China Brands, Marketing & Consumers

From Baijiu Latte to DIY Liquor Coffee: China’s Coffee Culture Takes a Shot at Coffee + Alcohol Fusion

The recent buzz surrounding the Luckin x Maotai collaboration shows that blending coffee + alcohol might just become the next major trend in Chinese coffee culture.

Published

2 years agoon

PREMIUM CONTENT

China’s coffee culture is brewing up something new as it embraces the fusion of coffee and alcohol. This blossoming trend, currently a hot topic online thanks to the Luckin x Maotai collaboration, is sparking curiosity and discussions about its lasting impact on coffee culture in China.

Would you like a shot with that? Recently, a trend involving the fusion of alcohol and coffee seems to be taking off in China, blending established liquor brands with popular domestic coffee labels.

The concept of mixing alcohol with coffee is relatively new in China, where classics like Irish Coffee never achieved the same recognition as they did in Western countries.

But also, the way in which ‘coffee + alcohol’ is introduced to consumers is different, with brands such as 7-Eleven and Luckin promoting their ‘coffee + liquor shot’ or ‘alcohol lattes.’

As a tea drinking nation, coffee culture is not part of Chinese traditional culture. However, over the past decade, China has witnessed the remarkable growth of a distinct and immensely popular Chinese coffee culture. In this evolving landscape, companies and consumers are continuously finding innovative ways to incorporate coffee into daily city life.

Coffee in China is typically an out-of-home purchase, particularly favored by the middle class (Ferreira & Ferreira 2018, 785). It has become intrinsically linked with modern urban life in China, taking on new cultural meanings related to status, lifestyle, aesthetics, urban communities, and the acquisition of new tastes. Millennials and Gen Z are at the forefront of shaping China’s coffee culture.

The pursuit of unique flavors is a defining aspect of China’s coffee culture, with a strong emphasis on specialty coffee. In fact, Shanghai alone boasts over 7,000 independent coffee houses, surpassing coffee hubs like London or New York (Xu & Ng 2022, 2349). Chinese coffee shops are known for introducing innovative concepts such as fruit-infused coffee, spicy chili coffee, garlic coffee, and liquor-flavored coffees.

Rather than introducing coffee into China’s drinking culture, alcohol is now being integrated into China’s coffee culture, providing consumers with yet another way to enjoy their coffee and explore new flavor experiences.

7-Eleven Blending Coffee with Alcohol

At various 7-Eleven convenience stores in China, you can now purchase a shot of alcohol to go with your coffee. For just 5 yuan ($0.70), customers can add a shot of their preferred liquor, such as Havana or Malibu, to their take-away coffee. It’s also possible to add it to your soda.

7-Eleven DIY counter: adding a shot of Malibu to takeaway coffee. (Image via Xiaohongshu user 今天怎么还没睡).

While we first noticed this option at a Beijing 7-eleven somewhere during the summer of 2023, Radii and Phoenix News reported that the first DYI counter was piloted at a Beijing store in October of 2022.

The counter, that specifically promotes the coffee + alcohol combo, is meant to serve customers who would previously purchase their coffee and then separately buy a full-priced mini bottle of liquor for anywhere in between 20-40 yuan ($2.75-$5.50) for 50ml.

DIY liquor counter at 7-Eleven in Beijing, promoting its “coffee + shot of alcohol” option (Photo by What’s on Weibo).

In late 2022, 7-Eleven in Taiwan also promoted the liquor + coffee combo as it exclusively offered the Hennessy cognac x City Prima coffee “Liquor Latte Set.”

City Prima x Hennessy at 7-Eleven Taiwan (Image via tw.com).

Luckin x Maotai Collab: Introducing Baijiu Latte

While the trend of adding alcohol to coffee seems to be taking off in China, Luckin coffee became all the talk on Chinese social media this week for its collaboration with Maotai (茅台), also known as Moutai, a renowned Chinese brand of baijiu – a type of strong distilled liquor.

Luckin launched the drink on Monday for 38 yuan ($5.20) under the name “酱香拿铁” (jiàng xiāng ná tiě) or “Sauce-Flavored Latte,” soon selling out at various stores and becoming a trending topic online. The ‘sauce’ reference is because of the distinct flavor profile associated with Maotai, often described as having a soy sauce-like aroma (“酱香型”).

