Backgrounder

Beware: 10 Scams in China To Watch Out For

What’s on Weibo has compiled a list of 10 scams in China that are recently trending on social media or in China’s newspapers, victimising hundreds of people every day.

Published

9 years agoon

As times change, so do scams. In an age of smartphones and social media, Chinese scammers are more prone to abandon old tricks and use new technology for their swindling business. But apart from new media and online fraud, there are still scammers who use people’s inexperience and desperation to earn money by simply fooling them on the streets. What’s on Weibo has compiled a list of 10 scams that are recently trending on social media or in China’s newspapers, victimising hundreds or thousands of people (including tourists) every day.

Also see our 2018 Top 8 Scams in China list!

PAYING A HIGH PRICE FOR UNIVERSITY

1. College Entrance Scam

Recently, Weibo netizens and Chinese media have been reporting on College Entrance Enrollment Scams (高考招生骗局): “Mr. Lu from Anhui always hoped his son would attend a good university,” Anhui Daily writes: “but his grades were not ideal. This is when Mr. Zhou appeared, who introduced himself as an official from an academic institution with the right means to make sure Mr. Lu’s son would be admitted to Hefei University of Technology, but he needed money for it.”

Worried about his son’s future, and fully trusting, Mr. Lu invested 125.000 RMB (over 20.000 US dollar) to get his son enrolled. Because his son initially received a (fake) admission letter from the university, the Lu family did not immediately discover they were scammed. When they did, their money was gone, and the son was not registered at any university at all.

The Lu family is not the only one to get victimised by this scam. Around this time of year, the results of the annual College Entrance Exams are released. Prospective students and their family feverishly look to get admitted to a good university. But because it is all about the grades, the prospects look grim for those who did not get a good score on their exam. This makes them vulnerable victims for these kinds of scams. “This time of year is the peek of all kinds of criminal activities related to the College Entrance Exams,” Anhui Daily writes: “Students and their parents should not be fooled.”

BLINDED BY JEALOUSY

2. “I Am Your Husband’s Mistress” Scam

An incoming message on your phone says: “Hi, I am your husband’s mistress. I love him and want to marry him. You can see our picture for yourself, if you don’t believe me.”

The message is a shock to many women, who do not hesitate to immediately click the link provided in the text message. Unknowingly, by clicking the link, their phone gets infected with a trojan horse virus. Many Chinese have installed apps on their phone such as Alipay (Chinese equivalent to Paypal). The virus enables scammers to access private information, and transfer money from their victim’s accounts.

So how do scammers know the person they send a message to is a married woman? Actually, they don’t. By sending the same message to as many people as possible, they enhance their chances of sending it to those that are female and married – vulnerable to clicking the link in the text.

Similarly, scammers also send out messages telling people that their daughter is a prostitute, providing them with a link for pictures as (non-existent) proof [one of our female Harbin friends was called by her father in the middle of the night, worried sick about his daughter].

Another version of this scam is the message from the school administration, telling parents to click the link to see their child’s latest report card. Scammers will even say they are their children’s English or maths teacher, boosting the chances of parents clicking the link provided.

The only way to handle these messages is to immediately delete them, without clicking the link attached. If in doubt, call school/daughter/husband to verify (although in some odd cases, the latter may happily say it is a scam when it is actually not..).

NOT MY CUP OF TEA

3. The Tea Ceremony Scam

The tea ceremony scam has been a common scam in China for years. It is aimed at tourists who are new to China, and are eager to experience something typically ‘Chinese’. Although the tea scammers are also active in Beijing (report), they famously operate around Shanghai’s People’s Park.

The scam usually involves two or three nice-looking young ladies who present themselves as “students” when approaching western tourists. What starts as small talk, soon leads to the girls inviting the tourist(s) to a traditional Chinese tea ceremony, where they will taste about eight different teas within fifteen minutes or so in a closed room in a backend alley teahouse. The tourists are led to believe that the tea that is served is inexpensive, but will later be presented with a bill of 650-2000 RMB (100-330 US dollar) or even more.

Tourists often do not even realise they have been scammed until the very end. Even a booking.com manager from New Zealand, though an experienced traveler, recently was scammed by the tea ceremony.

HANGING WITH THE WRONG CROWD

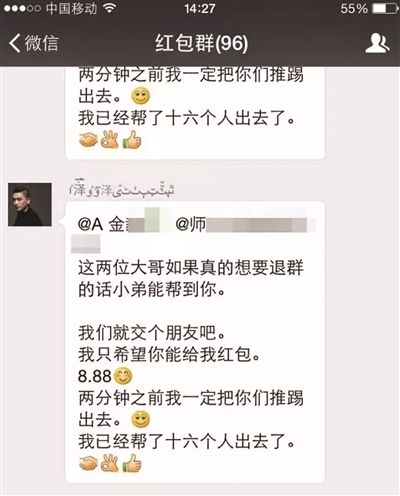

4. The WeChat Group Scam

WeChat (in Chinese: Weixin) is the most popular app in China. It is not just a way to connect to friends individually or by group chat, it is also an app that is used for making phone calls, ordering taxi’s, and doing money transactions. (For more on Weixin, read: China’s Weixin Revolution.) For many Chinese, the app has become an essential tool for everyday communication.

Recently, it has become more and more common for people to be asked to join a group of friends they do not know on Weixin, People’s Daily writes. Because these groups have names such as ‘finances’, or ‘entertainment’, many people agree to add themselves to the group, as it is quite normal to ‘follow’ various groups on Weixin. After doing so, they learn the group consists of hundreds of people posting spam, emoticons and vile words. When asking to exit the group, they soon discover they cannot withdraw.

The group also cannot be set to ‘do not disturb’ mode, making every message that pops up visible on your phone screen. Somebody in the group will then send you a message asking if you want to be removed from the group. If so, you will have to give him a so-called ‘red envelope’ (红包): a payment worth 8,88 RMB (1,5 US dollars). After paying, you will be removed from the groups within a couple of minutes.

Although victims of this scam will only lose a little bit of cash, this is now happening on such a large scale that these scammers are making large amounts of money. Tencent, the creator of WeChat, has responded that this specific scam is only happening to IOS users due to a software incompatibility. Users of iOs and WeChat are advised to update both their WeChat and their iOS version.

KEEPING THE DOCTOR AWAY

5. Beijing’s Hospital Scalpers

So-called hospital scalpers have been a problem in China for a long time. Hospital scalpers (医托) are people who earn their money by enticing people to obtain medical care at a certain hospital or clinic. As described by medical journalist Michael Woodhead from China Medical News (2014):

“The scalper is friendly and solicitous initially, advising the patients and family members that the official clinic is expensive and extremely busy and the service is poor. Sometimes they say the doctor on duty has a poor reputation or that the clinic is dirty and has poor hygiene. They then tell the victim that there is a better clinic nearby where they have connections and can get a quick appointment.The scalper then personally escorts the victim to the nearby clinic, where the ‘doctor’ and staff do many unnecessary expensive tests and prescribes some very common and cheap medicine but charges a high price.”

A hospital scalper in action at Beijing West Station (Sina 2015).

A hospital scalper in action at Beijing West Station (Sina 2015).

Earlier this month, Sina News reported about hundreds of people being victimised by one group of scalpers that mainly operate in and around Beijing’s West Station, Jishuitan Hospital, Fu Wai Hospital, Peking Union Medical Hospital Clinic and the 301 Hospital. The group, consisting of around sixty scammers, are active every day from early morning ’til afternoon, looking for inexperienced patients who come to Beijing to see a doctor, and are either just arriving, or are waiting in one of the long lines at the hospital.

The scammers wear costumes and look like professional staff members, asking people about their health problems and then referring them to the centrally located Baidetang Clinic near Beijing’s Pinganli Subway (Yude hutong).

