Chinese Apps

Top 5 of China’s Most Popular Short Video and Live Streaming Apps

An overview of the most-watched apps in China of this moment.

Published

5 years agoon

By

Gabi Verberg

The live streaming and short video app market is (still) absolutely booming in China. What’s on Weibo lists China’s most popular apps within this category for you: these are the top Chinese apps to watch.

China is the world’s largest smartphone market, and the mobile app business is booming. In August of last year, it was reported that approximately 800 million people are actively using the internet in China, about 58 percent of the country’s population. What is especially noteworthy is that some 788 million people are accessing the internet via mobile – a total of 98 percent of the China’s total online population.

To attract business from this immense number of mobile internet users, who on average spend some 4.2 hours per day on their phone, thousands of news apps are launched every year. In 2018, Chinese internet users could download 7.3 million different apps – 900.000 more than the year before.

To provide more insight into China’s mobile app market, What’s on Weibo has listed some of the most popular and noteworthy apps in China today. For this selection, we chose to avoid the most obvious popular apps, such as Weibo or WeChat, that are already frequently covered in English-language media.

Instead, we chose to feature those apps that are arguably not as well-known outside of mainland China, within five popular categories, namely: education, health, news, games, and short video & live streaming.

We made our selection based on the data from the Android app stores Tencent, Baidu, Huawei, and Zhushou360. We tried our best to give you a representative overview of various apps that are currently most used in China, but want to remind you that these lists are by no means absolute nor official “top 5” charts.

We will start with our top short video & live streaming list, stay tuned for the other categories that will follow shortly and will be listed below this article!

#1 Douyin Short Video 抖音短视频

Douyin, which literally means “trembling sound” (抖音), is a short video social networking app. The app is part of the ByteDance Inc. empire and was first launched in September 2016.

If the logo looks familiar, that may be because you know the popular international version of the app named ‘TikTok,’ which was the fourth most downloaded non-game app worldwide in 2018.

Douyin allows its users to live stream and to upload and view 15-second videos. The app provides several tools to finetune videos by adding various kinds of music, fast forwarding, or adding filters and stickers.

More than just a video and broadcasting app, Douyin is very much interactive, which inherently makes it a social media platform. Videos can be liked, shared and commented on, and people can follow each other. Through its broadcasting feature, users can also send each other money or virtual gifts.

The major ‘magic’ formula behind Douyin is its use of the AI algorithm of its parent company Bytedance Inc (the same company that runs the super popular news app Toutiao). This means the app constantly provides users with suggested content based on user profile and preferences. Adding to this, Douyin is the only app in this selection that automatically plays the next video if the current video you are watching has ended, increasing user engagement with the app.

Douyin’s approach is highly successful. In 2018, Douyin ranked as the tenth most popular app in China, and its popularity continues to grow. From September to December 2018, Douyin’s daily active users increased from 118.7 to 138.5 million.

Douyin currently is the most popular short video app in the Chinese Apple store, and in both the Huawei and Zhushou360 app stores, Douyin ranks second most popular app overall.

Also see our previous article exploring the difference between Douyin and its international version TikTok.

#2 Kuaishou 快手

Kuaishou, literally meaning “fast hand,” is also known as ‘Kwai’ and was first launched in 2011 as GIF Kuaishou (GIF快手) and changed its name and function to the current one in 2014.

In 2018, Kuaishou received various investments from Chinese tech giants Tencent, Alibaba, and Baidu, that also sought to profit from China’s growing market of short-video and live stream apps. As with Douyin, Kuaishou has also been successful outside of mainland China. In 2018, the app briefly ranked first in several Apple stores including those in Russia, Turkey, South Korea, Taiwan, and Indonesia.

With Kuaishou, just like Douyin, users can live stream and upload short videos. There are, however, some small differences between the apps. In Kuaishou, videos can be as long as 57 seconds, and the next video will not play automatically; meaning that users have to manually pick the next video they want to watch. Also in the video editing, its functions are different. In the Kuaishou app, users can specifically add filters to faces, and there is also a karaoke function.

In the fourth quarter of 2018, Kuaishou reached the miracle barrier of 100 million monthly active users, showing a modest 2,45 percent growth compared to the third quarter. Currently, Kuaishou is ranking second most popular video app in the Chinese Apple Store, and fifth in the Zhushou360 app store.