The collaboration has become super popular for various reasons, one major one being the unexpected yet exciting combination of two such well-known Chinese brands coming together.

Promotion of the Maotai coffee on Luckin’s Weibo page.

Luckin Coffee (瑞幸咖啡) was founded in Beijing in 2017, opened its first shops in early 2018, and it has seen incredible growth over the past five years. The brand’s primary emphasis lies in providing top-notch coffee at accessible prices in convenient locations. Due to its ubiquity and dominant position in the market, it’s sometimes also referred to as “China’s Starbucks” (“中国星巴克”).

Maotai, made in Maotai in Guizhou Province, prides itself for its 2000-year history and it became the first Chinese liquor to be produced in large-scale production. The strong luxury spirit (53%), known as China’s national liquor, is especially popular among middle-aged and elderly men.

With Luckin being particular popular among China’s younger generations, while Maotai is especially loved among the elder generations, one popular Weibo post about the recent collaboration said: “For young people, it’s their first cup of Maotai, for the elderly, it’s their first cup of Luckin.”

It is also one of the reasons why the trend has become so big this week: many consumers are just curious to try this novel combination, although not everyone likes its special taste.

Trying out the new Luckin x Maotai combo (photos via @互联网欢乐指南).

The blend of coffee with alcohol is really more about the flavor than the buzz; the baijiu-flavored Luckin coffee only has an alcohol content of about 0.5%. One Weibo hashtag related to the question of whether or not people should drive after consuming the drink amassed an astonishing 640 million views (#瑞幸回应喝茅台联名咖啡能否开车#). Despite the very low alcohol content, Luckin still advises that minors, pregnant women, and drivers should avoid consuming the beverage.

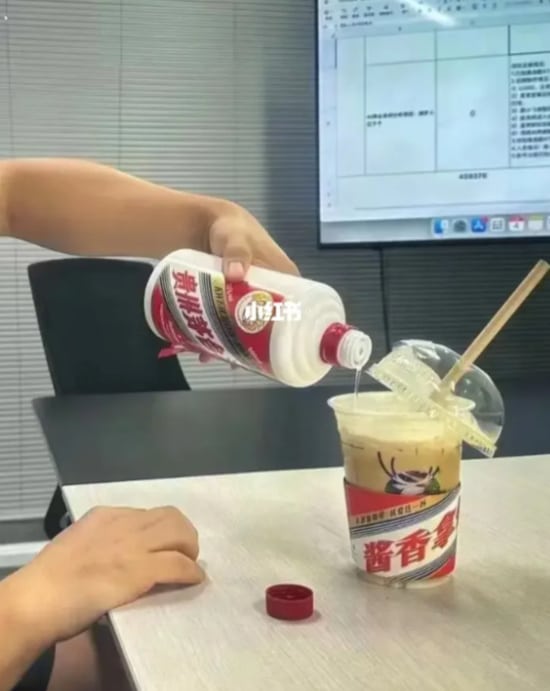

The “Chinese version of Irish Coffee,” image on Xiaohongshu via @謝琦鈦.

Some social media users add some extra Maotai to their coffee themselves, calling it the “Chinese version of Irish coffe” (“中国版的爱尔兰咖啡”).

“Milk Tea for Grown-Ups”

Luckin is not the only Chinese coffee house offering a Maotai-flavored latte. Other Chinese coffee shops have independently introduced their own versions of Maotai coffee, without official partnerships.

In addition to company-driven innovations, consumers are also experimenting with their own coffee + liquor blends. On the social media platform Xiaohongshu, numerous users are enthusiastically sharing their personalized methods infusing coffee with Maotai and various other types of alcohol, including adding miniature bottles of Baileys to Starbucks takeaway coffee.

Image via Xiaohongshu user @潮流情报官.

Others are going beyond the coffee trend, and mix their milk tea or fruit tea with Jameson, Kahlua, or other liquors, turning them into “grown-up milk tea” beverages (成年人的奶茶).

While such practices might receive disapproval in many countries, where daytime drinking and adding spirits to coffee could be seen as indicative of alcoholism and irresponsible behavior, in China, these actions generally lack these negative connotations. Many young people just view it as an innovative way to enjoy new tastes, describing it as “a new trendy way to drink coffee” (or tea).

Is the coffee + alcohol mix a temporary trend, or will it become a permanent part of China’s out-of-home coffee culture? On social media, most people are curious to try it out but they are also not convinced the combination is one to stay.