According to the article, one patient, coming from Xi’an, was waiting at the Union Medical Hospital when she was approached by a woman who informed about her medical problems. When the patient told the woman that she suffered from menstrual problems, the scammer told her that the specialist she needed was currently available at the qualified Baidetang Clinic. The patient, like many others who were victimised, ended up getting a short consult and some expensive medicine, spending 10.000 RMB (1630 US dollars). According to an undercover journalist, hospital scalpers receive 70% of the amount a patient spends at the clinic.

The Baidetang Clinic near Beijing’s Pinganli Subway Station (Sina 2015).

The Baidetang Clinic near Beijing’s Pinganli Subway Station (Sina 2015).

MONEY FLIES

6. “Canceled Flight” Message

This year, multiple Chinese media and netizens reported about the “canceled flight scam” (航班取消骗局). After booking a flight, passengers receive a text message from a 400-number saying that there has been a change in their flight, or that the flight has been canceled. In order to get their money back, passengers have to provide their name, ID information and bank account number.

Later on, passengers will discover that money is taken from their bank account, and that the text message they received was fake.

Anqing News Centre advises passengers to be careful with 400-numbers. After receiving similar messages, people should always first check with the official customer information number of their airline.

HIGH INTERESTS

7. Major Bank Scam

Over the last year, several large-scale bank scams made the headlines in China. Although putting money in the bank is generally considered the safest option to protect one’s money, many Chinese netizens say that they are losing trust in China’s banking system because large amounts of people’s savings that were kept in state-owned banks have gone missing.

The scammers involved are people who work at the bank. They attract depositors by offering them high interests. Instead of annual interest rates of 2–5%, these employees will tell depositors that they can give them interests of 10%, up to 20% or even higher. In such scams, the depositors often have to sign the terms of service, which include that they have to refrain from checking the account. After the swindle is exposed, the bank usually states that it is the client’s responsibility for believing such high interests; even if the scam took place within the bank itself and clients assumed they were dealing with an honest employee.

Many netizens have expressed their astonishment over this scam. One Weibo netizen said: “If we keep money in the bank, the bank should be responsible for our savings. Since the scammer is an employee of the bank, the bank should take the responsibility for his behavior.”

The only way to avoid this scam: if it is too good to be true, it usually is. Double check with other bank staff, and properly read the terms of service. A bank can never make a client refrain from checking their own accounts.

DOUBLE RENT

8. Landlord Message Scam

A common scam, similar to the ‘mistress’ text message and the ‘canceled flight’ one, is a message from your landlord, who says that he has changed phone numbers, and that this month’s rent needs to be transferred to the account of his wife or another bank number.

In the end, it turns out that this message is fake – but meanwhile, many people already transferred the money to the wrong account. They discover they’re duped when they receive a message from their actual landlord who has not received the month’s rent.

These kind of text messages are sent out randomly. Because the message is send out to many people, there are always those who actually need to pay their rent and are used to communicating with their landlord in this way.

NO HAPPY END

9. Massage Parlor Scam

Like with the Tea Ceremony scam, Massage Parlor scammers are focused on western tourists – men in specific. Basically, the scam involves somebody talking you into a massage on the streets. The ‘normal’ massage soon turns out to be a bit more erotic, and before you know it, the massage parlor big boss arrives, the door closes, and you have to pay up a large sum of money. As this tourist describes on Tripadvisor:

“I was offered a foot massage in Shanghai then was taken to a building where a different type of massage was offered on the body. I was forced to pick a girl then it took 10 minutes before we were done. Before the massage they told me about 300 RMB ($40.00) but after the massage a big guy walked in the room with 2 other guys and gave me a bill for $4200.00 which included room rent. I was shocked. They also knew which hotel I stayed.”

A host of a Dutch undercover show gets scammed in Shanghai (SBS6).

It is a common scam, especially in Shanghai city centre, that could end up becoming very costly.

Similarly, there is the KTV scam where people will lure tourists into nightclubs or karaoke and overcharge them on drinks. Avoiding these scams is simple: just do not trust anyone who approaches you on the street to take you to a club or salon.

NONE OF YOUR BUSINESS

10. China’s Pyramid Schemes (chuanxiao)

China’s ‘chuanxiao‘ scheme arguably is the most large-scale and psychological scam of this list. So-called ‘multi-level marketing’ (传销) or ‘pyramid schemes’ are quite commonplace in China, especially in certain provinces (Anhui, Hunan). New members are always is introduced to these schemes through old friends, former classmates, or relatives.

Chuanxiao are almost like cults, where people get trained in how to trick their Chinese friends into joining them. As explained in this blog by Nao, chuanxiao schemes are not about selling products, but about getting more people to join. The money people spend to join the group goes to the person above them, and the people above them. People are convinced (brainwashed?) they will eventually become millionaires if they stick to the group long enough.

People in chuanxiao live as a community, and collaborate on how to bond with new people and get them to join – and get their money into the system. Friends are usually invited to come over from other provinces for a business opportunity, or as a holiday, and are then taken into the group. Chuanxiao are psychological games, where people often only realise they have been scammed when it is already too late.

Know more scams you would like to share? Please leave your comment in the comment section below, or email us.

By Manya Koetse

Follow @WhatsOnWeibo

©2015 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

Backgrounder

“Oppenheimer” in China: Highlighting the Story of Qian Xuesen

Qian Xuesen is a renowned Chinese scientist whose life shares remarkable parallels with Oppenheimer’s.

Published

1 year agoon

September 16, 2023By

Zilan Qian

They shared the same campus, lived in the same era, and both played pivotal roles in shaping modern history while navigating the intricate interplay between science and politics. With the release of the “Oppenheimer” movie in China, the renowned Chinese scientist Qian Xuesen is being compared to the American J. Robert Oppenheimer.

In late August, the highly anticipated U.S. movie Oppenheimer finally premiered in China, shedding light on the life of the famous American theoretical physicist J. Robert Oppenheimer (1904-1967).

Besides igniting discussions about the life of this prominent scientist, the film has also reignited domestic media and public interest in Chinese scientists connected to Oppenheimer and nuclear physics.

There is one Chinese scientist whose life shares remarkable parallels with Oppenheimer’s. This is aerospace engineer and cyberneticist Qian Xuesen (钱学森, 1911-2009). Like Oppenheimer, he pursued his postgraduate studies overseas, taught at Caltech, and played a pivotal role during World War II for the US.

Qian Xuesen is so widely recognized in China that whenever I introduce myself there, I often clarify my last name by saying, “it’s the same Qian as Qian Xuesen’s,” to ensure that people get my name.

Some Chinese blogs recently compared the academic paths and scholarly contributions of the two scientists, while others highlighted the similarities in their political challenges, including the revocation of their security clearances.

The era of McCarthyism in the United States cast a shadow over Qian’s career, and, similar to Oppenheimer, he was branded as a “communist suspect.” Eventually, these political pressures forced him to return to China.

Although Qian’s return to China made his later life different from Oppenheimer’s, both scientists lived their lives navigating the complex dynamics between science and politics. Here, we provide a brief overview of the life and accomplishments of Qian Xuesen.

Departing: Going to America

Qian Xuesen (钱学森, also written as Hsue-Shen Tsien), often referred to as the “father of China’s missile and space program,” was born in Shanghai in 1911,1 a pivotal year marked by a historic revolution that brought an end to the imperial dynasty and gave rise to the Republic of China.

Much like Oppenheimer, who pursued further studies at Cambridge after completing his undergraduate education, Qian embarked on a journey to the United States following his bachelor’s studies at National Chiao Tung University (now Shanghai Jiao Tong University). He spent a year at Tsinghua University in preparation for his departure.

The year was 1935, during the eighth year of the Chinese Civil War and the fourth year of Japan’s invasion of China, setting the backdrop for his academic pursuits in a turbulent era.

