Backgrounder

Baihang and the Eight Personal Credit Programmes: A Credit Leap Forward

“The personal credit era has arrived,” some netizens say.

Published

6 years agoon

Baihang Credit has received ample coverage in Chinese press recently as it was launched as “the first unified personal-credit information firm” of the PRC. It joins forces with Alibaba, Tencent, and six other big companies in further building on China’s credit-based society. What’s on Weibo provides an overview of the developments that have led to the formation of this powerful credit platform.

Three years after eight commercial firms were granted permission by the People’s Bank of China (PBOC) to start their pilot programmes in operating personal credit systems in 2015, none of them have received a license.

Instead, they’ve now become shareholders and active contributors to a new unified platform that has access to an enormous number of personal credit data. At the so-called ‘trust alliance’ (信联) Baihang Credit (百行征信), state level and commercial organizations join forces in further developing China’s credit systems.

How they can share data without harming Chinese recent laws on privacy, however, remains vague.

Some background

An important moment within this development started over twelve years ago (to be precise: on March 20 of 2006), when the People’s Bank of China (PBOC) began operating its own independent Credit Reference Center. The goal of the brand-new center was to set up the reliable credit checking platform which China was still lacking at the time.

At its core, it was tasked with managing a national commercial and consumer credit reporting system, to enable financial institutions to assess borrowers’ creditworthiness.

Screenshot of The Credit Reference Center website.

In November of 2013, during the Third Plenary Session of the 18th CPC Congress, new plans were adopted to also “establish and improve a social credit system to commend honesty and punish dishonesty” (USC 2013), putting more pressure on the formation of a solid credit checking system in China.

Months later, in 2014, the Chinese State Council issued an official notice concerning the construction of a nationwide Social Credit System that was to be rolled out by 2020 (Creemers 2014).

Three Years of the “Credit Leap Forward”

It is perhaps no coincidence that not too long after the formal announcement of these plans, that would lead to a more credit-based Chinese society, the PBOC Credit Center opened its doors to eight Chinese companies to work on trial programmes to prepare for operating their own personal credit information businesses.

At the time, in 2015, the PBOC’s Credit Center had been around for nearly a decade, yet still ‘only’ covered 25% of the Chinese population, leaving ample risks in the control process of Chinese financial services (Yang 2017).

You could say that 2015 was an important year in which competition for China’s multi-billion personal credit investigation market really began, along with the flourishing of China’s Internet population and the growing demand for personal online data information (Jun 2015). A recent Caixin column by Xinhai Liu (刘新海), associate researcher at the Credit Reference Center, even calls the 2015-2018 period the “Credit Great Leap Forward” (“征信大跃进的三年”).

Besides that new personal credit rating tech firms started to pop up, the year 2015 was also the year when misconceptions arose in foreign media regarding these existing credit systems.* ACLU called it “nightmarish,” falsely claiming that all Chinese would be “measured by a score between 350 and 950, which is linked to their national identity card” and that “the government has announced that it will be mandatory by 2020.”

As explained in our recent article about this issue, these discussions – that continue in foreign media to this day – often blur the lines between the national Social Credit system and a number of private programs. (To understand more about the difference between the government’s Social Credit system and the commercial ones, please read the previous article we featured on this topic.)

These misunderstandings partly come from the fact that both the government’s plans on introducing their ‘Social Credit System’ (社会信用体系) and the Central Bank’s endeavors to build a stronger personal credit industry (个人征信行业) were major developments in the period from 2013-2015 up to the present.

The Eight Programmes

With such a strong demand for solid credit rating systems, why have none of the eight approved tech firms received their license, over three years after starting pilot operations?

One of the main problems with commercial services such as the well-known ‘Sesame Credit’ is, according to PBOC spokesperson Wan Cunzhi, that they are all “isolated islands” (“信息孤岛”) of non-shared data, that they are lacking in independence, and that their data management is not strong enough (Yang 2017).

The coming-together of these “islands” solves this problem and forms one solid platform under the ‘Baihang’ label. Which eight companies does this concern? An overview:

1. Sesame Credit (芝麻信用)

This is the best-known commercial personal credit score programme, implemented by Alibaba’s Ant Financial. Sesame Credit already had 520 million users as of 2017.

Sesame Credit example scores explained, from 385 being in the low range to 731 being in the ‘good’ range.

Sesame Credit was launched in 2015. Because it is part of the Alibaba family, Sesame Credit has an enormous amount of data at its disposal, from e-commerce sites to finance products (Taobao, Tianmao, Alipay, etc), through which it compiles users’ own scores, going from 350-950, for those who have opted into the program. The scores are based on a number of things, including people’s payment history, their contacts and network, and online behavior.

2. Tencent Credit (腾讯征信)

Since the Tencent company currently hosts 55% of China’s mobile internet usage on its platforms (Marr 2018), it has also an enormous amount of data at its disposal. Similar to Sesame Credit, Tencent Credit works with a 300-850 score system. It officially launched a trial of its score programme in January of 2018, but then took it down shortly after.

3. Kaola Credit (考拉征信)

Koala Credit is an independent third-party credit company established by the Shenzhen-based Lakara (拉卡拉) financial services company. Koala Credit was launched in May of 2015, around the same time as Sesame Credit launched its program. Lakara has strategic and powerful partnerships with China Unionpay, five major banks, and hundreds of other financial institutions. Lakara and Koala Credit jointly founded a pioneering lab in China that focuses on big data models. The University of the Chinese Academy of Sciences is involved in this project (Zhuo et al 2016, 299).

4. Pengyuan Credit (鹏元征信)

Established in 2005, Pengyuan Credit is amongst the oldest personal credit investigation firms of the eight selected by the PBOC. The company states on its website that its main goal since 2005 has been to “create a credit reporting ecosphere on the Internet,” shifting from traditional credit rating systems to online credit rating methods.

5. Sinoway Credit (华道征信)

The Beijing Sinoway Credit was established in 2013 by four large financial companies. As explained by BJReview (2016), Sinoway is among those companies (such as Zhima and Tencent) that accumulate data from their business rather than using traditional algorithms to collect financial and public data. They have exclusive access to enterprise data (Zhuo et al 2016, 299).

6. Qianhai Credit Service (深圳前海征信)

Qiu Han, CEO of Qianhai.

Another company established in 2013, Qianhai Credit is based in Shenzhen. It was launched by financial giant Pingan. The current CEO is the female big data specialist Qiu Han (邱寒).

7. China Chengxin Credit (中诚信征信)

The Beijing-based China Chengxin Credit company was founded in 2005, established by the China Chengxin Credit Management group. The firm provides personal credit information and companies and market research services. As described by the China Money Network, its database is connected to local administrations for industry and commerce, police, courts, telecom service providers to provide comprehensive credit information.

8. Intellicredit (中智诚征信)

Intellicredit is a Beijing-based independent, third-party credit registry. CEO Li Xuan (李萱) has previously expressed the company’s goal to handle any loopholes that let scammers get away with fraud in China’s online financial environment. The company is experienced in credit industries both in China and abroad, and its team has also worked on the establishment of the credit reporting system of the PBOC (Zhuo et al 2016, 299).

Baihang & Allies: An Abundance of Personal Data

The formal launch of Baihang Credit (百行征信), the “first unified personal credit information firm” of China, has become big news in Chinese media, with some calling it a personal credit industry game changer.

Lauch of Baihang Credit, May 23 2018 (photo via Weibo).

