China Memes & Viral

TikTok Is Watching: PetroChina Executive Hu Jiyong Fired after Extramarital Affair Exposed Online

After their romantic stroll in Chengdu was captured by street photographers, their illicit affair suddenly became the talk of the day.

Published

2 years agoon

A short video captured by a street photographer on China’s TikTok (Douyin) went completely viral this week, showcasing a Chinese official who held a high-ranking position at PetroChina enjoying a romantic stroll with his secret girlfriend. The video’s widespread circulation led to the downfall of Hu Jiyong and Ms. Dong, who also worked at PetroChina.

Hu Jiyong (胡继勇), the former Chinese executive director and general manager of Beijing Huanqiu Construction Co, a subsidiary of PetroChina, is the talk of the week on Chinese social media after a video of him holding hands with a supposed mistress went viral.

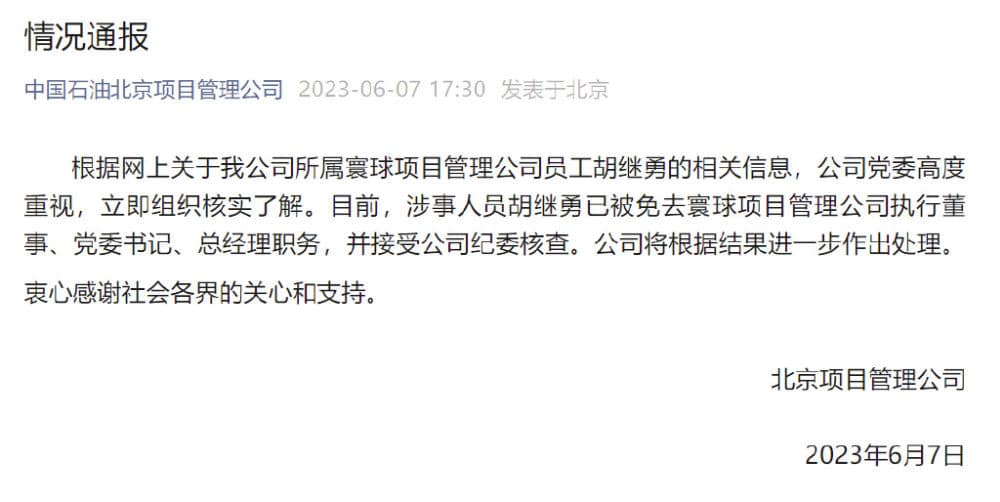

Hu Jiyong, who is a Party secretary, was removed from his post after the incident. PetroChina Beijing Project Management Company issued a statement on Wednesday at 17:30 in which they stated that Hu Jiyong had been dismissed from his positions as Executive Director, Party Committee Secretary, and General Manager of Huanqiu Project Management Company, and that he will be further investigated by the company’s disciplinary committee.

The statement by PetroChina.

State media outlet Shanghai Daily writes: “Being a Communist Party of China member, Hu has moral obligations, which he transgressed by having an alleged extramarital affair.”

On Weibo, the hashtag “PetroChina’s Hu Jiyong Fired” (#中石油胡继勇被免职#) received nearly 1,2 billion views on Wednesday, making it the absolute top trending topic of the day. On Chinese TikTok, the topic was also in the top 10 trending lists.

See and Be Seen in Chengdu

The video went viral after a street fashion photographer captured the two strolling the street and holding hands in downtown Chengdu in a popular area some even refer to as “Douyin Street” (TikTok Street / 抖音街).

Street photography has been common in China for many years, as photographers have since long been gathering around trendy spots from Beijing’s Sanlitun to Chengdu’s Taikoo Li with their big lens cameras to capture people walking by.

Many of these people are older, amateur photographers, who are simply snapping photos of attractive, fashionable, and unique-looking people as their hobby, posting these videos on Douyin, China’s Tiktok, and other platforms. There are also those who are working for street fashion accounts or style magazines, and are doing street snaps to capture China’s latest fashion trends.

The places where these street photographers gather are usually spots where people go to see and be seen. In one of the shots posted online, it seems that Ms. Dong is very much aware that she is being filmed. There are also photographers standing behind her.

The topic attracted 1.2 billion views on Weibo. With street photographers & Tiktok vloggers everywhere nowadays, careless cheaters are bound to be caught. But they seemed particularly nonchalant: they were being filmed from multiple angles while visiting a see-and-be-seen spot. pic.twitter.com/60m2b8avbt

— Manya Koetse (@manyapan) June 8, 2023

In 2019, Chengdu’s Taikooli already placed signs around the area prohibiting commercial street photography and warning about the unauthorized commercial use of an individual’s image (#成都太古里明确禁止未经允许街拍#).

