China Digital

The Lanjisu Fire That Changed China’s ‘Wangba’ Era

The tragic Lanjisu fire led to a nationwide crackdown on internet cafes in China.

Published

6 years agoon

A Beijing internet cafe fire that killed 25 young people in 2002 has become part of China’s collective memory: it was a shift in China’s internet cafe era. June 16 marks the anniversary of this tragic event.

On June 16, 2002, at 2:40 a.m., a devastating fire broke out at a second-story Internet cafe (wangba 网吧) in Beijing’s Haidian, the city’s university district.

News of the tragic fire shocked the entire nation. The fire had instantly killed twenty people and severely injured 17, of whom five later died in the hospital.

All of the dead and injured people were students; 12 of them were from the prep school of the Beijing University of Science and Technology (Wang 2009, 86).

Lanjisu fire, June 16 2002.

Although it did not take long for firefighters to arrive that night, the fire at the Lanjisu (蓝极速, ‘Blue speed’) internet cafe was mainly so disastrous because windows were firmly secured with iron burglar-proof bars, leaving no option for people to escape. The only door was locked; it happened more often that wangba owners would (illegally) operate overnight behind locked doors (Qiu 2009, 33).

Investigators later ruled arson as cause of the fire at the cafe, which was located at Xueyuan Road 20. Traces of gasoline were discovered at the scene, and two teenage male suspects (13-year-old Zhang and 14-year-old Song) were arrested two days later.

The teenage boys were middle school students who used to play games at the internet cafe, but had gotten into a quarrel with other visitors and were not allowed to come in. To take ‘revenge’, they had purchased 1.8 liter of gasoline at a nearby gas station just 3-4 hours before they committed arson.

One of the suspects in 2002 (people.com.cn).

It was later revealed that the two boys both came from poor and shattered families, involving drugs and crime (Lifeweek 2003; Qiu 2015).

In August of 2002, a Beijing court sentenced the 14-year-old boy (Song X.) to life imprisonment, while the 13-year-old was sent to a juvenile re-education center as he was under the age of 14.

A third person, a 17-year-old female also named Zhang, was sentenced to 12 years in prison for being an accomplice; she gave the boys money to buy the petroleum, and knew what they were up to. A fourth minor, a 14-year-old boy by the name of Liu, was sentenced to 18 years in prison for being part of the arson plan. The internet cafe owner was sentenced to 3 years in prison for breaching business and safety rules. The gas station was fined 50,000 yuan for selling gasoline to two minors (Lifeweek 2003; Sina 2008).

A turning point in the wangba boom

The Haidian Lanjisu fire had a big impact on China’s booming internet cafe culture. Internet cafes had been mushrooming in China since the mid and late 1990s. It was the time of Tencent’s highly popular instant messaging software OICQ and multiplayer online games. By 2002 there were thousands of wangba across Chinese cities, many of them unlicensed and illegal, with no fire control equipment.

Internet cafe in 1990s (new.qq.com).

The Lanjisu fire made the problem of China’s wangba a national concern. Not just the unsafe conditions were a reason for worry, but also the impact the internet cafes had on China’s youth, with students spending days on end playing online games in these smoky rooms, leading to a rise in school absence and internet addiction. Beijing’s vice mayor Liu Zhihua condemned internet cafes as “opium dens” for the country’s youth.

The fire led to a huge crackdown on illegal internet cafes. The Beijing authorities launched a campaign that would stop the development of new internet cafes and that would screen all existing wangba one by one, and to close all unlicensed businesses immediately and to confiscate their operational tools (Wang 2009, 87). Across the country, approximately 400,000 internet cafes were closed (Sina 2008).

Second hand confiscated wangba computers (http://www.hkcd.com/).

It also led to the implementation of new rules, such as that there could no longer be internet cafes within a 200-meter radius of schools, that minors were not allowed to enter, and that they had to be closed between midnight and 8 am (Venkatesh 2006, 55)

Since 2005, the remnants of the Lansiju internet cafe have been on display at the Haidian Safety Museum.

Image via People.cn.

The fire is remembered in China as the “6.16 Wangba Big Fire” (6·16网吧大火), and is still being discussed on Chinese social media to this day.