#3 Xigua Video 西瓜视频

Xigua, which means ‘watermelon,’ is the second-most popular short video app by Bytedance. ‘Eating watermelons’ or ‘the watermelon-eating masses’ (吃瓜群众) is a Chinese idiom that is frequently used by Chinese netizens, meaning that onlookers are interested in watching an (online) spectacle or discussion unfold without intervening.

Being a Bytedance product, Xigua also uses artificial intelligence and machine learning algorithms to recommend videos to its users. What is different from Douyin, is that Xigua categorizes its videos based on their contents. There are, for example, the categories handicraft, culture, square dancing, cuisine, and fashion. Adding to this, Xigua also offers a live streaming service and a wide variety of television programs and games.

Despite a small decrease in daily active viewers in the last quarter of 2018 from 41.2 million to 38.7 million, Xigua was still the third most popular video app in the Chinese Apple store, closely followed by another app by Bytedance called Huoshan (火山), a short video platform for people to share their stories and showcase their talent.

#4 MOMO 陌陌

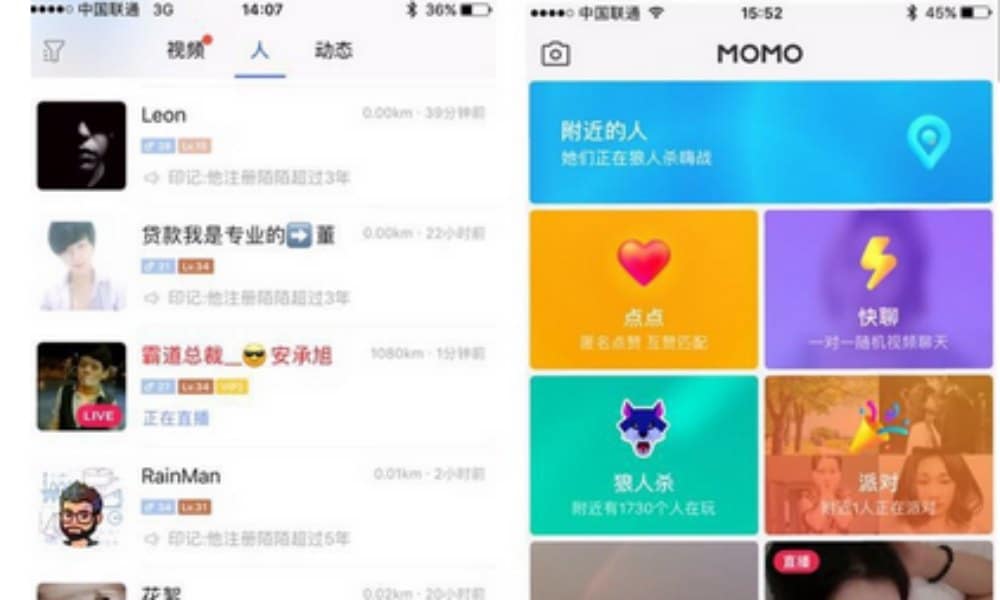

MOMO is a location-based social networking app where users can show themselves through video, text, voice, and pictures, and discover nearby people based on their geographic location. Despite the company calling the app a social networking platform, for many Chinese netizens, MOMO is simply known as a dating app.

Different from apps such as Douyin and Xigua, MOMO does not show content based on user preference but based on its geographic location. The main page of MOMO shows profiles of people around you, featured with picture and videos. If you see a person that you like, you can add the person or leave a ‘like’ or comment. In addition, the app also provides other functions such as a swipe function, a chat room and a place where you can play games with other users.

MOMO which is part of the Beijing MOMO Technology company, that first launched their app in 2011. Little than a year later, people all over the globe were introduced to MOMO’s international version. But in 2014, when the Chinese version started to gain a significant market share, the company decided to cancel its international edition and focus on its domestic business instead.

In 2018, MOMO acquired the Tinder-like dating app Tantan (探探), which had 6.3 million daily active users in the fourth quarter of 2018.

In the meantime, MOMO has also been growing in popularity, registering 16 million daily active users in 2018, making it the most popular app in the category live streaming and the 88th the most popular app overall – that may not sound too impressive, but within China’s booming app market, it actually is.