In an interview with Netease, the photographer in question stated that multiple people were taking photos and videos at the time, and that the couple did not refuse to being filmed. As usual, he later posted the video on his TikTok channel.

A sign at Chengdu’s Taikooli warns photographers to take people’s portrait rights into account.

The video soon started circulating online and blew up once people, including co-workers, recognized the man as the married PetroChina executive and identified the woman as another PetroChina employee. The photographer soon received private messages in which he was asked to take the video down, and he did. But it was already too late as the story has already snowballed out of control.

Netizens digging deeper soon found photos proving that the woman holding hands with Hu was his colleague. Some pointed out that the handbag the woman carried in the video appears to be a limited edition Lady Dior bag, that is allegedly priced anywhere from 39,000 to 44,000 yuan ($5470 – $6170).

On June 8, it was reported that the female PetroChina employee Ms. Dong was also dismissed. A related hashtag received over 110 million views on Weibo (#董某某也已停职并接受调查#)

Online Responses

The incident has garnered significant attention on Chinese social media. While stories about top officials being exposed for immoral behavior or corruption often generate considerable interest, this particular incident stands out due to the crucial role played by Chinese social media and netizens in uncovering the extramarital affair.

During the May holiday of this year, a woman from Hunan was at home tending to her baby and casually browsing through TikTok, when she stumbled upon a video showcasing her husband enjoying a theme park ride alongside another woman. After the story of how this affair was exposed through TikTok went trending (#女子刷短视频刷到老公和小三约会#), one other popular TikTok video included a woman shouting out to give everyone in the video frame a heads up: “If you are not here with you’re wife, go away, because I’m filming!”

While a few individuals advocate for addressing privacy issues and condemn the actions of street photographers who share people’s photos and videos, the majority of people are simply “eating watermelon” (吃瓜), meaning they are passively observing the online spectacle without directly involving themselves.

Others are actively delving into the private lives of Hu and Dong, exposing their previous social media posts, personal photos, and private information. Even though Ms. Dong has now deleted all her social media information (#牵手门女当事人疑似清空社交账号#), netizens had previously saved some content that many consider to be posts where she flaunts her wealth.

In the meantime, the incident has not only inspired a wave of memes but has also provided e-commerce platforms with an opportunity to capitalize on the situation by selling clothing items similar to those worn by the couple in the TikTok video.

The PetroChina logo is changed to fit the couple’s outfits.

The Lego version.

The manga AI version.

As the incident keeps fermenting online, Beijing Daily has published an opinion piece in which it is argued that too many of the discussions surrounding the story are driven by sensationalism and are crossing the line. Ms. Dong in specific has become a target of online bullying, harassment, and vulgar comments.

The author also suggests that the incident has become some source of entertainment, while actually involving serious issues related to the moral conduct of state-owned enterprise officials (#舆论反腐不能沦为网暴羞辱#).

Whether serious or not, it seems that one burning question on many people’s mind is where Ms. Dong got her dress from. With similar dresses popping up all over the Chinese internet, it has unexpectedly become the hottest summer dress trend of 2023.

Good news for anyone who loves the dress worn by Ms Dong in the controversial video: it's now sold all over the Chinese internet. pic.twitter.com/Osa745s9MW

— Manya Koetse (@manyapan) June 8, 2023

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

China ACG Culture

The Next Labubu: What the Rise of Wakuku Tells Us About China’s Collectible Toy Wave

From ugly-cute rebellion to a new kind of ‘C-pop,’ the breakout success of Wakuku sheds light on Chinese consumer culture and the forces driving China’s trend toy industry.

Published

4 days agoon

July 6, 2025

Wakuku is the most talked-about newcomer in China’s trend toy market. Besides its mischievous grin, what’s perhaps most noteworthy is how closely Wakuku follows the marketing success of Labubu. As the strongest new designer toy of 2025, Wakuku says a lot about China’s current creative economy — from youth-led consumer trends to hybrid business models.

As it is becoming increasingly clear that Chinese designer toy Labubu has basically conquered the world, it’s already time for the next made-in-China collectible toy to start trending on Chinese social media.

Now, the name that’s trending is Wakuku, a Chinese trend toy created by the Shenzhen-based company Letsvan.

In March 2025, a new panda-inspired Wakuku debuted at Miniso Land in Beijing, immediately breaking records and boosting overall store revenue by over 90%. Wakuku also broke daily sales records on May 17 with the launch of its “Fox-and-Bunny” collab at Miniso flagship stores in Shanghai and Nanjing. At the opening of the Miniso Space in Nanjing on June 18, another Wakuku figure sold out within just two hours. Over the past week, Wakuku went trending on Chinese social media multiple times.