“I don’t really know the flavor of coffee + alcohol, but judging from their effects – alcohol makes me sleepy and coffee wakes me up – I’m afraid it would mix up my nerves, so I don’t dare to try” one commenter (@无边桃炎) wrote.

“It’s just the taste [of mixing coffee with alcohol] that’s really good – apart from the Maotai Luckin one,” one person responded.

They are not alone; numerous young Chinese internet users are speculating that the recent Luckin collaboration is Maotai’s strategy to appeal to China’s younger generations, who do not necessarily appreciate its distinct flavor. These younger demographics have moved away from the traditional drinking culture in which baijiu plays a significant role.

“It’s just so unpleasant to drink,” others write. “Is it alcohol or is it coffee?” another person wonders: “In the end, it’s actually neither.”

While Luckin’s “Sauce-Flavored Latte” might not secure a permanent place on its menu, it’s clear that the trend of adding alcohol to coffee has gained popularity among China’s younger consumers. With 7-Eleven’s DIY counter offering a variety of sweeter liquors for customers to blend with their coffee, it appears they’ve found the perfect “shot” in this coffee and liquor trend.

By Manya Koetse

with contributions by Miranda Barnes

References

Ferreira, Jennifer, and Carlos Ferreira. 2018. “Challenges and Opportunities of New Retail Horizons in Emerging Markets: The Case of a Rising Coffee Culture in China.” Business Horizons 61, no. 5: 783-796.

Xu, Xinyue, and Aaron Yikai Ng. 2023. “Cultivation of New Taste: Taste Makers and New Forms of Distinction in China’s Coffee Culture.” Information, Communication & Society 26, no. 11: 2345-2362.

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

China Brands, Marketing & Consumers

Hasan Piker’s China Trip & the Unexpected Journey of a Chinese School Uniform to Angola

Hasan Piker’s controversial China tour, a Chinese school uniform resurfaces in Africa, a new winter hotspot, why Chinese elites ‘run’ to Tokyo, and more.

Published

3 months agoon

November 21, 2025

🌊 Signals — Week 47 (2025)

Part of Eye on Digital China, Signals highlights slower trends and online currents behind the daily scroll. This edition was sent to paid subscribers — subscribe to receive the next issue in your inbox.

Welcome to another edition of Eye on Digital China. Different from the China Trend Watch (check the latest one here if you missed it), this edition, part of the new Signals series, is about the slower side of China’s social media: the recurring themes and underlying shifts that signal broader trends beyond the quick daily headlines. Together with the deeper dives, the three combined aim to give you clear updates and a fuller overview of what’s happening in China’s online conversations & digital spaces.

For the coming two weeks, I’ll be traveling from Beijing to Chongqing and beyond (more on that soon) so please bear with me if my posting frequency dips a little. I’ll be sure to pick it up again soon and will do my best to keep you updated along the way. In the meantime, if you know of a must-try hotpot in Chongqing, please do let me know.

In this newsletter: Hasan Piker’s controversial China tour, a Chinese school uniform in Angola, a new winter hotspot, discussions on what happens to your Wechat after you die, why Chinese elites rùn to Tokyo, and more. Let’s dive in.

- 💰 The richest woman in China, according to the latest list by Hurun Research Institute, is the “queen of pharmaceuticals” Zhong Huijuan (钟慧娟) who has accumulated 141 billion yuan (over 19 billion USD). Women account for over 22% of Chinese billionaires (those with more than 5 billion RMB), underscoring China’s globally leading position in producing wealthy female entrepreneurs.

- 🧩 What happens to your WeChat after you die? A user who registered for NetEase Music with a newly reassigned phone number unexpectedly gained access to the late singer Coco Lee’s (李玟) account, as the number had originally belonged to her. The incident has reignited debate over how digital accounts should be handled after death, prompting platforms like NetEase and Tencent to reconsider policies on long-inactive accounts and take stronger measures to protect them.

- 📱 Although millions of viewers swoon over micro-dramas with fantasy storylines where rich, powerful men win over the “girl next door” through money and status, Chinese regulators are now stepping in to curb exaggerated plots featuring the so-called “dominant CEO” (霸道总裁) archetype, signaling stricter oversight for the booming short drama market.