Qian in his office at Caltech (image source).

One year after arriving in the U.S., Qian earned his master’s degree in aeronautical engineering from the Massachusetts Institute of Technology (MIT). Three years later, in 1939, the 27-year-old Qian Xuesen completed his PhD at the California Institute of Technology (Caltech), the very institution where Oppenheimer had been welcomed in 1927. In 1943, Qian solidified his position in academia as an associate professor at Caltech. While at Caltech, Qian helped found NASA’s Jet Propulsion Laboratory.

When World War II began, while Oppenheimer was overseeing the Manhattan Project’s efforts to assist the U.S. in developing the atomic bomb, Qian actively supported the U.S. government. He served on the U.S. government’s Scientific Advisory Board and attained the rank of lieutenant colonel.

The first meeting of the US Department of the Air Force Scientific Advisory Board in 1946. The predecessor, the Scientific Advisory Group, was founded in 1944 to evaluate the aeronautical programs and facilities of the Axis powers of World War II. Qian can be seen standing in the back, the second on the left (image source).

After the war, Qian went to teach at MIT and returned to Caltech as a full-time professor in 1949. During that same year, Mao Zedong proclaimed the establishment of the People’s Republic of China (PRC). Just one year later, the newly-formed nation became involved in the Korean War, and China fought a bloody battle against the United States.

Red Scare: Being Labeled as a Communist

Robert Oppenheimer and Qian Xuesen both had an interest in Communism even prior to World War II, attending communist gatherings and showing sympathy towards the Communist cause.

Qian and Oppenheimer may have briefly met each other through their shared involvement in communist activities. During his time at Caltech, Qian secretly attended meetings with Frank Oppenheimer, the brother of J. Robert Oppenheimer (Monk 2013).

However, it was only after the war that their political leanings became a focal point for the FBI.

Just as the FBI accused Oppenheimer of being an agent of the Soviet Union, they quickly labeled Qian as a subversive communist, largely due to his Chinese heritage. While the government did not succeed in proving that Qian had communist ties with China during that period, they did ultimately succeed in portraying Qian as a communist affiliated with China a decade later.

During the transition from the 1940s to the 1950s, the Cold War was underway, and the anti-communist witch-hunts associated with the McCarthy era started to intensify (BBC 2020).

In 1950, the Korean War erupted, with the People’s Republic of China (PRC) joining North Korea in the conflict against South Korea, which received support from the United States. It was during this tumultuous period that the FBI officially accused Qian of communist sympathies in 1950, leading to the revocation of his security clearance despite objections from Qian’s colleagues. Four years later, in 1954, Robert Oppenheimer went through a similar process.

The 1950’s security hearing of Qian (second left). (Image source).

After losing his security clearance, Qian began to pack up, saying he wanted to visit his aging parents back home. Federal agents seized his luggage, which they claimed contained classified materials, and arrested him on suspicion of subversive activity. Although Qian denied any Communist leanings and rejected the accusation, he was detained by the government in California and spent the next five years under house arrest.

Five years later, in 1955, two years after the end of the Korean War, Qian was sent home to China as part of an apparent exchange for 11 American airmen who had been captured during the war. He told waiting reporters he “would never step foot in America again,” and he kept his promise (BBC 2020).

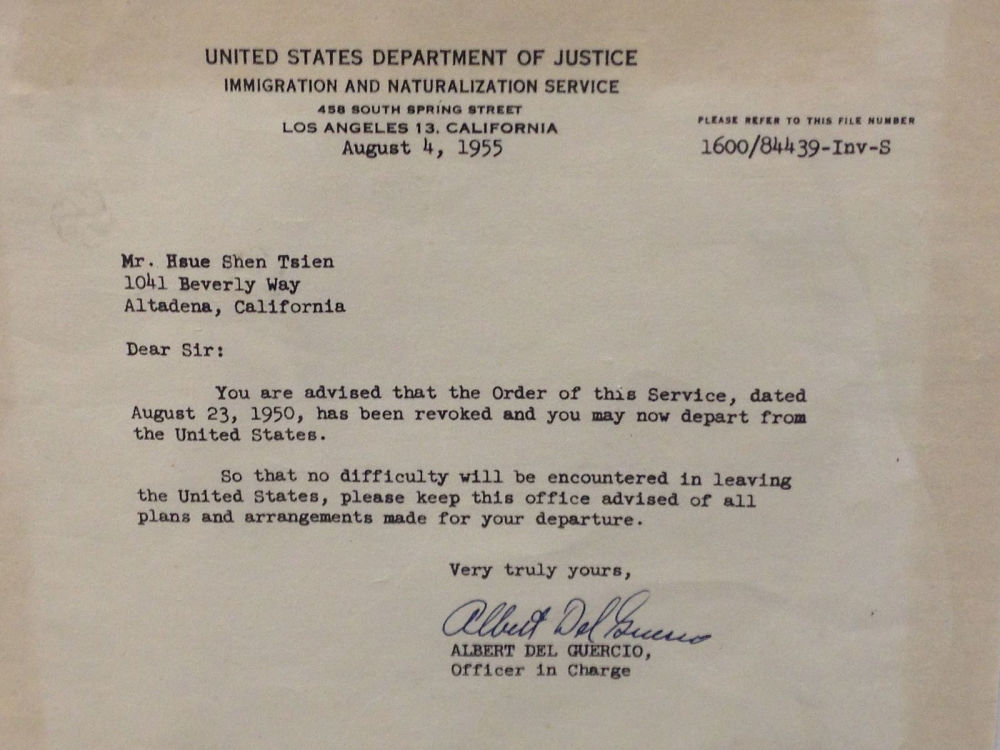

A letter from the US Immigration and Naturalization Service to Qian Xuesen, dated August 4, 1955, in which he was notified he was allowed to leave the US. The original copy is owned by Qian Xuesen Library of Shanghai Jiao Tong University, where the photo was taken. (Caption and image via wiki).

Dan Kimball, who was the Secretary of the US Navy at the time, expressed his regret about Qian’s departure, reportedly stating, “I’d rather shoot him dead than let him leave America. Wherever he goes, he equals five divisions.” He also stated: “It was the stupidest thing this country ever did. He was no more a communist than I was, and we forced him to go” (Perrett & Bradley, 2008).

Kimball may have foreseen the unfolding events accurately. After his return to China, Qian did indeed assume a pivotal role in enhancing China’s military capabilities, possibly surpassing the potency of five divisions. The missile programme that Qian helped develop in China resulted in weapons which were then fired back on America, including during the 1991 Gulf War (BBC 2020).

Returning: Becoming a National Hero

The China that Qian Xuesen had left behind was an entirely different China than the one he returned to. China, although having relatively few experts in the field, was embracing new possibilities and technologies related to rocketry and space exploration.

Within less than a month of his arrival, Qian was welcomed by the then Vice Prime Minister Chen Yi, and just four months later, he had the honor of meeting Chairman Mao himself.

Qian and Mao (image source).

In China, Qian began a remarkably successful career in rocket science, with great support from the state. He not only assumed leadership but also earned the distinguished title of the “father” of the Chinese missile program, instrumental in equipping China with Dongfeng ballistic missiles, Silkworm anti-ship missiles, and Long March space rockets.

Additionally, his efforts laid the foundation for China’s contemporary surveillance system.

By now, Qian has become somewhat of a folk hero. His tale of returning to China despite being thwarted by the U.S. government has become like a legendary narrative in China: driven by unwavering patriotism, he willingly abandoned his overseas success, surmounted formidable challenges, and dedicated himself to his motherland.

Throughout his lifetime, Qian received numerous state medals in recognition of his work, establishing him as a nationally celebrated intellectual. From 1989 to 2001, the state-launched public movement “Learn from Qian Xuesen” was promoted throughout the country, and by 2001, when Qian turned 90, the national praise for him was on a similar level as that for Deng Xiaoping in the decade prior (Wang 2011).