By Manya Koetse

Follow @whatsonweibo

References

Qiu, Jack Linchuan. 2009. Working-Class Network Society

Communication Technology and the Information Have-Less in Urban China. Cambridge, MA: MIT Press.

Qiu, Jack Linchuan. 2015 (2009). “Life and Death in the Chinese Informational City: The Challenges of Working-Class ICTs and the Information Have-less.” In: Living the Information Society in Asia, Erwin Alampay Alampay (ed), 130-157. ISEAS–Yusof Ishak Institute.

Sina. 2008. “北京蓝极速网吧老板今安在.” Sina News, 29 Dec http://news.sina.com.cn/s/2008-12-29/100416941011.shtml [16.6.18].

Venkatesh, P. 2006. “China on the I-way.” In: Strategic Management: Concepts and Cases, Hitt, Duane & Hoskisson (eds), chapter 2. Mason: Thomson Higher Education.

Wang, Xueqin. 2009. “Internet Cafes. What else can be done in addition to rectification?” In: Good governance in China–a way towards social harmony : case studies by China’s rising leaders, edited by Wang Mengkui, Lchapter 8. London & New York: Routledge.

Zhuang, Shan 庄山, Ke Li 柯立, Li Wei 李伟, Wu Ang 巫昂. 2003 (2002). “两个纵火少年和25条生命” [“Two Minor Arsonists and 25 Lives”]. LifeWeek 2002 (26), online April 8 2003 http://www.lifeweek.com.cn/2003/0408/1594.shtml [16.6.2018].

Spotted a mistake or want to add something? Please let us know in comments below or email us.

©2018 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya Koetse is the founder and editor-in-chief of whatsonweibo.com. She is a writer, public speaker, and researcher (Sinologist, MPhil) on social trends, digital developments, and new media in an ever-changing China, with a focus on Chinese society, pop culture, and gender issues. She shares her love for hotpot on hotpotambassador.com. Contact at manya@whatsonweibo.com, or follow on Twitter.

China Arts & Entertainment

Going All In on Short Streaming: About China’s Online ‘Micro Drama’ Craze

For viewers, they’re the ultimate guilty pleasure. For producers, micro dramas mean big profit.

Published

1 month agoon

March 26, 2024By

Ruixin Zhang

PREMIUM CONTENT

Closely intertwined with the Chinese social media landscape and the fast-paced online entertainment scene, micro dramas have emerged as an immensely popular way to enjoy dramas in bite-sized portions. With their short-format style, these dramas have become big business, leading Chinese production studios to compete and rush to create the next ‘mini’ hit.

In February of this year, Chinese social media started flooding with various hashtags highlighting the huge commercial success of ‘online micro-short dramas’ (wǎngluò wēiduǎnjù 网络微短剧), also referred to as ‘micro drama’ or ‘short dramas’ (微短剧).

Stories ranged from “Micro drama screenwriters making over 100k yuan [$13.8k] monthly” to “Hengdian building earning 2.8 million yuan [$387.8k] rent from micro dramas within six months” and “Couple earns over 400 million [$55 million] in a month by making short dramas,” all reinforcing the same message: micro dramas mean big profits. (Respectively #短剧爆款编剧月入可超10万元#, #横店一栋楼半年靠短剧租金收入280万元#, #一对夫妇做短剧每月进账4亿多#.)

Micro dramas, taking China by storm and also gaining traction overseas, are basically super short streaming series, with each episode usually lasting no more than two minutes.

From Horizontal to Vertical

Online short dramas are closely tied to Chinese social media and have been around for about a decade, initially appearing on platforms like Youku and Tudou. However, the genre didn’t explode in popularity until 2020.

That year, China’s State Administration of Radio, Film, and Television (SARFT) introduced a “fast registration and filing module for online micro dramas” to their “Key Online Film and Television Drama Information Filing System.” Online dramas or films can only be broadcast after obtaining an “online filing number.”

Chinese streaming giants such as iQiyi, Tencent, and Youku then began releasing 10-15 minute horizontal short dramas in late 2020. Despite their shorter length and faster pace, they actually weren’t much different from regular TV dramas.