- ☕ A popular Beijing coffee chain calling itself “People’s Cafe” (人民咖啡馆), with its style and logo evoking nationalist visual nostalgia, has changed its name after facing criticism for building its brand – including pricey coffee and merchandise – on Mao era and state-media political connotations. The cafe is now ‘Yachao People’s Cafe’ (要潮人民咖啡馆).

- 👀 Parents were recently shocked to see erotic ads appear on the Chinese nursery rhymes and children’s learning app BabyBus (宝宝巴士), which is meant for kids ages 0–8. BabyBus has since apologized, but the incident has sparked discussions about how to keep children safe from such content.

- 🧧The 2026 holiday schedule has continued to be a big topic of conversation as it includes a 9-day long Spring Festival break (from February 15 to February 23), making it the longest Lunar New Year holiday on record. The move not only gives people more time for family reunions, but also gives a huge boost to the domestic travel industry.

Hasan Piker’s Chinese Tour & The US–China Content Honeymoon

Livestreamer Hasan Piker during his visit to Tiananmen Square flag-rising ceremony.

It’s not time for the end-of-year overviews just yet – but I’ll already say that 2025 was the US–China ‘honeymoon’ year for content creation. It’s when China became “cool,” appealing, and eye-grabbing for young Western social media users, particularly Americans. The recent China trip of the prominent American online streamer Hasan Piker fits into that context.

This left-wing political commentator also known as ‘HasanAbi’ (3 million followers on Twitch, recently profiled by the New York Times) arrived in China for a two-week trip on November 11.

Piker screenshot from the interview with CGTN, published on CGTN.

His visit has been controversial on English-language social media, especially because Piker, known for his criticism of America (which he calls imperialist), has been overly praising China: calling himself “full Chinese,” waving the Chinese flag, joining state media outlet CGTN for an interview on China and the US, and gloating over a first-edition copy of Quotations from Chairman Mao (the Little Red Book). He portrays China as heavily misrepresented in the West and as a country the United States should learn from.

Hasan Piker did an interview with CGTN, posing with Li Jingjing 李菁菁.

During his livestreaming tour, Hasan, who is nicknamed “lemonbro” (柠檬哥) by Chinese netizens, also joined Chinese platforms Bilibili and Xiaohongshu.

But despite all the talk about Piker in the American online media sphere, online conversations, clicks, and views within China are underwhelming. As of now, he has around 24,000 followers on Bilibili, and he’s barely a topic of conversation on mainstream feeds.

Piker’s visit stands in stark contrast to that of American YouTuber IShowSpeed (Darren Watkins), who toured China in March. With lengthy livestreams from Beijing to Chongqing, his popularity exploded in China, where he came to be seen by many as a representative of cultural diplomacy.

IShowspeed in China, March 2025.

IShowSpeed’s success followed another peak moment in online US–China cultural exchange. In January 2025, waves of foreign TikTok users and popular creators migrated to the Chinese lifestyle app Xiaohongshu amid the looming TikTok ban.

Initially, the mass migration of American users to Xiaohongshu was a symbolic protest against Trump and US policies. In a playful act of political defiance, they downloaded Xiaohongshu to show they weren’t scared of government warnings about Chinese data collection. (For clarity: while TikTok is a made-in-China app, it is not accessible inside mainland China, where Douyin is the domestic version run by the same parent company).

The influx of foreigners — who were quickly nicknamed “TikTok refugees” — soon turned into a moment of cultural celebration. As American creators introduced themselves, Chinese users welcomed them warmly, eager to practice English and teach newcomers how to navigate the app. Discussions about language, culture, and societal differences flourished. Before long, “TikTok refugees” and “Xiaohongshu natives” were collaborating on homework assignments, swapping recipes, and bonding through humor. It was a rare moment of social media doing what we hope it can do: connect people, build bridges, and replace prejudice with curiosity.

Some of that same enthusiasm was also visible during IShowSpeed’s China tour. Despite the tour inevitably getting entangled with political and commercial interests, much of it was simply about an American boy swept up in the high energy of China’s vibrant cities and everything they offer.

Different from IShowSpeed, who is known for his meme-worthy online presence, Piker is primarily known for his radical political views. His China enthusiasm feels driven less by cultural curiosity and more by his critique of America.

Because of his stances — such as describing the US as a police state — it’s easy for Western critics to accuse him of hypocrisy in praising China, especially after a brief run-in with security police while livestreaming at Tiananmen Square.

