China Insight

Beijing (Failed) Protests Over Collapse of China’s Peer-to-Peer (P2P) Industry

A P2P Crisis: investors who have lost their savings tried to take their grievances to the street.

Published

6 years agoon

The regulatory crackdown on Chinese online lenders caused a climate of heightened tension in Beijing today, where investors who have lost their savings were trying to take their grievances to the street.

Recent crackdowns on China’s online lending industry have caused some unrest in Beijing today, where planned gatherings by victims who were trying to draw attention to their misfortune were immediately shut down by authorities.

Companies they’ve invested in were either closed down, or the directory boards have simply abandoned their business and have taken off (跑路).

Today, WeChat and Weibo have been buzzing with rumors of people being victimized by the P2P crackdown attempting to gather and protest in various places – one of them being in Beijing.

But local authorities and security guards have been quick to shut down protests, allegedly even barring some travelers from entering the city.

P2P Chaos

China’s P2P industry has seen a quick rise and fall over the past year, causing some panic and chaos.

Earlier this week, China’s New Fortune magazine reported of one case where an investor had just invested 360,000 RMB (±US$52,700) into P2P platform Guojinbao (国金宝), when they discovered the platform was already abandoned the day before, and there was no way to get their money back. It is just one among many recent cases.

Peer-to-peer (P2P) lending (defined as “a method of debt financing that enables individuals to borrow and lend money without the use of an official financial institution as an intermediary“) has experienced unprecedented growth in China over the last 10 years; hundreds of microloan lenders have sprouted up, in place of traditional state-owned banks, to provide funding and capital to everything from companies to individuals.

For many Chinese investors, P2P lending is an apparent attractive alternative investment. Especially because, according to a 2015 case study by the Associate of Chartered Certified Accountants (ACCA), only 9.6% of Chinese people are able to get proper bank loans.

Since China’s mushrooming online lending companies were largely unregulated before, the rise of P2P in China has also given way to a great number of ‘troubled’ companies and lending scams.

(Note: to understand more about the rise and fall of China’s online P2P lending, read this insightful overview by Jiefei Liu at Technode. Also check out our background article “The “Wild West” of Banking in China: Andrew Collier on China’s Shadow Banking” here“.)

As of this year, China’s central government has enacted stricter rules to protect against these kinds of shady business dealings, which have already affected hundreds of thousands of investors.

Stricter monetary policies and renewed regulations have led to a wave of closures this year.

On August 2, TechNode already reported about responses to the crackdown, with people protesting in front of police stations, organizing online investor rights groups, and making collective efforts to pressure authorities to get their money back.

P2P Protests

These responses now seem to intensify. The overseas Chinese community website Boxun reported about a planned protest march in Beijing on August 6, among others near Ritan park, which was cracked down by local authorities.

Alleged bystander videos showed how people were forcefully taken away by police (video and video and video) or how people were questioned on the train to Beijing (video) (NB! We have not been able to verify if these videos were indeed recorded today, we just know that the people posting them on WeChat/YouTube claim they are).

There were also reports of people being taken away on public buses. “Have truly never seen anything like this in Beijing. We counted 120+ buses at site of the (failed) protest against P2P lending fraud, stretching far as the eye can see – all the way to Diaoyutai. Cops nap, wait in each. Petitioners rounded up, shipped off inside. The SCALE..!,” Becky Davis (@rebeccaludavis), China Correspondent for Agence France-Presse, tweeted on her timeline.

A Twitter account named “P2P China Right” (@P2Pweiquan) posted: “As a result of the government’s powerful police force and strict guard, hundreds of buses are waiting at the gate of the CBRC, About 10000 people were forced to take the bus. Announcing: the 8/6 event failed!”

Although today was an especially charged day, it is not the first time Chinese authorities are cracking down on P2P platforms. In October 2015, Chinese authorities already introduced new regulations to reduce lending fraud.

In 2016, more P2P lending companies closed operations as a result of these new regulations. Most notably was Ezubo, a ponzi scheme disguised as a peer-to-peer lender, which allegedly defrauded more than 900,000 people.

By Manya Koetse, Miranda Barnes, and Ryan Gandolfo.

Follow @whatsonweibo

Spotted a mistake or want to add something? Please let us know in comments below or email us.

©2018 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Stories that are authored by the What's on Weibo Team are the stories that multiple authors contributed to. Please check the names at the end of the articles to see who the authors are.

Also Read

China Insight

The Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

The story of ‘Fat Cat’ has become a hot topic in China, sparking widespread sympathy and discussions online.

