Backgrounder

“Divorced Yet?” – Why China Has a Soaring Divorce Rate

The divorce rate in China increased by 3.9 percent over the last year. “Have you divorced today?” (今天你离了吗) has become a common joke between Chinese people.

Published

9 years agoon

By

Yiying Fan

The divorce rate in China increased to 3.9 percent over the last year, with 3.63 million couples bringing their marriage to an end, according to the latest data released by the Ministry of Civil Affairs. The rate has been rising for twelve consecutive years since 2003. “Have you divorced today?” (今天你离了吗) has recently become a common joke between Chinese people. While some blame China’s social media, others say the reasons for the soaring divorce rates can be found elsewhere.

In its Social Service Development Statistical Bulletin, the Chinese government recently reported that the national divorce rate soared to 2.67 percent in 2014, compared to 1.05 percent in 2003, and 0.4 percent in 1985. The renowned Chinese magazine Banyuetan (半月谈) interviewed couples about their reasons for divorce in June, concluding that the mass adoption of social media across China is mostly responsible for the rising divorce rate in China. A lot of couples think that social media has turned them away from each other.

The report also stated that Chinese social media apps such as Weixin (微信, WeChat) and Momo (陌陌, Chinese ‘Tinder’) have made it easier to reach out to people, which has messed up a lot of marriages.

On Sina Weibo, over a dozen of media, including People’s Daily (人民日报) and Global Times (环球时报), recently took the topic online to initiate a discussion amongst netizens on whether social media is the killer of marriages in China.

“Social media have made having an affair so easy.”

User AkiraHunter commented: “It’s really not easy to maintain a relationship or a marriage. In my opinion, social media is a major problem. WeChat, Momo and Century Love (世纪佳缘) have become key tools when it comes to hooking up. Social media have made having an affair so easy.”

Other users, however, do not believe that social media are the biggest reason to trigger divorce. Some think that the higher divorce rate can be explained by the social progress and growing gender equality in China.

“I don’t think social media are to be blamed for the high divorce rate. It’s rather just a medium for expressing human thoughts and desires,” says user Night of Anhui Sound: “The divorce rate in China would have kept rising without the existence of social media too, as society is making more progress and genders are more equal. Women now know how to protect themselves in cases of domestic violence or extramarital affairs.”

User Arale1 added: “We used to think that divorce is a shame for women. A lot of Chinese women put up with a dead marriage for the sake of their children, and because they needed financial support from their husbands. But nowadays, women don’t really need men to support them, as many women start to make more money than men. We have realized that we shouldn’t discommode ourselves anymore. Getting divorced is not the end of the world. On the contrary: it could be the beginning of a new happy life.”

“Nearly 40% of marriages in Beijing end in divorce.”

It’s worth noting that the comments above only apply to women in urban areas, where the divorce rate is much higher than in rural China. Nearly 40 percent of marriages in Beijing end in divorce – a remarkable peak compared to the national divorce rate of 2.67 percent.

Chinese women in big cities and urban regions now have more opportunities for higher education leading to well-paid jobs, which makes them financially independent. Young women in China don’t need to rely on their husband to support them anymore. Thus, money is no long the reason for not getting a divorce.

In rural areas, however, people are still not that tolerant of divorce. Many women are forced to stay in a broken marriage in order not to ruin their families’ reputation. It would also be more difficult for a divorced woman in rural China to find another man who is willing to marry her.

Another factor that cannot be neglected in this issue, is the China’s one child policy (独生子女政策). The post-1980s generation (80后) has been raised as an only child in the family, without having a siblings to interact with. This so-called “me generation” is often described as being selfish, impulsive and unwilling to compromise. Their parents urge them to get married, and then interfere with their marriages. The combination of these factors seems to be a major contributor to the higher divorce rate. According to the Ministry of Civil Affairs, of all couples filing for divorce in 2014, those born in the 80s had the highest divorce rate. “Lightning divorce” (闪婚闪离) has specifically been a trend among this ‘me generation’.

“We didn’t want to compromise, so we just got divorced.”

Unlike the dating culture in most western countries, Chinese couples usually do not live together before they decide to tie the knot. Typically, they date for a year or two – going to the movies, having dinner, occasionally having sex in a hotel room, or taking a few short trips together. Then the parents start to pressure them to get married. Some young women choose to get married in order not to become ‘leftover women‘ (剩女).

“Parents and other relatives won’t give you enough time to figure out with whom or when you want to be married. They believe it’s time to do it when you reach certain age. They pressure you so hard! We got married shortly after dating, and then realized we don’t even share the same values in life. As the only child in the family, no one wanted to compromise, so we just got divorced,” confesses Weibo user Kianase.

“Getting divorced for two dollars.”

In addition to the above reasons, the easy procedure and low cost of getting divorced in China also cause rising divorce rates. Before 2003, a reference from either the employer or a community leader was required for applying for a divorce. Many couples would not consider divorce due to the humiliating process. But now the rules have changed, and this is no longer needed. Unlike couples in other countries that are required to separate for a period of time before they can legally file for divorce, separation is not required in China. Couples can quickly, easily, and privately file for divorce. The divorce fee is less than two dollars and even free of charge in some cities.

However, these procedures are, again, changing. Some local civil affair departments have just launched the new policy of “limited numbers of divorce” (限号离婚), in hopes of decreasing impulsive divorces. Citizens in Guangzhou posted on Sina Weibo that they have to wait for at least a month to file for divorce.

The new policy finds online support. As the user Yefuping says: “Some government working efficiencies should be improved, while others should be slowed down. The speed of processing divorce should definitely be reduced, so that couples have some time to think twice before they sign the papers.”

By Yiying Fan

Follow @WhatsOnWeibo

©2015 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

About the author: Yiying Fan is a world traveler and Chinese freelance writer from Shanghai.

Backgrounder

“Oppenheimer” in China: Highlighting the Story of Qian Xuesen

Qian Xuesen is a renowned Chinese scientist whose life shares remarkable parallels with Oppenheimer’s.

Published

10 months agoon

September 16, 2023By

Zilan Qian

They shared the same campus, lived in the same era, and both played pivotal roles in shaping modern history while navigating the intricate interplay between science and politics. With the release of the “Oppenheimer” movie in China, the renowned Chinese scientist Qian Xuesen is being compared to the American J. Robert Oppenheimer.

In late August, the highly anticipated U.S. movie Oppenheimer finally premiered in China, shedding light on the life of the famous American theoretical physicist J. Robert Oppenheimer (1904-1967).

