself, praised by many not for the falsehoods he spread, but for consolidating a strong image of a dystopian America, one that balances the dark portrayal of China so often encountered in US media.

–Dynamics behind the trends

🔹Platform Politics

Both “Becoming Chinese” and the “kill line” are not just products of broader geopolitical shifts, US–China relations, and growing social insecurities. They are also inherently shaped by the platforms they emerged from and, in many ways, are products of those platforms themselves.

🇺🇸 “Chinese baddies building their TikTok success on Chinamaxxing”

In the West, “Becoming Chinese” trends are primarily created and shared on TikTok, an entertainment-focused platform built around endlessly scrolling short-form videos that are algorithmically recommended based on user behavior (particularly what people watch, engage with, or quickly scroll past). Although TikTok is originally Chinese—its parent company is ByteDance—it is separated from the app’s Chinese version (Douyin) and is only used outside China. TikTok has been popular in the US ever since its 2017 launch and is now used by some 200 million people there, with daily life, comedy, fashion & beauty and pop culture being among some of the popular content categories.

Since 2020, there have been repeated discussions about banning TikTok in the US over concerns about national security and the power of its algorithm due to its Chinese ownership—a prospect that proved widely unpopular among American TikTok creators. (As of this month, TikTok has finally reached a deal that allows the app to continue operating in the US, with its algorithm trained only on US data.)

As a result of this resistance against a potential ban, and against any policies changing the app’s dynamics, large numbers of users previously “fled” to the Chinese social media app Xiaohongshu, and began expressing overtly pro-China sentiments as a playful form of protest against what they saw as the anti-Chinese undertones of the proposed ban.

This background, along with the fact that TikTok is a platform generally focused on humor and relatability, has made it a place that is rather positive when it comes to China-related content. Earlier research confirms that, in sharp contrast to traditional US media, popular content on the app tends to frame China in a largely non-political and positive way.6

This has led to the current dynamics of the “Becoming Chinese” trend as a way for creators to profit. By creating these positive, entertaining, and short videos, they can aim for likes, build community, and grow their accounts. For a few “Chinese baddies,” their entire success was built on “Chinamaxxing.”

🇨🇳 “How to score on Bilibili”

In China’s social media environment, stories about the darker side of American society have always been a consistent part of online circles discussing US–China relations, and this holds especially true for Bilibili.

Although Bilibili originally started as a platform focused on ACG (anime, cartoons, games), it has evolved over the years along with its user base, which consists largely of college students and young professionals. It is now home to many creators producing political and geopolitical analytical content in a way that encourages interaction and aligns with Bilibili’s rather unpolished, humorous style.

Different from TikTok in America, popular Western-related content on China’s Bilibili platform is often framed through a strongly pro-Chinese lens and frequently carries anti-Western narratives. There are also foreign creators on the platform whose credibility is boosted when they produce what is considered pro-China or party-conforming content.7

Lao-A succeeded on Bilibili precisely because he tapped into what its users are most drawn to: using gaming slang and imagery to cast a dark light on American society on a platform whose users are increasingly politically engaged. At the same time, he claimed to be located in America itself, deep within the grim reality he described—further boosting his credibility.

In doing so, Lao-A showed that he understands how to “score” on Bilibili and has ultimately made an irreversible impact. The fact that he fabricated some of his stories does not seem to bother many people, who claim that being more nuanced would have simply led viewers to swipe away. These tactics have helped make him one of the most prominent “America watchers” on China’s social media in 2026.

🌀 Utopian Borrowing and Dystopian Pointing

Put side by side, “Becoming Chinese” and the “kill line” appear to be opposites: one romanticizes China, the other condemns America; one is playful and humorous, the other dark and serious; one thrives on Western social media, the other emerged from Chinese platforms; one is entertainment-driven, the other overtly political.

Yet both are built on similar foundations. Each taps into underlying anxieties and frustrations about the present, responds to broader global shifts, and relies on gamified language, stereotypes, or selective details that easily resonate with online audiences and encourage them to engage. In doing so, both trends are perfectly adapted to the platform dynamics and social media environments in which they flourish, and from which they benefit.