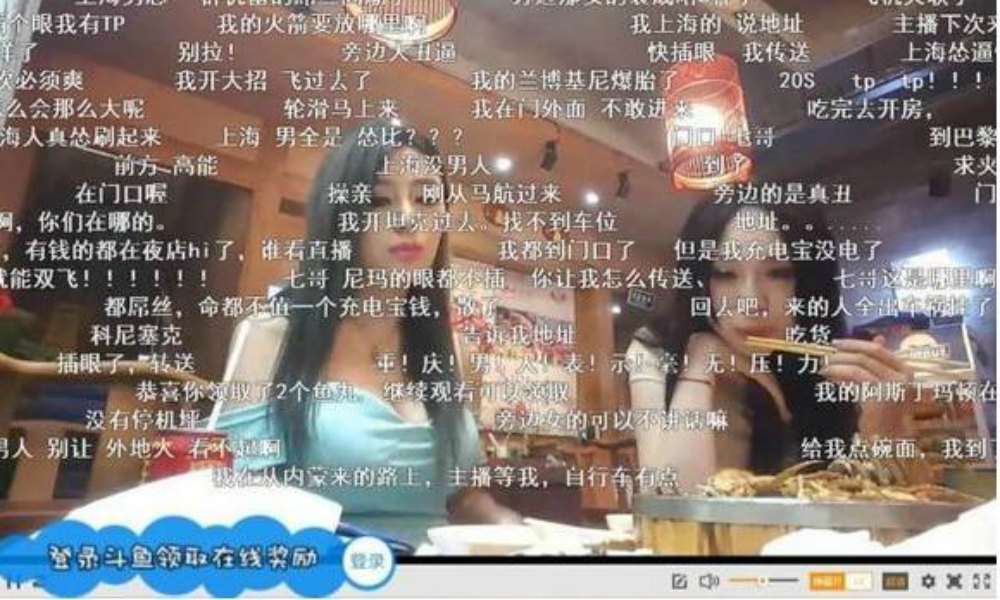

#5 DouYu Livestream 斗鱼直播

DouYu is an app by DouYu TV and was first launched in 2014. In 2016, DouYu received investments from both Tencent and Phoenix Media.

What mainly sets DouYu apart from other live stream apps, is that it provides its users with live streaming games such as Honor of Kings, Player Unknown’s Battlefield, DOTA and League of Legend. In addition, it also features practical videos such as cooking lessons or camping tutorials.

In 2018, DouYu was the second most popular live streaming app of China, right behind MOMO, with 7.2 daily active users at the end of the year. Currently, the app ranks among the most popular video apps in the Tencent Appstore.

Also see: Top 5 of Popular News Apps

By Gabi Verberg

Spotted a mistake or want to add something? Please let us know in comments below or email us.

©2019 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com

Gabi Verberg is a Business graduate from the University of Amsterdam who has worked and studied in Shanghai and Beijing. She now lives in Amsterdam and works as a part-time translator, with a particular interest in Chinese modern culture and politics.

China Digital

China’s 2024 Gaokao Triggers Online Discussions on AI

It’s Gaokao time! For the first time, China’s Gaokao essay topic was about the latest AI developments, triggering discussions on social media.

Published

2 months agoon

June 7, 2024

This week, China’s National College Entrance Exams, better known as the “Gaokao” (高考), became one of the most-discussed topics on Chinese social media. ‘Gaokao,’ ‘AI,’ and ‘Gaokao essay’ were the hottest words on Weibo by the end of the week.

The Gaokao (literally: ‘higher exams’) are a prerequisite for entering China’s higher education institutions and are usually taken by students in their last year of senior high school. June 7th marked the first day of the Gaokao, which will continue until June 9th.

For the over 13.4 million participating students, the Gaokao week is a pivotal moment. Scoring high on this exam can grant access to better colleges, significantly improving their chances of obtaining a good job after graduation. Given the potentially life-changing results, the Gaokao period is a stressful time for both students and their parents.

The Gaokao essay (高考作文) is a significant component of the Chinese language exam, testing students’ writing skills, critical thinking, and ability to express ideas coherently. The essay, which must be completed within a limited time, requires students to discuss given topics.

These topics are generally related to Chinese society and culture, consistently attracting attention on social media. This year, multiple essay questions were related to AI and social media.

Those taking the Beijing exam (北京卷), for example, received a question related to the “like” function on WeChat, suggesting that some people feel strongly about the number of “likes” they receive and give, asking students to reflect on the phenomenon of receiving and giving “likes” on social media.