Besides igniting discussions about the life of this prominent scientist, the film has also reignited domestic media and public interest in Chinese scientists connected to Oppenheimer and nuclear physics.

There is one Chinese scientist whose life shares remarkable parallels with Oppenheimer’s. This is aerospace engineer and cyberneticist Qian Xuesen (钱学森, 1911-2009). Like Oppenheimer, he pursued his postgraduate studies overseas, taught at Caltech, and played a pivotal role during World War II for the US.

Qian Xuesen is so widely recognized in China that whenever I introduce myself there, I often clarify my last name by saying, “it’s the same Qian as Qian Xuesen’s,” to ensure that people get my name.

Some Chinese blogs recently compared the academic paths and scholarly contributions of the two scientists, while others highlighted the similarities in their political challenges, including the revocation of their security clearances.

The era of McCarthyism in the United States cast a shadow over Qian’s career, and, similar to Oppenheimer, he was branded as a “communist suspect.” Eventually, these political pressures forced him to return to China.

Although Qian’s return to China made his later life different from Oppenheimer’s, both scientists lived their lives navigating the complex dynamics between science and politics. Here, we provide a brief overview of the life and accomplishments of Qian Xuesen.

Departing: Going to America

Qian Xuesen (钱学森, also written as Hsue-Shen Tsien), often referred to as the “father of China’s missile and space program,” was born in Shanghai in 1911,1 a pivotal year marked by a historic revolution that brought an end to the imperial dynasty and gave rise to the Republic of China.

Much like Oppenheimer, who pursued further studies at Cambridge after completing his undergraduate education, Qian embarked on a journey to the United States following his bachelor’s studies at National Chiao Tung University (now Shanghai Jiao Tong University). He spent a year at Tsinghua University in preparation for his departure.

The year was 1935, during the eighth year of the Chinese Civil War and the fourth year of Japan’s invasion of China, setting the backdrop for his academic pursuits in a turbulent era.

Qian in his office at Caltech (image source).

One year after arriving in the U.S., Qian earned his master’s degree in aeronautical engineering from the Massachusetts Institute of Technology (MIT). Three years later, in 1939, the 27-year-old Qian Xuesen completed his PhD at the California Institute of Technology (Caltech), the very institution where Oppenheimer had been welcomed in 1927. In 1943, Qian solidified his position in academia as an associate professor at Caltech. While at Caltech, Qian helped found NASA’s Jet Propulsion Laboratory.

When World War II began, while Oppenheimer was overseeing the Manhattan Project’s efforts to assist the U.S. in developing the atomic bomb, Qian actively supported the U.S. government. He served on the U.S. government’s Scientific Advisory Board and attained the rank of lieutenant colonel.

The first meeting of the US Department of the Air Force Scientific Advisory Board in 1946. The predecessor, the Scientific Advisory Group, was founded in 1944 to evaluate the aeronautical programs and facilities of the Axis powers of World War II. Qian can be seen standing in the back, the second on the left (image source).

After the war, Qian went to teach at MIT and returned to Caltech as a full-time professor in 1949. During that same year, Mao Zedong proclaimed the establishment of the People’s Republic of China (PRC). Just one year later, the newly-formed nation became involved in the Korean War, and China fought a bloody battle against the United States.

Red Scare: Being Labeled as a Communist

Robert Oppenheimer and Qian Xuesen both had an interest in Communism even prior to World War II, attending communist gatherings and showing sympathy towards the Communist cause.

Qian and Oppenheimer may have briefly met each other through their shared involvement in communist activities. During his time at Caltech, Qian secretly attended meetings with Frank Oppenheimer, the brother of J. Robert Oppenheimer (Monk 2013).

However, it was only after the war that their political leanings became a focal point for the FBI.

Just as the FBI accused Oppenheimer of being an agent of the Soviet Union, they quickly labeled Qian as a subversive communist, largely due to his Chinese heritage. While the government did not succeed in proving that Qian had communist ties with China during that period, they did ultimately succeed in portraying Qian as a communist affiliated with China a decade later.

During the transition from the 1940s to the 1950s, the Cold War was underway, and the anti-communist witch-hunts associated with the McCarthy era started to intensify (BBC 2020).

In 1950, the Korean War erupted, with the People’s Republic of China (PRC) joining North Korea in the conflict against South Korea, which received support from the United States. It was during this tumultuous period that the FBI officially accused Qian of communist sympathies in 1950, leading to the revocation of his security clearance despite objections from Qian’s colleagues. Four years later, in 1954, Robert Oppenheimer went through a similar process.

The 1950’s security hearing of Qian (second left). (Image source).

After losing his security clearance, Qian began to pack up, saying he wanted to visit his aging parents back home. Federal agents seized his luggage, which they claimed contained classified materials, and arrested him on suspicion of subversive activity. Although Qian denied any Communist leanings and rejected the accusation, he was detained by the government in California and spent the next five years under house arrest.

Five years later, in 1955, two years after the end of the Korean War, Qian was sent home to China as part of an apparent exchange for 11 American airmen who had been captured during the war. He told waiting reporters he “would never step foot in America again,” and he kept his promise (BBC 2020).

