China Brands, Marketing & Consumers

The Price is Not Right: Corn Controversy Takes over Chinese Social Media

It’s corn! The “6 yuan corn” debate just keeps going.

Published

3 years agoon

Recently there have been fierce discussions on Chinese social media about the price of corn after e-commerce platform Oriental Selection (东方甄选) started selling ears of corn for 6 yuan ($0.80) per piece.

The controversy caught the public’s attention when the famous Kuaishou livestreamer Simba (辛巴, real name Xin Youzhi), who has labeled himself as a ‘farmer’s son,’ criticized Oriental Selection for their corn prices.

Founded in 2021, Oriental Selection is an agricultural products e-commerce platform under New Oriental Online. In its company mission statement, Oriental Selection says its intention is to “help farmers” by providing the channels to sell their high-quality agricultural goods to online consumers.

Simba suggested that Oriental Selection was being deceitful by promising to help farmers while selling their corn for a relatively high price. According to Simba, they were just scamming ordinary people by selling an ear of corn that is worth 0.70 yuan ($0.10) for 6 yuan ($0.80), and also not really helping the farmers while taking 40% of their profits.

‘Sales king’ Xin Youzhi, aka Simba, was the one who started the current corn controversy.

During one of the following livestreams, Oriental Selection’s host Dong Yuhui (董宇辉) – who also happens to be a farmer’s son – responded to the remarks and said there was a valid reason for their corn to be priced “on the high side.” Simba was talking about corn in general, including the kind being fed to animals, while this is high-quality corn that is already worth 2 yuan ($0.30) the moment it is harvested.

Despite the explanation, the issue only triggered more discussions on the right price for corn and about the fuzzy structure of the agricultural e-commerce livestreaming business.

Is it really too expensive to sell corn for 6 yuan via livestreaming?

The corn supplier, the Chinese ‘Northeast Peasant Madame’ brand (东北农嫂), is actually selling their own product for 3.6 yuan ($0.50) – is that an honest price? What amount of that price actually goes to the farmers themselves?

‘Northeast Peasant Madame’ brand (东北农嫂).

One person responding to this issue via her Tiktok channel is the young farmer Liu Meina (刘美娜), who explained that Simba’s suggested “0.70 yuan per corn” was simply unrealistic, saying since it does not take the entire production process into account, including maintenance, packaging, transportation, and delivery.

Another factor mentioned by netizens is the entertainment value added to e-commerce by livestreaming channels. Earlier this year, Oriental Selection’s host Dong Yuhui and his colleagues became an online hit for adding an educational component to their livestreaming sessions.

These hosts were actually previously teachers at New Oriental. Facing a crackdown on China’s after-school tutoring, the company ventured into different business industries and let these former teachers go online to sell anything from peaches to shrimp via livestreaming, teaching some English while doing so (read more here). So this additional value of livestream hosts entertaining and educating their viewers should also be taken into account when debating the price of corn. Some call it “Dong Yuhui Premium” (“董宇辉溢价”).

Dong Yuhui (董宇辉) is one of the livestreamers that have turned New Oriental’s e-commerce into a viral hit.

In light of all the online discussions and controversy, netizens discovered that Oriental Selection is currently no longer selling corn (#东方甄选回应下架玉米#), which also became a trending topic on Weibo on September 29.

But the corn controversy does not end here. On September 28, Chinese netizens discovered that corn by the ‘Northeast Peasant Madame’ brand (东北农嫂) was being sold for no less than 8.5 yuan ($1.2) at the Pangdonglai supermarket chain (胖东来), going well beyond the price of Oriental Selection.

Trying to avoid a marketing crisis, the Pangdonglai chain quickly recalled its corn, stating there had been an issue with the supply price that led to its final store price becoming too high. That topic received over 160 million views on Weibo on Friday (#胖东来召回8.5元玉米#).

Behind all these online discussions are consumer frustrations about an untransparent market where the field of agricultural products has become more crowded and with more people taking a share, including retailers, e-commerce platforms, and livestreaming apps. Moreover, they often say they are “helping farmers” while they are actually just making money themselves.

One Weibo user commented: “Currently, ‘helping farmers’ is completely different from the original intention of ‘helping farmers.’ Right now, it’s not about helping farmers anymore, but about helping the companies who have made agricultural products their business.”

