China Arts & Entertainment

Overview of China’s 2016 Top TV Dramas

These are the 10 most popular TV dramas in mainland China in 2016.

Published

9 years agoon

The titles of Chinese TV dramas consistently pop up in the daily top trending lists of Sina Weibo. After featuring an overview of the most-watched Chinese TV dramas in 2015, What’s on Weibo has now compiled a list of 10 popular TV dramas in mainland China in 2016. These are the most-watched and most-discussed dramas according to Weibo and Baidu charts of March 2016.

Update: Also Read Our Top 10 of China’s 2017 Top TV Dramas Now!

(Note: Depending on where you live, the websites where these series are listed might have geo restrictions. You can circumvent this with a VPN to change your IP geo-location. We recommend NordVPN for this, as it is known for its fast streaming of online video content online.)

#1 Descendents of the Sun (太阳的后裔/태양의 후예)

War & Romance Drama / 2016 South Korea

Aired since February 24 2016 / KBS2 / 16 episodes

Directed by Li Yingfu / Lee Eung-Bok (李应福)

The number one of this list is the only drama out of these ten that was not produced in mainland China; it was made in South Korea, and it is a huge success both in Korea as in the PRC.

‘Descendents of the Sun’ tells the story of the unlikely romance between special forces captain Shi-Jin (Song Joong-Ki) and surgeon Mo-Yeon (Song Hye-Kyo). After their initial love-at-first-sight encounter, Shi-Jin and Mo-Yeon soon discover they have very different outlooks on life.

While out on a military mission, Shi-Jin has to fight and hurt people in order to protect his people, whereas Mo-Yeon does all she can to keep people alive – no matter what ethnicity, religion or culture they have. But despite their strong differences, Shi-Jin and Mo-Yeon cannot let go of each other.

A large part of this drama was filmed in Greece. The series can be viewed on Viki.

#2 The Imperial Doctress (明代女医师)

Costume Drama / 2016 Mainland China

Aired since February 16 2016 / Online Drama / 50 episodes

Directed by Li Guoli (李国立), Zheng Weiwen (郑伟文) & Lu Zeliang (卢泽良)

‘The Imperial Doctress’, also known as ‘Ming Medicine Woman’, brings the most famous female doctor of the Ming Dynasty to the TV screen. Tan Yunxian (谈允贤) lived in the Ming Dynasty from 1461-1554, and was a female physician in a time when Confucian ethics played a crucial role in everyday life and women had a low status in society.

The costume drama tells the story of the Tans, a family that has the doctor profession in its bloodline – even its past ancestors were imperial doctors. But when the family is set up by a grudgeful enemy, the royal court no longer allows them to practice medicine. Young daughter Tan Yunxian, played by Liu Shi Shi (刘诗诗, a.k.a. Cecelia Liu) secretly learns the art of medicine from her grandmother and helps to cure plagues and illnesses among the common people. The drama follows her as she grows up and struggles with her pursuit to become the doctor she wants to be. Emperor Zhu Qi Zhen (actor Wallace Huo) comes to play an important role in fulfilling her destiny (Viki 2016).

#3 Legend of the Qing Qiu Fox (青丘狐传说)

Costume & Fantasy Drama / 2016 Mainland China

Aired Since February 8, 2016 / Hunan TV / 40 episodes

Directed by Lin Yufen (林玉芬), Gao Linbao (高林豹) and Xu Huikang (徐惠康)

‘The Legend of the Qing Qiu Fox’ aka ‘The Legend of the Nine Tails Fox’ is a drama that consists of different supernatural stories and folktales about fox spirits and ghosts, based on work by Pu Songling.

Pu Songling was a Qing dynasty writer. His most famous work is the classical Chinese Liaozhai Zhiyi (Strange Tales from a Make-do Studio), a collection of stories about ghosts, spirits, and other extraordinary phenomena.

The drama can be watched through Viki.

#4 Far Away Love (远得要命的爱情)

Urban & Family Drama / 2016 Mainland China

First aired March 1 / 36 episodes

Directed by Niu Le (牛乐) and Zhu Shimao (朱时茂)

‘Far Away Love’ tells the story of the romance between Shen An (沈岸, played by Korean actor Park Haejin) and Meng Chuxia (孟初夏, played by Li Fei’er).