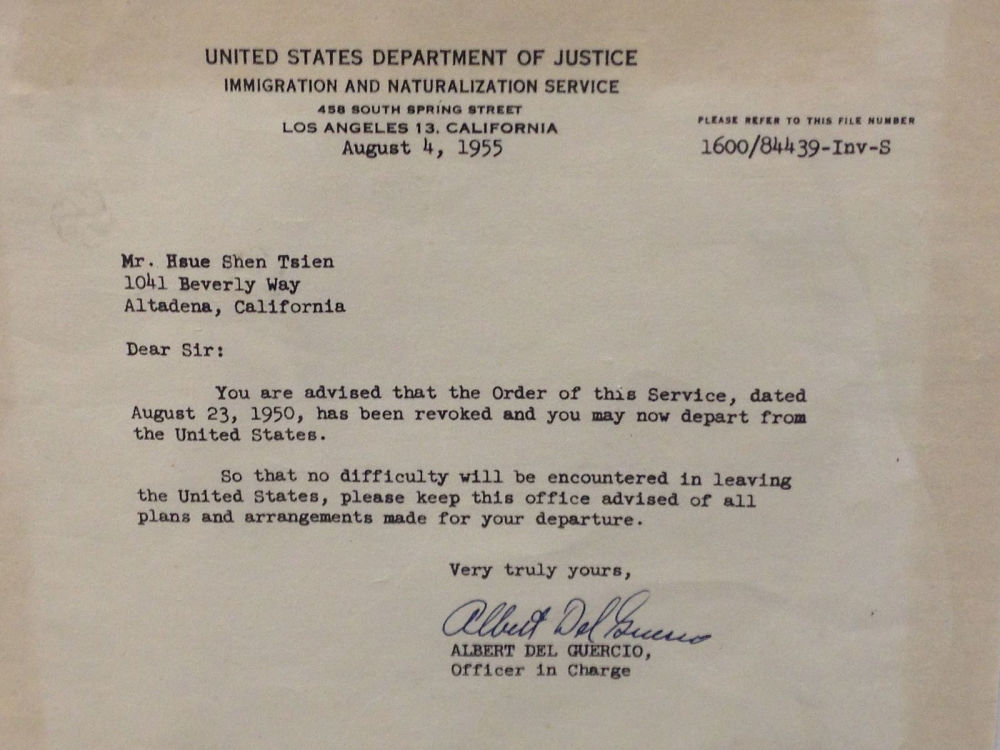

A letter from the US Immigration and Naturalization Service to Qian Xuesen, dated August 4, 1955, in which he was notified he was allowed to leave the US. The original copy is owned by Qian Xuesen Library of Shanghai Jiao Tong University, where the photo was taken. (Caption and image via wiki).

Dan Kimball, who was the Secretary of the US Navy at the time, expressed his regret about Qian’s departure, reportedly stating, “I’d rather shoot him dead than let him leave America. Wherever he goes, he equals five divisions.” He also stated: “It was the stupidest thing this country ever did. He was no more a communist than I was, and we forced him to go” (Perrett & Bradley, 2008).

Kimball may have foreseen the unfolding events accurately. After his return to China, Qian did indeed assume a pivotal role in enhancing China’s military capabilities, possibly surpassing the potency of five divisions. The missile programme that Qian helped develop in China resulted in weapons which were then fired back on America, including during the 1991 Gulf War (BBC 2020).

Returning: Becoming a National Hero

The China that Qian Xuesen had left behind was an entirely different China than the one he returned to. China, although having relatively few experts in the field, was embracing new possibilities and technologies related to rocketry and space exploration.

Within less than a month of his arrival, Qian was welcomed by the then Vice Prime Minister Chen Yi, and just four months later, he had the honor of meeting Chairman Mao himself.

Qian and Mao (image source).

In China, Qian began a remarkably successful career in rocket science, with great support from the state. He not only assumed leadership but also earned the distinguished title of the “father” of the Chinese missile program, instrumental in equipping China with Dongfeng ballistic missiles, Silkworm anti-ship missiles, and Long March space rockets.

Additionally, his efforts laid the foundation for China’s contemporary surveillance system.

By now, Qian has become somewhat of a folk hero. His tale of returning to China despite being thwarted by the U.S. government has become like a legendary narrative in China: driven by unwavering patriotism, he willingly abandoned his overseas success, surmounted formidable challenges, and dedicated himself to his motherland.

Throughout his lifetime, Qian received numerous state medals in recognition of his work, establishing him as a nationally celebrated intellectual. From 1989 to 2001, the state-launched public movement “Learn from Qian Xuesen” was promoted throughout the country, and by 2001, when Qian turned 90, the national praise for him was on a similar level as that for Deng Xiaoping in the decade prior (Wang 2011).

Qian Xuesen remains a celebrated figure. On September 3rd of this year, a new “Qian Xuesen School” was established in Wenzhou, Zhejiang Province, becoming the sixth high school bearing the scientist’s name since the founding of the first one only a year ago.

In 2017, the play “Qian Xuesen” was performed at Qian’s alma mater, Shanghai Jiaotong University. (Image source.)

Qian Xuesen’s legacy extends well beyond educational institutions. His name frequently appears in the media, including online articles, books, and other publications. There is the Qian Xuesen Library and a museum in Shanghai, containing over 70,000 artefacts related to him. Qian’s life story has also been the inspiration for a theater production and a 2012 movie titled Hsue-Shen Tsien (钱学森).2

Unanswered Questions

As is often the case when people are turned into heroes, some part of the stories are left behind while others are highlighted. This holds true for both Robert Oppenheimer and Qian Xuesen.

The Communist Party of China hailed Qian as a folk hero, aligning with their vision of a strong, patriotic nation. Many Chinese narratives avoid the debate over whether Qian’s return was linked to problems and accusations in the U.S., rather than genuine loyalty to his homeland.

In contrast, some international media have depicted Qian as a “political opportunist” who returned to China due to disillusionment with the U.S., also highlighting his criticism of “revisionist” colleagues during the Cultural Revolution and his denunciation of the 1989 student demonstrations.

Unlike the image of a resolute loyalist favored by the Chinese public, Qian’s political ideology was, in fact, not consistently aligned, and there were instances where he may have prioritized opportunity over loyalty at different stages of his life.

Qian also did not necessarily aspire to be a “flawless hero.” Upon returning to China, he declined all offers to have his biography written for him and refrained from sharing personal information with the media. Consequently, very little is known about his personal life, leaving many questions about the motivations driving him, and his true political inclinations.