“I bought a corn at a street shop today for 4 yuan ($0.55),” one Weibo blogger wrote: “It was big, sweet, and juicy, the quality was good and it was tasty – and people are still making money off of it. So yes, 6 yuan for a corn is certainly too expensive.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our weekly newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2022 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

China ACG Culture

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

Labubu is not ‘Chinese’ at all—and at the same time, it is very much a product of present-day China.

Published

4 weeks agoon

June 8, 2025

Labubu – the hottest toy of 2025 – is making headlines everywhere these days. The little creature is all over TikTok, and from New York to Bangkok and Dubai, people are lining up for hours to get their hands on the popular keyring doll.

In the UK, the Labubu hype has gone so far that its maker temporarily pulled the toys from all of its stores for “safety reasons,” following reports of customers fighting over them. In the Netherlands, the sole store where fans can buy the toys also had to hire extra security to manage the crowds, and Chinese customs authorities have intensified their efforts to prevent the dolls from being smuggled out of the country.

While the Labubu craze had slightly cooled in China compared to its initial peak, the character remains hugely popular and surged back into the top trending charts with the launch of POP MART’s Labubu 3.0 series in late April 2025 (which instantly sold out).

Following the global popularity of the Chinese game Black Myth: Wukong, state media are citing Labubu as another example of a successful Chinese cultural export—calling it ‘a benchmark for China’s pop culture’ and viewing its success as a sign of the globalization of Chinese designer toys.

But how ‘Chinese’ is Labubu, really? Here’s a closer look at its cultural identity and the story behind the trend.

The Journey to Labubu

In the perhaps unlikely case you have never heard of Labubu, I’ll explain: it’s a keyring toy with a naughty and, frankly, somewhat bizarre face and gremlin-like appearance that comes in various colors and variations. It’s mainly loved by young (Gen Z) women, who like to hang the toys on their bags or just keep them as collectibles.

The figurine is based on a character created by renowned Hong Kong-born artist Kasing Lung (龍家昇/龙家升, born 1972), whose work is inspired by Nordic legends of elves.

Kasung Lung, image via Bangkok Post.

Lung’s story is quite inspirational, and very international.

As a child, Lung immigrated to the Netherlands with his parents. Struggling to learn Dutch, young Kasing was given plenty of picture books. The picture books weren’t just a way to connect with his new environment, it also sparked a lifelong love for illustration.

Among Kasing’s favorite books were Where the Wild Things Are by Maurice Sendak and those by Edward Gorey — all full of fantasy, with some scary elements and artistic quality.

Later, as his Dutch improved, Kasing became an avid reader and turned into a true bookworm. The many fantasy novels and legendary tales he devoured planted the seed for creating his own world of elves and mythical creatures.

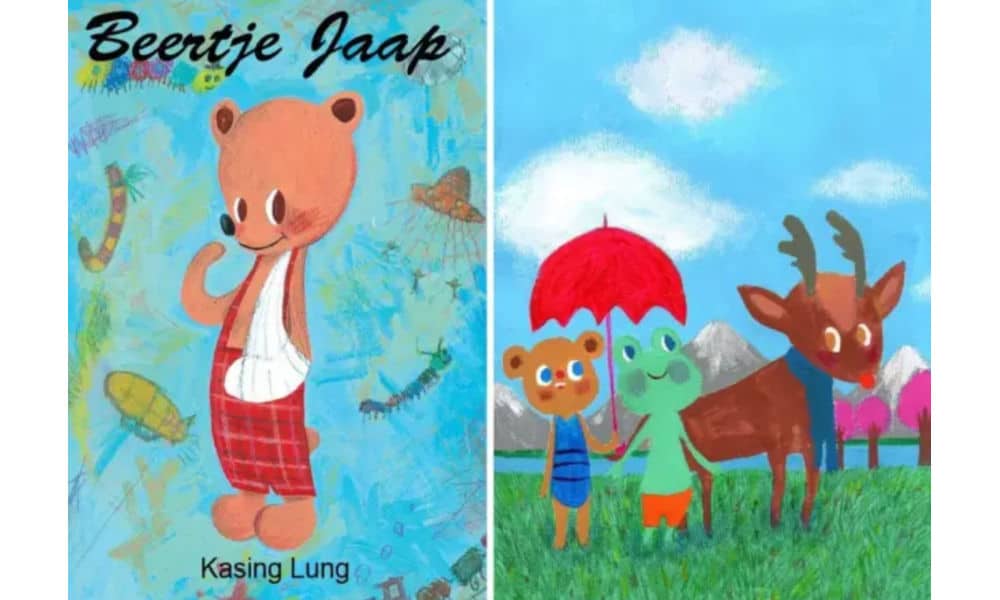

Kasing as a young boy on the right, and one of his children’s illustration books on the left.