Soon after, short video social platforms like Douyin (TikTok) and Kuaishou joined the trend, launching their own short dramas with episodes only lasting around 3 minutes each.

Of course, Douyin wouldn’t miss out on this trend and actively contributed to boosting the genre. To better suit its interface, Douyin converted horizontal-screen dramas into vertical ones (竖屏短剧).

Then, in 2021, the so-called mini-program (小程序) short dramas emerged, condensing each episode to 1-2 minutes, often spanning over 100 episodes.

These short dramas are advertised on platforms like Douyin, and when users click, they are directed to mini-programs where they need to pay for further viewing. Besides direct payment revenue, micro dramas may also bring in revenue from advertising.

‘Losers’ Striking Back

You might wonder what could possibly unfold in a TV drama lasting just two minutes per episode.

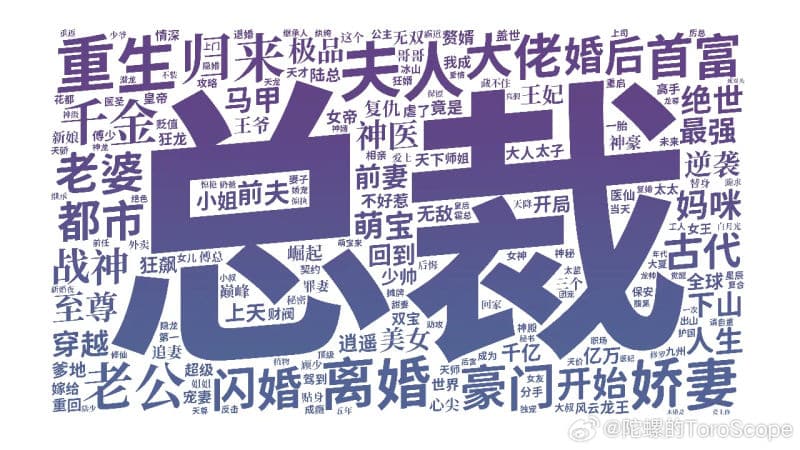

The Chinese cultural media outlet ‘Hedgehog Society’ (刺猬公社) collected data from nearly 6,000 short dramas and generated a word cloud based on their content keywords.

In works targeted at female audiences, the most common words revolve around (romantic) relationships, such as “madam” (夫人) and “CEO” (总裁). Unlike Chinese internet novels from over a decade ago, which often depicted perfect love and luxurious lifestyles, these short dramas offer a different perspective on married life and self-discovery.

According to Hedgehog Society’s data, the frequency of the term “divorce” (离婚) in short dramas is ten times higher than “married” (结婚) or “newlyweds” (新婚). Many of these dramas focus on how the female protagonist builds a better life after divorce and successfully stands up to her ex-husband or to those who once underestimated her — both physically and emotionally.

One of the wordclouds by 刺猬公社.

In male-oriented short dramas, the pursuit of power is a common theme, with phrases like “the strongest in history” (史上最强) and “war god” (战神) frequently mentioned. Another surprising theme is “matrilocal son” (赘婿), the son-in-law who lives with his wife’s family. In China, this term is derogatory, particularly referring to husbands with lower economic income and social status than their wives, which is considered embarrassing in traditional Chinese views. However, in these short dramas, the matrilocal son will employ various methods to earn the respect of his wife’s family and achieve significant success.

Although storylines differ, a recurring theme in these short dramas is protagonists wanting to turn their lives around. This desire for transformation is portrayed from various perspectives, whether it’s from the viewpoint of a wealthy, elite individual or from those with lower social status, such as divorced single women or matrilocal son-in-laws. This “feel-good” sentiment appears to resonate with many Chinese viewers.

Cultural influencer Lu Xuyu (@卢旭宁) quoted from a forum on short dramas, explaining the types of short dramas that are popular: Men seek success and admiration, and want to be pursued by beautiful women. Women seek romantic love or are still hoping the men around them finally wake up. One netizen commented more bluntly: “They are all about the counterattack of the losers (屌丝逆袭).”

The word used here is “diaosi,” a term used by Chinese netizens for many years to describe themselves as losers in a self-deprecating way to cope with the hardships of a competitive life, in which it has become increasingly difficult for Chinese youths to climb the social ladder.