Baihang Credit is a joint establishment of the aforementioned eight and the China Internet Finance Association.* It received its license in February of this year. The firm officially opened for business on May 23rd of 2018.

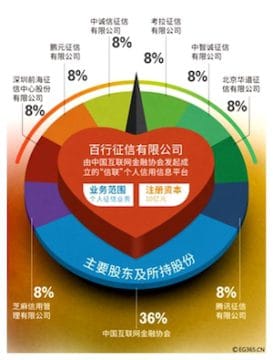

While the China Internet Finance association reportedly holds 36% of the Baihang firm, the other eight shareholders each hold 8% (Zhang & Liu 2018).

^

The eight companies are not just financial investors, but also active contributors and sharers of technology, resources, and data for the Baihang firm. The launch of this joint establishment means that both state-level institutions and commercial enterprises combine their efforts in building a strong personal credit investigation and service platform; the new system now links data collected by these powerful firms such as Tencent to the state-level China Internet Finance Association, which in itself is an initiative by the People’s Bank of China.

Besides basic data including personal information, education level, salaries or employer, companies such as Sesame Credit or Tencent also have access to a rich collection of consumer data, ranging from social media, e-commerce purchases, online travel data, to location, phone records and even social connections.

The eight firms will also play an important role in Baihang’s management. Sesame Credit, Tencent Credit, Qianhai Credit, Sinoway and Koala Credit have all entered the company’s board of directors. The other three companies will join the board of supervisors (Sina Finance 2018). The 57-year-old Zhu Huanqi (朱焕启) will be Baihang’s CEO and president; he previously worked at Huida Asset Management.

The PBOC told Caixin Global that all parts of the eight companies that previously dealt with personal credit ratings will now be incorporated into Baihang. The other parts can continue to operate as data service providers. In the future, Sesame Credit, for example, will continue to research commercial credit services.

Many Questions Linger

While the recent alliance has received ample attention in Chinese media as an important moment in China’s transforming alleged ‘credit-based’ society, many questions still linger.

One Nanjing research institute writes on Weibo: “The joining of these companies means they can share big data. This also means that if a person is behind [in payments] on one platform, they will also have no access to loans on any of the others.”

But is it all about sharing personal financial credit information, or is this about the sharing of other data as well? What are the legal implications of Baihang operations? And to what extent, if at all, will the system link to the upcoming nationwide Social Credit System?

Caixin Global noted that Baihang Credit will face challenges regarding Chinese Cybersecurity Law, which imposes strict limits on ‘secondary uses’ of data beyond its original purpose, and requires individual authorization when personal data is transferred from one institution to another (Sacks 2018; Zhang & Liu 2018).

In this Caixin article, the PBOC’s spokesperson would not elaborate on how Baihang will collect and use personal data. He was only quoted in saying only that contributions to Baihang will be handled “according to market rules.”

“Personal Credit Era has Arrived”

Despite the many articles about Baihang in Chinese media, it has not become a much-discussed topic on social media; netizens discussing Chinese credit systems seem more concerned with the height of their Sesame Credit score.

One Weibo user, however, did write about the Baihang alliance, commenting: “The personal credit era has arrived” (“个人信用时代到来”).

Other people worry about the impact of this alliance, saying: “You’ll see that if you have a negative balance on your bank account, you won’t be able to use the public bathroom anymore.” (Recently, various cities in China are upgrading their public toilets, integrating AI features such as facial recognition for people to receive free toilet paper.)

Some commenters simply call the companies that have joined under Baihang “a pile of trash.”

Although Sesame Credit will not receive a license to operate its personal credit investigation business, it is highly probable that users of their credit programme will still be able to enjoy the perks of, among many other things, entering libraries for free or riding rental bikes without deposit with a high score.

“I’ve just arrived in Hangzhou and can do many things for free,” one person wrote: “I feel like my Credit Score is omnipotent.”

Baihang’s recent alliance is about to make Chinese personal credit scores even more omnipotent – the ‘Credit Leap Forward’ is well underway.

By Manya Koetse

Follow @whatsonweibo

Directly support Manya Koetse. By supporting this author you make future articles possible and help the maintenance and independence of this site. Donate directly through Paypal here. Also check out the What’s on Weibo donations page for donations through creditcard & WeChat and for more information.

* In an article from December of 2015, for example, The Independent suggested that “China has created a social tool which gives people a score for how good a citizen they are,” describing how “China” had put forward “a concept straight out of a cyberpunk dystopia” named Sesame Credit.

* The Chinese Internet Finance Association, also known as the NIFA (National Internet Finance Association) was established in March of 2015 upon approval by the Chinese State Council and Ministry of Civil Affairs. It is a state-level organization.

References (others linked directly within text)

Creemers, Rogier. 2014. “Planning Outline for the Construction of a Social Credit System (2014-2020).” China Copyright and Media, 14 June China https://chinacopyrightandmedia.wordpress.com/2014/06/14/planning-outline-for-the-construction-of-a-social-credit-system-2014-2020/ [10.6.18].

Creditchina. 2018. “百行征信入场,8家股东剥离个人征信业务.” CreditChina.gov, 4 June http://www.creditchina.gov.cn/gerenxinyong/gerenxinyongliebiao/201806/t20180604_117132.html [10.6.18].

Huang, Zhiling. 2016. “Six Obstacles to Producing Reliable Big-Data Credit Reports.” BJ Review, 15 December http://www.bjreview.com/Business/201612/t20161212_800074419.html [9.6.18].

Jun, Wang. 2015. “Road to Credit.” Beijing Review, 3 August http://www.bjreview.com.cn/business/txt/2015-08/03/content_698269.htm [9.6.18].

Marr, Bernard. 2018. “Artificial Intelligence (AI) In China: The Amazing Ways Tencent Is Driving It’s Adoption.” Forbes, 4 June https://www.forbes.com/sites/bernardmarr/2018/06/04/artificial-intelligence-ai-in-china-the-amazing-ways-tencent-is-driving-its-adoption/#5130d54b479a [10.6.18].

Sacks, Samm. 2018. “New China Data Privacy Standard Looks More Far-Reaching than GDPR” CSIS, 29 January https://www.csis.org/analysis/new-china-data-privacy-standard-looks-more-far-reaching-gdpr [9.6.18].

Sina Finance. 2018. “百行征信揭开面纱 芝麻信用腾讯征信等五家入董事会.” sina Finance, 4 January http://finance.sina.com.cn/money/bank/bank_yhfg/2018-01-05/doc-ifyqinzs8775295.shtml [10.6.18].

USC. 2013. “Decision Of The Central Committee Of The Communist Party Of China On Some Major Issues Concerning Comprehensively Deepening The Reform, November 12, 2013.” USC, 12 November https://china.usc.edu/decision-central-committee-communist-party-china-some-major-issues-concerning-comprehensively [10.9.18].

Yang, Felix. 2017. “Is Xinlian the answer to the Individual Credit Checking System in China?” Kapronasia, 25 Aug https://www.kapronasia.com/china-banking-research-category/item/886-is-xinlian-the-answer-to-the-individual-credit-checking-system-in-china.html [10.6.18].

Zhang, Yuzhe, and Liu Xiao. 2018. “Launch of Unified Platform Boots Private Firms From Personal Credit Business.” Caixin Global, May 28 https://www.caixinglobal.com/2018-05-28/launch-of-unified-platform-boots-private-firms-from-personal-credit-business-101258187.html [10.6.18].