Meng Chuxia is a kind-hearted and optimistic single 28-year-old ‘shengnu’ (‘leftover woman’) who takes care of the son of her long lost sister. Shen An is a businessman who has returned to China from overseas to start a new company. When Shen An and Meng Chuxia meet, they are both not expecting to find love. Shen An is engaged to be married and Meng Chuxia is struggling to raise her teenage nephew. But despite their life situations, different (hidden) pasts and prejudices, you can probably guess what happens..

AsiaStarz writes that this drama was already produced in 2013, but was only aired now due to the strict Chinese TV censorship policies.

This drama is popular in both China and Korea because of the lead played by Park Haejin, who is very popular in South Korea and mainland China. The actor also stars in the Korean television series “Cheese in the Trap,” which is also extremely popular in China. The series were sold to Chinese video platforms Youku and Tudou for $125,000 per episode – the highest price ever paid for a Korean cable drama according to the Korea Herald.

#5 Because of Love (因为爱情有幸福)

Love & Family Drama / 2016 Mainland China

First aired February 24 / Hunan TV (湖南卫视) / 70 episodes

Directed by Liu Junjie (刘俊杰)

‘Because of Love’, also known as ‘The Love of Happiness’, revolves around Lu Xiaonan (by Tang Yixin aka Tina Tang), an independent and strong woman who has just married to Kevin (William Chan), who has returned to China from America. As the newlyweds form a new family, Kevin gets reconnected to his roots as he finds the family he lost when he was young. But the reconnection with his family does not bring the anticipated happiness as memories from the past resurface, making Xiaonan and Kevin having to face difficulties in their young marriage.

The first episode can be viewed here.

#6 The Three Heroes and Five Gallants (五鼠闹东京)

Costume Drama / 2016 Mainland China

First aired February 17, 2016 / Anhui TV / 42 episodes

Directed by Wu Jiatai (吴家骀)

Based on the work by the 19th century Chinese writer Shi Yukun, this drama tells the 11th century story of the loyal knights who supported the legendary judge Bao Zheng in his fight against crime and corruption.

The first episode can be viewed here.

#7 The Legend of Mi Yue (芈月传)

Costume and Historical Drama / 2015 Mainland China

First aired November 30, 2015 / Dongfang & Beijing TV / 81 episodes

Directed by Zheng Xiaolong (郑晓龙)

‘The Legend of Mi Yue’ tells the story of the first influential stateswoman of China, who lived over 2000 years ago. Just like the ‘Imperial Doctress‘, this drama also tells about the trials and tribulations of a strong female figure from China’s history.

Mi Yue, daughter of King Wei of Chu, was the first stateswoman in the history of China. The drama details her turbulent life, as Mi Yue becomes a concubine, gets separated her from first love Huang Xie, is banished, and eventually rises to power as the first Empress Dowager in China’s history (wiki). For more about Mi Yue, also read this article from the Women of China website.

The role of Mi Yue is played by renowned actress Sun Li (孙俪), who has previously won awards for best actress of China.

#8 The Lover’s Lies (爱人的谎言)

Love & Family Drama / 2016 Mainland China

First aired February 24, 2016 / LETV / 50 episodes

Directed by Yu Zhonghe (余中和) and Lin Hongjie (林宏杰)

When Tong Sijie (童四季) becomes an orphan at an early age, she struggles and has to work different jobs to take care of her siblings. Then she meets the rich Yiyi – a love that seems to written in the stars. Just when Sijie and Yiyi decide they want to stay together forever, Yiyi’s dominant mother interferes in their relationship, spreading lies that drift the two lovers apart.

Check out the opening tune and the first episode here.

#9 Nirvana in Fire (琅琊榜)

Costume & Historical Drama / 2015 Mainland China

First aired September 19th, 2015 / Beijing TV / 54 episodes

Directed by Kong Sheng (孔笙) and Li Xue (李雪)

‘Nirvana in Fire‘ takes place in fourth century China, during the war between the feudal Northern Wei and Southern Liang dynasties. The story revolves around Lin Shu, the 19-year-old only child of General Lin Xie who is fighting in this war and does all he can to seek justice for him and his family. The series is based on the work by author Hai Yan.