Addicted to Micro Drama

By early 2024, the viewership of China’s micro dramas had soared to 120 million monthly active users, with the genre particularly resonating with lower-income individuals and the elderly in lower-tier markets.

However, short dramas also enjoy widespread popularity among many young people. According to data cited by Bilibili creator Caoxiaoling (@曹小灵比比叨), 64.9% of the audience falls within the 15-29 age group.

For these young viewers, short dramas offer rapid plot twists, meme-worthy dialogues, condensing the content of several episodes of a long drama into just one minute—stripping away everything except the pure “feel-good” sentiment, which seems rare in the contemporary online media environment. Micro dramas have become the ultimate ‘guilty pleasure.’

Various micro dramas, image by Sicomedia.

Even the renowned Chinese actress Ning Jing (@宁静) admitted to being hooked on short dramas. She confessed that while initially feeling “scammed” by the poor production and acting, she became increasingly addicted as she continued watching.

It’s easy to get hooked. Despite criticisms of low quality or shallowness, micro dramas are easy to digest, featuring clear storylines and characters. They don’t demand night-long binge sessions or investment in complex storylines. Instead, people can quickly watch multiple episodes while waiting for their bus or during a short break, satisfying their daily drama fix without investing too much time.

Chasing the gold rush

During the recent Spring Festival holiday, the Chinese box office didn’t witness significant growth compared to previous years. In the meantime, the micro drama “I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈), shot in just 10 days with a post-production cost of 80,000 yuan ($11,000), achieved a single-day revenue exceeding 2 million yuan ($277k). It’s about a college girl who time-travels back to the 1980s, reluctantly getting married to a divorced pig farm owner with kids, but unexpectedly falling in love.

Despite its simple production and clichéd plot, micro dramas like this are drawing in millions of viewers. The producer earned over 100 million yuan ($13 million) from this drama and another short one.

“I Went Back to the 80s and Became a Stepmother” (我在八零年代当后妈).

The popularity of short dramas, along with these significant profits, has attracted many people to join the short drama industry. According to some industry insiders, a short drama production team often involves hundreds or even thousands of contributors who help in writing scripts. These contributors include college students, unemployed individuals, and online writers — seemingly anyone can participate.

By now, Hengdian World Studios, the largest film and television shooting base in China, is already packed with crews filming short dramas. With many production teams facing a shortage of extras, reports have surfaced indicating significant increases in salaries, with retired civil workers even being enlisted as actors.

Despite the overwhelming success of some short dramas like “I Went Back to the 80s and Became a Stepmother,” it is not easy to replicate their formula. The screenwriter of the time-travel drama, Mi Meng (@咪蒙的微故事), is a renowned online writer who is very familiar with how to use online strategies to draw in more viewers. For many average creators, their short drama production journey is much more difficult and less fruitful.

But with low costs and potentially high returns, even if only one out of a hundred productions succeeds, it could be sufficient to recover the expenses of the others. This high-stakes, cutthroat competition poses a significant challenge for smaller players in the micro drama industry – although they actually fueled the genre’s growth.

As more scriptwriters and short dramas flood the market, leading to content becoming increasingly similar, the chances of making profits are likely to decrease. Many short drama platforms have yet to start generating net profits.

This situation has sparked concerns among netizens and critics regarding the future of short dramas. Given the genre’s success and intense competition, a transformation seems inevitable: only the shortest dramas that cater to the largest audiences will survive.

In the meantime, however, netizens are enjoying the hugely wide selection of micro dramas still available to them. One Weibo blogger, Renmin University Professor Ma Liang (@学者马亮), writes: “I spent some time researching short videos and watched quite a few. I must admit, once you start, you just can’t stop. ”

By Ruixin Zhang, edited with further input by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Brands, Marketing & Consumers

Tick, Tock, Time to Pay Up? Douyin Is Testing Out Paywalled Short Videos

Is content payment a new beginning for the popular short video app Douyin (China’s TikTok) or would it be the end?

Published

5 months agoon

November 18, 2023

The introduction of a Douyin novel feature, that would enable content creators to impose a fee for accessing their short video content, has sparked discussions across Chinese social media. Although the feature would benefit creators, many Douyin users are skeptical.