After initially returning to Hong Kong in the 1990s, Lung later moved back to the Netherlands and eventually settled in Belgium.

Following a journey of many rejections and persistence, he began publishing his own illustrations and picture books for the European market.

Image via Sina.

In 2010, Hong Kong toy brand How2work’s Howard Lee reached out to Lung. One of How2work’s missions is cultivating creative talent and supporting the Hong Kong art scene. Lee invited Kasung to turn his illustrations into 3D, collectible figurines. Kasung, a collector of Playmobil figures since childhood, agreed to the collaboration for the sake of curiosity and creativity.

Lung’s partnership with How2work marked a transition to toy designer, although Lung also continued to stay active as an illustrator. Besides his own “Max is moe” (Max is tired) picture book, he also did illustrations for a series by renowned Belgian author Brigitte Minne (Lizzy leert zwemmen, Lizzy leert dansen).

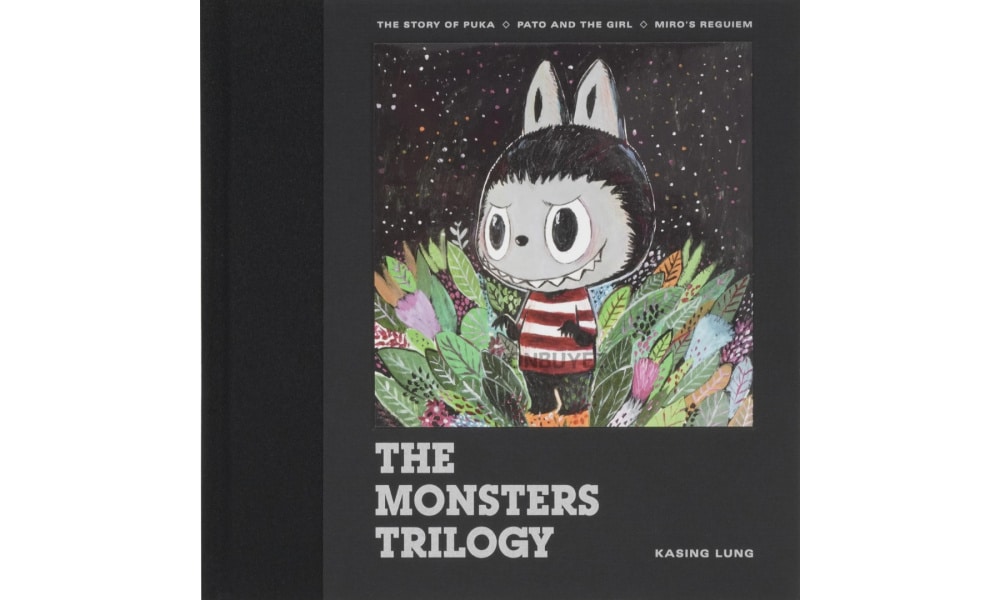

A few years later, Lung introduced what would become known as The Monsters Trilogy: a fantasy universe populated by elf-like creatures. Much like The Smurfs, the Monsters formed a tribe of distinct characters, each with their own personalities and traits, led by a tribal leader named Zimomo.

With its quirky appearance, sharp teeth, and mischievous grin, Labubu stood out as one of the long-eared elves.

When Labubu Met POPMART

Although the Labubu character has been around since 2015, it took some time to gain fame. It wasn’t until Labubu became part of POP MART’s (泡泡玛特) toy lineup in 2019 that it began reaching a mass audience.

POP MART is a Chinese company specializing in artsy toys, figurines, and trendy, pop culture-inspired goods. Founded in 2010 by a then college student, the brand launched with a mission to “light up passion and bring joy,” with a particular focus on young female consumers (15-30 age group) (Wang 2023).

One of POP MART’s most iconic art toy characters—and its first major commercial success—is Molly, designed by Hong Kong artist Kenny Wong in collaboration with How2work.

Prices vary depending on the toy, but small figurines start as low as 34 RMB (about US$5), while collectibles can go as high as 5,999 yuan (US$835). Resellers often charge significantly more.

Pop Mart and its first major commercial success: Molly (source).

POP MART is more than just a store, it’s an operational platform that covers the entire chain of trendy toys, from product development to retail and marketing (Liu 2025).