Published

3 months agoon

May 9, 2024

The tragic story behind the recent suicide of a 21-year-old Chinese gamer nicknamed ‘Fat Cat’ has become a major topic of discussion on Chinese social media, touching upon broader societal issues from unfair gender dynamics to businesses taking advantage of grieving internet users.

The story of a 21-year-old Chinese gamer from Hunan who committed suicide has gone completely viral on Weibo and beyond this week, generating many discussions.

In late April of this year, the young man nicknamed ‘Fat Cat’ (胖猫 Pàng Māo, literally fat or chubby cat), tragically ended his life by jumping into the river near the Chongqing Yangtze River Bridge (重庆长江大桥) following a breakup with his girlfriend. By now, the incident has come to be known as the “Fat Cat Jumping Into the River Incident” (胖猫跳江事件).

News of his suicide soon made its rounds on the internet, and some bloggers started looking into what was behind the story. The man’s sister also spoke out through online channels, and numerous chat records between the young man and his girlfriend emerged online.

One aspect of his story that gained traction in early May is the revelation that the man had invested all his resources into the relationship. Allegedly, he made significant financial sacrifices, giving his girlfriend over 510,000 RMB (approximately 71,000 USD) throughout their relationship, in a time frame of two years.

When his girlfriend ended the relationship, despite all of his efforts, he was devastated and took his own life.

The story was picked up by various Chinese media outlets, and prominent social and political commentator Hu Xijin also wrote a post about Fat Cat, stating the sad story had made him tear up.

As the news spread, it sparked a multitude of hashtags on Weibo, with thousands of netizens pouring out their thoughts and emotions in response to the story.

Playing Games for Love

The main part of this story that is triggering online discussions is how ‘Fat Cat,’ a young man who possessed virtually nothing, managed to provide his girlfriend, who was six years older, with such a significant amount of money – and why he was willing to sacrifice so much in order to do so.

The young man reportedly was able to make money by playing video games, specifically by being a so-called ‘booster’ by playing with others and helping them get to a higher level in multiplayer online battle games.

According to his sister, he started working as a ‘professional’ video gamer as a means of generating money to satisfy his girlfriend, who allegedly always demanded more.

He registered a total of 36 accounts to receive orders to play online games, making 20 yuan per game (about $2.80). Because this consumed all of his time, he barely went out anymore and his social life was dead.

In order to save more money, he tried to keep his own expenses as low as possible, and would only get takeout food for himself for no more than 10 yuan ($1,4). His online avatar was an image of a cat saying “I don’t want to eat vegetables, I want to eat McDonald’s.”

The woman in question who he made so many sacrifices for is named Tan Zhu (谭竹), and she soon became the topic of public scrutiny. In one screenshot of a chat conversation between Tan and her boyfriend that leaked online, she claimed she needed money for various things. The two had agreed to get married later in this year.

Despite of this, she still broke up with him, driving him to jump off the bridge after transferring his remaining 66,000 RMB (9135 USD) to Tan Zhu.

As the story fermented online, Tan Zhu also shared her side of the story. She claimed that she had met ‘Fat Cat’ over two years ago through online gaming and had started a long distance relationship with him. They had actually only met up twice before he moved to Chongqing. She emphasized that financial gain was never a motivating factor in their relationship.

Tan additionally asserted that she had previously repaid 130,000 RMB (18,000 USD) to him and that they had reached a settlement agreement shortly before his tragic death.

Ordering Take-Out to Mourn Fat Cat

– “I hope you rest in peace.”

– “Little fat cat, I hope you’ll be less foolish in your next life.”

– “In your next life, love yourself first.”

These are just a few of the messages left by netizens on notes attached to takeout food deliveries near the Chongqing Yangtze River Bridge.

AI-generated image spread on Chinese social media in connection to the event.