Zhuo Huang, Yang Lei & Shihan Shen. 2016. “China’s personal c>edit reporting system in the internet finance era: challenges and opportunities.” China Economic Journal (9:3): 288-303.

Spotted a mistake or want to add something? Please let us know in comments below or email us.

©2018 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya Koetse is the founder and editor-in-chief of whatsonweibo.com. She is a writer, public speaker, and researcher (Sinologist, MPhil) on social trends, digital developments, and new media in an ever-changing China, with a focus on Chinese society, pop culture, and gender issues. She shares her love for hotpot on hotpotambassador.com. Contact at manya@whatsonweibo.com, or follow on Twitter.

Backgrounder

“Oppenheimer” in China: Highlighting the Story of Qian Xuesen

Qian Xuesen is a renowned Chinese scientist whose life shares remarkable parallels with Oppenheimer’s.

Published

10 months agoon

September 16, 2023By

Zilan Qian

They shared the same campus, lived in the same era, and both played pivotal roles in shaping modern history while navigating the intricate interplay between science and politics. With the release of the “Oppenheimer” movie in China, the renowned Chinese scientist Qian Xuesen is being compared to the American J. Robert Oppenheimer.

In late August, the highly anticipated U.S. movie Oppenheimer finally premiered in China, shedding light on the life of the famous American theoretical physicist J. Robert Oppenheimer (1904-1967).

Besides igniting discussions about the life of this prominent scientist, the film has also reignited domestic media and public interest in Chinese scientists connected to Oppenheimer and nuclear physics.

There is one Chinese scientist whose life shares remarkable parallels with Oppenheimer’s. This is aerospace engineer and cyberneticist Qian Xuesen (钱学森, 1911-2009). Like Oppenheimer, he pursued his postgraduate studies overseas, taught at Caltech, and played a pivotal role during World War II for the US.

Qian Xuesen is so widely recognized in China that whenever I introduce myself there, I often clarify my last name by saying, “it’s the same Qian as Qian Xuesen’s,” to ensure that people get my name.

Some Chinese blogs recently compared the academic paths and scholarly contributions of the two scientists, while others highlighted the similarities in their political challenges, including the revocation of their security clearances.

The era of McCarthyism in the United States cast a shadow over Qian’s career, and, similar to Oppenheimer, he was branded as a “communist suspect.” Eventually, these political pressures forced him to return to China.

Although Qian’s return to China made his later life different from Oppenheimer’s, both scientists lived their lives navigating the complex dynamics between science and politics. Here, we provide a brief overview of the life and accomplishments of Qian Xuesen.

Departing: Going to America

Qian Xuesen (钱学森, also written as Hsue-Shen Tsien), often referred to as the “father of China’s missile and space program,” was born in Shanghai in 1911,1 a pivotal year marked by a historic revolution that brought an end to the imperial dynasty and gave rise to the Republic of China.

Much like Oppenheimer, who pursued further studies at Cambridge after completing his undergraduate education, Qian embarked on a journey to the United States following his bachelor’s studies at National Chiao Tung University (now Shanghai Jiao Tong University). He spent a year at Tsinghua University in preparation for his departure.

The year was 1935, during the eighth year of the Chinese Civil War and the fourth year of Japan’s invasion of China, setting the backdrop for his academic pursuits in a turbulent era.

Qian in his office at Caltech (image source).

One year after arriving in the U.S., Qian earned his master’s degree in aeronautical engineering from the Massachusetts Institute of Technology (MIT). Three years later, in 1939, the 27-year-old Qian Xuesen completed his PhD at the California Institute of Technology (Caltech), the very institution where Oppenheimer had been welcomed in 1927. In 1943, Qian solidified his position in academia as an associate professor at Caltech. While at Caltech, Qian helped found NASA’s Jet Propulsion Laboratory.

When World War II began, while Oppenheimer was overseeing the Manhattan Project’s efforts to assist the U.S. in developing the atomic bomb, Qian actively supported the U.S. government. He served on the U.S. government’s Scientific Advisory Board and attained the rank of lieutenant colonel.

The first meeting of the US Department of the Air Force Scientific Advisory Board in 1946. The predecessor, the Scientific Advisory Group, was founded in 1944 to evaluate the aeronautical programs and facilities of the Axis powers of World War II. Qian can be seen standing in the back, the second on the left (image source).

After the war, Qian went to teach at MIT and returned to Caltech as a full-time professor in 1949. During that same year, Mao Zedong proclaimed the establishment of the People’s Republic of China (PRC). Just one year later, the newly-formed nation became involved in the Korean War, and China fought a bloody battle against the United States.

Red Scare: Being Labeled as a Communist

Robert Oppenheimer and Qian Xuesen both had an interest in Communism even prior to World War II, attending communist gatherings and showing sympathy towards the Communist cause.

Qian and Oppenheimer may have briefly met each other through their shared involvement in communist activities. During his time at Caltech, Qian secretly attended meetings with Frank Oppenheimer, the brother of J. Robert Oppenheimer (Monk 2013).

However, it was only after the war that their political leanings became a focal point for the FBI.

Just as the FBI accused Oppenheimer of being an agent of the Soviet Union, they quickly labeled Qian as a subversive communist, largely due to his Chinese heritage. While the government did not succeed in proving that Qian had communist ties with China during that period, they did ultimately succeed in portraying Qian as a communist affiliated with China a decade later.

During the transition from the 1940s to the 1950s, the Cold War was underway, and the anti-communist witch-hunts associated with the McCarthy era started to intensify (BBC 2020).

In 1950, the Korean War erupted, with the People’s Republic of China (PRC) joining North Korea in the conflict against South Korea, which received support from the United States. It was during this tumultuous period that the FBI officially accused Qian of communist sympathies in 1950, leading to the revocation of his security clearance despite objections from Qian’s colleagues. Four years later, in 1954, Robert Oppenheimer went through a similar process.

The 1950’s security hearing of Qian (second left). (Image source).

After losing his security clearance, Qian began to pack up, saying he wanted to visit his aging parents back home. Federal agents seized his luggage, which they claimed contained classified materials, and arrested him on suspicion of subversive activity. Although Qian denied any Communist leanings and rejected the accusation, he was detained by the government in California and spent the next five years under house arrest.