Seen in broader context, Piker’s China trip reflects a shift in how China is used in American online discourse.

Before, it was Chinese ‘public intellectuals’ (公知) who praised the US as a ‘lighthouse country’ (灯塔国), a beacon of democracy, to indirectly critique China and promote a Western modernization model. Later, Chinese online influencers showcased their lives abroad to emphasize how much ‘brighter the moon’ was outside China.

In the post-Covid years, the current reversed: Western content creators, from TikTok influencers to political commentators, increasingly use China to make arguments that are fundamentally about America.

Between these cycles, authentic cultural curiosity gets pushed to the sidelines. The TikTok-refugee moment in early January may have been the closest we’ve come in years: a brief window where Chinese and American users met each other with curiosity, camaraderie, and creativity.

Hasan’s tour, in contrast, reflects a newer phase, one where China is increasingly used as a stage for Western political identity rather than a complex and diverse country to understand on its own terms. I think the honeymoon phase is over.

“Liu Sihan, Your School Uniform Ended Up in Angola”: China’s Second-Hand Clothing in Africa

A Chinese school uniform went viral after a Chinese social media user spotted it in Angola.

“Liu Sihan, your schooluniform is hot in Africa” (刘思涵你的校服在非洲火了) is a sentence that unexpectedly trended after a Chinese blogger named Xiao Le (小乐) shared a video of a schoolkid in Angola wearing a Chinese second-hand uniform from Qingdao Xushuilu Primary School, that had the nametag Liu Sihan on it.

The topic sparked discussions about what actually happens to clothing after it’s donated, and many people were surprised to learn how widely Chinese discarded clothing circulates in parts of Africa.

Liu Sihan’s mother, whose daughter is now a 9th grader in Qingdao, had previously donated the uniform to a community clothing donation box (社区旧衣回收箱) after Liu outgrew it. She intended it to help someone in need, never imagining it to travel all the way to Africa.

In light of this story, one netizen shared a video showing a local African market selling all kinds of Chinese school items, including backpacks, and people wearing clothing once belonging to workers for Chinese delivery platforms. “In Africa, you can see school uniforms from all parts of China, and even Meituan and Eleme outfits,” one blogger wrote.

When it comes to second-hand clothing trade, we know much more about Europe–Africa and US–Africa flows than about Chinese exports, and it seems there haven’t been many studies on this specific topic yet. Still, alongside China’s rapid economic transformations, the rise of fast fashion, and the fact that China is the world’s largest producer and consumer of textiles, the country now has an enormous abundance of second-hand clothing.

According to a 2023 study by Wu et al. (link), China still has a long way to go in sustainable clothing disposal. Around 40% of Chinese consumers either keep unwanted clothes at home or throw them away.

But there may be a shift underway. Donation options are expanding quickly, from government bins to brand programs, and from second-hand stores to online platforms that offer at-home pickup.

Chinese social media users posting images of school/work uniforms from China worn by Africans.

As awareness grows around the benefits of donating clothing (reducing waste, supporting sustainability, and the emotional satisfaction of giving), donation rates may rise significantly. The story of Liu Sihan’s uniform, which many found amusing, might even encourage more people to donate. And if that happens, scenes of African children (and adults) wearing Chinese-donated clothes may become much more common than they now are.

Laojunshan: New Hotspot in Cold Winter

Images from Xiaohongshu, 背包里的星子, 旅行定制师小漾

Go to Zibo for BBQ, go to Tianshui for malatang, go to Harbin for the Ice Festival, cycle to Kaifeng for soup dumplings, or head to Dunhuang to ride a camel — over recent years, a number of Chinese domestic destinations have turned into viral hotspots, boosted by online marketing initiatives and Xiaohongshu influencers.

This year, Laojunshan is among the places climbing the trending lists as a must-visit spot for its spectacular snow-covered landscapes that remind many of classical Chinese paintings. Laojunshan (老君山), a scenic mountain in Henan Province, is attracting more domestic tourists for winter excursions.

Xiaohongshu is filled with travel tips: how to get there from Luoyang station (by bus), and the best times of day to catch the snow in perfect light (7–9 AM or around 6–6:30 PM).

With Laojunshan, we see a familiar pattern: local tourism bureaus, state media, and influencers collectively driving new waves of visitors to the area, bringing crucial revenue to local industries during what would otherwise be slower winter months.