News that Chinese social media app Douyin is rolling out a new feature which allows creators to introduce a paywall for their short video content has triggered online discussions in China this week.

The feature, which made headlines on November 16, is presently in the testing phase. A number of influential content creators are now allowed to ‘paywall’ part of their video content.

Douyin is the hugely popular app by Chinese tech giant Bytedance. TikTok is the international version of the Chinese successful short video app, and although they’re often presented as being the same product, Douyin and Tiktok are actually two separate entities.

In addition to variations in content management and general usage, Douyin differs from TikTok in terms of features. Douyin previously experimented with functionalities such as charging users for accessing mini-dramas on the platform or the ability to tip content creators.

The pay-to-view feature on Douyin would require users to pay a certain fee in Douyin coins (抖币) in order to view paywalled content. One Douyin coin is equivalent to 0.1 yuan ($0,014). The platform itself takes 30% of the income as a service charge.

According to China Securities Times or STCN (证券时报网), Douyin insiders said that any short video content meeting Douyin’s requirements could be set as “pay-per-view.”

Creators, who can set their own paywall prices, should reportedly meet three criteria to qualify for the pay-to-view feature: their account cannot have any violation records for a period of 90 days, they should have at least 100,000 followers, and they have to have completed the real-name authentication process.

On Douyin and Weibo, Chinese netizens express various views on the feature. Many people do not think it would be a good idea to charge money for short videos. One video blogger (@小片片说大片) pointed out the existing challenge of persuading netizens to pay for longer videos, let alone expecting them to pay for shorter ones.

“The moment I’d need to pay money for it, I’ll delete the app,” some commenters write.

This statement appears to capture the prevailing sentiment among most internet users regarding a subscription-based Douyin environment. According to a survey conducted by the media platform Pear Video, more than 93% of respondents expressed they would not be willing to pay for short videos.

An online poll by Pear Video showed that the majority of respondents would not be willing to pay for short videos on Douyin.

“This could be a breaking point for Douyin,” one person predicts: “Other platforms could replace it.” There are more people who think it would be the end of Douyin and that other (free) short video platforms might take its place.

Some commenters, however, had their own reasons for supporting a pay-per-view function on the platform, suggesting it would help them solve their Douyin addiction. One commenter remarked, “Fantastic, this might finally help me break free from watching short videos!” Another individual responded, “Perhaps this could serve as a remedy for my procrastination.”

As discussions about the new feature trended, Douyin’s customer service responded, stating that it would eventually be up to content creators whether or not they want to activate the paid feature for their videos, and that it would be up to users whether or not they would be interested in such content – otherwise they can just swipe away.

Another social media user wrote: “There’s only one kind of video I’m willing to pay for, and it’s not on Douyin.”

By Manya Koetse

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Battle for the Bottom Bed

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

Chengdu Disney: The Quirkiest Hotspot in China

Where to Eat and Drink in Beijing: Yellen’s Picks

The ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

Top 9 Chinese Movies to Watch This Spring Festival Holiday

Party Slogan, Weibo Hashtag: “The Next China Will Still Be China”

From Pitch to Politics: About the Messy Messi Affair in Hong Kong (Updated)

Looking Back on the 2024 CMG Spring Festival Gala: Highs, Lows, and Noteworthy Moments

Two Years After MU5735 Crash: New Report Finds “Nothing Abnormal” Surrounding Deadly Nose Dive

More than Malatang: Tianshui’s Recipe for Success

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

Chengdu Disney: The Quirkiest Hotspot in China

In Hot Water: The Nongfu Spring Controversy Explained

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight2 months ago

China Insight2 months agoThe ‘Two Sessions’ Suggestions: Six Proposals Raising Online Discussions

-

China Arts & Entertainment3 months ago

China Arts & Entertainment3 months agoTop 9 Chinese Movies to Watch This Spring Festival Holiday

-

China Media2 months ago

China Media2 months agoParty Slogan, Weibo Hashtag: “The Next China Will Still Be China”

-

China World2 months ago

China World2 months agoFrom Pitch to Politics: About the Messy Messi Affair in Hong Kong (Updated)