Qian Xuesen remains a celebrated figure. On September 3rd of this year, a new “Qian Xuesen School” was established in Wenzhou, Zhejiang Province, becoming the sixth high school bearing the scientist’s name since the founding of the first one only a year ago.

In 2017, the play “Qian Xuesen” was performed at Qian’s alma mater, Shanghai Jiaotong University. (Image source.)

Qian Xuesen’s legacy extends well beyond educational institutions. His name frequently appears in the media, including online articles, books, and other publications. There is the Qian Xuesen Library and a museum in Shanghai, containing over 70,000 artefacts related to him. Qian’s life story has also been the inspiration for a theater production and a 2012 movie titled Hsue-Shen Tsien (钱学森).2

Unanswered Questions

As is often the case when people are turned into heroes, some part of the stories are left behind while others are highlighted. This holds true for both Robert Oppenheimer and Qian Xuesen.

The Communist Party of China hailed Qian as a folk hero, aligning with their vision of a strong, patriotic nation. Many Chinese narratives avoid the debate over whether Qian’s return was linked to problems and accusations in the U.S., rather than genuine loyalty to his homeland.

In contrast, some international media have depicted Qian as a “political opportunist” who returned to China due to disillusionment with the U.S., also highlighting his criticism of “revisionist” colleagues during the Cultural Revolution and his denunciation of the 1989 student demonstrations.

Unlike the image of a resolute loyalist favored by the Chinese public, Qian’s political ideology was, in fact, not consistently aligned, and there were instances where he may have prioritized opportunity over loyalty at different stages of his life.

Qian also did not necessarily aspire to be a “flawless hero.” Upon returning to China, he declined all offers to have his biography written for him and refrained from sharing personal information with the media. Consequently, very little is known about his personal life, leaving many questions about the motivations driving him, and his true political inclinations.

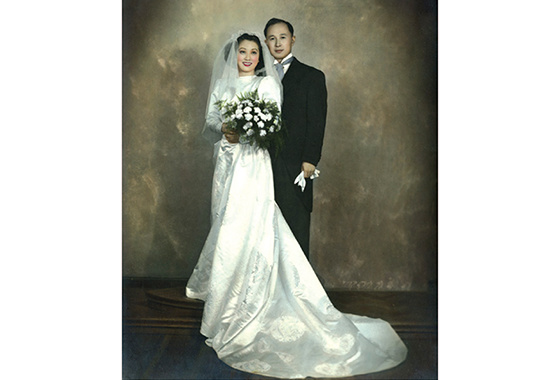

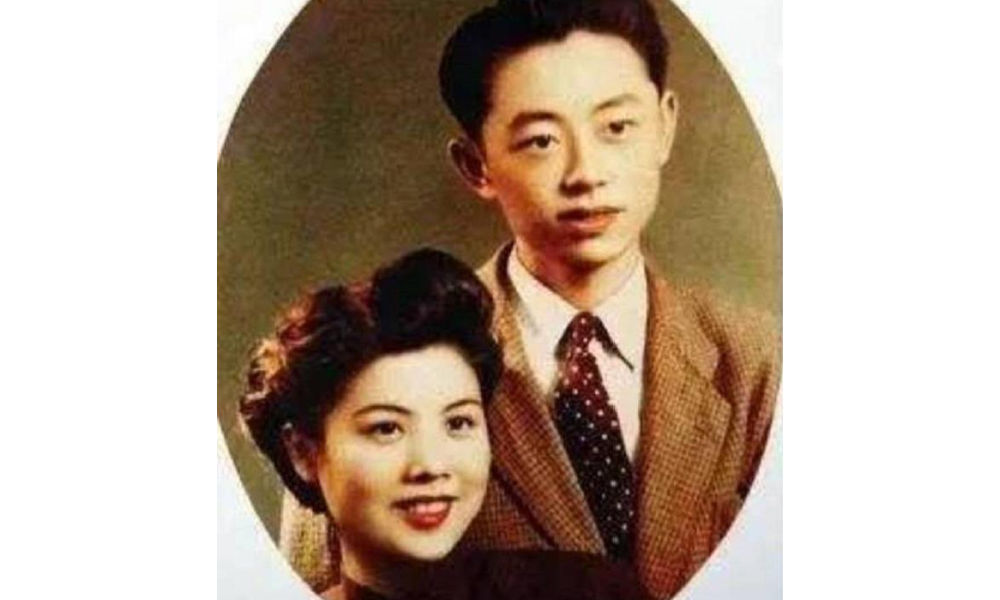

The marriage photo of Qian and Jiang. (Image source).

We do know that Qian’s wife, Jiang Ying (蒋英), had a remarkable background. She was of Chinese-Japanese mixed race and was the daughter of a prominent military strategist associated with Chiang Kai-shek. Jiang Ying was also an accomplished opera singer and later became a professor of music and opera at the Central Conservatory of Music in Beijing.

Just as with Qian, there remain numerous unanswered questions surrounding Oppenheimer, including the extent of his communist sympathies and whether these sympathies indirectly assisted the Soviet Union during the Cold War.

Perhaps both scientists never imagined they would face these questions when they first decided to study physics. After all, they were scientists, not the heroes that some narratives portray them to be.

Also read:

■ Farewell to a Self-Taught Master: Remembering China’s Colorful, Bold, and Iconic Artist Huang Yongyu

■ “His Name Was Mao Anying”: Renewed Remembrance of Mao Zedong’s Son on Chinese Social Media

By Zilan Qian

Follow @whatsonweibo

1 Some sources claim that Qian was born in Hangzhou, while others say he was born in Shanghai with ancestral roots in Hangzhou.

2The Chinese character 钱 is typically romanized as “Qian” in Pinyin. However, “Tsien” is a romanization in Wu Chinese, which corresponds to the dialect spoken in the region where Qian Xuesen and his family have ancestral roots.

This article has been edited for clarity by Manya Koetse

References (other sources hyperlinked in text)

BBC. 2020. “Qian Xuesen: The man the US deported – who then helped China into space.” BBC.com, 27 October https://www.bbc.com/news/stories-54695598 [9.16.23].

Monk, Ray. 2013. Robert Oppenheimer: A Life inside the Center, First American Edition. New York: Doubleday.

Perrett, Bradley, and James R. Asker. 2008. “Person of the Year: Qian Xuesen.” Aviation Week and Space Technology 168 (1): 57-61.

Wang, Ning. 2011. “The Making of an Intellectual Hero: Chinese Narratives of Qian Xuesen.” The China Quarterly, 206, 352-371. doi:10.1017/S0305741011000300

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Backgrounder

Farewell to a Self-Taught Master: Remembering China’s Colorful, Bold, and Iconic Artist Huang Yongyu

Renowned Chinese artist and the creator of the ‘Blue Rabbit’ zodiac stamp Huang Yongyu has passed away at the age of 98. “I’m not afraid to die. If I’m dead, you may tickle me and see if I smile.”