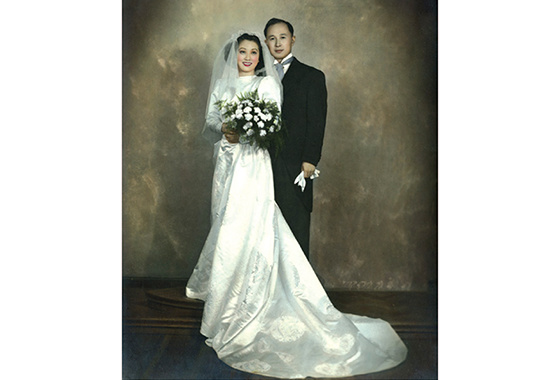

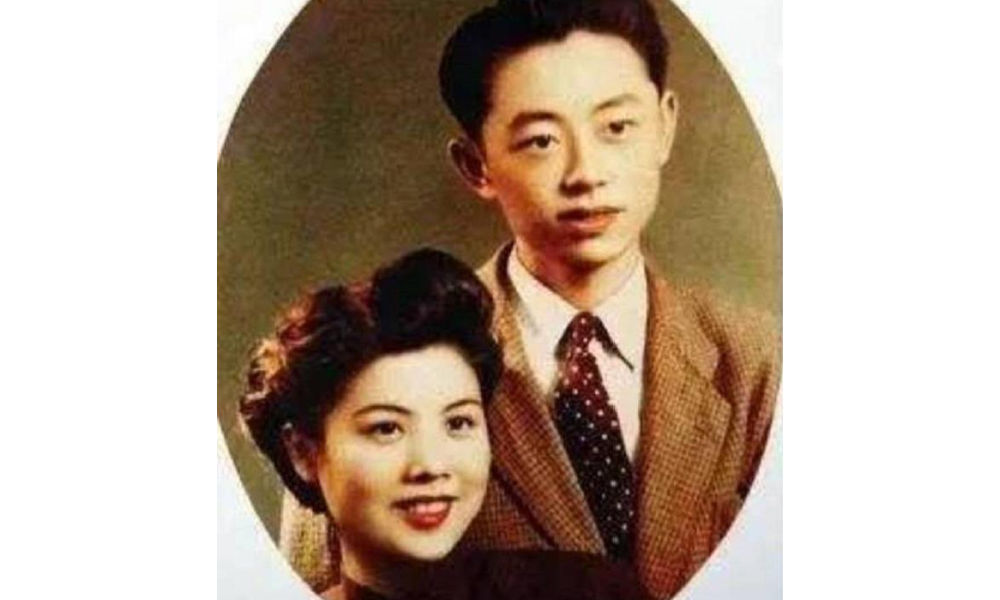

The marriage photo of Qian and Jiang. (Image source).

We do know that Qian’s wife, Jiang Ying (蒋英), had a remarkable background. She was of Chinese-Japanese mixed race and was the daughter of a prominent military strategist associated with Chiang Kai-shek. Jiang Ying was also an accomplished opera singer and later became a professor of music and opera at the Central Conservatory of Music in Beijing.

Just as with Qian, there remain numerous unanswered questions surrounding Oppenheimer, including the extent of his communist sympathies and whether these sympathies indirectly assisted the Soviet Union during the Cold War.

Perhaps both scientists never imagined they would face these questions when they first decided to study physics. After all, they were scientists, not the heroes that some narratives portray them to be.

Also read:

■ Farewell to a Self-Taught Master: Remembering China’s Colorful, Bold, and Iconic Artist Huang Yongyu

■ “His Name Was Mao Anying”: Renewed Remembrance of Mao Zedong’s Son on Chinese Social Media

By Zilan Qian

Follow @whatsonweibo

1 Some sources claim that Qian was born in Hangzhou, while others say he was born in Shanghai with ancestral roots in Hangzhou.

2The Chinese character 钱 is typically romanized as “Qian” in Pinyin. However, “Tsien” is a romanization in Wu Chinese, which corresponds to the dialect spoken in the region where Qian Xuesen and his family have ancestral roots.

This article has been edited for clarity by Manya Koetse

References (other sources hyperlinked in text)

BBC. 2020. “Qian Xuesen: The man the US deported – who then helped China into space.” BBC.com, 27 October https://www.bbc.com/news/stories-54695598 [9.16.23].

Monk, Ray. 2013. Robert Oppenheimer: A Life inside the Center, First American Edition. New York: Doubleday.

Perrett, Bradley, and James R. Asker. 2008. “Person of the Year: Qian Xuesen.” Aviation Week and Space Technology 168 (1): 57-61.

Wang, Ning. 2011. “The Making of an Intellectual Hero: Chinese Narratives of Qian Xuesen.” The China Quarterly, 206, 352-371. doi:10.1017/S0305741011000300

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Backgrounder

Farewell to a Self-Taught Master: Remembering China’s Colorful, Bold, and Iconic Artist Huang Yongyu

Renowned Chinese artist and the creator of the ‘Blue Rabbit’ zodiac stamp Huang Yongyu has passed away at the age of 98. “I’m not afraid to die. If I’m dead, you may tickle me and see if I smile.”

Published

1 year agoon

June 15, 2023

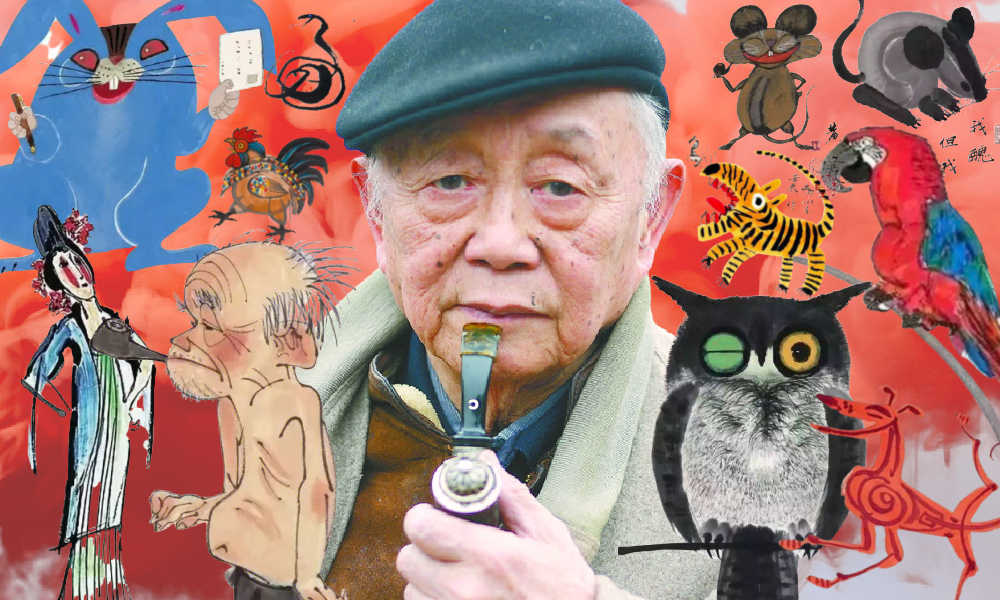

The famous Chinese painter, satirical poet, and cartoonist Huang Yongyu has passed away. Born in 1924, Huang endured war and hardship, yet never lost his zest for life. When his creativity was hindered and his work was suppressed during politically tumultuous times, he remained resilient and increased “the fun of living” by making his world more colorful.

He was a youthful optimist at old age, and will now be remembered as an immortal legend. The renowned Chinese painter and stamp designer Huang Yongyu (黄永玉) passed away on June 13 at the age of 98. His departure garnered significant attention on Chinese social media platforms this week.

