China Brands, Marketing & Consumers

Top 10 Most Popular Smartphones in China 2017 (According to Weibo)

Just before the biggest online shopping events of the year, these are the most popular smartphone brands in China 2017 – a top 10 list compiled by What’s on Weibo.

Published

7 years agoon

The sales of smartphones are going through the roof during China’s annual e-commerce shopping festival Single’s Day (11/11). What smartphone brands and models are the most popular on Chinese social media this year?

UPDATE! Now read our Top 10 of Most Popular Chinese Smartphones in 2018 and check out our Top 10 China’s Most Popular Smartphone Brands & Models (May/June 2019)

The countdown to Single’s Day, China’s annual largest online shopping event on November 11, is about to start. Smartphones are always amongst the top-selling items during the yearly big sale, and the various newly-launched models are hitting the social media top trending topic lists on a daily basis weeks before. Time to take a look into what phones are currently most popular amongst Chinese netizens.

Sina News recently reported that an increasing number of young Chinese consumers are willing to spend their entire monthly income or even more on a new mobile phone. Since more than 95% of Internet users in China use mobile devices rather than desktop computers to go online, chosing the right mobile is all the more important for Chinese consumers.

And for this season, the ‘right mobile’ (1) has a futuristic ‘bezel-less’ screen without edges: the bigger, the brighter, the better. With the growing importance of selfies in this social media era, the perfect phone of the moment (2) also has a high-performing front facing camera. It is also noteworthy that (3) many of the hottest phones of this moment come in various sizes and especially in various trendy colors to offer buyers more choice, tailored to their personal taste.

To create more insight into the most popular smartphone brands in China, we have compiled a list of ten Weibo smartphone brands with the most followers here.* Note that we did not include the iPhone, because despite the various channels related to iPhone on Weibo, there is no official iPhone channel.

To give you an indication, however, the Sina Weibo iPhone User Channel (@微博iPhone客户端) has a staggering 53.3 million followers – which would still make it one of China’s most popular mobile phones on social media, despite its declining popularity due to competition from domestic brands. The launch of the iPhone X on Friday is also a much-anticipated one in China.

The following smartphones currently have the largest following on Sina Weibo. With Single’s Day coming up, all brands are promoting their latest models, giving a hint to consumers on what to buy for the big November 11 online sales:

1. OPPO @OPPO企业官方微博

27.222.000+ followers

The number one smartphone brand in China – according to Weibo – is Oppo, a Guangdong-based brand officially launched in 2004. Oppo is mainly known for targeting China’s young consumers with its trendy designs and smart marketing. In 2016, the brand was ranked as the number 4 smartphone brand globally.

Right before Single’s Day, Oppo is now pushing forward its newest Oppo R11s model phone on social media. The phone will be released on November 2, and together with the much-anticipated R11s Plus model, could become one of the top-sellers on November 11.

Oppo is launching the Oppo R11s as a smartphone that is not just beautiful (with an all-screen ‘bezel-less’ display), but also smart. The phone can be unlocked within 0.08 seconds through the latest facial recognition technology.

Oppo’s smartphones are known as excellent selfie-making-tools, and its latest model is also promoted for having a 20-megapixel front and back camera. Oppo uses the Weibo hashtag ‘Oppo’s All-New 20MP Front&Back R11s’ (#OPPO全新前后2000万R11s#) to discuss the new model. On Tuesday, two days before the official launch, the hashtag was already viewed over 640 million times. There’s no pricing announced yet (will update). Update: prices start at CNY 2999 (±450$).

2. Vivo @Vivo智能手机

23.337.000+ followers

Vivo is another Chinese domestic brand that has gained worldwide success, first entering the market in 2009. Its headquarters are based in Dongguan, Guangdong.

On September 30, Vivo launched its Vivo X20 Plus and VivoX20, the successor of best-seller Vivo X9. With a price of CNY 2,998 (±$450) on JD.com, it is a popular phone that offers some advanced features, 6.01 inch (18:9) full view display, and dual camera setup, for a very reasonable price.

The popularity of the Vivo X20 is evident on Weibo. Hashtag (#vivo全面屏手机X20#) has been viewed over a billion times.