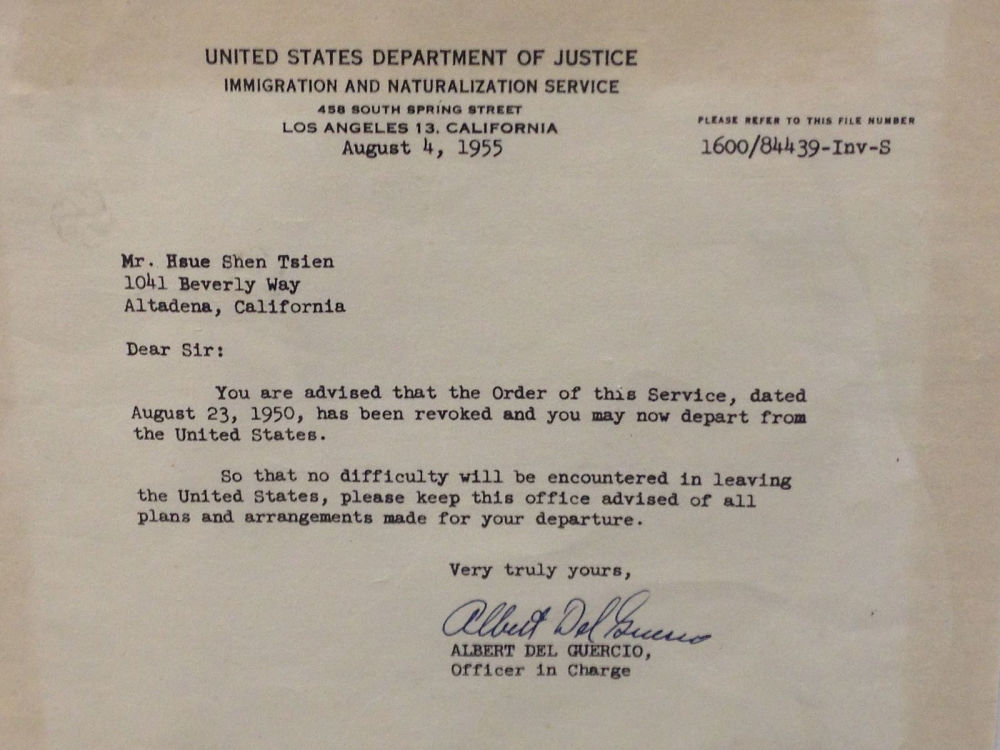

Five years later, in 1955, two years after the end of the Korean War, Qian was sent home to China as part of an apparent exchange for 11 American airmen who had been captured during the war. He told waiting reporters he “would never step foot in America again,” and he kept his promise (BBC 2020).

A letter from the US Immigration and Naturalization Service to Qian Xuesen, dated August 4, 1955, in which he was notified he was allowed to leave the US. The original copy is owned by Qian Xuesen Library of Shanghai Jiao Tong University, where the photo was taken. (Caption and image via wiki).

Dan Kimball, who was the Secretary of the US Navy at the time, expressed his regret about Qian’s departure, reportedly stating, “I’d rather shoot him dead than let him leave America. Wherever he goes, he equals five divisions.” He also stated: “It was the stupidest thing this country ever did. He was no more a communist than I was, and we forced him to go” (Perrett & Bradley, 2008).

Kimball may have foreseen the unfolding events accurately. After his return to China, Qian did indeed assume a pivotal role in enhancing China’s military capabilities, possibly surpassing the potency of five divisions. The missile programme that Qian helped develop in China resulted in weapons which were then fired back on America, including during the 1991 Gulf War (BBC 2020).

Returning: Becoming a National Hero

The China that Qian Xuesen had left behind was an entirely different China than the one he returned to. China, although having relatively few experts in the field, was embracing new possibilities and technologies related to rocketry and space exploration.

Within less than a month of his arrival, Qian was welcomed by the then Vice Prime Minister Chen Yi, and just four months later, he had the honor of meeting Chairman Mao himself.

Qian and Mao (image source).

In China, Qian began a remarkably successful career in rocket science, with great support from the state. He not only assumed leadership but also earned the distinguished title of the “father” of the Chinese missile program, instrumental in equipping China with Dongfeng ballistic missiles, Silkworm anti-ship missiles, and Long March space rockets.

Additionally, his efforts laid the foundation for China’s contemporary surveillance system.

By now, Qian has become somewhat of a folk hero. His tale of returning to China despite being thwarted by the U.S. government has become like a legendary narrative in China: driven by unwavering patriotism, he willingly abandoned his overseas success, surmounted formidable challenges, and dedicated himself to his motherland.

Throughout his lifetime, Qian received numerous state medals in recognition of his work, establishing him as a nationally celebrated intellectual. From 1989 to 2001, the state-launched public movement “Learn from Qian Xuesen” was promoted throughout the country, and by 2001, when Qian turned 90, the national praise for him was on a similar level as that for Deng Xiaoping in the decade prior (Wang 2011).

Qian Xuesen remains a celebrated figure. On September 3rd of this year, a new “Qian Xuesen School” was established in Wenzhou, Zhejiang Province, becoming the sixth high school bearing the scientist’s name since the founding of the first one only a year ago.

In 2017, the play “Qian Xuesen” was performed at Qian’s alma mater, Shanghai Jiaotong University. (Image source.)

Qian Xuesen’s legacy extends well beyond educational institutions. His name frequently appears in the media, including online articles, books, and other publications. There is the Qian Xuesen Library and a museum in Shanghai, containing over 70,000 artefacts related to him. Qian’s life story has also been the inspiration for a theater production and a 2012 movie titled Hsue-Shen Tsien (钱学森).2

Unanswered Questions

As is often the case when people are turned into heroes, some part of the stories are left behind while others are highlighted. This holds true for both Robert Oppenheimer and Qian Xuesen.

The Communist Party of China hailed Qian as a folk hero, aligning with their vision of a strong, patriotic nation. Many Chinese narratives avoid the debate over whether Qian’s return was linked to problems and accusations in the U.S., rather than genuine loyalty to his homeland.

In contrast, some international media have depicted Qian as a “political opportunist” who returned to China due to disillusionment with the U.S., also highlighting his criticism of “revisionist” colleagues during the Cultural Revolution and his denunciation of the 1989 student demonstrations.

Unlike the image of a resolute loyalist favored by the Chinese public, Qian’s political ideology was, in fact, not consistently aligned, and there were instances where he may have prioritized opportunity over loyalty at different stages of his life.

Qian also did not necessarily aspire to be a “flawless hero.” Upon returning to China, he declined all offers to have his biography written for him and refrained from sharing personal information with the media. Consequently, very little is known about his personal life, leaving many questions about the motivations driving him, and his true political inclinations.

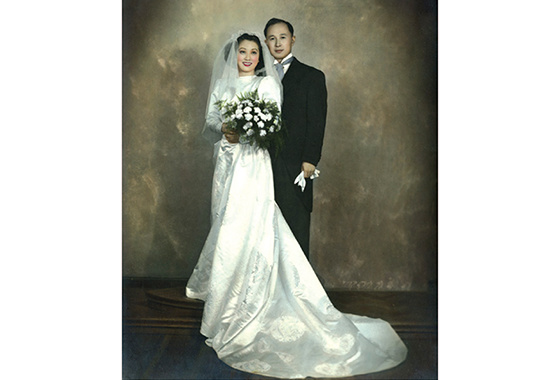

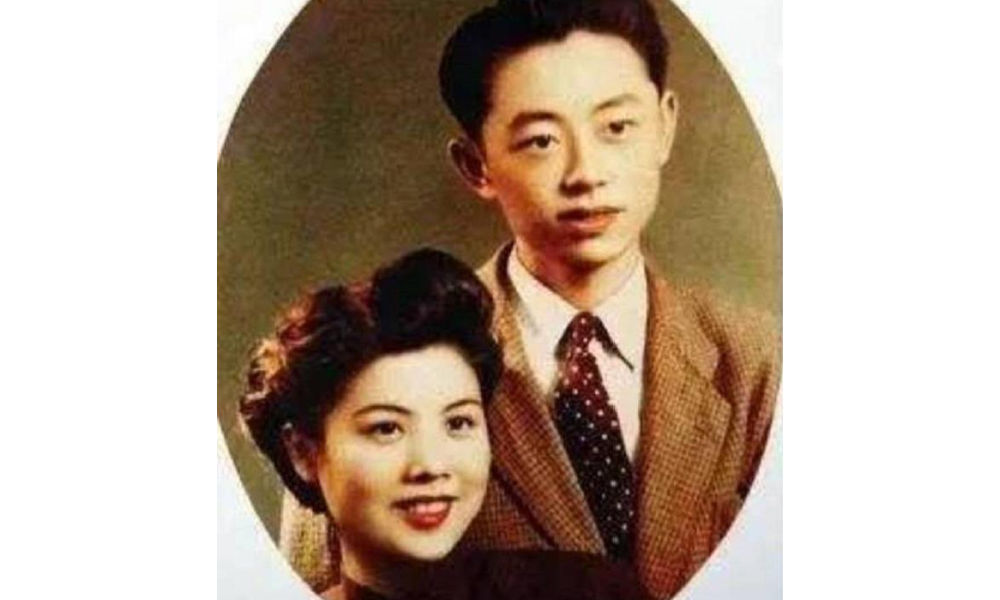

The marriage photo of Qian and Jiang. (Image source).