The drama has won several awards.

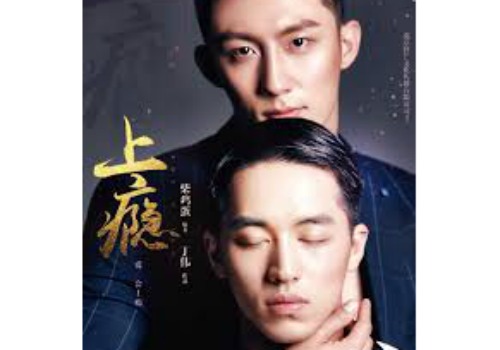

#10 Addiction (上瘾)

Gay Love Drama / 2016 Mainland China

First aired January 29th, 2016 / Beijing TV / 15 episodes

Directed by Ding Wei (丁伟)

This popular drama, that is also known under the English name of ‘Addicted’ or ‘Heroin’, is about the special bond that evolves between two young men Bai Luoyin (Xu Wei Zhou) and Gu Hai (Johnny Huang Jingyu). Bai, who lives with his father and grandmother, gets connected to Gu Hai when Bai’s mother remarries to Gu Hai’s father. Gu Hai harbors a deep grudge towards his father since his mother’s death, and the two men, both dealing with their family situations and personal conflicts, start to develop feelings for each other.

The show became big news in late February when media reported that the drama was taken offline by Chinese censors for showing “abnormal sexual relationships and behaviours”.

Although the drama was taken offline, it is still in the best-watched ranks.

– By Manya Koetse

Follow @WhatsOnWeibo

©2016 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

China ACG Culture

A Very Short Guide to China’s Most Popular Designer Toys

Published

4 hours agoon

July 6, 2025

In our last article, we’ve determined how Wakuku’s rise is not just about copying & following in Labubu’s footsteps and more about how China is setting the pace for global pop culture IPs. I now want to give you a small peek into the main characters in the field that are currently relevant.

Even if these dolls aren’t really your thing, you’ll inevitably run into them and everything happening around them.

Before diving into the top trending characters, a quick word on the challenges ahead for Labubu & co:

🚩 Bloomberg Opinion columnist Shuli Ren recently argued that Labubu’s biggest threat isn’t competition from Wakuku or knockoffs like “Lafufu,” but the fragility of its resale ecosystem — particularly how POP MART balances supply, scarcity, and reseller control.

Scarcity is part of what makes Labubu feel premium. But if too many dolls go to scalpers, it alienates real fans. If scalpers can’t profit, Labubu risks losing its luxury edge. Managing this dynamic may be POP MART’s greatest long-term challenge.

🚩 Chinese Gen Z consumers value authenticity — and that’s something money can’t manufacture. If China’s booming IP toy industry prioritizes speed and profit over soul, the hype may die out at a certain point.

🚩 The same goes for storytelling. Characters need a solid universe to grow in. Labubu had years to build out its fantasy universe. Cute alone isn’t enough — characterless toys don’t leave a lasting impression and don’t resonate with consumers.

Examples of popularity rankings of Chinese IP toys on Xiaohongshu.

With that in mind… let’s meet the main players.

On platforms like Xiaohongshu, Douyin, and Weibo, users regularly rank the hottest collectible IPs. Based on those rankings, here’s a quick who’s-who of China’s current trend toy universe:

1. Labubu (拉布布)

Brand: POP MART

Creator: Kasing Lung

Year launched: 2015 (independent), 2019 with POP MART.

The undisputed icon of China’s trend toy world, Labubu is a mischievous Nordic forest troll with big eyes, nine pointy teeth, and bunny ears. Its quirky, ugly-cute design, endless possibilities of DIY costume changes, and viral celebrity endorsements have made it a must-have collectible and a global pop culture phenomenon.

2. Wakuku (哇库库)

Brand & Creator: Letsvan, backed by QuantaSing Group

Year launched: 2024 with first blind box

Wakuku, a “tribal jungle hunter” with a cheeky grin and unibrow, is seen as the rising star in China’s trend toy market. Wakuku’s rapid rise is fueled by celebrity marketing, pop-up launches, and its strong appeal among Gen Z, especially considering Wakuku is more affordable than Labubu.