From left to right: the March, May, and June successful Wakuku series/figurines

Like Labubu, Wakuku is a collectible keychain doll with a soft vinyl face and a plush body. These designer toys are especially popular among Chinese Gen Z female consumers, who use them as fashion accessories (hanging them from bags) or as desk companions.

We previously wrote in depth about the birth of Labubu, its launch by the Chinese POP MART (founded 2010), and the recipe for its global popularity in this article, so if you’re new to this trend of Chinese designer toys, you’ll want to check it out first (link).

Labubu has been making international headlines for months now, with the hype reaching a new peak when a human-sized Labubu sold for a record 1.08 million RMB (US$150,700), followed by a special edition that was purchased for nearly 760,000 RMB (US$106,000).

Now, Wakuku is the new kid on the block, and while it took Labubu nine years to win over young Chinese consumers, it barely took Wakuku a year — the character was created in 2022–2023, made its retail debut in 2024, and went viral within months.

Its pricing is affordable (59–159 RMB, around $8.2-$22) and some netizens argue it’s more quality for money.

While Labubu is a Nordic forest elf, Wakuku is a tribal jungle warrior. It comes in various designs and colors depending on the series and is sold in blind boxes (盲盒), meaning buyers don’t know exactly which design they’re getting — which adds an element of surprise.

➡️ There’s a lot to say about Wakuku, but perhaps the most noteworthy aspect is how closely it mirrors the trajectory of POP MART’s Labubu.

Wakuku’s recent success in China highlights the growing appeal and rapid rise of Chinese IPs (beyond its legal “intellectual property” meaning, ‘IPs’ is used to refer to unique cultural brands, characters, or stories that can be developed into collectibles, merchandise, and broader pop culture phenomena).

Although many critics predict that the Labubu trend will blow over soon, the popularity of Wakuku and other Labubu-like newcomers shows that these toys are not just a fleeting craze, but a cultural phenomenon that reflects the mindset of young Chinese consumers, China’s cross-industry business dynamics, and the global rise of a new kind of ‘C-pop.’

Wakuku: A Cheeky Jungle Copycat

When I say that Wakuku follows POP MART’s path almost exactly, I’m not exaggerating. Wakuku may be portrayed as a wild jungle child, but it’s definitely also a copycat.

It uses the same materials as Labubu (soft vinyl + plush), the name follows the same ABB format (Labubu, Wakuku, and the panda-themed Wakuku Pangdada), and the character story is built on a similar fantasy universe.

In fact, Letsvan’s very existence is tied to POP MART’s rise — the company was only founded in 2020, the same year POP MART, then already a decade old, went public on the Hong Kong Stock Exchange and became a dominant industry force.

In terms of marketing, Wakuku imitates POP MART’s strategy: blind boxes, well-timed viral drops, limited-edition tactics, and immersive retail environments.

It even follows a similar international expansion model as POP MART, turning Thailand into its first stop (出海首站) — not just because of its cultural proximity and flourishing Gen Z social media market, but also because Thailand was one of the first and most successful foreign markets for Labubu.

Its success is also deeply linked to celebrity endorsement. Just as Labubu gained global traction with icons like BLACKPINK’s Lisa and Rihanna seen holding the doll, Wakuku too leans heavily on celebrity visibility and entertainment culture.

Like Labubu, Wakuku even launched its own Wakuku theme song.

Since 2024, Letsvan has partnered with Yuehua Entertainment (乐华娱乐) — one of China’s leading talent agencies — to tap into its entertainment resources and celebrity network, powering the Wakuku marketing engine. Since stars like Esther Yu (虞书欣) were spotted wearing Wakuku as a jeans hanger, demand for the doll skyrocketed. Yuehua’s founder, Du Hua (杜华), even gifted a Wakuku to David Beckham as part of its celebrity strategy.

From Beckham to Esther Yu; celebrity endorsements play a big role in the viral marketing of Wakuku.

But what’s most important in Wakuku’s success — and how it builds on Labubu — is that it fully embraces the ugly-cute (丑萌 chǒu méng) aesthetic. Wakuku has a mischievous smile, expressive eyes, a slightly crooked face, a unibrow, and freckles — fitting perfectly with what many young Chinese consumers love: expressive, anti-perfectionist characters (反精致).

“Ugly-Cute” as an Aesthetic Rebellion

Letsvan is clearly riding the wave of “ugly trend toys” (丑萌潮玩) that POP MART spent years cultivating.