(NB: there is something noteworthy about the Weibo account of Vivo, which had 23+ million followers on October 26, and a staggering 29+ million followers only five days later. Although most reputable brands do not want to associate their brand with fake accounts, it is possible that some fans were bought – or perhaps the brand has just hugely gained popularity over the past week. In that case, it is actually Vivo that is the number one on this list. For now, we’ll stick to the follower numbers as counted between October 24-27.)

3. Xiaomi @小米

16.872.000+ followers

Since the launch of its first smartphone in 2011, Beijing-brand Xiaomi has become one of the world’s largest smartphone makers.

The Xiaomi (Mi) brand was initially often called an ‘iPhone copycat,’ but it is now a trendsetting brand in the smartphone business. With its 2016 Mi Mix model, the brand was among the first to ditch thick bezels and go beyond the 16:9 aspect ratio to introduce the ‘all screen’ or ‘bezel-less’ screens, which are all the buzz now. The Mi Mix became one of the year’s hottest smartphones.

The Mi Mix 2, Xiaomi 6, and Xiaomi Note 3 are the devices currently being promoted through the Xiaomi official Weibo channel.

With a Phillipe Starck design and premium IPS LCD screen, the Mi Mix 2 has already been getting ravenous reviews on tech sites. Some reviews, however, do note its ‘underperforming camera.’

The ‘Xiaomi Note 3’ topic #小米Note3# is also very popular on Weibo, where it has received 560 million views thus far.

It is sold for CNY 2199 (±330$) on JD.com; much cheaper than the Mix 2 which is sold for approximately CNY 3299 (±496$). With a price of CNY 2999 (±450$), the Xiaomi 6 is in between.

4. Honor (荣耀) @荣耀手机

16.638.000+ followers

Honor, established in 2013, is the budget-friendly sister of the Huawei brand. The company’s sub-brand has been doing very well over the past year. Rather than focusing on hyping up its brand name through celebrity campaigns, Honor focuses on great value for money.

On the brand’s Weibo account, it promotes its Honor V9 and Honor V9 Play as the to-buy models for November 11. The latter is currently sold for as low as CNY 999 (±150$). The Honor V9 starts at CNY 2599 (±390$).

Both the Honor V9 (#荣耀V9#) and Honor V9 Play (#荣耀V9play#) have received a lot of attention on social media this year, with millions of views and comments.

The Honor V9 has a 5.7-inch curved glass screen. It has dual SIM and an internal storage of either 64GB or 128GN expandable to 256GB by microSD.

The latest Honor models are available in multiple trendy colors. But above all of this, it is the affordability that makes this phone popular.

5. Huawei @华为

14.631.000+ followers.

Huawei remains to be one of China’s top smartphone brands. Its new model Huawei Mate 10, the follow-up to last year’s Mate 9, became a trending topic on Weibo earlier this week, with the hashtag #华为Mate10# receiving over 480 million views in some days time.

In China, the Mate 10 (128GB) is available at approximately CNY 4499.00 (±675$). With its thin bezels, 5.9-inch display, fingerprint sensor, fast-charging battery, and trendy colors (Midnight Blue, Titanium Gray, Mocha Brown, Pink Gold), this model forms a serious competition to the iPhone X.

6. Meizu @魅族科技

13.509.000+ followers.

Meizu is another Chinese homegrown brand, established by high school dropout Jack Wong (Huáng Zhāng 黄章) in 2003. Since then, it has grown out to be the 11th best-selling smartphone maker in the world.

Its newest model is the Pro 7, starting from CNY 2499 (±375$), follows all the latest trends: it has thin bezels, a strong battery and dual camera, and a slick design. The model is also available in various colors, which is one of the major trends of the season – of course, a pink edition is crucial nowadays.

7. Samsung @三星

8.690.000+ followers.

Samsung has three official accounts on Weibo; Samsung Electronics, Samsung China, and Samsung Galaxy. The latter, by far, has the most followers of the three. This account, with well over 8,5 million followers, is fully dedicated to Samsung’s high-end mobile phones.

The brand is now especially highlighting its Samsung Galaxy Note 8 model. Starting from CNY 6980 (±1050$) this is amongst the most expensive popular smartphones around.