3. Molly (茉莉)

Brand: POP MART

Designer: Kenny Wong (王信明)

Year launched: 2006 (creator concept); POP MART 2014, first blind boxes in 2016

Molly is a classic trend toy IP, one of POP MART’s favorites, with a massive fanbase and long-lasting popularity. The character was allegedly inspired by a chance encounter with a determined young kid at a charity fundraiser event, after which Kenny Wong created Molly as a blue-eyed girl with short hair, a bit of a temperament, and an iconic pouting expression that never leaves her face.

4. SKULLPANDA (骷髅熊猫)

Brand: POP MART

Creator: Chinese designer Xiong Miao

Year launched: 2018 (creator concept); POP MART 2020

Skullpanda is one of POP MART’s flagship IPs —it’s a goth-inspired fantasy design. According to POP MART, SKULLPANDA journeys through different worlds, taking on various personas and living out myriad lives. On this grand adventure, it’s on a quest to find its truest self and break new ground all while contemplating the shape of infinity.

5. Baby Zoraa

Brand: TNT SPACE

Creator: Wang Zequn, CEO of TNT SPACE

Year launched: 2022, same year as company launch

Baby Zoraa is cute yet devlish fierce and is one of the most popular IPs under TNT SPACE. Baby Zoraa is the sister of Boy Rayan, another popular character under the same brand. Baby Zoraa’s first blind box edition reached #1 on Tmall’s trend toy sales charts and sold over 500,000 units.

6. Dora (大表姐)

Brand: TNT SPACE

Year Launched: 2023

Dora is a cool, rebellious “big sister” figure, instantly recognizable for her bold attitude and expressive style. She’s a Gen Z favorite for her gender-fluid, empowering persona, and became a breakout sucess under TNT when it launched its bigger blind boxes in 2023.

7. Twinkle Twinkle [Star Man] (星星人)

Brand: POP MART

Creator: Illustrators Daxin and Ali

Year launched: In 2024 with POP MART

This character has recently skyrocketed in popularity as a “healing star character” inspired by how stars shine even in darkness. POP MART markets this character as being full of innocence and fantasy to provide some relaxation in this modern society full of busyness and pressure.

8. Hirono (小野)

Brand: POP MART

Creator: Lang

Year launched: In 2024 with POP MART

This freckled, perpetually grumpy boy has a wild spirit combining introversion and playful defiance. Hirono highlights the subtle fluctuations of life, its ups and downs, incorporating joy, sadness, fear, and more – a personification of profound human emotions.

9. Crybaby (哭娃)

Brand: POP MART

Creator: Thai artist Molly Yllom (aka Nisa “Mod” Srikamdee)

Year launched: 2017 (creator concept), 2023 POP MART launch

Like Wakuku, Crybaby suddenly went from a niche IP to a new hot trend toy in 2025. Together with Wakuku, it is called the “next Labubu.” Thai artist Molly Yllom created the character after the loss of her beloved dog. Crybaby is a symbol of emotional expression, particularly the idea that it’s okay to cry and express feelings.

10. Pouka Pouka (波卡波卡)

Brand: 52TOYS

Creator: Ma Xiaoben

Year launched: 2025

With its round, chubby face, squirrel cheeks, playful smile, and soft, comforting appearance, Pouka Pouka aims to evoke feelings of warmth, healing, and emotional comfort.

Other characters to watch: CiciLu, Panda Roll (胖哒幼), NANCI (囡茜), FARMER BOB (农夫鲍勃), Rayan, Ozai (哦崽), Lulu the Piggy (LuLu猪), Pucky (毕奇).

We’re still working on this list!

By Manya Koetse

(follow on X, LinkedIn, or Instagram)

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China ACG Culture

The Next Labubu: What the Rise of Wakuku Tells Us About China’s Collectible Toy Wave

From ugly-cute rebellion to a new kind of ‘C-pop,’ the breakout success of Wakuku sheds light on Chinese consumer culture and the forces driving China’s trend toy industry.