Published

1 year agoon

June 15, 2023

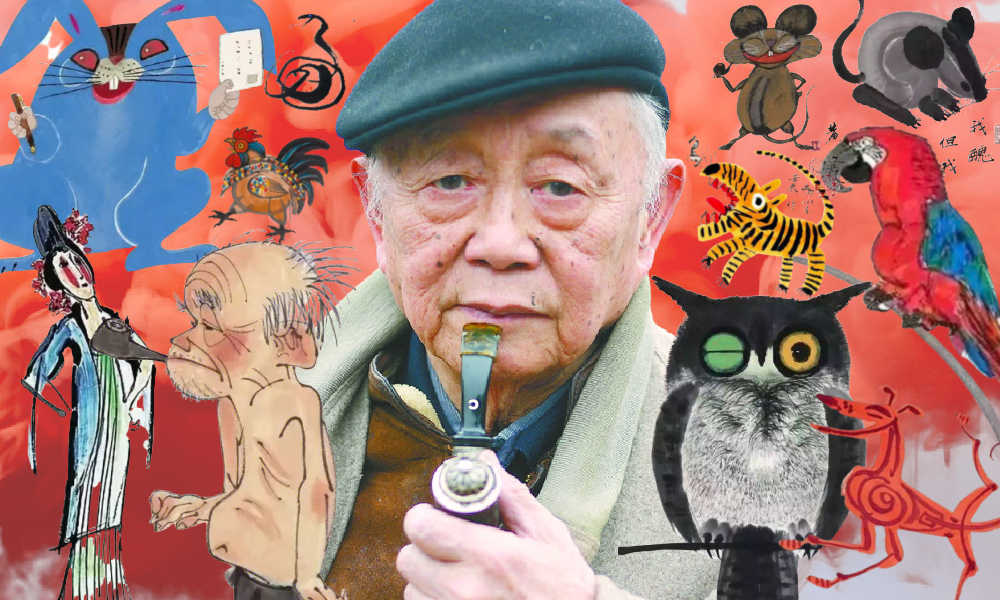

The famous Chinese painter, satirical poet, and cartoonist Huang Yongyu has passed away. Born in 1924, Huang endured war and hardship, yet never lost his zest for life. When his creativity was hindered and his work was suppressed during politically tumultuous times, he remained resilient and increased “the fun of living” by making his world more colorful.

He was a youthful optimist at old age, and will now be remembered as an immortal legend. The renowned Chinese painter and stamp designer Huang Yongyu (黄永玉) passed away on June 13 at the age of 98. His departure garnered significant attention on Chinese social media platforms this week.

On Weibo, the hashtag “Huang Yongyu Passed Away” (#黄永玉逝世#) received over 160 million views by Wednesday evening.

Huang was a member of the China National Academy of Painting (中国国家画院) as well as a Professor at the Central Academy of Fine Arts (中央美术学院).

Huang Yongyu is widely recognized in China for his notable contribution to stamp design, particularly for his iconic creation of the monkey stamp in 1980. Although he designed a second monkey stamp in 2016, the 1980 stamp holds significant historical importance as it marked the commencement of China Post’s annual tradition of releasing zodiac stamps, which have since become highly regarded and collectible items.

Huang’s famous money stamp that was issued by China Post in 1980.

The monkey stamp designed by Huang Yongyu has become a cherished collector’s item, even outside of China. On online marketplaces like eBay, individual stamps from this series are being sold for approximately $2000 these days.

Huang Yongyu’s latest most famous stamp was this year’s China Post zodiac stamp. The stamp, a blue rabbit with red eyes, caused some online commotion as many people thought it looked “horrific.”

Some thought the red-eyed blue rabbit looked like a rat. Others thought it looked “evil” or “monster-like.” There were also those who wondered if the blue rabbit looked so wild because it just caught Covid.

Huang’s (in)famous blue rabbit stamp.

Nevertheless, many people lined up at post offices for the stamps and they immediately sold out.

In light of the controversy, Huang Yongyu spoke about the stamps in a livestream in January of 2023. The 98-year-old artist claimed he had simply drawn the rabbit to spread joy and celebrate the new year, stating, “Painting a rabbit stamp is a happy thing. Everyone could draw my rabbit. It’s not like I’m the only one who can draw this.”

Huang’s response also went viral, with one Weibo hashtag dedicated to the topic receiving over 12 million views (#蓝兔邮票设计者直播回应争议#) at the time. Those defending Huang emphasized how it was precisely his playful, light, and unique approach to art that has made Huang’s work so famous.

A Self-Made Artist

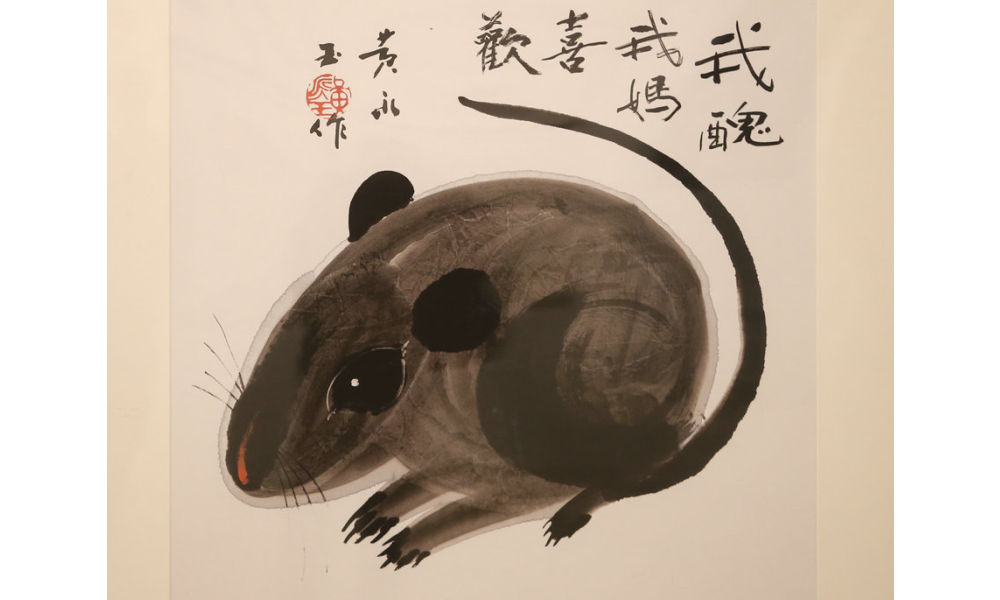

“I’m ugly, but my mum likes me”

‘Ugly Mouse’ by Huang Yongyu [Image via China Daily].

Huang Yongyu was born on August 9, 1924, in Hunan’s Chengde as a native of the Tujia ethnic group.

He was born into an extraordinary family. His grandfather, Huang Jingming (黄镜铭), worked for Xiong Xiling (熊希齡), who would become the Premier of the Republic of China. His first cousin and lifelong friend was the famous Chinese novelist Shen Congwen (沈从文). Huang’s father studied music and art and was good at drawing and playing the accordion. His mother graduated from the Second Provincial Normal School and was the first woman in her county to cut her hair short and wear a short skirt (CCTV).

Born in times of unrest and poverty, Huang never went to college and was sent away to live with relatives at the age of 13. His father would die shortly after, depriving him of a final goodbye. Huang started working in various places and regions, from porcelain workshops in Dehua to artisans’ spaces in Quanzhou. At the age of 16, Huang was already earning a living as a painter and woodcutter, showcasing his talents and setting the foundation for his future artistic pursuits.

When he was 22, Huang married his first girlfriend Zhang Meixi (张梅溪), a general’s daughter, with whom he shared a love for animals. He confessed his love for her when they both found themselves in a bomb shelter after an air-raid alarm.

Huang and Zhang Meixi [163.com]

In his twenties, Huang Yongyu emerged as a sought-after artist in Hong Kong, where he had relocated in 1948 to evade persecution for his left-wing activities. Despite achieving success there, he heeded Shen Congwen’s advice in 1953 and moved to Beijing. Accompanied by his wife and their 7-month-old child, Huang took on a teaching position at the esteemed Central Academy of Fine Arts (中央美术学院).

The couple raised all kinds of animals at their Beijing home, from dogs and owls to turkeys and sika deers, and even monkeys and bears (Baike).

Throughout Huang’s career, animals played a significant role, not only reflecting his youthful spirit but also serving as vehicles for conveying satirical messages.

One recurring motif in his artwork was the incorporation of mice. In one of his famous works, a grey mouse is accompanied by the phrase ‘I’m ugly, but my mum likes me’ (‘我丑,但我妈喜欢’), reinforcing the notion that regardless of our outward appearance or circumstances, we remain beloved children in the eyes of our mothers.