Despite the fact that it is high-tech, the phone has not seen a very warm welcome in China. There could be various reasons for this; political tensions between Korea and China over THAAD, Samsung’s harmed reputation over its battery catastrophe, or simply the fact that Chinese consumers are value-oriented.

The Note 8 is barely any bigger than the cheaper Galaxy S8+. Although Samsung’s Note series became all the rage when they set the ‘phablet’ trend, the newest flagship models of other brands all have comparably large, bezel-less screens. With phones such as the Huawei Mate 10, the Xiaomi Mix 2, Oppo R11s, iPhone X, and Vivo X20, Samsung Note 8 is facing some serious competition within its range.

8. Sony Xperia 索尼Xperia

4.471.900+ followers.

Sony Xperia is the only Japanese brand amongst China’s most popular smartphone brands.

The brand is currently promoting its Xperia XZ Premium, which was first spotted in red back in May when it appeared on Weibo.

The Xperia XZ Premium has a 5.2-inch LCD display and specific rectangular design. With 1,3 million views for the ‘Xperia XZ Premium Launch’ (#索尼xperia xz1发布#) topic on Weibo, the phone is currently not amongst the top hottest models in China.

The brand is promoting its smartphone’s “3D Creator” on Weibo. This feature allows users to scan their face, food, or other objects and makes a 3D avatar of it that can be shared on social media or 3D print. “Can I take a picture of an Xperia XZ Premium and then make a 3D print of an Xperia XZ Premium?”, some netizens jokingly comment.

The model was officially launched in China on October 27, its price (64GB/red) is approximately CNY 6399 (±962$) – a lot more expensive than the budget-friendly red Honor V9.

9. Gionee @金立

3.134.000+ followers.

Gionee is a Chinese smartphone manufacturer based in Shenzhen, Guangdong. Founded in 2002, it is one of China’s largest mobile phone manufacturers.

Gionee is now actively promoting the successor of last year’s M6: the M7 model, which was launched in September 2017.

Its campaign for this phone actively focuses on China’s 30-something generation who are worried about their career and (young) children. Perhaps because Gionee is one of the older brands amongst its new smartphone competitors, it tells the 30-somethings “we’re growing (and advancing) together.”

The M7 has a 6.01-inch full HD display, fingerprint sensor, DUAL-sim, and goes with the trend with its full view 18:9 display. It is priced around CNY 2799 (±420$).

10. Nubia @努比亚

2.518.000+ followers.

As with Meizu and Gionee, Nubia is a Chinese brand that is generally less well-known in Europe or America than other Chinese brands such as Xiaomi or Huawei. Nevertheless, Nubia, owned by parent company ZTE, has been doing very well in China’s top-scoring smartphone lists since it was officially launched in 2015.

Before Single’s Day, the brand is now promoting its newly-launched Z17S and Z17 Mini S model. The first is priced around CNY 2999 (±450$) and the latter is more budget-friendly with CNY 1999 (±300$).

The Z17S (#努比亚Z17S#) competes with all the more expensive flagship models in offering users a 5.73 inch full HD+ screen of 18:9 ratio, and two cameras on the front. It comes in colors black and blue.

An addition to the list

With 2.2+ million followers on Sina Weibo, OnePlus (@一加手机) should also be mentioned here.

Founded in 2013, OnePlus (一加科技) is a relatively new Chinese smartphone brand. Its headquarters are based in Guangdong. The brand’s One Plus 5 model is currently also popular on Sina Weibo, despite being the most expensive phone (CNY 4288/645$) the brand has ever made.

Recent top-selling lists

A recent top 30 list (in Chinese, September 27) of best-sold smartphones on e-commerce platform Tmall shows the following top 10:

1. Honor8 32 GB (¥1099/±165$)

2. iPhone7 Plus 32GB (¥5198/±785$)

3. Vivo X9 64GB (¥2598/±392$)

4. Huawei Mate9 32 GB (¥2899/±437$)

5. Oppo RII 64GB (¥2999/±452$)

6. Samsung Galaxy S8 64GB (¥5688/±858$)

7. Honor V9 64GB (¥2699/±407$)

8. Oppo R9S Plus 64 GB (¥3199/±482$)

9. Gionee M2017 128 GB (¥6999/)

10. Moto Z 65 GB (¥3699/±558$)

According to this week’s (last week of October) best-selling smartphones (热卖排行), Suning and JD.com – some of China’s top mobile phone retailers – both show a different top 3:

Suning:

1. Apple iPhone 8 64GB

2. Apple iPhone 8 Plus

3. Xiaomi Redmi 4x 64GB

JD.com:

1. Xiaomi Mix2 64GB

2. Xiaomi 6 128 GB

3. Vivo X20 64 GB

The many different top smartphone lists on Chinese tech and e-commerce sites show that smartphone trends are changing fast, and also suggests that best-phone-lists on Chinese media sites often differ from each other for various reasons.