Within a decade of opening it first store in Beijing, POP MART experienced explosive growth, expanded globally, and was listed on the Hong Kong Stock Exchange.

The enormous success of POP MART has been the subject of countless marketing studies, drawing various conclusions about how the company managed to hit such a cultural and commercial sweet spot beyond its mere focus on female Gen Z consumers.

🎁 Gamifying consumption | One common conclusion about the success of POP MART, is that it offers more than just products—it offers an experience. At the heart of the brand is its signature blind box model, where customers purchase mystery boxes from specific product lines without knowing which item is inside. Those who are lucky enough will unpack a special ‘hidden edition.’ Originating in Japanese capsule toy culture, this element of surprise gamifies the shopping experience, makes it more shareable on social media, and fuels the desire to complete collections or hunt for rare figures through repeat purchases.

🌍 Creating a POP MART universe | Although POP MART has partnerships with major international brands such as Disney, Marvel, and Snoopy, it places a strong focus on developing its own intellectual property (IP) toys and figurines. In doing so, POP MART has created a universe of original characters, giving them a life beyond the store through things like collaborations, art shows and exhibitions, and even its own theme park in Beijing.

💖 Emotional consumption | What makes POP MART particularly irresistible to so many consumers is the emotional appeal of its toys and collectibles. It taps into nostalgia, cuteness, and aesthetic charm. The toys become companions, either as a desktop buddy or travel buddy. Much of the toys’ value lies in their role as social currency, driven by hype, emotional gratification, and a sense of social bonding and identity (Ge 2024).

The man behind POP MART and its strategy is founder and CEO Wang Ning (王宁), a former street dance champion (!) and passionate entrepreneur with a clear vision for the company. He consistently aims to discover the next iconic design, something that could actually rival Mickey Mouse or Hello Kitty.

In past interviews, Wang has discussed how consumer values are gradually shifting. The rise of niche toys into the mainstream, he says, reflects this transformation. Platforms like Douyin, China’s strong e-commerce infrastructure, and the digital era more broadly have all contributed to changing attitudes, where people are increasingly buying not for utility, but for the sake of happy moments.

While Wang Ning dreams of a more joyful world, he also knows how to make money (with a net worth of $20.3 billion USD, it was actually just announced that he’s Henan’s richest person now)—every new artist and toy design under POP MART is carefully researched and strategically evaluated before being signed.

Labubu’s journey before its POP MART partnership had already shown its appeal: Kasing Lung and How2Work had built a small but loyal fanbase pre-2019. But it was through the power of POP MART that Labubu really reached global fame.

Labubu: Most Wanted

Riding the wave of POP MART’s global expansion, Labubu became a breakout success, eventually evolving into a global phenomenon and cultural icon.

Now, celebrities around the world are flaunting their Labubus, further fueling the hype—from K-pop star Lisa Manobal to Thai Princess Sirivannavari and Barbadian singer Rihanna.

In China, one of the most-discussed topics on social media recently is the staggering resale price of the Labubu dolls.

Third edition of the beloved Labubu series titled “Big into energy” (Image via Pop Mart Hong Kong).

“The 99 yuan [$13.75] Labubu blind box is being hyped up to 2,600 yuan [$360]” (#99元Labubu隐藏款被炒至2600元#), Fengmian News recently reported.

Labubu collaborations and limited editions are even more expensive. Some, like the Labubu x Vans edition, originally retailed for 599 yuan ($83) and are now listed for as much as 14,800 yuan ($2,055).

Recently, Taiwanese singer and actor Jiro Wang (汪东城) posted a video venting his frustration over scalpers buying up all the Labubus and reselling them at outrageous prices. “It’s infuriating!” he said. “I can’t even buy one myself!” (#汪东城批Labubu黄牛是恶人#).

One Weibo hashtag asks: “Who is actually buying these expensive Labubus?” (#几千块的Labubu到底谁在买#).

Turns out—many people are.

Not only is Labubu adored and collected by millions, an entire subculture has emerged around the toy. Especially in China, where Labubu was famous before, the monster is now entering a new phase: playful customization. Fans are using the toy as a canvas to tell new stories and deepen their emotional connection, transforming Labubu from a collectible into a DIY project.

Labubu getting braces and net outfits – evolving from collectible to DIY project.

There’s a growing trend of dressing Labubu in designer couture or dynastic costumes (Taobao offers a wide array of outfits), but fans are going further—customizing flower headbands, adorning their dolls with tooth gems, or even giving them orthodontic braces for their famously crooked teeth (#labubu牙套#).