On Weibo, the hashtag “Huang Yongyu Passed Away” (#黄永玉逝世#) received over 160 million views by Wednesday evening.

Huang was a member of the China National Academy of Painting (中国国家画院) as well as a Professor at the Central Academy of Fine Arts (中央美术学院).

Huang Yongyu is widely recognized in China for his notable contribution to stamp design, particularly for his iconic creation of the monkey stamp in 1980. Although he designed a second monkey stamp in 2016, the 1980 stamp holds significant historical importance as it marked the commencement of China Post’s annual tradition of releasing zodiac stamps, which have since become highly regarded and collectible items.

Huang’s famous money stamp that was issued by China Post in 1980.

The monkey stamp designed by Huang Yongyu has become a cherished collector’s item, even outside of China. On online marketplaces like eBay, individual stamps from this series are being sold for approximately $2000 these days.

Huang Yongyu’s latest most famous stamp was this year’s China Post zodiac stamp. The stamp, a blue rabbit with red eyes, caused some online commotion as many people thought it looked “horrific.”

Some thought the red-eyed blue rabbit looked like a rat. Others thought it looked “evil” or “monster-like.” There were also those who wondered if the blue rabbit looked so wild because it just caught Covid.

Huang’s (in)famous blue rabbit stamp.

Nevertheless, many people lined up at post offices for the stamps and they immediately sold out.

In light of the controversy, Huang Yongyu spoke about the stamps in a livestream in January of 2023. The 98-year-old artist claimed he had simply drawn the rabbit to spread joy and celebrate the new year, stating, “Painting a rabbit stamp is a happy thing. Everyone could draw my rabbit. It’s not like I’m the only one who can draw this.”

Huang’s response also went viral, with one Weibo hashtag dedicated to the topic receiving over 12 million views (#蓝兔邮票设计者直播回应争议#) at the time. Those defending Huang emphasized how it was precisely his playful, light, and unique approach to art that has made Huang’s work so famous.

A Self-Made Artist

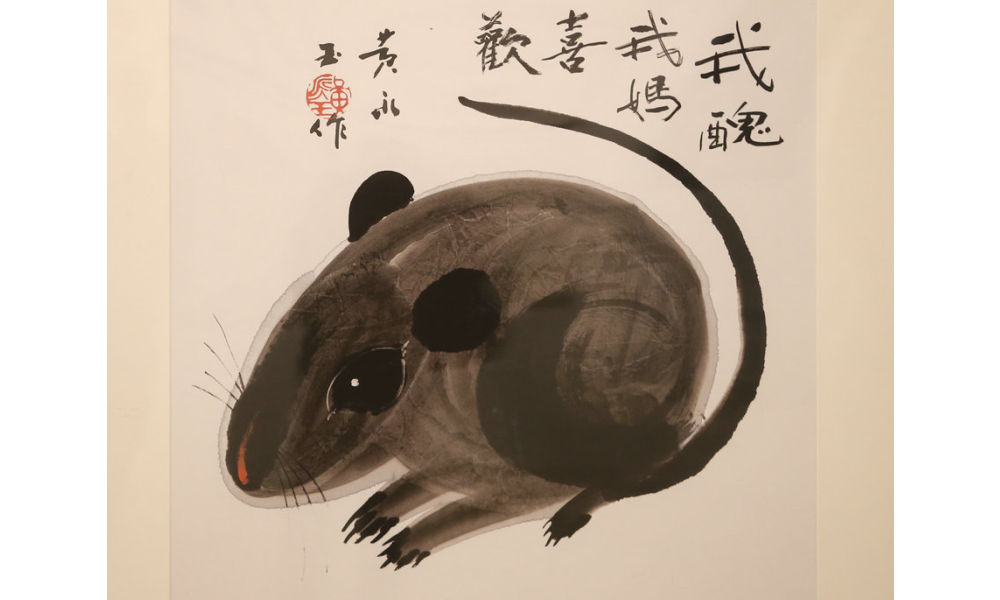

“I’m ugly, but my mum likes me”

‘Ugly Mouse’ by Huang Yongyu [Image via China Daily].

Huang Yongyu was born on August 9, 1924, in Hunan’s Chengde as a native of the Tujia ethnic group.

He was born into an extraordinary family. His grandfather, Huang Jingming (黄镜铭), worked for Xiong Xiling (熊希齡), who would become the Premier of the Republic of China. His first cousin and lifelong friend was the famous Chinese novelist Shen Congwen (沈从文). Huang’s father studied music and art and was good at drawing and playing the accordion. His mother graduated from the Second Provincial Normal School and was the first woman in her county to cut her hair short and wear a short skirt (CCTV).

Born in times of unrest and poverty, Huang never went to college and was sent away to live with relatives at the age of 13. His father would die shortly after, depriving him of a final goodbye. Huang started working in various places and regions, from porcelain workshops in Dehua to artisans’ spaces in Quanzhou. At the age of 16, Huang was already earning a living as a painter and woodcutter, showcasing his talents and setting the foundation for his future artistic pursuits.

When he was 22, Huang married his first girlfriend Zhang Meixi (张梅溪), a general’s daughter, with whom he shared a love for animals. He confessed his love for her when they both found themselves in a bomb shelter after an air-raid alarm.

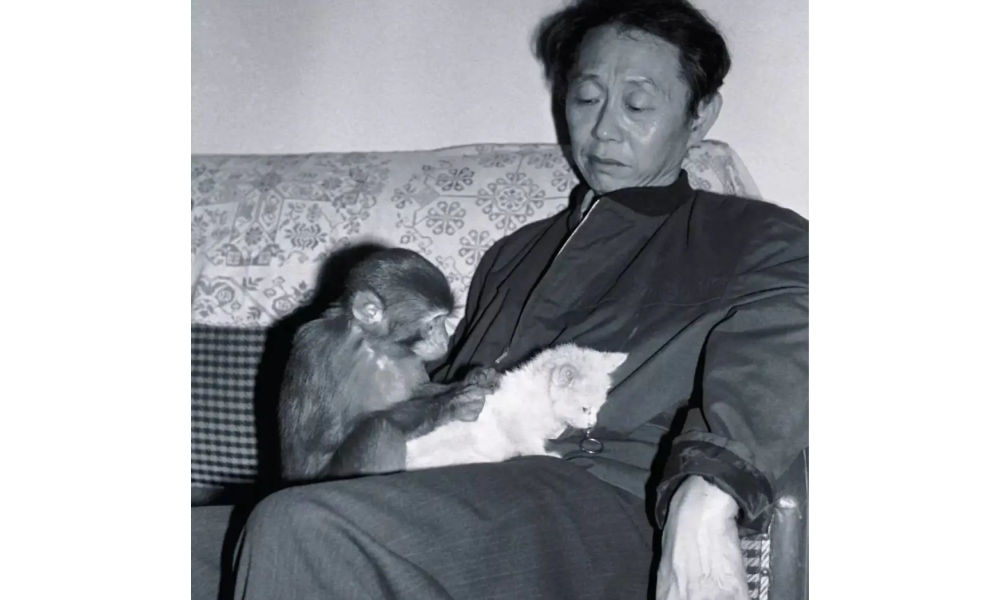

Huang and Zhang Meixi [163.com]