Published

6 hours agoon

July 6, 2025

Wakuku is the most talked-about newcomer in China’s trend toy market. Besides its mischievous grin, what’s perhaps most noteworthy is how closely Wakuku follows the marketing success of Labubu. As the strongest new designer toy of 2025, Wakuku says a lot about China’s current creative economy — from youth-led consumer trends to hybrid business models.

As it is becoming increasingly clear that Chinese designer toy Labubu has basically conquered the world, it’s already time for the next made-in-China collectible toy to start trending on Chinese social media.

Now, the name that’s trending is Wakuku, a Chinese trend toy created by the Shenzhen-based company Letsvan.

In March 2025, a new panda-inspired Wakuku debuted at Miniso Land in Beijing, immediately breaking records and boosting overall store revenue by over 90%. Wakuku also broke daily sales records on May 17 with the launch of its “Fox-and-Bunny” collab at Miniso flagship stores in Shanghai and Nanjing. At the opening of the Miniso Space in Nanjing on June 18, another Wakuku figure sold out within just two hours. Over the past week, Wakuku went trending on Chinese social media multiple times.

From left to right: the March, May, and June successful Wakuku series/figurines

Like Labubu, Wakuku is a collectible keychain doll with a soft vinyl face and a plush body. These designer toys are especially popular among Chinese Gen Z female consumers, who use them as fashion accessories (hanging them from bags) or as desk companions.

We previously wrote in depth about the birth of Labubu, its launch by the Chinese POP MART (founded 2010), and the recipe for its global popularity in this article, so if you’re new to this trend of Chinese designer toys, you’ll want to check it out first (link).

Labubu has been making international headlines for months now, with the hype reaching a new peak when a human-sized Labubu sold for a record 1.08 million RMB (US$150,700), followed by a special edition that was purchased for nearly 760,000 RMB (US$106,000).

Now, Wakuku is the new kid on the block, and while it took Labubu nine years to win over young Chinese consumers, it barely took Wakuku a year — the character was created in 2022–2023, made its retail debut in 2024, and went viral within months.

Its pricing is affordable (59–159 RMB, around $8.2-$22) and some netizens argue it’s more quality for money.

While Labubu is a Nordic forest elf, Wakuku is a tribal jungle warrior. It comes in various designs and colors depending on the series and is sold in blind boxes (盲盒), meaning buyers don’t know exactly which design they’re getting — which adds an element of surprise.

➡️ There’s a lot to say about Wakuku, but perhaps the most noteworthy aspect is how closely it mirrors the trajectory of POP MART’s Labubu.

Wakuku’s recent success in China highlights the growing appeal and rapid rise of Chinese IPs (beyond its legal “intellectual property” meaning, ‘IPs’ is used to refer to unique cultural brands, characters, or stories that can be developed into collectibles, merchandise, and broader pop culture phenomena).

Although many critics predict that the Labubu trend will blow over soon, the popularity of Wakuku and other Labubu-like newcomers shows that these toys are not just a fleeting craze, but a cultural phenomenon that reflects the mindset of young Chinese consumers, China’s cross-industry business dynamics, and the global rise of a new kind of ‘C-pop.’

Wakuku: A Cheeky Jungle Copycat

When I say that Wakuku follows POP MART’s path almost exactly, I’m not exaggerating. Wakuku may be portrayed as a wild jungle child, but it’s definitely also a copycat.

It uses the same materials as Labubu (soft vinyl + plush), the name follows the same ABB format (Labubu, Wakuku, and the panda-themed Wakuku Pangdada), and the character story is built on a similar fantasy universe.

In fact, Letsvan’s very existence is tied to POP MART’s rise — the company was only founded in 2020, the same year POP MART, then already a decade old, went public on the Hong Kong Stock Exchange and became a dominant industry force.

In terms of marketing, Wakuku imitates POP MART’s strategy: blind boxes, well-timed viral drops, limited-edition tactics, and immersive retail environments.

It even follows a similar international expansion model as POP MART, turning Thailand into its first stop (出海首站) — not just because of its cultural proximity and flourishing Gen Z social media market, but also because Thailand was one of the first and most successful foreign markets for Labubu.