We do know that Qian’s wife, Jiang Ying (蒋英), had a remarkable background. She was of Chinese-Japanese mixed race and was the daughter of a prominent military strategist associated with Chiang Kai-shek. Jiang Ying was also an accomplished opera singer and later became a professor of music and opera at the Central Conservatory of Music in Beijing.

Just as with Qian, there remain numerous unanswered questions surrounding Oppenheimer, including the extent of his communist sympathies and whether these sympathies indirectly assisted the Soviet Union during the Cold War.

Perhaps both scientists never imagined they would face these questions when they first decided to study physics. After all, they were scientists, not the heroes that some narratives portray them to be.

Also read:

■ Farewell to a Self-Taught Master: Remembering China’s Colorful, Bold, and Iconic Artist Huang Yongyu

■ “His Name Was Mao Anying”: Renewed Remembrance of Mao Zedong’s Son on Chinese Social Media

By Zilan Qian

Follow @whatsonweibo

1 Some sources claim that Qian was born in Hangzhou, while others say he was born in Shanghai with ancestral roots in Hangzhou.

2The Chinese character 钱 is typically romanized as “Qian” in Pinyin. However, “Tsien” is a romanization in Wu Chinese, which corresponds to the dialect spoken in the region where Qian Xuesen and his family have ancestral roots.

This article has been edited for clarity by Manya Koetse

References (other sources hyperlinked in text)

BBC. 2020. “Qian Xuesen: The man the US deported – who then helped China into space.” BBC.com, 27 October https://www.bbc.com/news/stories-54695598 [9.16.23].

Monk, Ray. 2013. Robert Oppenheimer: A Life inside the Center, First American Edition. New York: Doubleday.

Perrett, Bradley, and James R. Asker. 2008. “Person of the Year: Qian Xuesen.” Aviation Week and Space Technology 168 (1): 57-61.

Wang, Ning. 2011. “The Making of an Intellectual Hero: Chinese Narratives of Qian Xuesen.” The China Quarterly, 206, 352-371. doi:10.1017/S0305741011000300

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Backgrounder

Farewell to a Self-Taught Master: Remembering China’s Colorful, Bold, and Iconic Artist Huang Yongyu

Renowned Chinese artist and the creator of the ‘Blue Rabbit’ zodiac stamp Huang Yongyu has passed away at the age of 98. “I’m not afraid to die. If I’m dead, you may tickle me and see if I smile.”

Published

1 year agoon

June 15, 2023

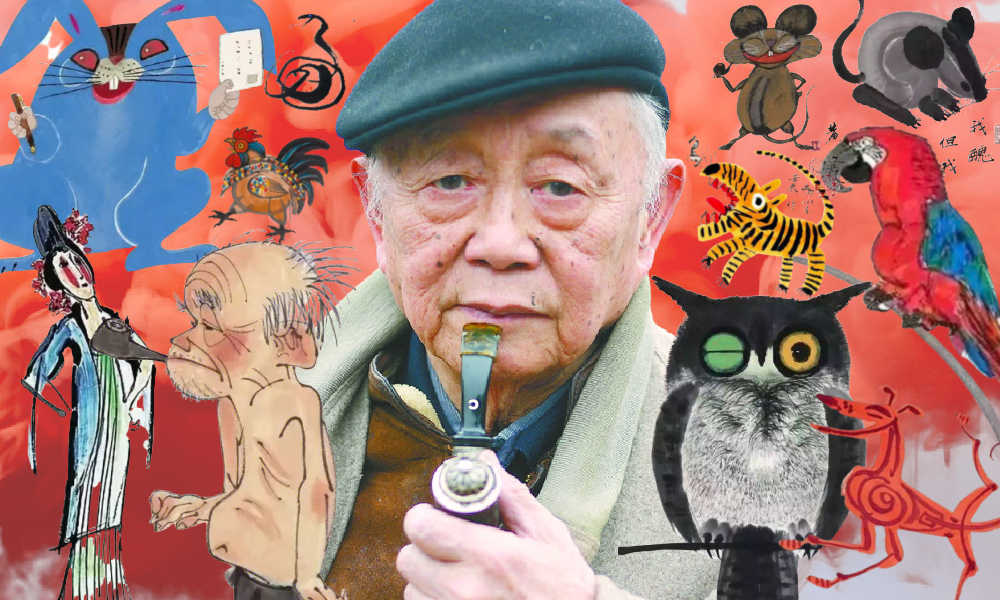

The famous Chinese painter, satirical poet, and cartoonist Huang Yongyu has passed away. Born in 1924, Huang endured war and hardship, yet never lost his zest for life. When his creativity was hindered and his work was suppressed during politically tumultuous times, he remained resilient and increased “the fun of living” by making his world more colorful.

He was a youthful optimist at old age, and will now be remembered as an immortal legend. The renowned Chinese painter and stamp designer Huang Yongyu (黄永玉) passed away on June 13 at the age of 98. His departure garnered significant attention on Chinese social media platforms this week.

On Weibo, the hashtag “Huang Yongyu Passed Away” (#黄永玉逝世#) received over 160 million views by Wednesday evening.

Huang was a member of the China National Academy of Painting (中国国家画院) as well as a Professor at the Central Academy of Fine Arts (中央美术学院).

Huang Yongyu is widely recognized in China for his notable contribution to stamp design, particularly for his iconic creation of the monkey stamp in 1980. Although he designed a second monkey stamp in 2016, the 1980 stamp holds significant historical importance as it marked the commencement of China Post’s annual tradition of releasing zodiac stamps, which have since become highly regarded and collectible items.

Huang’s famous money stamp that was issued by China Post in 1980.

The monkey stamp designed by Huang Yongyu has become a cherished collector’s item, even outside of China. On online marketplaces like eBay, individual stamps from this series are being sold for approximately $2000 these days.

Huang Yongyu’s latest most famous stamp was this year’s China Post zodiac stamp. The stamp, a blue rabbit with red eyes, caused some online commotion as many people thought it looked “horrific.”

Some thought the red-eyed blue rabbit looked like a rat. Others thought it looked “evil” or “monster-like.” There were also those who wondered if the blue rabbit looked so wild because it just caught Covid.

Huang’s (in)famous blue rabbit stamp.

Nevertheless, many people lined up at post offices for the stamps and they immediately sold out.