But the question receiving the most attention on social media was part of the New Curriculum Standard Test I (新课标I卷), which is distributed among different provinces.

Students vs. Chatbots: Letting AI Write an Essay on AI

Students received the following topic prompt for their Gaokao essay, which should be at least 800 characters long:

“With the spread of the internet and AI applications, we can quickly get answers to more and more questions. Will this also lead to us having fewer problems?” (随着互联网的普及、人工智能的应用,越来越多的问题能很快得到答案。那么,我们的问题是否会越来越少?)

The question sparked discussions because it was the first time a Gaokao essay question focused on AI applications designed to interact with users, like ChatGPT.

Although many thought the essay question was easy—unlike this year’s math exam—it still generated some interesting reflections.

Some Weibo users responded that the answer to the question was within the question itself. One Weibo blogger answered: “If there were no AI, we wouldn’t have this question, so problems/questions related to AI will only increase. The emergence of new things will inevitably be accompanied by new problems.”

Others commented on the concerns brought by the emergence of AI applications like ChatGPT. In early 2023, hashtags such as “Ten Professions That Could be Replaced by ChatGPT” (#可能被ChatGPT取代的10大职业#) gained a lot of attention on Chinese social media, where many were concerned that jobs from various industries, including customer service, programming, media, education, market research, finance, etc., would soon be done by AI chatbots instead of humans.

In line with this thought and the AI theme of this year’s Gaokao essay, netizens and some Chinese media outlets decided to let various language models take the exam and see how they would perform: could AI actually do better in writing an essay about AI than Chinese students? (Related hashtags: #让AI写高考作文#, #假如AI写高考语文作文#; #ChatGPT来交卷了#).

Xinhua, for example, asked Open AI’s ChatGPT to answer various questions. Sina Tech (新浪科技) also asked OpenAI’s ChatGPT to answer the AI-related essay question, along with Chinese chatbots, like Baidu’s Erniebot (文心一言), Tencent’s Yuanbao (元宝), iFlytek’s Sparkdesk (星火), and Alibaba’s Tongyi Qianwen (通义千问). Toutiao News did the same, letting three chatbots (ChatGPT, Erniebot, Tongyi Qianwen) compete against each other.

There is no general consensus on how well these AI chatbots can write a Gaokao essay. Although compared to last year, there are now more and better domestic AI models, OpenAI’s ChatGPT-4 is generally still seen as the best chatbot out there.

This was its answer (originally in Chinese, translated to English with ChatGPT):

New Issues and Thoughts Brought by Technological Progress

With the popularization of the internet and the application of artificial intelligence, we can quickly obtain a large amount of information, and many questions can be answered in a short time. However, does this mean that we will have fewer questions? I believe the answer is no.

Firstly, although technology provides us with convenience, new technologies also bring new problems. The popularization of the internet has made information dissemination faster, but at the same time, the authenticity and accuracy of information have become new concerns. Fake news, information overload, and privacy breaches are increasingly prominent issues. These new problems need to be identified, understood, and resolved by us.

Secondly, the application of artificial intelligence, although it improves efficiency, also brings ethical and social issues. The transparency of AI decision-making, algorithmic bias, and the impact on the job market are all urgent issues that society needs to address. People need to constantly raise new questions to ensure a balance between technological progress and social welfare.

Furthermore, the development of technology prompts us to reflect more deeply on humanity itself. We need to rethink the relationship between humans and technology and consider the role and boundaries of technology in our lives. These philosophical issues are more important than ever.

Therefore, technological progress does not reduce our questions but rather prompts more new questions and reflections. It is these constantly emerging questions that drive social progress and human thought. We need to embrace the challenges brought by technology with a more open and critical attitude and actively seek solutions.

Although the domestic chatbots gave somewhat different answers, the overall tone was similar, though some commenters argued that ChatGPT was still the strongest, along with iFlytek’s Sparkdesk.

An online poll asking Weibo users to grade the ChatGPT essay from lower than 20 points up to the full 60 points saw divided responses, though a majority rated it as lower than 20 points.

How well can ChatGPT write an essay about AI? Opinions are divided.

This shows that many commenters think that AI chatbots are still not able to beat humans when it comes to writing Gaokao essays.