In his twenties, Huang Yongyu emerged as a sought-after artist in Hong Kong, where he had relocated in 1948 to evade persecution for his left-wing activities. Despite achieving success there, he heeded Shen Congwen’s advice in 1953 and moved to Beijing. Accompanied by his wife and their 7-month-old child, Huang took on a teaching position at the esteemed Central Academy of Fine Arts (中央美术学院).

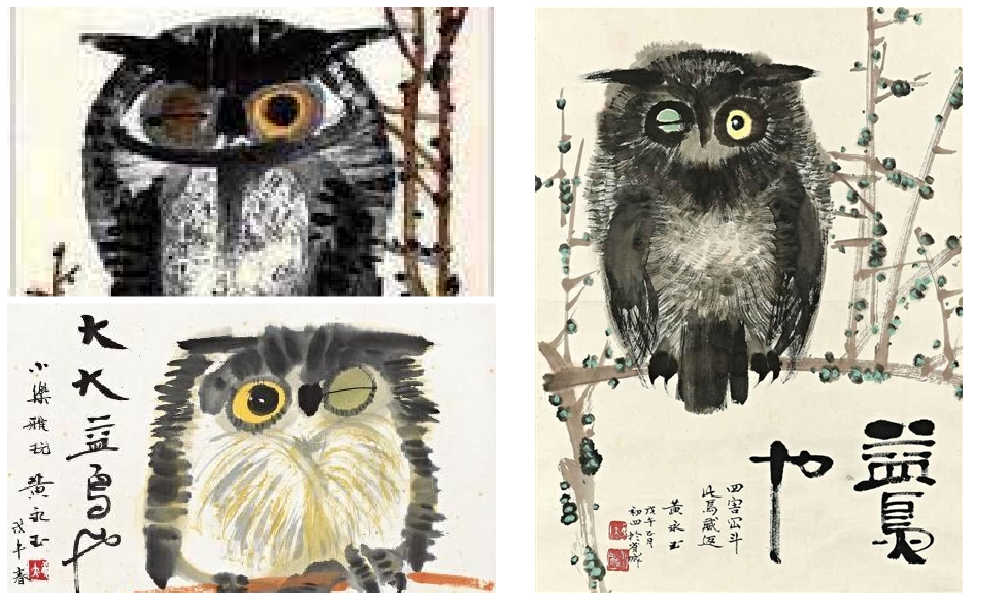

The couple raised all kinds of animals at their Beijing home, from dogs and owls to turkeys and sika deers, and even monkeys and bears (Baike).

Throughout Huang’s career, animals played a significant role, not only reflecting his youthful spirit but also serving as vehicles for conveying satirical messages.

One recurring motif in his artwork was the incorporation of mice. In one of his famous works, a grey mouse is accompanied by the phrase ‘I’m ugly, but my mum likes me’ (‘我丑,但我妈喜欢’), reinforcing the notion that regardless of our outward appearance or circumstances, we remain beloved children in the eyes of our mothers.

As a teacher, Huang liked to keep his lessons open-minded and he, who refused to join the Party himself, stressed the importance of art over politics. He would hold “no shirt parties” in which his all-male studio students would paint in an atmosphere of openness and camaraderie during hot summer nights (Andrews 1994, 221; Hawks 2017, 99).

By 1962, creativity in the classroom was limited and there were far more restrictions to what could and could not be created, said, and taught.

Bright Colors in Dark Times

“Strengthen my resolve and increase the fun of living”

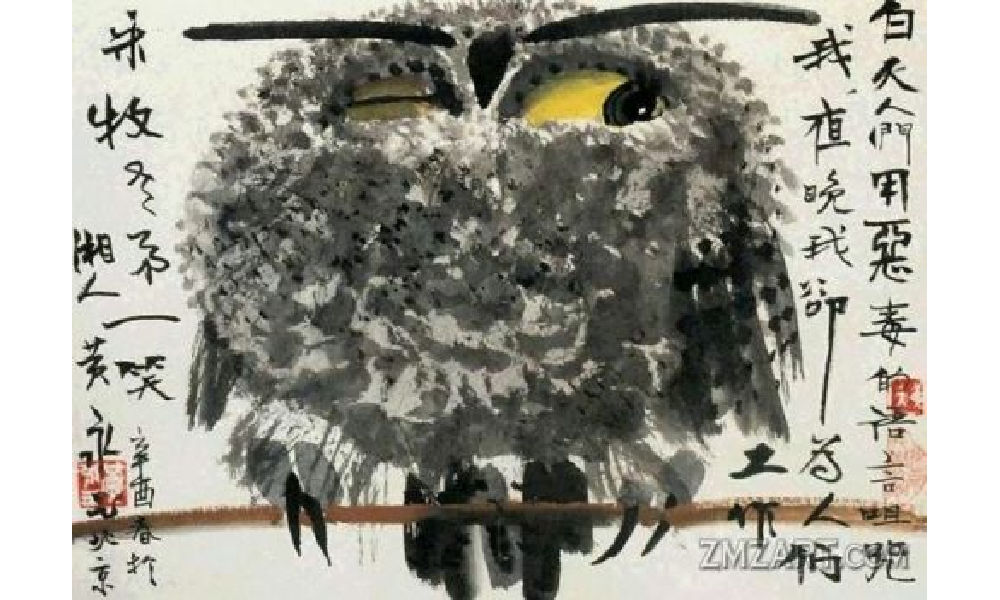

Huang Yongyu’s winking owl, 1973, via Wikiart.