🔍 Why are Chinese youth so obsessed with things that look quirky or ugly?

A recent article by the Beijing Science Center (北京科学中心) highlights how “ugly-cute” toys like Labubu and Wakuku deviate from traditional Chinese aesthetics, and reflect a deeper generational pushback against perfection and societal expectations.

The pressure young people face — in education, at work, from family expectations, and information overload — is a red thread running through how China’s Gen Z behaves as a social media user and consumer (also see the last newsletter on nostalgia core).

To cope with daily stress, many turn to softer forms of resistance, such as the “lying flat” movement or the sluggish “rat lifestyle” in which people reject societal pressures to succeed, choosing instead to do the bare minimum and live simply.

This generational pushback also extends to traditional norms around marriage, gender roles, and ideals of beauty. Designer toys like Labubu and Wakuku are quirky, asymmetrical, gender-fluid, rebellious, and reflect a broader cultural shift: a playful rejection of conformity and a celebration of personal expression, authenticity, and self-acceptance.

Another popular designer toy is Crybaby, designed by Thai designer Molly, and described as follows: “Crybaby is not a boy or a girl, it is not even just human, it represents an emotion that comes from deep within. It can be anything and everything! Laughter isn’t the only way to make you feel better, crying can be healing too. If one day, a smile can’t alleviate your problems, baby, let’s cry together.”

But this isn’t just about rejecting tradition. It’s also about seeking happiness, comfort, and surprise: emotional value. And it’s usually not brand-focused but influencer-led. What matters is the story around it and who recommends it (unless the brand becomes the influencer itself — which is what’s ultimately happening with POP MART).

One of the unofficial ambassadors of the chǒu méng ugly-cute trend is Quan Hongchan (全红婵), the teenage diving champion and Olympic gold medallist from Guangdong. Quan is beloved not just for her talent, but also for her playful, down-to-earth personality.

During the Paris Olympics, she went viral for her backpack, which was overflowing with stuffed animals (some joked she was “carrying a zoo on her back”) — and for her animal-themed slippers, including a pair of ugly fish ones.

Quan Hongchan with her Wakuku, and her backpack and slippers during her Paris Olympics days.

It’s no surprise that Quan Hongchan is now also among the celebrities boosting the popularity of the quirky Wakuku.

From Factory to Fandom: A New Kind of “C-pop” in the Making

The success of Wakuku and other similar toys shows that they’re much more than Labubu 2.0; they’re all part of a broader trend tapping into the tastes and values of Chinese youth — which also speaks to a global audience.

And this trend is serious business. POP MART is one of the world’s fastest-growing consumer brands, with a current market value of approximately $43 billion, according to Morgan Stanley.

No wonder everyone wants a piece of the ‘Labubu pie,’ from small vendors to major companies.

It’s not just the resellers of authentic Labubu dolls who are profiting from the trend — so are the sellers of ‘Lafufu,’ a nickname for counterfeit Labubu dolls, that have become ubiquitous on e-commerce platforms and in toy markets (quite literally).

Wakuku’s rapid rise is also a story of calculated imitation. In this case, copying isn’t seen as a flaw but as smart market participation.

The founding team behind Letsvan already had a decade of experience in product design before setting out on their journey to become a major player in China’s popular designer toy and character merchandise market.

But their real breakthrough came in early 2025, when QuantaSing (量子之歌), a leading adult learning ed-tech company with no previous ties to toys, acquired a 61% stake in the company.

With QuantaSing’s financial backing, Yuehua Entertainment’s marketing power, and Miniso’s distribution reach, Wakuku took it to the next level.

The speed and precision with which Letsvan, QuantaSing, and Wakuku moved to monetize a subcultural trend — even before it fully peaked — shows just how advanced China’s trend toy industry has become.

This is no longer just about cute (or ugly-cute) designs; it’s about strategic ecosystems by ‘IP factories,’ from concept and design to manufacturing and distribution, blind-box scarcity tactics, immersive store experiences, and influencer-led viral campaigns — all part of a roadmap that POP MART refined and is now adopted by many others finding their way into this lucrative market. Their success is powered by the strength of China’s industrial & digital infrastructure, along with cross-industry collaboration.

The rise of Chinese designer toy companies reminds of the playbook of K-pop entertainment companies — with tight control over IP creation, strong visual branding, carefully engineered virality, and a deep understanding of fandom culture. (For more on this, see my earlier explanation of the K-pop success formula.)

If K-pop’s global impact is any indication, China’s designer toy IPs are only beginning to show their potential. The ecosystems forming around these products — from factory to fandom — signal that Labubu and Wakuku are just the first wave of a much larger movement.