In light of the controversy, Huang Yongyu spoke about the stamps in a livestream in January of 2023. The 98-year-old artist claimed he had simply drawn the rabbit to spread joy and celebrate the new year, stating, “Painting a rabbit stamp is a happy thing. Everyone could draw my rabbit. It’s not like I’m the only one who can draw this.”

Huang’s response also went viral, with one Weibo hashtag dedicated to the topic receiving over 12 million views (#蓝兔邮票设计者直播回应争议#) at the time. Those defending Huang emphasized how it was precisely his playful, light, and unique approach to art that has made Huang’s work so famous.

A Self-Made Artist

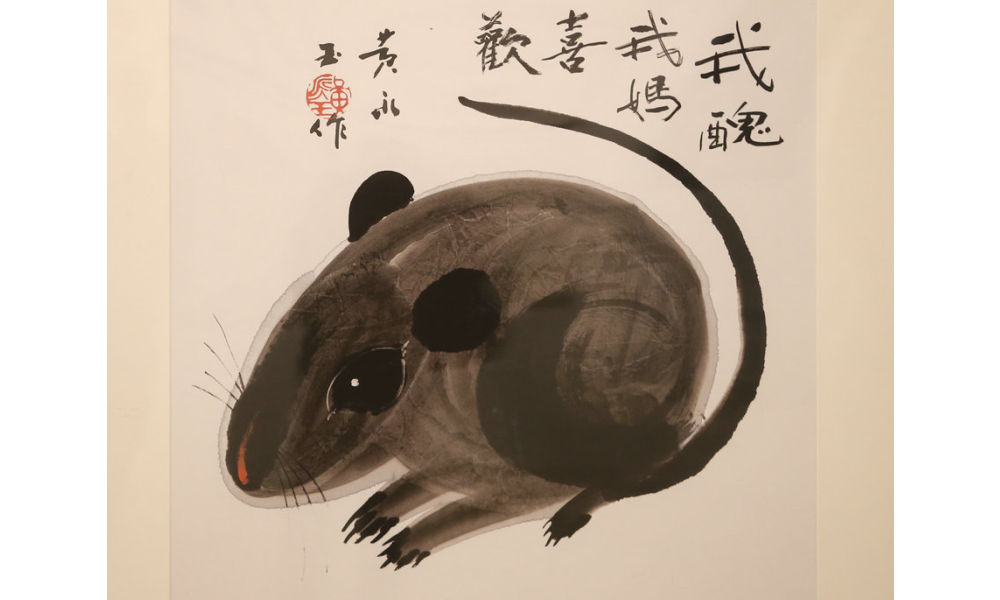

“I’m ugly, but my mum likes me”

‘Ugly Mouse’ by Huang Yongyu [Image via China Daily].

Huang Yongyu was born on August 9, 1924, in Hunan’s Chengde as a native of the Tujia ethnic group.

He was born into an extraordinary family. His grandfather, Huang Jingming (黄镜铭), worked for Xiong Xiling (熊希齡), who would become the Premier of the Republic of China. His first cousin and lifelong friend was the famous Chinese novelist Shen Congwen (沈从文). Huang’s father studied music and art and was good at drawing and playing the accordion. His mother graduated from the Second Provincial Normal School and was the first woman in her county to cut her hair short and wear a short skirt (CCTV).

Born in times of unrest and poverty, Huang never went to college and was sent away to live with relatives at the age of 13. His father would die shortly after, depriving him of a final goodbye. Huang started working in various places and regions, from porcelain workshops in Dehua to artisans’ spaces in Quanzhou. At the age of 16, Huang was already earning a living as a painter and woodcutter, showcasing his talents and setting the foundation for his future artistic pursuits.

When he was 22, Huang married his first girlfriend Zhang Meixi (张梅溪), a general’s daughter, with whom he shared a love for animals. He confessed his love for her when they both found themselves in a bomb shelter after an air-raid alarm.

Huang and Zhang Meixi [163.com]

In his twenties, Huang Yongyu emerged as a sought-after artist in Hong Kong, where he had relocated in 1948 to evade persecution for his left-wing activities. Despite achieving success there, he heeded Shen Congwen’s advice in 1953 and moved to Beijing. Accompanied by his wife and their 7-month-old child, Huang took on a teaching position at the esteemed Central Academy of Fine Arts (中央美术学院).

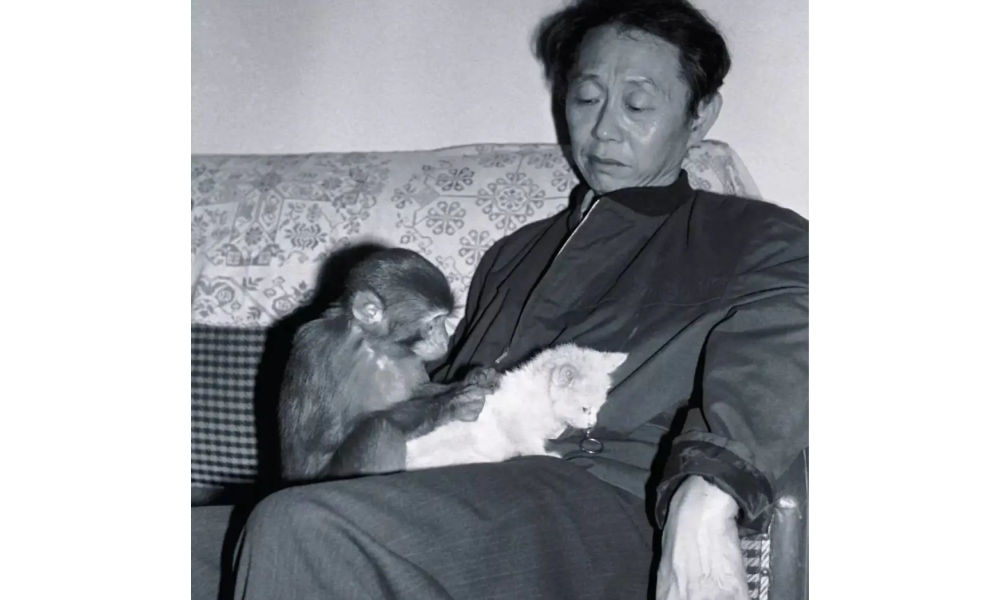

The couple raised all kinds of animals at their Beijing home, from dogs and owls to turkeys and sika deers, and even monkeys and bears (Baike).

Throughout Huang’s career, animals played a significant role, not only reflecting his youthful spirit but also serving as vehicles for conveying satirical messages.

One recurring motif in his artwork was the incorporation of mice. In one of his famous works, a grey mouse is accompanied by the phrase ‘I’m ugly, but my mum likes me’ (‘我丑,但我妈喜欢’), reinforcing the notion that regardless of our outward appearance or circumstances, we remain beloved children in the eyes of our mothers.

As a teacher, Huang liked to keep his lessons open-minded and he, who refused to join the Party himself, stressed the importance of art over politics. He would hold “no shirt parties” in which his all-male studio students would paint in an atmosphere of openness and camaraderie during hot summer nights (Andrews 1994, 221; Hawks 2017, 99).

By 1962, creativity in the classroom was limited and there were far more restrictions to what could and could not be created, said, and taught.