As a teacher, Huang liked to keep his lessons open-minded and he, who refused to join the Party himself, stressed the importance of art over politics. He would hold “no shirt parties” in which his all-male studio students would paint in an atmosphere of openness and camaraderie during hot summer nights (Andrews 1994, 221; Hawks 2017, 99).

By 1962, creativity in the classroom was limited and there were far more restrictions to what could and could not be created, said, and taught.

Bright Colors in Dark Times

“Strengthen my resolve and increase the fun of living”

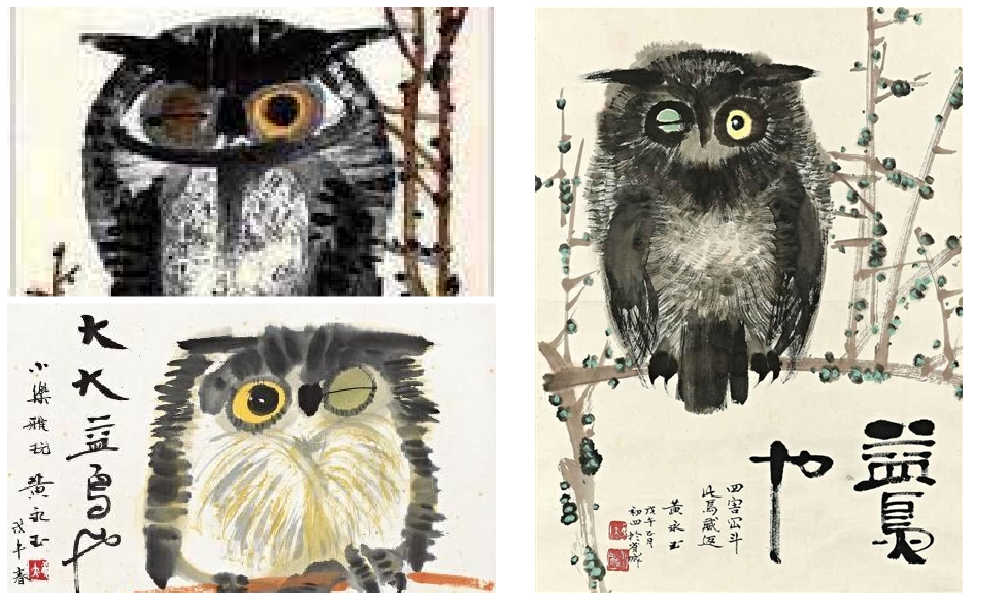

Huang Yongyu’s winking owl, 1973, via Wikiart.

In 1963, Huang was sent to the countryside as part of the “Four Cleanups” movement (四清运动, 1963-1966). Although Huang cooperated with the requirement to attend political meetings and do farm work, he distanced himself from attempts to reform his thinking. In his own time, and even during political meetings, he would continue to compose satirical and humorous pictures and captions centered around animals, which would later turn into his ‘A Can of Worms’ series (Hawks 2017, 99; see Morningsun.org).

Three years later, at the beginning of the Cultural Revolution, many Chinese major artists, including Huang, were detained in makeshift jails called ‘niupeng‘ (牛棚), cowsheds. Huang’s work was declared to be counter-revolutionary, and he was denounced and severely beaten. Despite the difficult circumstances, Huang’s humor and kindness would remind his fellow artist prisoners of the joy of daily living (2017, 95-96).

After his release, Huang and his family were relocated to a cramped room on the outskirts of Beijing. The authorities, thinking they could thwart his artistic pursuits, provided him with a shed that had only one window, which faced a neighbor’s wall. However, this limitation didn’t deter Huang. Instead, he ingeniously utilized vibrant pigments that shone brightly even in the dimly lit space.

During this time, he also decided to make himself an “extra window” by creating an oil painting titled “Eternal Window” (永远的窗户). Huang later explained that the flower blossoms in the paining were also intended to “strengthen my resolve and increase the fun of living” (Hawks 2017, 4; 100-101).

Huang Yongyu’s Eternal Window [Baidu].

In 1973, during the peak of the Cultural Revolution, Huang painted his famous winking owl. The calligraphy next to the owl reads: “During the day people curse me with vile words, but at night I work for them” (“白天人们用恶毒的语言诅咒我,夜晚我为他们工作”) (Matthysen 2021, 165).

The painting was seen as a display of animosity towards the regime, and Huang got in trouble for it. Later on in his career, however, Huang would continue to paint owls. In 1977, when the Cultural Revolution had ended, Huang Yongyu painted other owls to ridicules his former critics (2021, 174).

According to art scholar Shelly Drake Hawks, Huang Yongyu employed animals in his artwork to satirize the realities of life under socialism. This approach can be loosely compared to George Orwell’s famous novel Animal Farm.

However, Huang’s artistic style, vibrant personal life, and boundary-pushing work ethic also draw parallels to Picasso. Like Picasso, Huang embraced a colorful life, adopted an innovative approach to art, and challenged artistic norms.

An Optimist Despite All Hardships

“Quickly come praise me, while I’m still alive”

Huang Yongyu will be remembered in China with love and affection for numerous reasons. Whether it is his distinctive artwork, his mischievous smile and trademark pipe, his unwavering determination to follow his own path despite the authorities’ expectations, or his enduring love for his wife of over 75 years, there are countless aspects to appreciate and admire about Huang.

One things that is certainly admirable is how he was able to maintain a youthful and joyful attitude after suffering many hardships and losing so many friends.

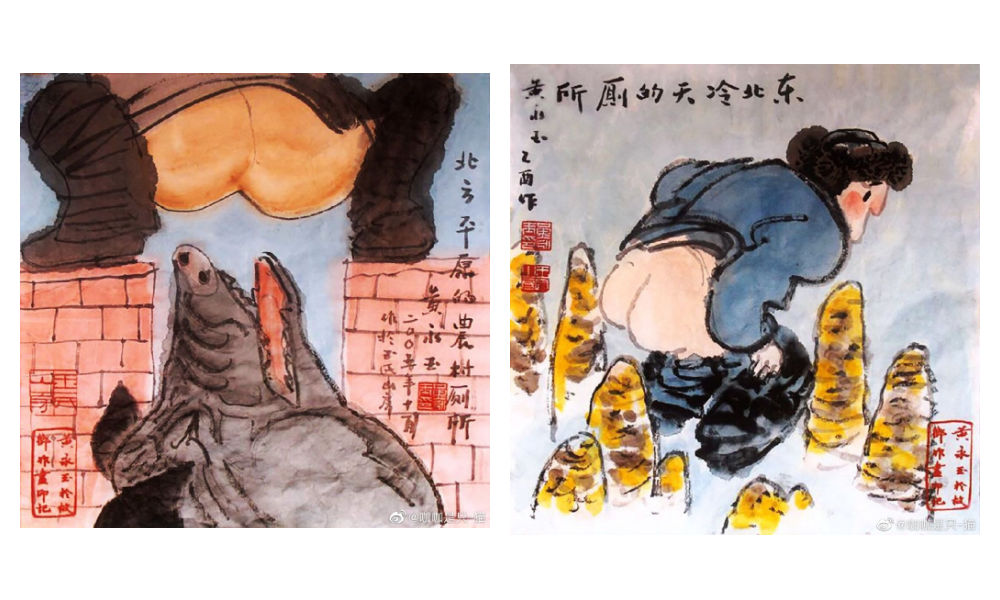

“An intriguing soul. Too wonderful to describe,” one Weibo commenter wrote about Huang, sharing pictures of Huang Yongyu’s “Scenes of Pooping” (出恭图) work.

Old age did not hold him back. At the age of 70, his paintings sold for millions. When he was in his eighties, he was featured on the cover of Esquire (时尚先生) magazine.