Commenters reacted to the various AI-generated essays in various ways, including:

• “Actually, none of them are very good. They are too formulaic and standardized, lacking the natural creativity and originality that humans possess.”

• “They just give soulless standard answers.”

• “It’s all about ‘firstly,’ ‘secondly,’ ‘furthermore.'”

• “There are no examples, no points proven; it should be a low grade.”

• “It’s just too stiff.”

• “This is like reading reports, not essays.”

• “AI places more emphasis on logic, which aligns with the writing style of foreigners.”

• “There’s no feeling in these essays; there’s a certain kind of AI feeling to AI.”

Meanwhile, some bloggers are taking up the challenge and are publishing their own online essays in response to the Gaokao question.

Some of them are not worried that chatbots will take over their critical tasks: “AI will be AI. There’s no connection to the social realities, and it’s as cold as ice.”

“Their words might make sense, but they lack feeling.”

But for some discussing the topic, they have come to realize that they are already depending too much on digital tools and AI applications for their everyday tasks, writing: “I made an attempt to write an essay, but discovered I already forgot how to do it!” For them, the discussion itself is a wake-up call that writing an essay from scratch is a skill that requires practice and cannot be fully replaced by chatbots, making personal creativity essential to score points and avoid the ‘AI-fication’ of texts.

PS:

In his book China’s Millennials, Eric Fish describes the limits on Chinese students’ answers; taboo responses, such as those containing harsh criticisms of the Chinese government or society, could potentially lead to failure. Although the essay is purportedly meant to showcase the student’s creativity, it must adhere to the unwritten rules of what is socially acceptable.

By Manya Koetse

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Arts & Entertainment

Going All In on Short Streaming: About China’s Online ‘Micro Drama’ Craze

For viewers, they’re the ultimate guilty pleasure. For producers, micro dramas mean big profit.

Published

4 months agoon

March 26, 2024By

Ruixin Zhang

PREMIUM CONTENT

Closely intertwined with the Chinese social media landscape and the fast-paced online entertainment scene, micro dramas have emerged as an immensely popular way to enjoy dramas in bite-sized portions. With their short-format style, these dramas have become big business, leading Chinese production studios to compete and rush to create the next ‘mini’ hit.

In February of this year, Chinese social media started flooding with various hashtags highlighting the huge commercial success of ‘online micro-short dramas’ (wǎngluò wēiduǎnjù 网络微短剧), also referred to as ‘micro drama’ or ‘short dramas’ (微短剧).

Stories ranged from “Micro drama screenwriters making over 100k yuan [$13.8k] monthly” to “Hengdian building earning 2.8 million yuan [$387.8k] rent from micro dramas within six months” and “Couple earns over 400 million [$55 million] in a month by making short dramas,” all reinforcing the same message: micro dramas mean big profits. (Respectively #短剧爆款编剧月入可超10万元#, #横店一栋楼半年靠短剧租金收入280万元#, #一对夫妇做短剧每月进账4亿多#.)

Micro dramas, taking China by storm and also gaining traction overseas, are basically super short streaming series, with each episode usually lasting no more than two minutes.

From Horizontal to Vertical

Online short dramas are closely tied to Chinese social media and have been around for about a decade, initially appearing on platforms like Youku and Tudou. However, the genre didn’t explode in popularity until 2020.

That year, China’s State Administration of Radio, Film, and Television (SARFT) introduced a “fast registration and filing module for online micro dramas” to their “Key Online Film and Television Drama Information Filing System.” Online dramas or films can only be broadcast after obtaining an “online filing number.”

Chinese streaming giants such as iQiyi, Tencent, and Youku then began releasing 10-15 minute horizontal short dramas in late 2020. Despite their shorter length and faster pace, they actually weren’t much different from regular TV dramas.

Soon after, short video social platforms like Douyin (TikTok) and Kuaishou joined the trend, launching their own short dramas with episodes only lasting around 3 minutes each.

Of course, Douyin wouldn’t miss out on this trend and actively contributed to boosting the genre. To better suit its interface, Douyin converted horizontal-screen dramas into vertical ones (竖屏短剧).

Then, in 2021, the so-called mini-program (小程序) short dramas emerged, condensing each episode to 1-2 minutes, often spanning over 100 episodes.

These short dramas are advertised on platforms like Douyin, and when users click, they are directed to mini-programs where they need to pay for further viewing. Besides direct payment revenue, micro dramas may also bring in revenue from advertising.