– By Manya Koetse

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China ACG Culture

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

Labubu is not ‘Chinese’ at all—and at the same time, it is very much a product of present-day China.

Published

1 month agoon

June 8, 2025

Labubu – the hottest toy of 2025 – is making headlines everywhere these days. The little creature is all over TikTok, and from New York to Bangkok and Dubai, people are lining up for hours to get their hands on the popular keyring doll.

In the UK, the Labubu hype has gone so far that its maker temporarily pulled the toys from all of its stores for “safety reasons,” following reports of customers fighting over them. In the Netherlands, the sole store where fans can buy the toys also had to hire extra security to manage the crowds, and Chinese customs authorities have intensified their efforts to prevent the dolls from being smuggled out of the country.

While the Labubu craze had slightly cooled in China compared to its initial peak, the character remains hugely popular and surged back into the top trending charts with the launch of POP MART’s Labubu 3.0 series in late April 2025 (which instantly sold out).

Following the global popularity of the Chinese game Black Myth: Wukong, state media are citing Labubu as another example of a successful Chinese cultural export—calling it ‘a benchmark for China’s pop culture’ and viewing its success as a sign of the globalization of Chinese designer toys.

But how ‘Chinese’ is Labubu, really? Here’s a closer look at its cultural identity and the story behind the trend.

The Journey to Labubu

In the perhaps unlikely case you have never heard of Labubu, I’ll explain: it’s a keyring toy with a naughty and, frankly, somewhat bizarre face and gremlin-like appearance that comes in various colors and variations. It’s mainly loved by young (Gen Z) women, who like to hang the toys on their bags or just keep them as collectibles.

The figurine is based on a character created by renowned Hong Kong-born artist Kasing Lung (龍家昇/龙家升, born 1972), whose work is inspired by Nordic legends of elves.

Kasung Lung, image via Bangkok Post.

Lung’s story is quite inspirational, and very international.

As a child, Lung immigrated to the Netherlands with his parents. Struggling to learn Dutch, young Kasing was given plenty of picture books. The picture books weren’t just a way to connect with his new environment, it also sparked a lifelong love for illustration.

Among Kasing’s favorite books were Where the Wild Things Are by Maurice Sendak and those by Edward Gorey — all full of fantasy, with some scary elements and artistic quality.

Later, as his Dutch improved, Kasing became an avid reader and turned into a true bookworm. The many fantasy novels and legendary tales he devoured planted the seed for creating his own world of elves and mythical creatures.

Kasing as a young boy on the right, and one of his children’s illustration books on the left.

After initially returning to Hong Kong in the 1990s, Lung later moved back to the Netherlands and eventually settled in Belgium.

Following a journey of many rejections and persistence, he began publishing his own illustrations and picture books for the European market.

Image via Sina.

In 2010, Hong Kong toy brand How2work’s Howard Lee reached out to Lung. One of How2work’s missions is cultivating creative talent and supporting the Hong Kong art scene. Lee invited Kasung to turn his illustrations into 3D, collectible figurines. Kasung, a collector of Playmobil figures since childhood, agreed to the collaboration for the sake of curiosity and creativity.

Lung’s partnership with How2work marked a transition to toy designer, although Lung also continued to stay active as an illustrator. Besides his own “Max is moe” (Max is tired) picture book, he also did illustrations for a series by renowned Belgian author Brigitte Minne (Lizzy leert zwemmen, Lizzy leert dansen).