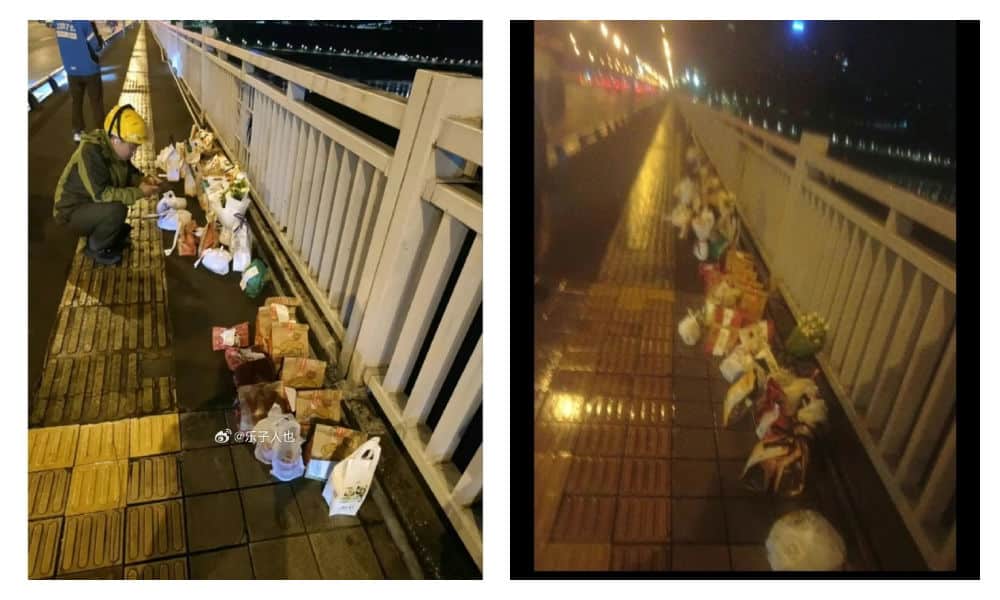

As Fat Cat’s story stirred up significant online discussion, with many expressing sympathy for the young man who rarely indulged in spending on food and drinks, some internet users took the step of ordering McDonalds and other food delivery services to the bridge, where he tragically jumped from, in his honor.

This soon snowballed into more people ordering food and drinks to the bridge, resulting in a constant flow of delivery staff and a pile-up of take-out bags.

Delivery food on the bridge, photo via Weibo.

However, as the food delivery efforts picked up pace, it came to light that some of the deliveries ordered and paid for were either empty or contained something different; certain restaurants, aware of the collective effort to honor the young man, deliberately left the food boxes empty or substituted sodas or tea with tap water.

At least five restaurants were caught not delivering the actual orders. Chinese bubble tea shop ChaPanda was exposed for substituting water for milk tea in their cups. On May 3rd, ChaPanda responded that they had fired the responsible employee.

Another store, the Zhu Xiaoxiao Luosifen (朱小小螺蛳粉), responded on that they had temporarily closed the shop in question to deal with the issue. Chinese fast food chain NewYobo (牛约堡) also acknowledged that at least twenty orders they received were incomplete.

Fast food company Wallace (华莱士) responded to the controversy by stating they had dismissed the employees involved. Mixue Ice Cream & Tea (蜜雪冰城) issued an apology and temporarily closed one of their stores implicated in delivering empty orders.

In the midst of all the controversy, Fat Cat’s sister asked internet users to refrain from ordering take-out food as a means of mourning and honoring her brother.

Nevertheless, take-out food and flowers continued to accumulate near the bridge, prompting local authorities to think of ways of how to deal with this unique method of honoring the deceased gamer.

Gamer Boy Meets Girl

On Chinese social media, this story has also become a topic of debate in the context of gender dynamics and social inequality.

There are some male bloggers who are angry with Tan Zhu, suggesting her behaviour is an example of everything that’s supposedly “wrong” with Chinese women in this day and age.

Others place blame on Fat Cat for believing that he could buy love and maintain a relationship through financial means. This irked some feminist bloggers, who see it as a chauvinistic attitude towards women.

A main, recurring idea in these discussions is that young Chinese men such as Fat Cat, who are at the low end of the social ladder, are actually particularly vulnerable in a fiercely competitive society. Here, a gender imbalance and surplus of unmarried men make it easier for women to potentially exploit those desperate for companionship.

The story of Fat Cat brings back memories of ‘Mo Cha Official,’ a not-so-famous blogger who gained posthumous fame in 2021 when details of his unhappy life surfaced online.

Likewise, the tragic tale of WePhone founder Su Xiangmao (苏享茂) resurfaces. In 2017, the 37-year-old IT entrepreneur from Beijing took his own life, leaving behind a note alleging blackmail by his 29-year-old ex-wife, who demanded 10 million RMB (±1.5 million USD) (read story).

Another aspect of this viral story that is mentioned by netizens is how it gained so much attention during the Chinese May holidays, coinciding with the tragic news of the southern China highway collapse in Guangdong. That major incident resulted in the deaths of at least 48 people, and triggered questions over road safety and flawed construction designs. Some speculate that the prominence given to the Fat Cat story on trending topic lists may have been a deliberate attempt to divert attention away from this incident.