What these trends ultimately reveal is not a definitive truth about either country, but the power of digital discourse to seize on existing discontent to shape or influence perceptions of the United States and China. One becomes a utopia to borrow from, the other a dystopia to point at. Perhaps the most important takeaway is not how different these trends are, but how similar the underlying impulses behind these narratives actually are, revealing deeper ideas about American and Chinese internet users having so much more in common than meets the eye.

Meanwhile, Lao-A has already begun to move on a bit. His focus for now has shifted, at least partly, from America’s “kill line” to Japanese society. On TikTok, many of the creators who “discovered” they were “Chinese” in early January have also pivoted and are now posting about Pilates, reviewing Thai food, or booking holidays to Spain. Even “Perfect Angel,” who was the first to tweet that “Very Chinese time” phrase in 2025, just tweeted that “being Canadian is in this year.”

Who knows what we’ll become tomorrow? Maybe it really is time for that cup of hot water now.

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

1 See: Elle Jones. 2026. “Why Everyone Is Now Chinese.” Substack, January 11. https://substack.com/home/post/p-184141480 [January 30, 2026].

2 See: Zeyi Yang and Louise Matsakis. 2026. “Why Everyone Is Suddenly in a ‘Very Chinese Time’ in Their Lives.” WIRED, January 16 https://www.wired.com/story/made-in-china-chinese-time-of-my-life/ [January 30, 2026].

3 See: Li Yuan. 2026. “Why China Is Suddenly Obsessed With American Poverty.” The New York Times, January 13 https://www.nytimes.com/2026/01/13/business/china-american-poverty.html [February 1, 2026].

4 See: The Economist. 2026. “China Obsesses over America’s “Kill Line.”” The Economist, January 12 https://www.economist.com/china/2026/01/12/china-obsesses-over-americas-kill-line [February 1, 2026].

5 See: Ma Junjie. 2025. “A ‘Loser’s Nation’ and the Abandoned Chinese Dream.” The Diplomat, September 4. https://thediplomat.com/2025/09/a-losers-nation-and-the-abandoned-chinese-dream/ [February 3, 2026].

6 See: Cole Henry Highhouse. 2022. “China Content on TikTok: The Influence of Social Media Videos on National Image.” Online Media and Global Communication 1 (4): 697–722.

6 See: Florian Schneider. 2021. “China’s Viral Villages: Digital Nationalism and the COVID-19 Crisis on Online Video-Sharing Platform Bilibili.” Communication And The Public 6 (1-4): 48-66.

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2026 Eye on Digital China/Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Eye on Digital China is a reader-supported publication by

Manya Koetse (@manyapan) and powered by What’s on Weibo.

It offers independent analysis of China’s online culture, media, and social trends.

To receive the newsletter and support this work, consider

becoming a paid subscriber.

Get in touch

Have a tip, story lead, or book recommendation? Interested in contributing? For ideas, suggestions, or just a quick hello, reach out here.

Spring Festival Trend Watch: Gala Highlights, Small-City Travel, and the Mazu Ritual Controversy

Inside Chunwan 2026: China’s Spring Festival Gala

The Fake Patients of Xiangyang: Hospital Scandal Shakes Welfare System Trust

China Trend Watch: Takaichi’s Win, Olympic Tensions, and “Tapping Out”

Spending the Day in China’s Wartime Capital

From a Hospital in Crisis to Chaotic Pig Feasts

Trump, Taiwan & The Three-Body Problem: How Chinese Social Media Frames the US Strike on Venezuela

Chinamaxxing and the “Kill Line”: Why Two Viral Trends Took Off in the US and China

China’s 2025 Year in Review in 12 Phrases

The “Are You Dead Yet?” Phenomenon: How a Dark Satire Became China’s #1 Paid App

Popular Reads

-

Chapter Dive8 months ago

Chapter Dive8 months agoHidden Cameras and Taboo Topics: The Many Layers of the “Nanjing Sister Hong” Scandal

-

Chapter Dive10 months ago

Chapter Dive10 months agoUnderstanding the Dr. Xiao Medical Scandal

-

China Insight7 months ago

China Insight7 months ago“Jiangyou Bullying Incident”: From Online Outrage to Offline Protest

-

Chapter Dive10 months ago

Chapter Dive10 months agoChina Is Not Censoring Its Social Media to Please the West