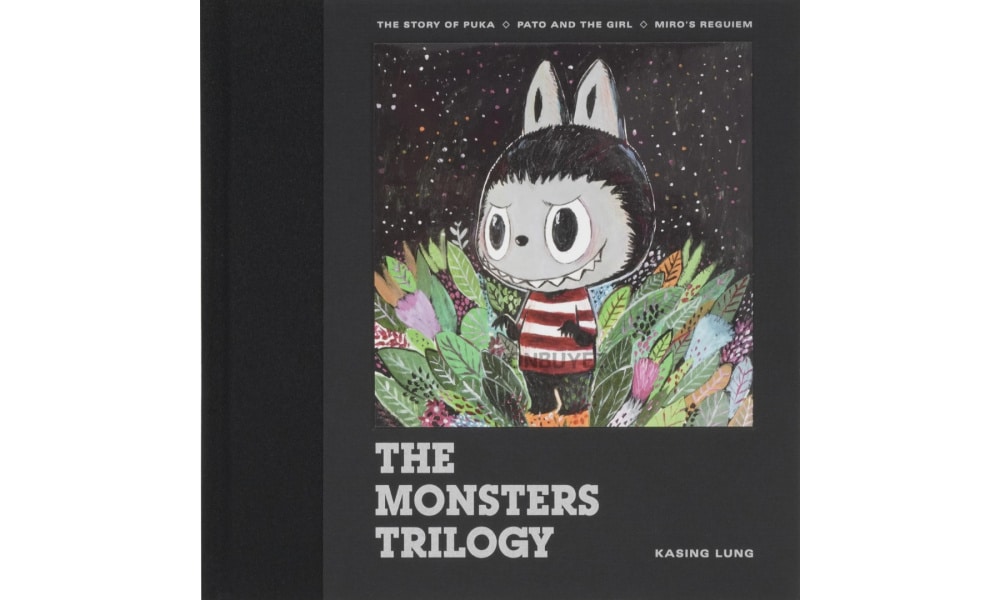

A few years later, Lung introduced what would become known as The Monsters Trilogy: a fantasy universe populated by elf-like creatures. Much like The Smurfs, the Monsters formed a tribe of distinct characters, each with their own personalities and traits, led by a tribal leader named Zimomo.

With its quirky appearance, sharp teeth, and mischievous grin, Labubu stood out as one of the long-eared elves.

When Labubu Met POPMART

Although the Labubu character has been around since 2015, it took some time to gain fame. It wasn’t until Labubu became part of POP MART’s (泡泡玛特) toy lineup in 2019 that it began reaching a mass audience.

POP MART is a Chinese company specializing in artsy toys, figurines, and trendy, pop culture-inspired goods. Founded in 2010 by a then college student, the brand launched with a mission to “light up passion and bring joy,” with a particular focus on young female consumers (15-30 age group) (Wang 2023).

One of POP MART’s most iconic art toy characters—and its first major commercial success—is Molly, designed by Hong Kong artist Kenny Wong in collaboration with How2work.

Prices vary depending on the toy, but small figurines start as low as 34 RMB (about US$5), while collectibles can go as high as 5,999 yuan (US$835). Resellers often charge significantly more.

Pop Mart and its first major commercial success: Molly (source).

POP MART is more than just a store, it’s an operational platform that covers the entire chain of trendy toys, from product development to retail and marketing (Liu 2025).

Within a decade of opening it first store in Beijing, POP MART experienced explosive growth, expanded globally, and was listed on the Hong Kong Stock Exchange.

The enormous success of POP MART has been the subject of countless marketing studies, drawing various conclusions about how the company managed to hit such a cultural and commercial sweet spot beyond its mere focus on female Gen Z consumers.

🎁 Gamifying consumption | One common conclusion about the success of POP MART, is that it offers more than just products—it offers an experience. At the heart of the brand is its signature blind box model, where customers purchase mystery boxes from specific product lines without knowing which item is inside. Those who are lucky enough will unpack a special ‘hidden edition.’ Originating in Japanese capsule toy culture, this element of surprise gamifies the shopping experience, makes it more shareable on social media, and fuels the desire to complete collections or hunt for rare figures through repeat purchases.

🌍 Creating a POP MART universe | Although POP MART has partnerships with major international brands such as Disney, Marvel, and Snoopy, it places a strong focus on developing its own intellectual property (IP) toys and figurines. In doing so, POP MART has created a universe of original characters, giving them a life beyond the store through things like collaborations, art shows and exhibitions, and even its own theme park in Beijing.

💖 Emotional consumption | What makes POP MART particularly irresistible to so many consumers is the emotional appeal of its toys and collectibles. It taps into nostalgia, cuteness, and aesthetic charm. The toys become companions, either as a desktop buddy or travel buddy. Much of the toys’ value lies in their role as social currency, driven by hype, emotional gratification, and a sense of social bonding and identity (Ge 2024).

The man behind POP MART and its strategy is founder and CEO Wang Ning (王宁), a former street dance champion (!) and passionate entrepreneur with a clear vision for the company. He consistently aims to discover the next iconic design, something that could actually rival Mickey Mouse or Hello Kitty.

In past interviews, Wang has discussed how consumer values are gradually shifting. The rise of niche toys into the mainstream, he says, reflects this transformation. Platforms like Douyin, China’s strong e-commerce infrastructure, and the digital era more broadly have all contributed to changing attitudes, where people are increasingly buying not for utility, but for the sake of happy moments.

While Wang Ning dreams of a more joyful world, he also knows how to make money (with a net worth of $20.3 billion USD, it was actually just announced that he’s Henan’s richest person now)—every new artist and toy design under POP MART is carefully researched and strategically evaluated before being signed.