‘Losers’ Striking Back

You might wonder what could possibly unfold in a TV drama lasting just two minutes per episode.

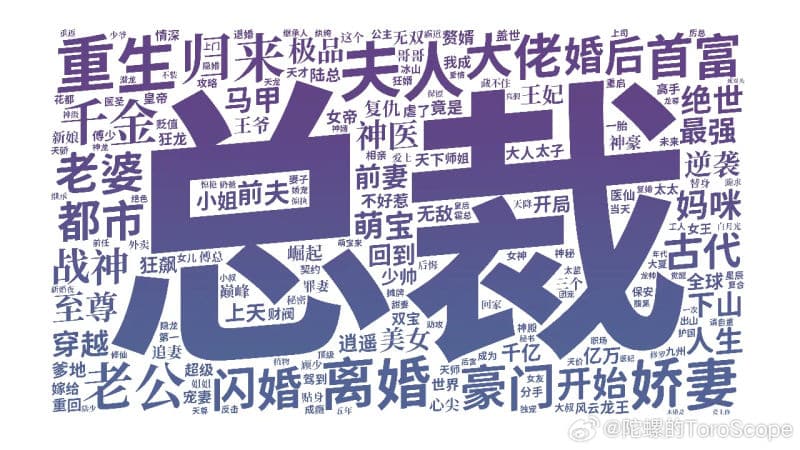

The Chinese cultural media outlet ‘Hedgehog Society’ (刺猬公社) collected data from nearly 6,000 short dramas and generated a word cloud based on their content keywords.

In works targeted at female audiences, the most common words revolve around (romantic) relationships, such as “madam” (夫人) and “CEO” (总裁). Unlike Chinese internet novels from over a decade ago, which often depicted perfect love and luxurious lifestyles, these short dramas offer a different perspective on married life and self-discovery.

According to Hedgehog Society’s data, the frequency of the term “divorce” (离婚) in short dramas is ten times higher than “married” (结婚) or “newlyweds” (新婚). Many of these dramas focus on how the female protagonist builds a better life after divorce and successfully stands up to her ex-husband or to those who once underestimated her — both physically and emotionally.

One of the wordclouds by 刺猬公社.

In male-oriented short dramas, the pursuit of power is a common theme, with phrases like “the strongest in history” (史上最强) and “war god” (战神) frequently mentioned. Another surprising theme is “matrilocal son” (赘婿), the son-in-law who lives with his wife’s family. In China, this term is derogatory, particularly referring to husbands with lower economic income and social status than their wives, which is considered embarrassing in traditional Chinese views. However, in these short dramas, the matrilocal son will employ various methods to earn the respect of his wife’s family and achieve significant success.

Although storylines differ, a recurring theme in these short dramas is protagonists wanting to turn their lives around. This desire for transformation is portrayed from various perspectives, whether it’s from the viewpoint of a wealthy, elite individual or from those with lower social status, such as divorced single women or matrilocal son-in-laws. This “feel-good” sentiment appears to resonate with many Chinese viewers.

Cultural influencer Lu Xuyu (@卢旭宁) quoted from a forum on short dramas, explaining the types of short dramas that are popular: Men seek success and admiration, and want to be pursued by beautiful women. Women seek romantic love or are still hoping the men around them finally wake up. One netizen commented more bluntly: “They are all about the counterattack of the losers (屌丝逆袭).”

The word used here is “diaosi,” a term used by Chinese netizens for many years to describe themselves as losers in a self-deprecating way to cope with the hardships of a competitive life, in which it has become increasingly difficult for Chinese youths to climb the social ladder.

Addicted to Micro Drama

By early 2024, the viewership of China’s micro dramas had soared to 120 million monthly active users, with the genre particularly resonating with lower-income individuals and the elderly in lower-tier markets.

However, short dramas also enjoy widespread popularity among many young people. According to data cited by Bilibili creator Caoxiaoling (@曹小灵比比叨), 64.9% of the audience falls within the 15-29 age group.

For these young viewers, short dramas offer rapid plot twists, meme-worthy dialogues, condensing the content of several episodes of a long drama into just one minute—stripping away everything except the pure “feel-good” sentiment, which seems rare in the contemporary online media environment. Micro dramas have become the ultimate ‘guilty pleasure.’