Its success is also deeply linked to celebrity endorsement. Just as Labubu gained global traction with icons like BLACKPINK’s Lisa and Rihanna seen holding the doll, Wakuku too leans heavily on celebrity visibility and entertainment culture.

Like Labubu, Wakuku even launched its own Wakuku theme song.

Since 2024, Letsvan has partnered with Yuehua Entertainment (乐华娱乐) — one of China’s leading talent agencies — to tap into its entertainment resources and celebrity network, powering the Wakuku marketing engine. Since stars like Esther Yu (虞书欣) were spotted wearing Wakuku as a jeans hanger, demand for the doll skyrocketed. Yuehua’s founder, Du Hua (杜华), even gifted a Wakuku to David Beckham as part of its celebrity strategy.

From Beckham to Esther Yu; celebrity endorsements play a big role in the viral marketing of Wakuku.

But what’s most important in Wakuku’s success — and how it builds on Labubu — is that it fully embraces the ugly-cute (丑萌 chǒu méng) aesthetic. Wakuku has a mischievous smile, expressive eyes, a slightly crooked face, a unibrow, and freckles — fitting perfectly with what many young Chinese consumers love: expressive, anti-perfectionist characters (反精致).

“Ugly-Cute” as an Aesthetic Rebellion

Letsvan is clearly riding the wave of “ugly trend toys” (丑萌潮玩) that POP MART spent years cultivating.

🔍 Why are Chinese youth so obsessed with things that look quirky or ugly?

A recent article by the Beijing Science Center (北京科学中心) highlights how “ugly-cute” toys like Labubu and Wakuku deviate from traditional Chinese aesthetics, and reflect a deeper generational pushback against perfection and societal expectations.

The pressure young people face — in education, at work, from family expectations, and information overload — is a red thread running through how China’s Gen Z behaves as a social media user and consumer (also see the last newsletter on nostalgia core).

To cope with daily stress, many turn to softer forms of resistance, such as the “lying flat” movement or the sluggish “rat lifestyle” in which people reject societal pressures to succeed, choosing instead to do the bare minimum and live simply.

This generational pushback also extends to traditional norms around marriage, gender roles, and ideals of beauty. Designer toys like Labubu and Wakuku are quirky, asymmetrical, gender-fluid, rebellious, and reflect a broader cultural shift: a playful rejection of conformity and a celebration of personal expression, authenticity, and self-acceptance.

Another popular designer toy is Crybaby, designed by Thai designer Molly, and described as follows: “Crybaby is not a boy or a girl, it is not even just human, it represents an emotion that comes from deep within. It can be anything and everything! Laughter isn’t the only way to make you feel better, crying can be healing too. If one day, a smile can’t alleviate your problems, baby, let’s cry together.”

But this isn’t just about rejecting tradition. It’s also about seeking happiness, comfort, and surprise: emotional value. And it’s usually not brand-focused but influencer-led. What matters is the story around it and who recommends it (unless the brand becomes the influencer itself — which is what’s ultimately happening with POP MART).

One of the unofficial ambassadors of the chǒu méng ugly-cute trend is Quan Hongchan (全红婵), the teenage diving champion and Olympic gold medallist from Guangdong. Quan is beloved not just for her talent, but also for her playful, down-to-earth personality.

During the Paris Olympics, she went viral for her backpack, which was overflowing with stuffed animals (some joked she was “carrying a zoo on her back”) — and for her animal-themed slippers, including a pair of ugly fish ones.

Quan Hongchan with her Wakuku, and her backpack and slippers during her Paris Olympics days.

It’s no surprise that Quan Hongchan is now also among the celebrities boosting the popularity of the quirky Wakuku.

From Factory to Fandom: A New Kind of “C-pop” in the Making

The success of Wakuku and other similar toys shows that they’re much more than Labubu 2.0; they’re all part of a broader trend tapping into the tastes and values of Chinese youth — which also speaks to a global audience.

And this trend is serious business. POP MART is one of the world’s fastest-growing consumer brands, with a current market value of approximately $43 billion, according to Morgan Stanley.

No wonder everyone wants a piece of the ‘Labubu pie,’ from small vendors to major companies.

It’s not just the resellers of authentic Labubu dolls who are profiting from the trend — so are the sellers of ‘Lafufu,’ a nickname for counterfeit Labubu dolls, that have become ubiquitous on e-commerce platforms and in toy markets (quite literally).