In online communities, some fans have gone as far as creating dedicated generative AI agents for Labubu, allowing others to generate images of the character in various outfits, environments, and scenarios.

Labubu AI by Mewpie.

It’s no longer just the POP MART universe—it’s the Labubu universe now.

“Culturally Odorless”

So, how ‘Chinese’ is Labubu really? Actually, Labubu is not ‘Chinese’ at all—and at the same time, it is very much a product of present-day China.

🌍 Not Chinese at all

Like other famous IP characters, from the Dutch Miffy to Japan’s Pikachu and Hello Kitty, Labubu is “culturally odorless,” a term used to refer to how cultural features of the country of invention are absent from the product itself.

The term was coined by Japanese scholar Koichi Iwabuchi to describe how Japanese media products—particularly in animation—are designed or marketed to minimize identifiable Japanese cultural traits. This erasure of “Japaneseness” helped anime (from Astro Boy to Super Mario and Pokémon) become a globally appealing and commercially successful cultural export, especially in post-WWII America and beyond.

Moreover, by avoiding culturally or nationally specific traits, these creations are placed in a kind of fantasy realm, detached from real-world identities. Somewhat ironically, it is precisely this neutrality that has made Japanese IPs so distinctively recognizable as “Japanese” (Du 2019, 15).

Many Labubu fans probably also don’t see the toy as “Chinese” at all—there are no obvious cultural references in its design. Its style and fantasy feel are arguably closer to Japanese anime than anything tied to Chinese identity.

When a Weibo blogger recently argued that Labubu’s international rise represents a more powerful example of soft power than DeepSeek, one popular reply asked: “But what’s Chinese about it?”

🇨🇳 Actually very Chinese

Yet, Labubu is undeniably a product of today’s China—not necessarily because of Kasing Lung (Hong Kong/Dutch/Belgian) or How2work (Hong Kong), but because of the Beijing-based POP MART.

Wang Ning’s POP MART is a true product of its time, inspired by and aligned with China’s new wave of digital startups. From Bytedance to Xiaohongshu and Bilibili, many of China’s most innovative companies move beyond horizontal product offerings or traditional service goals. Instead, they think vertically and break out of the box—evolving into entire ecosystems of their own. (Fun fact: the entrepreneurs behind these companies were all born in the 1980s, between 1983 and 1989).

In that sense, state media like People’s Daily calling Labubu “a benchmark of China’s pop culture” isn’t off the mark.

Still, some marketing critics argue there’s room for more ‘Chineseness’ in Labubu and POP MART’s brand-building strategies—particularly through collections inspired by Chinese heritage, which could further promote national culture on the global stage (Wang 2023).

Meanwhile, Chinese official channels have already begun positioning Labubu as a cultural ambassador. In the summer of 2024, a life-sized Labubu doll embarked on a four-day tour of Thailand to celebrate the 50th anniversary of China–Thailand diplomatic relations.

The life-sized mascot of a popular Chinese toy character, Labubu, visited Bangkok landmarks and was named “Amazing Thailand Experience Explorer” to boost Chinese tourism. Photo Credit: Facebook/Pop Mart, via TrvelWeekly Asia.

In the future, Labubu, just like Hello Kitty in Japan, is likely to become the face of more campaigns promoting tourism and cross-cultural exchange.

Whatever happens next, it’s undeniable that Labubu stands at the forefront of a breakthrough moment for Chinese designer toys in the global market, and, from that position, serves as a unique ambassador for a new wave of Chinese creative exports that resonate with international audiences.

For now, most Labubu fans, however, don’t care about all of that – they are still on the hunt for the next little monster, and that’s enough to keep the Labubu hype burning.🔥

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

References (other sources included in hyperlinks)

• Du, Daisy Yan. 2019. Animated Encounters: Transnational Movements of Chinese Animation, 1940-1970s. Honolulu: University of Hawaii Press.

• Ge, Tongyu. 2024. “The Role of Emotional Value of Goods in Guiding Consumer Behaviour: A Case Study Based on Pop Mart.” Proceedings of the 5th International Conference on Education Innovation and Philosophical Inquiries. DOI: 10.54254/2753-7048/54/20241623.

• Liu, Enyong. 2025. “Analysis of Marketing Strategies of POP MART,” Proceedings of the 3rd International Conference on Financial Technology and Business Analysis DOI: 10.54254/2754-1169/149/2024.