‘Fat Cat’ was cremated. His family stated their intention to take necessary legal steps to recover the money from his former girlfriend, but Tan Zhu reportedly already reached an agreement with the father and settled the case. Nevertheless, the case continues to generate discussions online, with some people wondering: “Is it over yet? Can we talk about something different now?”

Fat Cat images projected in Times Square

However, given that images of the ‘Fat Cat’ avatar have even appeared in Times Square in New York by now (Chinese internet users projected it on one of the big LED screens), it’s likely that this story will be remembered and talked about for some time to come.

UPDATE MAY 25

On May 20, local authorities issued a lengthy report to clarify the timeline of events and details surrounding the death of “Fat Cat,” which had attracted significant attention across China.

The report concluded that there was no fraud involved and that “Fat Cat” and his girlfriend were in a genuine relationship. Tan did not deceive “Fat Cat” for money; the transfers were voluntary. Furthermore, Tan returned most of the money to his parents.

The gamer’s sister is reportedly still being investigated for potentially infringing on Tan’s privacy by disclosing numerous private details to the public.

In the end, one thing is clear in this gamer’s tragic story, which is that there are no winners.

By Manya Koetse

– With contributions by Miranda Barnes and Ruixin Zhang

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Brands, Marketing & Consumers

A Brew of Controversy: Lu Xun and LELECHA’s ‘Smoky’ Oolong Tea

Chinese tea brand LELECHA faced backlash for using the iconic literary figure Lu Xun to promote their “Smoky Oolong” milk tea, sparking controversy over the exploitation of his legacy.

Published

3 months agoon

May 3, 2024

It seemed like such a good idea. For this year’s World Book Day, Chinese tea brand LELECHA (乐乐茶) put a spotlight on Lu Xun (鲁迅, 1881-1936), one of the most celebrated Chinese authors the 20th century and turned him into the the ‘brand ambassador’ of their special new “Smoky Oolong” (烟腔乌龙) milk tea.

LELECHA is a Chinese chain specializing in new-style tea beverages, including bubble tea and fruit tea. It debuted in Shanghai in 2016, and since then, it has expanded rapidly, opening dozens of new stores not only in Shanghai but also in other major cities across China.

Starting on April 23, not only did the LELECHA ‘Smoky Oolong” paper cups feature Lu Xun’s portrait, but also other promotional materials by LELECHA, such as menus and paper bags, accompanied by the slogan: “Old Smoky Oolong, New Youth” (“老烟腔,新青年”). The marketing campaign was a joint collaboration between LELECHA and publishing house Yilin Press.

Lu Xun featured on LELECHA products, image via Netease.

The slogan “Old Smoky Oolong, New Youth” is a play on the Chinese magazine ‘New Youth’ or ‘La Jeunesse’ (新青年), the influential literary magazine in which Lu’s famous short story, “Diary of a Madman,” was published in 1918.

The design of the tea featuring Lu Xun’s image, its colors, and painting style also pay homage to the era in which Lu Xun rose to prominence.

Lu Xun (pen name of Zhou Shuren) was a leading figure within China’s May Fourth Movement. The May Fourth Movement (1915-24) is also referred to as the Chinese Enlightenment or the Chinese Renaissance. It was the cultural revolution brought about by the political demonstrations on the fourth of May 1919 when citizens and students in Beijing paraded the streets to protest decisions made at the post-World War I Versailles Conference and called for the destruction of traditional culture[1].

In this historical context, Lu Xun emerged as a significant cultural figure, renowned for his critical and enlightened perspectives on Chinese society.

To this day, Lu Xun remains a highly respected figure. In the post-Mao era, some critics felt that Lu Xun was actually revered a bit too much, and called for efforts to ‘demystify’ him. In 1979, for example, writer Mao Dun called for a halt to the movement to turn Lu Xun into “a god-like figure”[2].

Perhaps LELECHA’s marketing team figured they could not go wrong by creating a milk tea product around China’s beloved Lu Xun. But for various reasons, the marketing campaign backfired, landing LELECHA in hot water. The topic went trending on Chinese social media, where many criticized the tea company.

Commodification of ‘Marxist’ Lu Xun

The first issue with LELECHA’s Lu Xun campaign is a legal one. It seems the tea chain used Lu Xun’s portrait without permission. Zhou Lingfei, Lu Xun’s great-grandson and president of the Lu Xun Cultural Foundation, quickly demanded an end to the unauthorized use of Lu Xun’s image on tea cups and other merchandise. He even hired a law firm to take legal action against the campaign.