Labubu’s journey before its POP MART partnership had already shown its appeal: Kasing Lung and How2Work had built a small but loyal fanbase pre-2019. But it was through the power of POP MART that Labubu really reached global fame.

Labubu: Most Wanted

Riding the wave of POP MART’s global expansion, Labubu became a breakout success, eventually evolving into a global phenomenon and cultural icon.

Now, celebrities around the world are flaunting their Labubus, further fueling the hype—from K-pop star Lisa Manobal to Thai Princess Sirivannavari and Barbadian singer Rihanna.

In China, one of the most-discussed topics on social media recently is the staggering resale price of the Labubu dolls.

Third edition of the beloved Labubu series titled “Big into energy” (Image via Pop Mart Hong Kong).

“The 99 yuan [$13.75] Labubu blind box is being hyped up to 2,600 yuan [$360]” (#99元Labubu隐藏款被炒至2600元#), Fengmian News recently reported.

Labubu collaborations and limited editions are even more expensive. Some, like the Labubu x Vans edition, originally retailed for 599 yuan ($83) and are now listed for as much as 14,800 yuan ($2,055).

Recently, Taiwanese singer and actor Jiro Wang (汪东城) posted a video venting his frustration over scalpers buying up all the Labubus and reselling them at outrageous prices. “It’s infuriating!” he said. “I can’t even buy one myself!” (#汪东城批Labubu黄牛是恶人#).

One Weibo hashtag asks: “Who is actually buying these expensive Labubus?” (#几千块的Labubu到底谁在买#).

Turns out—many people are.

Not only is Labubu adored and collected by millions, an entire subculture has emerged around the toy. Especially in China, where Labubu was famous before, the monster is now entering a new phase: playful customization. Fans are using the toy as a canvas to tell new stories and deepen their emotional connection, transforming Labubu from a collectible into a DIY project.

Labubu getting braces and net outfits – evolving from collectible to DIY project.

There’s a growing trend of dressing Labubu in designer couture or dynastic costumes (Taobao offers a wide array of outfits), but fans are going further—customizing flower headbands, adorning their dolls with tooth gems, or even giving them orthodontic braces for their famously crooked teeth (#labubu牙套#).

In online communities, some fans have gone as far as creating dedicated generative AI agents for Labubu, allowing others to generate images of the character in various outfits, environments, and scenarios.

Labubu AI by Mewpie.

It’s no longer just the POP MART universe—it’s the Labubu universe now.

“Culturally Odorless”

So, how ‘Chinese’ is Labubu really? Actually, Labubu is not ‘Chinese’ at all—and at the same time, it is very much a product of present-day China.

🌍 Not Chinese at all

Like other famous IP characters, from the Dutch Miffy to Japan’s Pikachu and Hello Kitty, Labubu is “culturally odorless,” a term used to refer to how cultural features of the country of invention are absent from the product itself.

The term was coined by Japanese scholar Koichi Iwabuchi to describe how Japanese media products—particularly in animation—are designed or marketed to minimize identifiable Japanese cultural traits. This erasure of “Japaneseness” helped anime (from Astro Boy to Super Mario and Pokémon) become a globally appealing and commercially successful cultural export, especially in post-WWII America and beyond.

Moreover, by avoiding culturally or nationally specific traits, these creations are placed in a kind of fantasy realm, detached from real-world identities. Somewhat ironically, it is precisely this neutrality that has made Japanese IPs so distinctively recognizable as “Japanese” (Du 2019, 15).

Many Labubu fans probably also don’t see the toy as “Chinese” at all—there are no obvious cultural references in its design. Its style and fantasy feel are arguably closer to Japanese anime than anything tied to Chinese identity.

When a Weibo blogger recently argued that Labubu’s international rise represents a more powerful example of soft power than DeepSeek, one popular reply asked: “But what’s Chinese about it?”

🇨🇳 Actually very Chinese

Yet, Labubu is undeniably a product of today’s China—not necessarily because of Kasing Lung (Hong Kong/Dutch/Belgian) or How2work (Hong Kong), but because of the Beijing-based POP MART.

Wang Ning’s POP MART is a true product of its time, inspired by and aligned with China’s new wave of digital startups. From Bytedance to Xiaohongshu and Bilibili, many of China’s most innovative companies move beyond horizontal product offerings or traditional service goals. Instead, they think vertically and break out of the box—evolving into entire ecosystems of their own. (Fun fact: the entrepreneurs behind these companies were all born in the 1980s, between 1983 and 1989).

In that sense, state media like People’s Daily calling Labubu “a benchmark of China’s pop culture” isn’t off the mark.