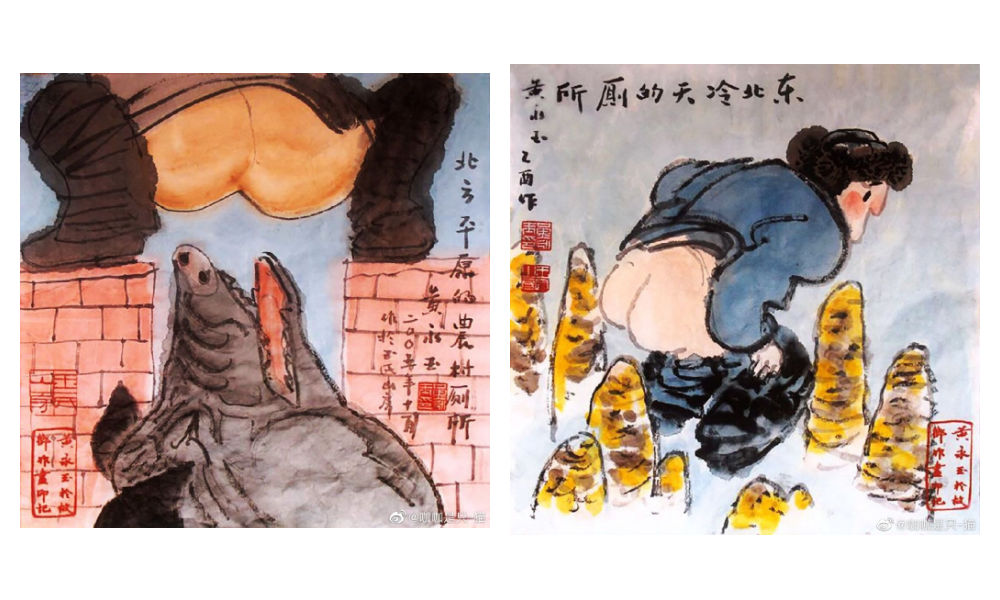

In 1963, Huang was sent to the countryside as part of the “Four Cleanups” movement (四清运动, 1963-1966). Although Huang cooperated with the requirement to attend political meetings and do farm work, he distanced himself from attempts to reform his thinking. In his own time, and even during political meetings, he would continue to compose satirical and humorous pictures and captions centered around animals, which would later turn into his ‘A Can of Worms’ series (Hawks 2017, 99; see Morningsun.org).

Three years later, at the beginning of the Cultural Revolution, many Chinese major artists, including Huang, were detained in makeshift jails called ‘niupeng‘ (牛棚), cowsheds. Huang’s work was declared to be counter-revolutionary, and he was denounced and severely beaten. Despite the difficult circumstances, Huang’s humor and kindness would remind his fellow artist prisoners of the joy of daily living (2017, 95-96).

After his release, Huang and his family were relocated to a cramped room on the outskirts of Beijing. The authorities, thinking they could thwart his artistic pursuits, provided him with a shed that had only one window, which faced a neighbor’s wall. However, this limitation didn’t deter Huang. Instead, he ingeniously utilized vibrant pigments that shone brightly even in the dimly lit space.

During this time, he also decided to make himself an “extra window” by creating an oil painting titled “Eternal Window” (永远的窗户). Huang later explained that the flower blossoms in the paining were also intended to “strengthen my resolve and increase the fun of living” (Hawks 2017, 4; 100-101).

Huang Yongyu’s Eternal Window [Baidu].

In 1973, during the peak of the Cultural Revolution, Huang painted his famous winking owl. The calligraphy next to the owl reads: “During the day people curse me with vile words, but at night I work for them” (“白天人们用恶毒的语言诅咒我,夜晚我为他们工作”) (Matthysen 2021, 165).

The painting was seen as a display of animosity towards the regime, and Huang got in trouble for it. Later on in his career, however, Huang would continue to paint owls. In 1977, when the Cultural Revolution had ended, Huang Yongyu painted other owls to ridicules his former critics (2021, 174).

According to art scholar Shelly Drake Hawks, Huang Yongyu employed animals in his artwork to satirize the realities of life under socialism. This approach can be loosely compared to George Orwell’s famous novel Animal Farm.

However, Huang’s artistic style, vibrant personal life, and boundary-pushing work ethic also draw parallels to Picasso. Like Picasso, Huang embraced a colorful life, adopted an innovative approach to art, and challenged artistic norms.

An Optimist Despite All Hardships

“Quickly come praise me, while I’m still alive”

Huang Yongyu will be remembered in China with love and affection for numerous reasons. Whether it is his distinctive artwork, his mischievous smile and trademark pipe, his unwavering determination to follow his own path despite the authorities’ expectations, or his enduring love for his wife of over 75 years, there are countless aspects to appreciate and admire about Huang.

One things that is certainly admirable is how he was able to maintain a youthful and joyful attitude after suffering many hardships and losing so many friends.

“An intriguing soul. Too wonderful to describe,” one Weibo commenter wrote about Huang, sharing pictures of Huang Yongyu’s “Scenes of Pooping” (出恭图) work.

Old age did not hold him back. At the age of 70, his paintings sold for millions. When he was in his eighties, he was featured on the cover of Esquire (时尚先生) magazine.

At the age of 82, he stirred controversy in Hong Kong with his “Adam and Eve” sculpture featuring male and female genitalia, leading to complaints from some viewers. When confronted with the backlash, Huang answered, “I just wanted to have a taste of being sued, and see how the government would react” (Ora Ora).

I'm guessing the 98-year-old Huang loved the controversy. When confronted with backlash for his sculpture featuring male and female genitalia in 2007 Hong Kong, Huang answered, "I just wanted to have a taste of being sued, and see how the government would react." pic.twitter.com/kG0MVVM4SN

— Manya Koetse (@manyapan) June 15, 2023

In his nineties, he started driving a Ferrari. He owned mansions in his hometown in Hunan, in Beijing, in Hong Kong, and in Italy – all designed by himself (Chen 2019).

Huang kept working and creating until the end of his life. “It’s good to work diligently. Your work may be meaningful. Maybe it won’t be. Don’t insist on life being particularly meaningful. If it’s happy and interesting, then that’s great enough.”