WeChat New Features & Hong Kong Police on Douyin

🟦 WeChat has been gradually rolling out a new feature that allows users to recall a batch of messages all at once, which saves you the frantic effort of deleting each message individually after realizing you sent them to the wrong group (or just regret a late-night rant). Many users are welcoming the update, along with another feature that lets you delete a contact without wiping the entire chat history. This is useful for anyone who wants to preserve evidence of what happened before cutting ties.

🟦The Hong Kong Police Force recently celebrated its two-year anniversary on Douyin (the Chinese version of TikTok), having accumulated nearly 5 million followers during that time. To mark the occasion, they invited actor Simon Yam to record a commemorative video for their channel (@香港警察). The presence of the Hong Kong Police on the Chinese app — and the approachable, meme-friendly way they’ve chosen to engage with younger mainland audiences — is yet another signal of Hong Kong institutions’ strategic alignment with mainland China’s digital infrastructure, a shift that has been gradually taking place. The anniversary video proved popular on Douyin, attracting thousands of likes and comments.

Why Chinese Elite Rùn to Japan (by ChinaTalk)

Over the past week, Japan has been trending every single day on Chinese social media in light of escalating bilateral tensions after Japanese PM Takaichi made remarks about Taiwan that China views as a direct military threat. The diplomatic freeze is triggering all kinds of trends, from rising anti-Japanese sentiment online and a ban on Japanese seafood imports to Chinese authorities warning citizens not to travel to Japan.

You’d think Chinese people would want to be anywhere but Japan right now — but the reality is far more nuanced.

In a recent feature in ChinaTalk, Jordan Schneider interviewed Japanese journalist & researcher Takehiro Masutomo (舛友雄大) who has just published a book about Japan’s new Chinese diaspora, explaining what draws Chinese dissidents, intellectuals, billionaires, and middle-class families to Tokyo.

The book is titled Run Ri: 潤日 Following the Footsteps of Elite Chinese Escaping to Japan (only available in Japanese and Traditional Chinese for now). (The word Rùn 润/潤, by the way, is Chinese online slang and meme expresses the desire to escape the country.)

A very interesting read on how Chinese communities are settling in Japan, a place they see as freer than Hong Kong and safer than the U.S., and one they’re surprisingly optimistic about — even more so than the Japanese themselves.

Thanks for reading this Eye on Digital China Signals. For fast-moving trends and deeper dives, keep an eye on the upcoming newsletters.

And if you just so happen to be reading this without a subscription and appreciate my work, consider joining to receive future issues straight in your inbox.

A small housekeeping note:

This Eye on Digital China newsletter is co-published for subscribers on both Substack and the main site. If you’re registered on both platforms, you’ll receive duplicate emails — so if that bothers you, please pick your preferred platform and unsubscribe from the other.

Many thanks to Miranda Barnes for helping curate some of the topics in this edition.

— Manya

Spotted an error or want to add something? Comment below or email me.

First-time commenters require manual approval.

©2025 Eye on Digital China / What’s on Weibo. Do not reproduce without permission —

contact info@whatsonweibo.com.

China Brands, Marketing & Consumers

House of Wahaha: Zong Fuli Resigns

In the year following her father’s death, Zong Fuli dealt with controversy after controversy as the head of Chinese food & beverage giant Wahaha.

Published

5 months agoon

October 14, 2025

It’s a bit like a Succession-style corporate drama 🍿.

Over the past few years, we’ve covered stories surrounding Chinese beverage giant Wahaha (娃哈哈) several times — and with good reason.

Since the passing of its much-beloved founder Zong Qinghou (宗庆后) in March 2024, the company has been caught in waves of internal turmoil.

Some context: Wahaha is regarded as a patriotic brand in China — not only because it’s the country’s equivalent of Coca-Cola or PepsiCo (they even launched their own cola in 1998 called “Future Cola” 非常可乐, with the slogan “The future will be better” 未来会更好), but also because its iconic drinks are tied to the childhood memories of millions.

Future Cola by Wahaha via Wikipedia.

There’s also the famous 2006 story when Zong Qinghou refused a buyout offer from Danone. Although the details of that deal are complex, the rejection was widely seen as Zong’s defense of a Chinese brand against foreign takeover, contributing to his status as a national business hero.