• Wang, Zitao. 2023. “A Case Study of POP MART Marketing Strategy.” Proceedings of the 2023 International Conference on Management Research and Economic Development. DOI: 10.54254/2754-1169/20/

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Brands, Marketing & Consumers

Guming’s 1 Yuan Ice Water: China’s Coolest Summer Trend

Published

1 month agoon

May 22, 2025

🔥 Quick Take: Trending in China

This is a brief update from our curated roundup of what’s trending in China this week. A version of this story also appears in the Weibo Watch newsletter. Subscribe to stay in the loop.

Over the past decade, China’s milk tea industry has become something of a cultural phenomenon. The market has gone well beyond milk tea or bubble tea alone, and is now about any tea-based drink — hot or cold — and the marketing ideas that come with it, from trendy snacks to collectible wannahaves.

This time, it’s the Chinese teashop brand Guming (古茗) that has managed to become an online hit again. Not because of creative collabs or artsy tea cups — the reason is surprisingly plain: selling a cup of ice and water for 1 yuan ($0.15).

How come Guming’s “one cup of iced water” (一杯冰水) has become a hit among Chinese teashop goers? One reason is that it’s something people often want yet hesitate to ask for. Now that it’s actually on the menu (medium cup, regular ice, no sugar), people can just order it for 1 RMB — cheaper than a bottle of water from the supermarket — and it’s become a major hit, like a little ‘luxury’ everyone can afford.

People love getting a cup of ice water (more ice than water) to cool down in hot weather, add it to their lemon tea or iced coffee, or store it in the freezer at home or work for their DIY drinks. Add instant coffee and you’ve got your own iced Americano. Others throw in a tea bag for a refreshing iced tea.

Some say it’s the perfect product for lazy people who don’t make their own ice cubes or who like convenience on the go.

Besides the iced water, Guming has also added a simple lemon water (鲜活柠檬水) to its menu for 2.5 yuan ($0.35). Perfect to quench thirst on a hot summer’s day, one Xiaohongshu user called it Guming’s “secret weapon” (大杀器) in China’s (milk) tea shop market.

Compared to relatively low-priced tea beverage competitors like Mixue Ice Cream & Tea (蜜雪冰城), which sells lemon water for 4 yuan ($0.56), Guming offers great value for money (although it should be noted that Guming, unlike Mixue, doesn’t use real lemon slices but diluted lemon juice).

People are loving these simple and affordable pleasures.

Just last month, Guming shot to the top of Weibo’s trending lists when it launched its new collaboration with the Chinese anime-style game Honkai: Star Rail (崩坏:星穹铁道), featuring a range of collectible tea cups, bags, and other accessories.

Guming was founded in 2010 in Zhejiang and has become one of China’s largest custom beverage chains alongside Mixue and Luckin. Competition is fierce — but at least Guming has its iced water as a secret weapon for this summer.

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Jiehun Huazhai (结婚化债): Getting Married to Pay Off Debts

Yearnings, Dreamcore, and the Rise of AI Nostalgia in China

Beauty Influencer Du Meizhu Accused of Scamming Fan Out of $27K

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

Lured with “Free Trip”: 8 Taiwanese Tourists Trafficked to Myanmar Scam Centers

China Is Not Censoring Its Social Media to Please the West

IShowSpeed in China: Streaming China’s Stories Well

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

China Reacts: 3 Trending Hashtags Shaping the Tariff War Narrative

China Trending Week 15/16: Gu Ming Viral Collab, Maozi & Meigui Fallout, Datong Post-Engagement Rape Case

Chinese New Nickname for Trump Mixes Fairy Tales with Tariff War

Strange Encounter During IShowSpeed’s Chengdu Livestream

No Quiet Qingming: From High-Tech Tomb-Sweeping to IShowSpeed & the Seven China Streams

Understanding the Dr. Xiao Medical Scandal

From Trade Crisis to Patriotic Push: Chinese Online Reactions to Trump’s Tariffs

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Media12 months ago

China Media12 months agoA Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

-

China Memes & Viral12 months ago

China Memes & Viral12 months agoThe “City bu City” (City不City) Meme Takes Chinese Internet by Storm

-

China Society9 months ago

China Society9 months agoDeath of Chinese Female Motorcycle Influencer ‘Shigao ProMax’ Sparks Debate on Risky Rides for Online Attention

-

China World11 months ago

China World11 months agoChina at Paris 2024 Olympics Trend File: Medals and Moments on Chinese Social Media