Others noted that the image of Lu Xun that was used by LELECHA resembled a famous painting of Lu Xun by Yang Zhiguang (杨之光), potentially also infringing on Yang’s copyright.

But there are more reasons why people online are upset about the Lu Xun x LELECHA marketing campaign. One is how the use of the word “smoky” is seen as disrespectful towards Lu Xun. Lu Xun was known for his heavy smoking, which ultimately contributed to his early death.

It’s also ironic that Lu Xun, widely seen as a Marxist, is being used as a ‘brand ambassador’ for a commercial tea brand. This exploits Lu Xun’s image for profit, turning his legacy into a commodity with the ‘smoky oolong’ tea and related merchandise.

“Such blatant commercialization of Lu Xun, is there no bottom limit anymore?”, one Weibo user wrote. Another person commented: “If Lu Xun were still alive and knew he had become a tool for capitalists to make money, he’d probably scold you in an article. ”

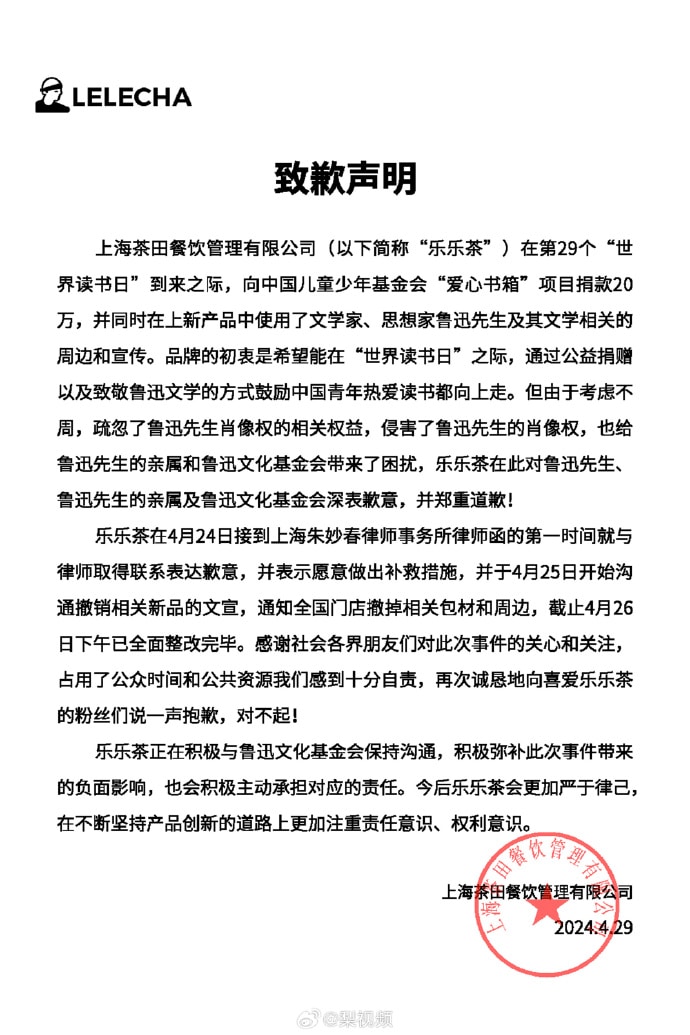

On April 29, LELECHA finally issued an apology to Lu Xun’s relatives and the Lu Xun Cultural Foundation for neglecting the legal aspects of their marketing campaign. They claimed it was meant to promote reading among China’s youth. All Lu Xun materials have now been removed from LELECHA’s stores.

Statement by LELECHA.

On Chinese social media, where the hot tea became a hot potato, opinions on the issue are divided. While many netizens think it is unacceptable to infringe on Lu Xun’s portrait rights like that, there are others who appreciate the merchandise.