Various micro dramas, image by Sicomedia.

Even the renowned Chinese actress Ning Jing (@宁静) admitted to being hooked on short dramas. She confessed that while initially feeling “scammed” by the poor production and acting, she became increasingly addicted as she continued watching.

It’s easy to get hooked. Despite criticisms of low quality or shallowness, micro dramas are easy to digest, featuring clear storylines and characters. They don’t demand night-long binge sessions or investment in complex storylines. Instead, people can quickly watch multiple episodes while waiting for their bus or during a short break, satisfying their daily drama fix without investing too much time.

Chasing the gold rush

During the recent Spring Festival holiday, the Chinese box office didn’t witness significant growth compared to previous years. In the meantime, the micro drama “I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈), shot in just 10 days with a post-production cost of 80,000 yuan ($11,000), achieved a single-day revenue exceeding 2 million yuan ($277k). It’s about a college girl who time-travels back to the 1980s, reluctantly getting married to a divorced pig farm owner with kids, but unexpectedly falling in love.

Despite its simple production and clichéd plot, micro dramas like this are drawing in millions of viewers. The producer earned over 100 million yuan ($13 million) from this drama and another short one.

“I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈).

The popularity of short dramas, along with these significant profits, has attracted many people to join the short drama industry. According to some industry insiders, a short drama production team often involves hundreds or even thousands of contributors who help in writing scripts. These contributors include college students, unemployed individuals, and online writers — seemingly anyone can participate.

By now, Hengdian World Studios, the largest film and television shooting base in China, is already packed with crews filming short dramas. With many production teams facing a shortage of extras, reports have surfaced indicating significant increases in salaries, with retired civil workers even being enlisted as actors.

Despite the overwhelming success of some short dramas like “I Went Back to the 80s and Became a Stepmother,” it is not easy to replicate their formula. The screenwriter of the time-travel drama, Mi Meng (@咪蒙的微故事), is a renowned online writer who is very familiar with how to use online strategies to draw in more viewers. For many average creators, their short drama production journey is much more difficult and less fruitful.

But with low costs and potentially high returns, even if only one out of a hundred productions succeeds, it could be sufficient to recover the expenses of the others. This high-stakes, cutthroat competition poses a significant challenge for smaller players in the micro drama industry – although they actually fueled the genre’s growth.

As more scriptwriters and short dramas flood the market, leading to content becoming increasingly similar, the chances of making profits are likely to decrease. Many short drama platforms have yet to start generating net profits.

This situation has sparked concerns among netizens and critics regarding the future of short dramas. Given the genre’s success and intense competition, a transformation seems inevitable: only the shortest dramas that cater to the largest audiences will survive.

In the meantime, however, netizens are enjoying the hugely wide selection of micro dramas still available to them. One Weibo blogger, Renmin University Professor Ma Liang (@学者马亮), writes: “I spent some time researching short videos and watched quite a few. I must admit, once you start, you just can’t stop. ”

By Ruixin Zhang, edited with further input by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Future is Here

“Bye Bye Biden”: Biden’s Many Nicknames in Chinese

Enjoying the ‘Sea’ in Beijing’s Ditan Park

A Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

Weibo Watch: Get Up, Stand Up

The Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

A Brew of Controversy: Lu Xun and LELECHA’s ‘Smoky’ Oolong Tea

Singing Competition or Patriotic Fight? Hunan TV’s ‘Singer 2024’ Stirs Nationalistic Sentiments

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

Weibo Watch: The Battle for the Bottom Bed

About the “AI Chatbot Based on Xi Jinping” Story

China’s Intensified Social Media Propaganda: “Taiwan Must Return to Motherland”

Weibo Watch: Telling China’s Stories Wrong

Saying Goodbye to “Uncle Wang”: Wang Wenbin Becomes Chinese Ambassador to Cambodia

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight3 months ago

China Insight3 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music4 months ago

China Music4 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Digital10 months ago

China Digital10 months agoToo Sexy for Weibo? Online Discussions on the Concept of ‘Cābiān’

-

China Arts & Entertainment12 months ago

China Arts & Entertainment12 months agoBehind 8 Billion Streams: Who is Dao Lang Cursing in the Chinese Hit Song ‘Luocha Kingdom’?

Ruangwith Viwathanatepa

May 9, 2019 at 11:56 am

Thank you for you article