After the death of Zong, his daughter Zong Fuli, also known as Kelly Zong (宗馥莉), took over.

🔹 But Zong Fuli soon faced controversy after controversy, including revelations that Wahaha had outsourced production of some bottled water lines to cheaper contractors (link).

🔹 There was also a high-profile family inheritance dispute involving three illegitimate children of Zong Qinghou, now living in the US, who sued Zong Fuli in Hong Kong courts, claiming they were each entitled to multi-million-dollar trust funds and assets.

🔹 More legal trouble arrived when regulators and other shareholders objected to Zong Fuli using the “Wahaha” mark through subsidiaries and for new products outside officially approved channels (the company has 46% state ownership).

⚡️ The trending news of the moment is that Zong Fuli has officially resigned from all positions at Wahaha Group as chairman, legal representative, and director. She reportedly resigned on September 12, after which she started her own brand named “Wa Xiao Zong” (娃小宗). One related hashtag received over 320 million views on Weibo (#宗馥莉已经辞职#). Wahaha’s board confirmed the move on October 10, appointing Xu Simin (许思敏) as the new General Manager. Zong remains Wahaha’s second-largest shareholder.

🔹 To complicate matters further, Zong’s uncle, Zong Wei (宗伟), has now launched a rival brand — Hu Xiao Wa (沪小娃) — with product lines and distribution networks nearly identical to Wahaha’s.

As explained by Weibo blogger Tusiji (兔撕鸡大老爷), under Zong Qinghou, Wahaha relied on a family-run “feudal” system with various family-controlled factories. Zong Fuli allegedly tried to dismantle this system to centralize power, fracturing the Wahaha brand and angering both relatives and state investors.

Others also claim that Zong had already been engaged in a major “De-Wahaha-ization” (去娃哈哈化) campaign long before her resignation.

In August of this year, Zong gave an exclusive interview to Caijing (财经) magazine where she addressed leadership challenges and public controversies. In the interview, Zong spoke more about her views on running Wahaha, advocating long-term strategic growth over short-term results, and sharing her determination to not let controversy distract her from business operations. That plan seems to have failed.

While Chinese netizens are watching this family brand war unfold, many are rooting for Zong after everything she has gone through – they feel her father left her in a complicated mess after his death.

At the same time, others believe she tried to run Wahaha in a modern “Western” way and blame her for that.

For the brand image of Wahaha, the whole ordeal is a huge blow. Many people are now vowing not to buy the brand again.

As for Zong’s new brand, we’ll have to wait for the next episode in this family company drama to see how it unfolds.

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Eye on Digital China is a reader-supported publication by

Manya Koetse (@manyapan) and powered by What’s on Weibo.

It offers independent analysis of China’s online culture, media, and social trends.

To receive the newsletter and support this work, consider

becoming a paid subscriber.

Get in touch

Have a tip, story lead, or book recommendation? Interested in contributing? For ideas, suggestions, or just a quick hello, reach out here.

Spring Festival Trend Watch: Gala Highlights, Small-City Travel, and the Mazu Ritual Controversy

Inside Chunwan 2026: China’s Spring Festival Gala

The Fake Patients of Xiangyang: Hospital Scandal Shakes Welfare System Trust

China Trend Watch: Takaichi’s Win, Olympic Tensions, and “Tapping Out”

Spending the Day in China’s Wartime Capital

From a Hospital in Crisis to Chaotic Pig Feasts

Trump, Taiwan & The Three-Body Problem: How Chinese Social Media Frames the US Strike on Venezuela

Hong Kong Fire Updates, Nantong’s Viral Moment & Japanese Concert Cancellations

Chinamaxxing and the “Kill Line”: Why Two Viral Trends Took Off in the US and China

China’s 2025 Year in Review in 12 Phrases

Popular Reads

-

Chapter Dive8 months ago

Chapter Dive8 months agoHidden Cameras and Taboo Topics: The Many Layers of the “Nanjing Sister Hong” Scandal

-

Chapter Dive10 months ago

Chapter Dive10 months agoUnderstanding the Dr. Xiao Medical Scandal

-

China Insight7 months ago

China Insight7 months ago“Jiangyou Bullying Incident”: From Online Outrage to Offline Protest

-

Chapter Dive10 months ago

Chapter Dive10 months agoChina Is Not Censoring Its Social Media to Please the West