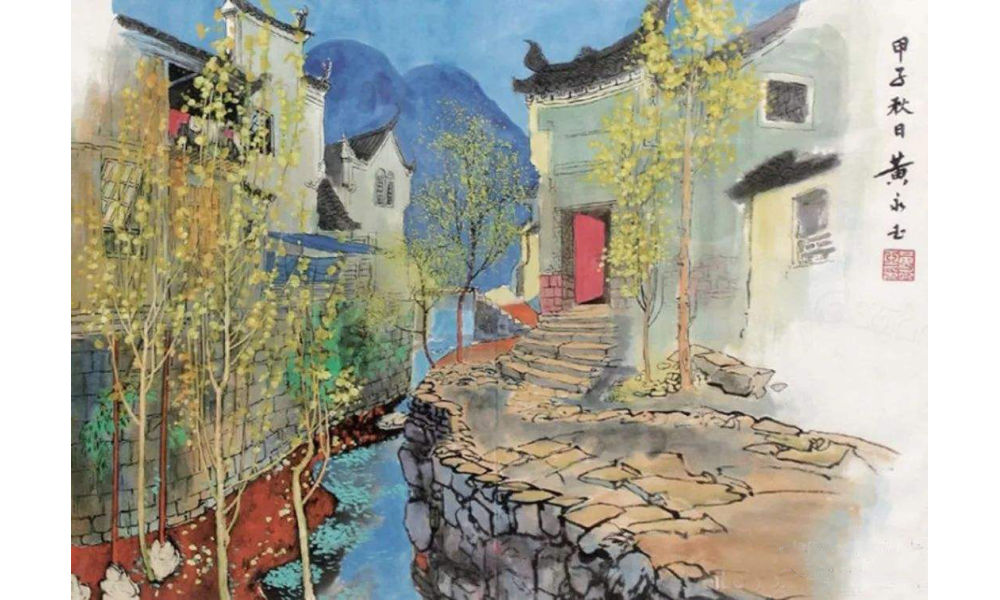

“Hometown Scenery” or rather “Hunan Scenery” (湘西风景) by Huang.

Huang did not dread the end of his life.

“My old friends have all died, I’m the only one left,” he said at the age of 95. He wrote his will early and decided he wanted a memorial service for himself before his final departure. “Quickly come praise me, while I’m still alive,” he said, envisioning himself reclining on a chair in the center of the room, “listening to how everyone applauds me” (CCTV, Sohu).

He stated: “I don’t fear death at all. I always joke that when I die, you should tickle me first and see if I’ll smile” (“对死我是一点也不畏惧,我开玩笑,我等死了之后先胳肢我一下,看我笑不笑”).

Huang with Yiwo (伊喔), the original model for the monkey stamp [Shanghai Observer].

Huang also was not sentimental about what should happen to his ashes. In a 2019 article in Guangming Daily, it was revealed that he suggested to his wife the idea of pouring his ashes into the toilet and flushing them away with the water.

However, his wife playfully retorted, saying, “No, that won’t do. Your life has been too challenging; you would clog the toilet.”

To this, Huang responded, “Then wrap my ashes into dumplings and let everyone [at the funeral] eat them, so you can tell them, ‘You’ve consumed Huang Yongyu’s ashes!'”

But she also opposed of that idea, saying that they would vomit and curse him forever.

Nevertheless, his wife expressed opposition to this idea, citing concerns that it would cause people to vomit and curse him indefinitely.

In response, Huang declared, “Then let’s forget about my ashes. If you miss me after I’m gone, just look up at the sky and the clouds.” Eventually, his wife would pass away before him, in 2020, at the age of 98, having spent 77 years together with Huang.

Huang will surely be missed. Not just by the loved ones he leaves behind, but also by millions of his fans and admirers in China and beyond.

“We will cherish your memory, Mr. Huang,” one Weibo blogger wrote. Others honor Huang by sharing some of his famous quotes, such as, “Sincerity is more important than skill, which is why birds will always sing better than humans” (“真挚比技巧重要,所以鸟总比人唱得好”).

Among thousands of other comments, another social media user bid farewell to Huang Yongyu: “Our fascinating Master has transcended. He is now a fascinating soul. We will fondly remember you.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

References

Andrews, Julia Frances. 1994. Painters and Politics in the People’s Republic of China, 1949-1979. Berkley: University of California Press.

Baike. “Huang Yongyu 黄永玉.” Baidu Baike https://baike.baidu.com/item/%E9%BB%84%E6%B0%B8%E7%8E%89/1501951 [June 14, 2023].

CCTV. 2023. “Why Everyone Loves Huang Yongyu [为什么人人都爱黄永玉].” WeChat 央视网 June 14.

Chen Hongbiao 陈洪标. 2019. “Most Spicy Artist: Featured in a Magazine at 80, Flirting with Lin Qingxia at 91, Playing with Cars at 95, Wants Memorial Service While Still Alive [最骚画家:80岁上杂志,91岁撩林青霞,95岁玩车,活着想开追悼会].” Sohu/Guangming Daily March 16: https://www.sohu.com/a/301686701_819105 [June 15, 2023].

Hawks, Shelley Drake. 2017. The Art of Resistance Painting by Candlelight in Mao’s China. Seattle: University of Washington Press.

Matthysen, Mieke. 2021. Ignorance is Bliss: The Chinese Art of Not Knowing. Palgrave Macmillan.

Ora Ora. “HUANG YONGYU 黃永玉.” Ora Ora https://www.ora-ora.com/artists/103-huang-yongyu/ [June 15, 2023].

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Future is Here

“Bye Bye Biden”: Biden’s Many Nicknames in Chinese

Enjoying the ‘Sea’ in Beijing’s Ditan Park

A Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

Weibo Watch: Get Up, Stand Up

The Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

A Brew of Controversy: Lu Xun and LELECHA’s ‘Smoky’ Oolong Tea

Singing Competition or Patriotic Fight? Hunan TV’s ‘Singer 2024’ Stirs Nationalistic Sentiments

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

Weibo Watch: The Battle for the Bottom Bed

About the “AI Chatbot Based on Xi Jinping” Story

China’s Intensified Social Media Propaganda: “Taiwan Must Return to Motherland”

Weibo Watch: Telling China’s Stories Wrong

Saying Goodbye to “Uncle Wang”: Wang Wenbin Becomes Chinese Ambassador to Cambodia

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight3 months ago

China Insight3 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music4 months ago

China Music4 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Digital10 months ago

China Digital10 months agoToo Sexy for Weibo? Online Discussions on the Concept of ‘Cābiān’

-

China Arts & Entertainment12 months ago

China Arts & Entertainment12 months agoBehind 8 Billion Streams: Who is Dao Lang Cursing in the Chinese Hit Song ‘Luocha Kingdom’?