Wakuku’s rapid rise is also a story of calculated imitation. In this case, copying isn’t seen as a flaw but as smart market participation.

The founding team behind Letsvan already had a decade of experience in product design before setting out on their journey to become a major player in China’s popular designer toy and character merchandise market.

But their real breakthrough came in early 2025, when QuantaSing (量子之歌), a leading adult learning ed-tech company with no previous ties to toys, acquired a 61% stake in the company.

With QuantaSing’s financial backing, Yuehua Entertainment’s marketing power, and Miniso’s distribution reach, Wakuku took it to the next level.

The speed and precision with which Letsvan, QuantaSing, and Wakuku moved to monetize a subcultural trend — even before it fully peaked — shows just how advanced China’s trend toy industry has become.

This is no longer just about cute (or ugly-cute) designs; it’s about strategic ecosystems by ‘IP factories,’ from concept and design to manufacturing and distribution, blind-box scarcity tactics, immersive store experiences, and influencer-led viral campaigns — all part of a roadmap that POP MART refined and is now adopted by many others finding their way into this lucrative market. Their success is powered by the strength of China’s industrial & digital infrastructure, along with cross-industry collaboration.

The rise of Chinese designer toy companies reminds of the playbook of K-pop entertainment companies — with tight control over IP creation, strong visual branding, carefully engineered virality, and a deep understanding of fandom culture. (For more on this, see my earlier explanation of the K-pop success formula.)

If K-pop’s global impact is any indication, China’s designer toy IPs are only beginning to show their potential. The ecosystems forming around these products — from factory to fandom — signal that Labubu and Wakuku are just the first wave of a much larger movement.

– By Manya Koetse

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2025 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

A Very Short Guide to China’s Most Popular Designer Toys

The Next Labubu: What the Rise of Wakuku Tells Us About China’s Collectible Toy Wave

Jiehun Huazhai (结婚化债): Getting Married to Pay Off Debts

Yearnings, Dreamcore, and the Rise of AI Nostalgia in China

Beauty Influencer Du Meizhu Accused of Scamming Fan Out of $27K

China Is Not Censoring Its Social Media to Please the West

IShowSpeed in China: Streaming China’s Stories Well

Inside the Labubu Craze and the Globalization of Chinese Designer Toys

China Reacts: 3 Trending Hashtags Shaping the Tariff War Narrative

China Trending Week 15/16: Gu Ming Viral Collab, Maozi & Meigui Fallout, Datong Post-Engagement Rape Case

Chinese New Nickname for Trump Mixes Fairy Tales with Tariff War

Strange Encounter During IShowSpeed’s Chengdu Livestream

No Quiet Qingming: From High-Tech Tomb-Sweeping to IShowSpeed & the Seven China Streams

Understanding the Dr. Xiao Medical Scandal

From Trade Crisis to Patriotic Push: Chinese Online Reactions to Trump’s Tariffs

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Media12 months ago

China Media12 months agoA Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

-

China Memes & Viral12 months ago

China Memes & Viral12 months agoThe “City bu City” (City不City) Meme Takes Chinese Internet by Storm

-

China Society9 months ago

China Society9 months agoDeath of Chinese Female Motorcycle Influencer ‘Shigao ProMax’ Sparks Debate on Risky Rides for Online Attention

-

China World11 months ago

China World11 months agoChina at Paris 2024 Olympics Trend File: Medals and Moments on Chinese Social Media

wendy mashabela

June 23, 2016 at 7:13 pm

I really like this Chinese movies , on channel 447 cctv4 .But what really hurts me is that these actors and actress speaks their language I really can’t hear them. if atleast they can explain or write in english on the screen please,,i really love this movies please help.And I’m from SA

Isy

October 17, 2016 at 12:42 pm

There’s a lot of websites where you can watch Asian drama’s with subtitles. Personally, I use a website called KissAsian. Hope I was of help!

Marcia Curtain

June 16, 2019 at 5:16 am

Would like to know more about a TV series I started to watch on China recently I think it’s called Mai Xiang

It as showing on CCTV I think

Thank you