Bright Colors in Dark Times

“Strengthen my resolve and increase the fun of living”

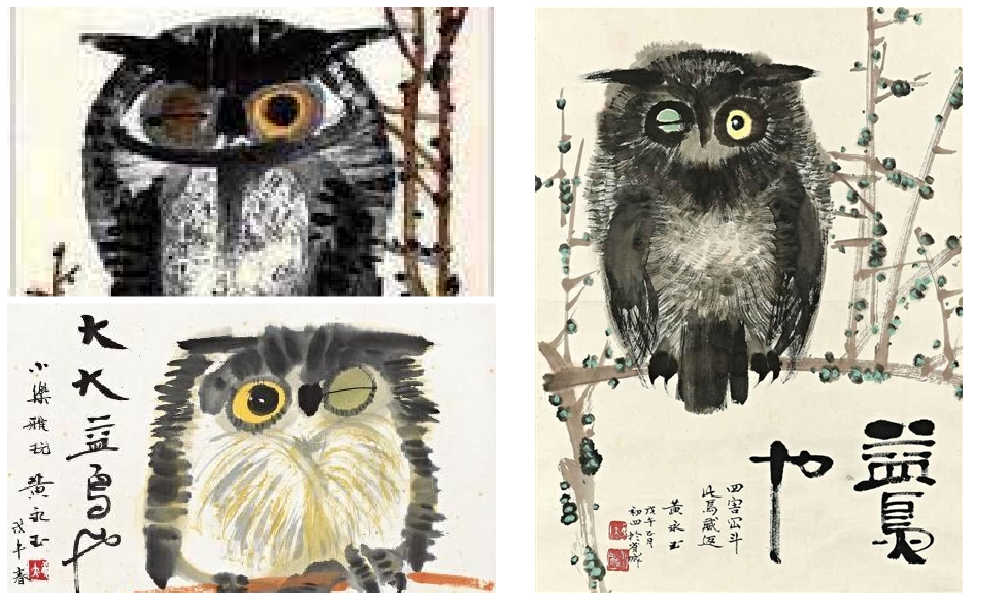

Huang Yongyu’s winking owl, 1973, via Wikiart.

In 1963, Huang was sent to the countryside as part of the “Four Cleanups” movement (四清运动, 1963-1966). Although Huang cooperated with the requirement to attend political meetings and do farm work, he distanced himself from attempts to reform his thinking. In his own time, and even during political meetings, he would continue to compose satirical and humorous pictures and captions centered around animals, which would later turn into his ‘A Can of Worms’ series (Hawks 2017, 99; see Morningsun.org).

Three years later, at the beginning of the Cultural Revolution, many Chinese major artists, including Huang, were detained in makeshift jails called ‘niupeng‘ (牛棚), cowsheds. Huang’s work was declared to be counter-revolutionary, and he was denounced and severely beaten. Despite the difficult circumstances, Huang’s humor and kindness would remind his fellow artist prisoners of the joy of daily living (2017, 95-96).

After his release, Huang and his family were relocated to a cramped room on the outskirts of Beijing. The authorities, thinking they could thwart his artistic pursuits, provided him with a shed that had only one window, which faced a neighbor’s wall. However, this limitation didn’t deter Huang. Instead, he ingeniously utilized vibrant pigments that shone brightly even in the dimly lit space.

During this time, he also decided to make himself an “extra window” by creating an oil painting titled “Eternal Window” (永远的窗户). Huang later explained that the flower blossoms in the paining were also intended to “strengthen my resolve and increase the fun of living” (Hawks 2017, 4; 100-101).

Huang Yongyu’s Eternal Window [Baidu].

In 1973, during the peak of the Cultural Revolution, Huang painted his famous winking owl. The calligraphy next to the owl reads: “During the day people curse me with vile words, but at night I work for them” (“白天人们用恶毒的语言诅咒我,夜晚我为他们工作”) (Matthysen 2021, 165).

The painting was seen as a display of animosity towards the regime, and Huang got in trouble for it. Later on in his career, however, Huang would continue to paint owls. In 1977, when the Cultural Revolution had ended, Huang Yongyu painted other owls to ridicules his former critics (2021, 174).

According to art scholar Shelly Drake Hawks, Huang Yongyu employed animals in his artwork to satirize the realities of life under socialism. This approach can be loosely compared to George Orwell’s famous novel Animal Farm.

However, Huang’s artistic style, vibrant personal life, and boundary-pushing work ethic also draw parallels to Picasso. Like Picasso, Huang embraced a colorful life, adopted an innovative approach to art, and challenged artistic norms.

An Optimist Despite All Hardships

“Quickly come praise me, while I’m still alive”

Huang Yongyu will be remembered in China with love and affection for numerous reasons. Whether it is his distinctive artwork, his mischievous smile and trademark pipe, his unwavering determination to follow his own path despite the authorities’ expectations, or his enduring love for his wife of over 75 years, there are countless aspects to appreciate and admire about Huang.

One things that is certainly admirable is how he was able to maintain a youthful and joyful attitude after suffering many hardships and losing so many friends.

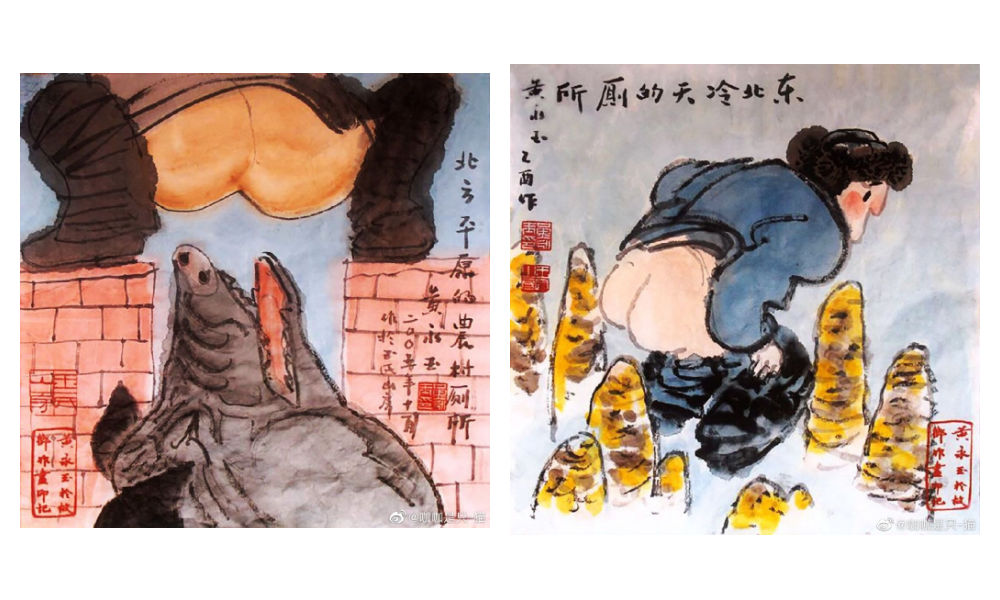

“An intriguing soul. Too wonderful to describe,” one Weibo commenter wrote about Huang, sharing pictures of Huang Yongyu’s “Scenes of Pooping” (出恭图) work.

Old age did not hold him back. At the age of 70, his paintings sold for millions. When he was in his eighties, he was featured on the cover of Esquire (时尚先生) magazine.

At the age of 82, he stirred controversy in Hong Kong with his “Adam and Eve” sculpture featuring male and female genitalia, leading to complaints from some viewers. When confronted with the backlash, Huang answered, “I just wanted to have a taste of being sued, and see how the government would react” (Ora Ora).