At the age of 82, he stirred controversy in Hong Kong with his “Adam and Eve” sculpture featuring male and female genitalia, leading to complaints from some viewers. When confronted with the backlash, Huang answered, “I just wanted to have a taste of being sued, and see how the government would react” (Ora Ora).

I'm guessing the 98-year-old Huang loved the controversy. When confronted with backlash for his sculpture featuring male and female genitalia in 2007 Hong Kong, Huang answered, "I just wanted to have a taste of being sued, and see how the government would react." pic.twitter.com/kG0MVVM4SN

— Manya Koetse (@manyapan) June 15, 2023

In his nineties, he started driving a Ferrari. He owned mansions in his hometown in Hunan, in Beijing, in Hong Kong, and in Italy – all designed by himself (Chen 2019).

Huang kept working and creating until the end of his life. “It’s good to work diligently. Your work may be meaningful. Maybe it won’t be. Don’t insist on life being particularly meaningful. If it’s happy and interesting, then that’s great enough.”

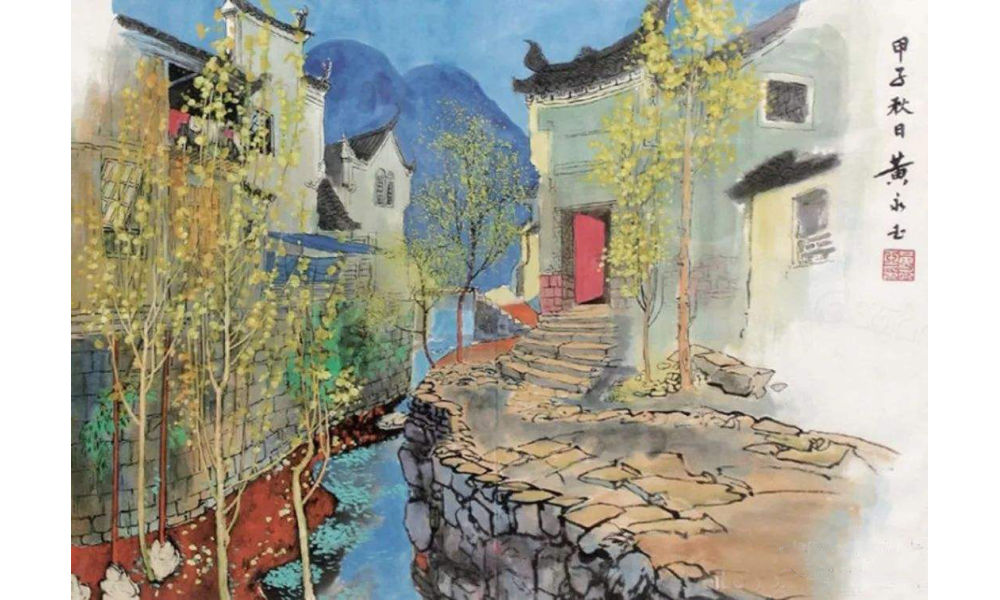

“Hometown Scenery” or rather “Hunan Scenery” (湘西风景) by Huang.

Huang did not dread the end of his life.

“My old friends have all died, I’m the only one left,” he said at the age of 95. He wrote his will early and decided he wanted a memorial service for himself before his final departure. “Quickly come praise me, while I’m still alive,” he said, envisioning himself reclining on a chair in the center of the room, “listening to how everyone applauds me” (CCTV, Sohu).

He stated: “I don’t fear death at all. I always joke that when I die, you should tickle me first and see if I’ll smile” (“对死我是一点也不畏惧,我开玩笑,我等死了之后先胳肢我一下,看我笑不笑”).

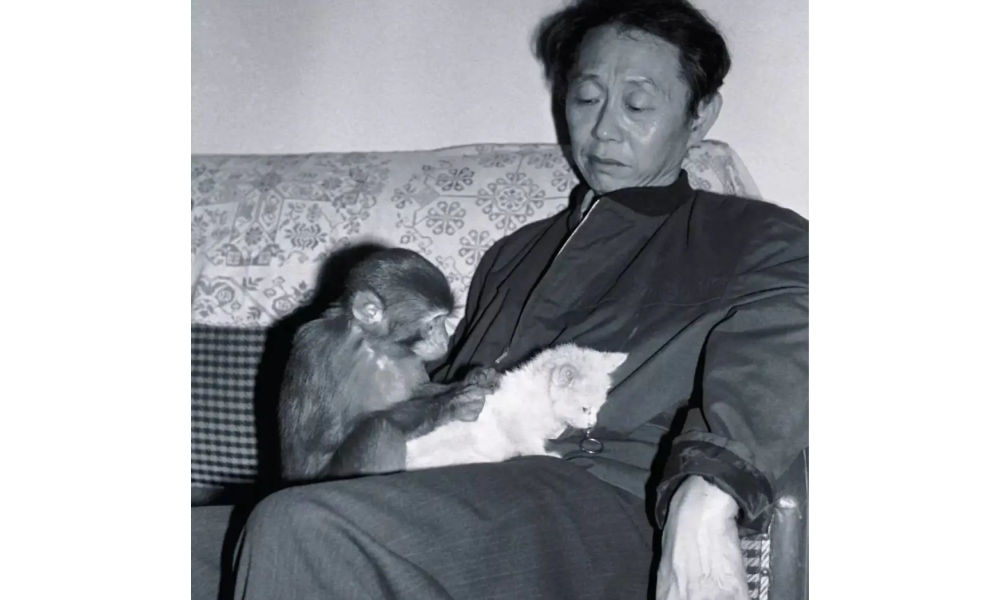

Huang with Yiwo (伊喔), the original model for the monkey stamp [Shanghai Observer].

Huang also was not sentimental about what should happen to his ashes. In a 2019 article in Guangming Daily, it was revealed that he suggested to his wife the idea of pouring his ashes into the toilet and flushing them away with the water.

However, his wife playfully retorted, saying, “No, that won’t do. Your life has been too challenging; you would clog the toilet.”

To this, Huang responded, “Then wrap my ashes into dumplings and let everyone [at the funeral] eat them, so you can tell them, ‘You’ve consumed Huang Yongyu’s ashes!'”

But she also opposed of that idea, saying that they would vomit and curse him forever.

Nevertheless, his wife expressed opposition to this idea, citing concerns that it would cause people to vomit and curse him indefinitely.

In response, Huang declared, “Then let’s forget about my ashes. If you miss me after I’m gone, just look up at the sky and the clouds.” Eventually, his wife would pass away before him, in 2020, at the age of 98, having spent 77 years together with Huang.

Huang will surely be missed. Not just by the loved ones he leaves behind, but also by millions of his fans and admirers in China and beyond.

“We will cherish your memory, Mr. Huang,” one Weibo blogger wrote. Others honor Huang by sharing some of his famous quotes, such as, “Sincerity is more important than skill, which is why birds will always sing better than humans” (“真挚比技巧重要,所以鸟总比人唱得好”).

Among thousands of other comments, another social media user bid farewell to Huang Yongyu: “Our fascinating Master has transcended. He is now a fascinating soul. We will fondly remember you.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

References

Andrews, Julia Frances. 1994. Painters and Politics in the People’s Republic of China, 1949-1979. Berkley: University of California Press.

Baike. “Huang Yongyu 黄永玉.” Baidu Baike https://baike.baidu.com/item/%E9%BB%84%E6%B0%B8%E7%8E%89/1501951 [June 14, 2023].

CCTV. 2023. “Why Everyone Loves Huang Yongyu [为什么人人都爱黄永玉].” WeChat 央视网 June 14.