Still, some marketing critics argue there’s room for more ‘Chineseness’ in Labubu and POP MART’s brand-building strategies—particularly through collections inspired by Chinese heritage, which could further promote national culture on the global stage (Wang 2023).

Meanwhile, Chinese official channels have already begun positioning Labubu as a cultural ambassador. In the summer of 2024, a life-sized Labubu doll embarked on a four-day tour of Thailand to celebrate the 50th anniversary of China–Thailand diplomatic relations.

The life-sized mascot of a popular Chinese toy character, Labubu, visited Bangkok landmarks and was named “Amazing Thailand Experience Explorer” to boost Chinese tourism. Photo Credit: Facebook/Pop Mart, via TrvelWeekly Asia.

In the future, Labubu, just like Hello Kitty in Japan, is likely to become the face of more campaigns promoting tourism and cross-cultural exchange.

Whatever happens next, it’s undeniable that Labubu stands at the forefront of a breakthrough moment for Chinese designer toys in the global market, and, from that position, serves as a unique ambassador for a new wave of Chinese creative exports that resonate with international audiences.

For now, most Labubu fans, however, don’t care about all of that – they are still on the hunt for the next little monster, and that’s enough to keep the Labubu hype burning.🔥

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

References (other sources included in hyperlinks)

• Du, Daisy Yan. 2019. Animated Encounters: Transnational Movements of Chinese Animation, 1940-1970s. Honolulu: University of Hawaii Press.

• Ge, Tongyu. 2024. “The Role of Emotional Value of Goods in Guiding Consumer Behaviour: A Case Study Based on Pop Mart.” Proceedings of the 5th International Conference on Education Innovation and Philosophical Inquiries. DOI: 10.54254/2753-7048/54/20241623.

• Liu, Enyong. 2025. “Analysis of Marketing Strategies of POP MART,” Proceedings of the 3rd International Conference on Financial Technology and Business Analysis DOI: 10.54254/2754-1169/149/2024.

• Wang, Zitao. 2023. “A Case Study of POP MART Marketing Strategy.” Proceedings of the 2023 International Conference on Management Research and Economic Development. DOI: 10.54254/2754-1169/20/

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

What’s on Weibo is a reader-supported publication, run by Manya Koetse (@manyapan), offering independent analysis of social trends in China for over a decade. To receive new posts and support our work, consider becoming a paid subscriber.

A Very Short Guide to China’s Most Popular Designer Toys

The Next Labubu: What the Rise of Wakuku Tells Us About China’s Collectible Toy Wave

Jiehun Huazhai (结婚化债): Getting Married to Pay Off Debts

Yearnings, Dreamcore, and the Rise of AI Nostalgia in China

Beauty Influencer Du Meizhu Accused of Scamming Fan Out of $27K

China Is Not Censoring Its Social Media to Please the West

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

China Reacts: 3 Trending Hashtags Shaping the Tariff War Narrative

China Trending Week 15/16: Gu Ming Viral Collab, Maozi & Meigui Fallout, Datong Post-Engagement Rape Case

Chinese New Nickname for Trump Mixes Fairy Tales with Tariff War

No Quiet Qingming: From High-Tech Tomb-Sweeping to IShowSpeed & the Seven China Streams

Understanding the Dr. Xiao Medical Scandal

From Trade Crisis to Patriotic Push: Chinese Online Reactions to Trump’s Tariffs

Behind the Mysterious Death of Chinese Internet Celebrity Cat Wukong

Do You Know Who Li Gang Is? Anti-Corruption Official Arrested for Corruption

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Media12 months ago

China Media12 months agoA Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

-

China Society9 months ago

China Society9 months agoDeath of Chinese Female Motorcycle Influencer ‘Shigao ProMax’ Sparks Debate on Risky Rides for Online Attention

-

China World11 months ago

China World11 months agoChina at Paris 2024 Olympics Trend File: Medals and Moments on Chinese Social Media

-

China Memes & Viral11 months ago

China Memes & Viral11 months agoTeam China’s 10 Most Meme-Worthy Moments at the 2024 Paris Olympics

mario linor

June 12, 2023 at 3:53 am

The problem is not the morals, the problem is that we live in a world of spies, CC cameras, and envious people with a phone becomes too easily avengers of who knows what. How can a man, even if a top manager of a corporation, and his girl-friend or what, be thrown to the crowds to feed with anger and resentment? The lack of strict laws for the privacy of people are the issue of this century. Anyone, me, you, we, can be put in this situation by a rival or just by idiots with a phone. A family is destroyed, I am sure the wife would have wanted to face this issue in another way; now he lost the job and for the family is a huge loss for which the one who cowardly took these picture is the only responsible. Shame!