I'm guessing the 98-year-old Huang loved the controversy. When confronted with backlash for his sculpture featuring male and female genitalia in 2007 Hong Kong, Huang answered, "I just wanted to have a taste of being sued, and see how the government would react." pic.twitter.com/kG0MVVM4SN

— Manya Koetse (@manyapan) June 15, 2023

In his nineties, he started driving a Ferrari. He owned mansions in his hometown in Hunan, in Beijing, in Hong Kong, and in Italy – all designed by himself (Chen 2019).

Huang kept working and creating until the end of his life. “It’s good to work diligently. Your work may be meaningful. Maybe it won’t be. Don’t insist on life being particularly meaningful. If it’s happy and interesting, then that’s great enough.”

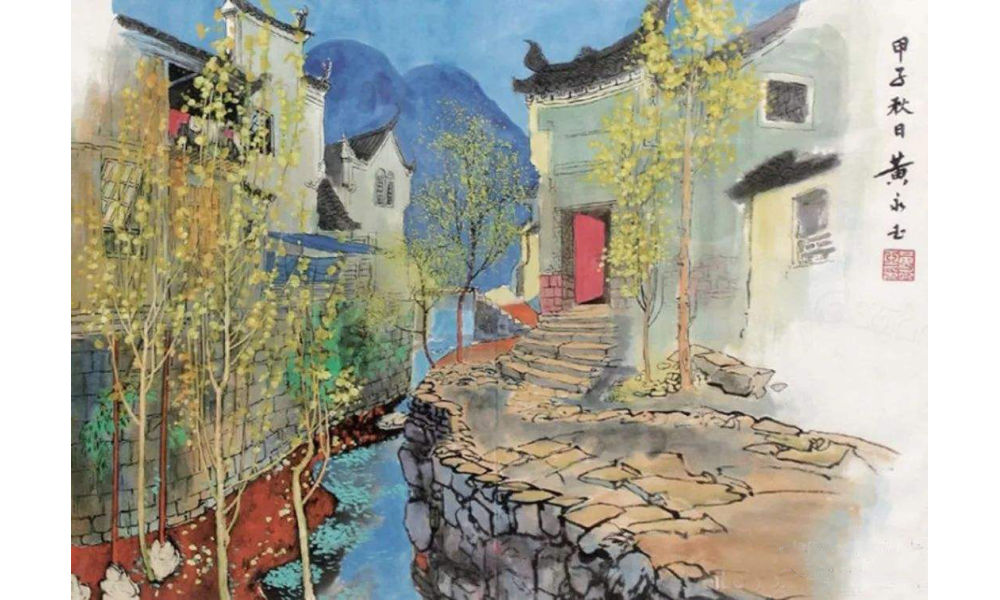

“Hometown Scenery” or rather “Hunan Scenery” (湘西风景) by Huang.

Huang did not dread the end of his life.

“My old friends have all died, I’m the only one left,” he said at the age of 95. He wrote his will early and decided he wanted a memorial service for himself before his final departure. “Quickly come praise me, while I’m still alive,” he said, envisioning himself reclining on a chair in the center of the room, “listening to how everyone applauds me” (CCTV, Sohu).

He stated: “I don’t fear death at all. I always joke that when I die, you should tickle me first and see if I’ll smile” (“对死我是一点也不畏惧,我开玩笑,我等死了之后先胳肢我一下,看我笑不笑”).

Huang with Yiwo (伊喔), the original model for the monkey stamp [Shanghai Observer].

Huang also was not sentimental about what should happen to his ashes. In a 2019 article in Guangming Daily, it was revealed that he suggested to his wife the idea of pouring his ashes into the toilet and flushing them away with the water.

However, his wife playfully retorted, saying, “No, that won’t do. Your life has been too challenging; you would clog the toilet.”

To this, Huang responded, “Then wrap my ashes into dumplings and let everyone [at the funeral] eat them, so you can tell them, ‘You’ve consumed Huang Yongyu’s ashes!'”

But she also opposed of that idea, saying that they would vomit and curse him forever.

Nevertheless, his wife expressed opposition to this idea, citing concerns that it would cause people to vomit and curse him indefinitely.

In response, Huang declared, “Then let’s forget about my ashes. If you miss me after I’m gone, just look up at the sky and the clouds.” Eventually, his wife would pass away before him, in 2020, at the age of 98, having spent 77 years together with Huang.

Huang will surely be missed. Not just by the loved ones he leaves behind, but also by millions of his fans and admirers in China and beyond.

“We will cherish your memory, Mr. Huang,” one Weibo blogger wrote. Others honor Huang by sharing some of his famous quotes, such as, “Sincerity is more important than skill, which is why birds will always sing better than humans” (“真挚比技巧重要,所以鸟总比人唱得好”).

Among thousands of other comments, another social media user bid farewell to Huang Yongyu: “Our fascinating Master has transcended. He is now a fascinating soul. We will fondly remember you.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

References

Andrews, Julia Frances. 1994. Painters and Politics in the People’s Republic of China, 1949-1979. Berkley: University of California Press.

Baike. “Huang Yongyu 黄永玉.” Baidu Baike https://baike.baidu.com/item/%E9%BB%84%E6%B0%B8%E7%8E%89/1501951 [June 14, 2023].

CCTV. 2023. “Why Everyone Loves Huang Yongyu [为什么人人都爱黄永玉].” WeChat 央视网 June 14.

Chen Hongbiao 陈洪标. 2019. “Most Spicy Artist: Featured in a Magazine at 80, Flirting with Lin Qingxia at 91, Playing with Cars at 95, Wants Memorial Service While Still Alive [最骚画家:80岁上杂志,91岁撩林青霞,95岁玩车,活着想开追悼会].” Sohu/Guangming Daily March 16: https://www.sohu.com/a/301686701_819105 [June 15, 2023].

Hawks, Shelley Drake. 2017. The Art of Resistance Painting by Candlelight in Mao’s China. Seattle: University of Washington Press.

Matthysen, Mieke. 2021. Ignorance is Bliss: The Chinese Art of Not Knowing. Palgrave Macmillan.

Ora Ora. “HUANG YONGYU 黃永玉.” Ora Ora https://www.ora-ora.com/artists/103-huang-yongyu/ [June 15, 2023].

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Future is Here

“Bye Bye Biden”: Biden’s Many Nicknames in Chinese

Enjoying the ‘Sea’ in Beijing’s Ditan Park

A Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

Weibo Watch: Get Up, Stand Up

The Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

A Brew of Controversy: Lu Xun and LELECHA’s ‘Smoky’ Oolong Tea

Singing Competition or Patriotic Fight? Hunan TV’s ‘Singer 2024’ Stirs Nationalistic Sentiments

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

Weibo Watch: The Battle for the Bottom Bed

About the “AI Chatbot Based on Xi Jinping” Story

China’s Intensified Social Media Propaganda: “Taiwan Must Return to Motherland”

Weibo Watch: Telling China’s Stories Wrong

Saying Goodbye to “Uncle Wang”: Wang Wenbin Becomes Chinese Ambassador to Cambodia

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight3 months ago

China Insight3 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music4 months ago

China Music4 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Digital10 months ago

China Digital10 months agoToo Sexy for Weibo? Online Discussions on the Concept of ‘Cābiān’

-

China Arts & Entertainment12 months ago

China Arts & Entertainment12 months agoBehind 8 Billion Streams: Who is Dao Lang Cursing in the Chinese Hit Song ‘Luocha Kingdom’?