Chen Hongbiao 陈洪标. 2019. “Most Spicy Artist: Featured in a Magazine at 80, Flirting with Lin Qingxia at 91, Playing with Cars at 95, Wants Memorial Service While Still Alive [最骚画家:80岁上杂志,91岁撩林青霞,95岁玩车,活着想开追悼会].” Sohu/Guangming Daily March 16: https://www.sohu.com/a/301686701_819105 [June 15, 2023].

Hawks, Shelley Drake. 2017. The Art of Resistance Painting by Candlelight in Mao’s China. Seattle: University of Washington Press.

Matthysen, Mieke. 2021. Ignorance is Bliss: The Chinese Art of Not Knowing. Palgrave Macmillan.

Ora Ora. “HUANG YONGYU 黃永玉.” Ora Ora https://www.ora-ora.com/artists/103-huang-yongyu/ [June 15, 2023].

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

The Viral Bao’an: How a Xiaoxitian Security Guard Became Famous Over a Pay Raise

The Hashtagification of Chinese Propaganda

Hidden Hotel Cameras in Shijiazhuang: Controversy and Growing Distrust

Death of Chinese Female Motorcycle Influencer ‘Shigao ProMax’ Sparks Debate on Risky Rides for Online Attention

Why the “人人人人景点人人人人” Hashtag is Trending Again on Chinese Social Media

About Wang Chuqin’s Broken Paddle at Paris 2024

“Land Rover Woman” Sparks Outrage: Qingdao Road Rage Incident Goes Viral in China

China at Paris 2024 Olympics Trend File: Medals and Moments on Chinese Social Media

Weibo Watch: The Land Rover Woman Controversy Explained

Stolen Bodies, Censored Headlines: Shanxi Aorui’s Human Bone Scandal

Fired After Pregnancy Announcement: Court Case Involving Pregnant Employee Sparks Online Debate

Weibo Watch: Going the Wrong Way

Team China’s 10 Most Meme-Worthy Moments at the 2024 Paris Olympics

Weibo Watch: Shaping Olympic Narratives

“No Kimonos Allowed” – Ongoing Debate on Japanese Attire in China

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight6 months ago

China Insight6 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music7 months ago

China Music7 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Insight8 months ago

China Insight8 months agoThe ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

-

China Insight11 months ago

China Insight11 months agoThe Story of Li Jun & Liang Liang: How the Challenges of an Ordinary Chinese Couple Captivated China’s Internet

de Wijs

July 9, 2015 at 10:23 pm

In Taiwan there have been scams like a stranger calling you to tell you your child has been abducted. They will even play a tape to ‘prove’ this is indeed the case, and then tell you to hand over a certain amount of money. As with all strange messages/communication, always double check!

Ann

July 9, 2015 at 10:32 pm

Also I’ve heard of set ups of men intimidating women, and a black cab coming in between as a ‘rescuer’ who turns out to be part of the plot. When the woman goes in the cab, she will be robbed.

aaa

July 10, 2015 at 4:40 pm

“taxi’s” should be “taxis”

Johnny Rico

July 10, 2015 at 7:44 pm

The 100 yuan note trick: you pay with a 100 note at a corner shop, the owner receives it, swaps it for a fake one under the counter. He then calls you back, telling you that you gave him fake money and he wants a different 100 note.

Jan

July 11, 2015 at 5:16 am

I missed the banknote teller machine scam. Say, you pay 1200 RMB, 12 notes of 100 RMB. They put it in the manipulated teller machine and it shows you gave only 11 notes and you need to give one more.

David

July 9, 2016 at 4:54 pm

Many thanks for sharing Manya! Some of these scams are really creative and it’s scary imagining how many people are being scammed by them. Thankfully, for travellers/foreigners in China, they are less likely to face some of these scams, but they are not spared by the many other scams such as the one you have raised such as the tea ceremony scam and massage parlour scam. From research (http://travelscams.org/asia/common-tourist-scams-china/), some other scams to look out for are fake money, fake taxis, fake jade, fake traditional chinese medicine shops and even fake bus stops!

Vanlal Dinpuia

August 13, 2016 at 10:53 pm

What about red mercury scam in China ?

Keith

December 13, 2016 at 4:10 pm

Does anyone know about Gold market scam seems many people are being targeted to invest all savings into spot markets

Peng Liang

January 13, 2017 at 8:53 am

I got experienced it once on 10th Jan 2017. The lady (seems attractive) been talking to me about it and telling me why choose gold market instead of stocks. She send me a website called goldunitedltd.com and saying it’s under strict hong kong laws and regulations so it can’t be a fraud. She will slowly ice-break with you and then she would say normally she would not do this but she can help you to open a VIP account but you have to keep it a secret as it’s against company’s policy. 50k usd for VIP and just let her know how much I want/can invest and she will help me anytime. 8-10% ROI every month. Well, I’m not a very good investor but that kind of ROI just based on gold binary options, is a high chance fraud. I did not put my money in anyway.

Knee Active Plus quando prenderlo

January 5, 2018 at 11:35 am

This is my first time pay a quick visit at here and i

am truly pleassant to read everthing at one place.

Website: Knee Active Plus quando prenderlo

Mariette Ashford

May 3, 2018 at 1:32 am

One wouldn’t really think much of this, all I really wanted to do was invest and be part of it but the way I was lied by this brokers was terrible, to easily take money from all in the name of investment and when I wanted to make withdrawals every single attempt was fruitless with constant hassle to invest more I really can’t say more than I have already said. I would really consider myself to be one of the very few lucky ones as I was able to have my funds recovered from this scam Binary option brokers, although it was through unethical means as far I am concerned but what can I care after how my hard-earned funds where taken from me, these guys are the best in less than 7days all my funds including bonuses had been recovered, If your broker lost your funds trading Binary options Geminihacks.com are more than able to get your funds back without any traces best of luck people.

Chui

October 27, 2018 at 12:13 pm

There are tons of scams all over the internet and in person. I have been in this situation, after falling for the rampant investment scam scourging everywhere. I was devastated but got referred to a firm that helped out to get over 1million HKD back from them.

You can reach out to the consultant who helped

maxgale08 atgeemail dotcom

Jaxia Quest

January 20, 2019 at 1:40 am

So glad I am never going to travel to China. But still nice to know, so I can watch out for scammers here in the states and online.

MT

June 12, 2019 at 10:28 am

Recently I met a Chinese lady in Tinder. She seems to be nice and we chatted for quite some time (almost 1 week). She seems very genuine, telling about her life, what she do, her struggles..etc. She send picture of herself and say we both get along well. Unknowingly along the line she did mention about investing on stocks & forex, even show me her statement how much she earn from it. She said her cousin are financial expert and the one that give the tip to her. I find it bit odd but I believe at first. Now after 1 week of nice chatting, the critical point question came in. She said since she making so much, she can help me. Why don’t I setup an account (she gave me a link) and when she receive latest news then I can follow to buy in. Let’s make money together…

I am typically very careful with all these things, especially when it comes to money. What I am so sad was that I thought I would have a nice lady as a friend (or maybe more) but my defense instinct kicks in pretty quick when she mention about the investment. I am sad cos I invested my time to chat with her not knowing is all a SCAM! 🙁

San

September 3, 2019 at 3:32 pm

One of my nephews was applying to China for further studies and guy name Lee W. Yong was contacted. He promised that he can get him in to well reputed university, Peking University, with monthly stipends and scholarship. He had put his advertising in WeChat. He called his company China Student Consulting.

Then he starts to demand money for the process. His parents transferred the money with the hope for their son’s better future.

Once they sent him all the demanded fee, he started to beg for more. He said the customs office is asking money to send the documents. You could tell that he was lying. Once his family started to demand for proof of their son’s admission. He would argue that everything is ready to ship and waiting for demanded extra money. So far he took 6300RMB. And when his parent admanantly asked for proof, he blocked them in WeChat account. Now he is out of reach enjoying his loot of somebody’s hard earned money.