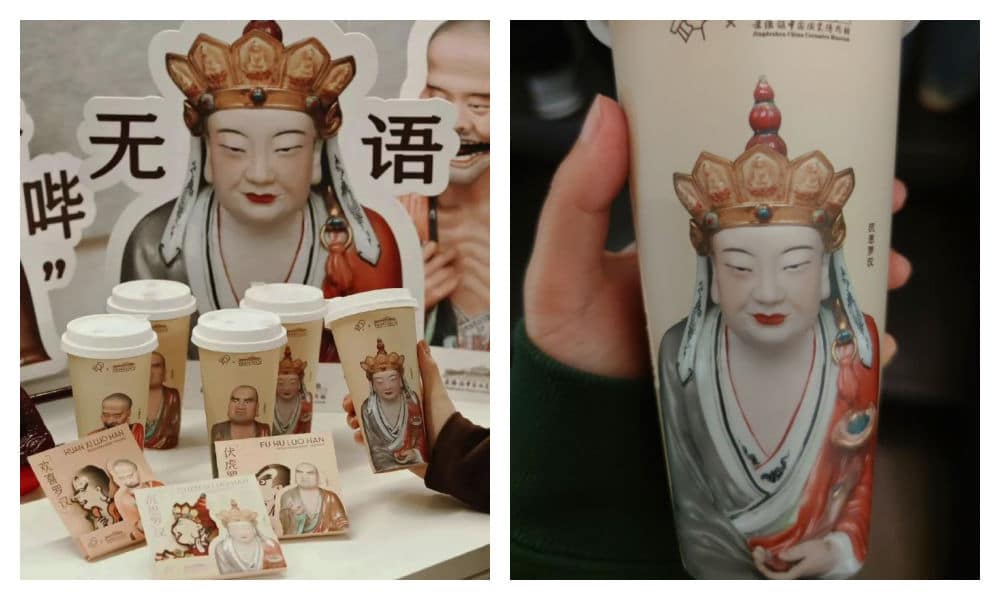

The LELECHA controversy is similar to another issue that went trending in late 2023, when the well-known Chinese tea chain HeyTea (喜茶) collaborated with the Jingdezhen Ceramics Museum to release a special ‘Buddha’s Happiness’ (佛喜) latte tea series adorned with Buddha images on the cups, along with other merchandise such as stickers and magnets. The series featured three customized “Buddha’s Happiness” cups modeled on the “Speechless Bodhisattva” (无语菩萨), which soon became popular among netizens.

The HeyTea Buddha latte series, including merchandise, was pulled from shelves just three days after its launch.

However, the ‘Buddha’s Happiness’ success came to an abrupt halt when the Ethnic and Religious Affairs Bureau of Shenzhen intervened, citing regulations that prohibit commercial promotion of religion. HeyTea wasted no time challenging the objections made by the Bureau and promptly removed the tea series and all related merchandise from its stores, just three days after its initial launch.

Following the Happy Buddha and Lu Xun milk tea controversies, Chinese tea brands are bound to be more careful in the future when it comes to their collaborative marketing campaigns and whether or not they’re crossing any boundaries.

Some people couldn’t care less if they don’t launch another campaign at all. One Weibo user wrote: “Every day there’s a new collaboration here, another one there, but I’d just prefer a simple cup of tea.”

By Manya Koetse

[1]Schoppa, Keith. 2000. The Columbia Guide to Modern Chinese History. New York: Columbia UP, 159.

[2]Zhong, Xueping. 2010. “Who Is Afraid Of Lu Xun? The Politics Of ‘Debates About Lu Xun’ (鲁迅论争lu Xun Lun Zheng) And The Question Of His Legacy In Post-Revolution China.” In Culture and Social Transformations in Reform Era China, 257–284, 262.

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Future is Here

“Bye Bye Biden”: Biden’s Many Nicknames in Chinese

Enjoying the ‘Sea’ in Beijing’s Ditan Park

A Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

Weibo Watch: Get Up, Stand Up

The Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

A Brew of Controversy: Lu Xun and LELECHA’s ‘Smoky’ Oolong Tea

Singing Competition or Patriotic Fight? Hunan TV’s ‘Singer 2024’ Stirs Nationalistic Sentiments

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

Weibo Watch: The Battle for the Bottom Bed

About the “AI Chatbot Based on Xi Jinping” Story

China’s Intensified Social Media Propaganda: “Taiwan Must Return to Motherland”

Weibo Watch: Telling China’s Stories Wrong

Saying Goodbye to “Uncle Wang”: Wang Wenbin Becomes Chinese Ambassador to Cambodia

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight3 months ago

China Insight3 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music4 months ago

China Music4 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Digital10 months ago

China Digital10 months agoToo Sexy for Weibo? Online Discussions on the Concept of ‘Cābiān’

-

China Arts & Entertainment12 months ago

China Arts & Entertainment12 months agoBehind 8 Billion Streams: Who is Dao Lang Cursing in the Chinese Hit Song ‘Luocha Kingdom’?