According to some predictions by experts on Weibo, the hottest phones of this year’s online e-commerce festival on November 11 will be the iPhone X, Xiaomi MIX2, Meizu Pro 7, Oppo R11, Vivo X20 and the OnePlus 5.

By Manya Koetse

Follow @whatsonweibo

* This list does not take the possible use of manipulated followers into account here.

Spotted a mistake or want to add something? Please let us know in comments below or email us.

©2017 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya Koetse is the founder and editor-in-chief of whatsonweibo.com. She is a writer, public speaker, and researcher (Sinologist, MPhil) on social trends, digital developments, and new media in an ever-changing China, with a focus on Chinese society, pop culture, and gender issues. She shares her love for hotpot on hotpotambassador.com. Contact at manya@whatsonweibo.com, or follow on Twitter.

China Books & Literature

Why Chinese Publishers Are Boycotting the 618 Shopping Festival

Bookworms love to get a good deal on books, but when the deals are too good, it can actually harm the publishing industry.

Published

2 months agoon

June 8, 2024By

Ruixin Zhang

JD.com’s 618 shopping festival is driving down book prices to such an extent that it has prompted a boycott by Chinese publishers, who are concerned about the financial sustainability of their industry.

When June begins, promotional campaigns for China’s 618 Online Shopping Festival suddenly appear everywhere—it’s hard to ignore.

The 618 Festival is a product of China’s booming e-commerce culture. Taking place annually on June 18th, it is China’s largest mid-year shopping carnival. While Alibaba’s “Singles’ Day” shopping festival has been taking place on November 11th since 2009, the 618 Festival was launched by another Chinese e-commerce giant, JD.com (京东), to celebrate the company’s anniversary, boost its sales, and increase its brand value.

By now, other e-commerce platforms such as Taobao and Pinduoduo have joined the 618 Festival, and it has turned into another major nationwide shopping spree event.

For many book lovers in China, 618 has become the perfect opportunity to stock up on books. In previous years, e-commerce platforms like JD.com and Dangdang (当当) would roll out tempting offers during the festival, such as “300 RMB ($41) off for every 500 RMB ($69) spent” or “50 RMB ($7) off for every 100 RMB ($13.8) spent.”

Starting in May, about a month before 618, the largest bookworm community group on the Douban platform, nicknamed “Buying Like Landsliding, Reading Like Silk Spinning” (买书如山倒,看书如抽丝), would start buzzing with activity, discussing book sales, comparing shopping lists, or sharing views about different issues.

Social media users share lists of which books to buy during the 618 shopping festivities.

This year, however, the mood within the group was different. Many members posted that before the 618 season began, books from various publishers were suddenly taken down from e-commerce platforms, disappearing from their online shopping carts. This unusual occurrence sparked discussions among book lovers, with speculations arising about a potential conflict between Chinese publishers and e-commerce platforms.

A joint statement posted in May provided clarity. According to Chinese media outlet The Paper (@澎湃新闻), eight publishers in Beijing and the Shanghai Publishing and Distribution Association, which represent 46 publishing units in Shanghai, issued a statement indicating they refuse to participate in this year’s 618 promotional campaign as proposed by JD.com.

The collective industry boycott has a clear motivation: during JD’s 618 promotional campaign, which offers all books at steep discounts (e.g., 60-70% off) for eight days, publishers lose money on each book sold. Meanwhile, JD.com continues to profit by forcing publishers to sell books at significantly reduced prices (e.g., 80% off). For many publishers, it is simply not sustainable to sell books at 20% of the original price.

One person who has openly spoken out against JD.com’s practices is Shen Haobo (沈浩波), founder and CEO of Chinese book publisher Motie Group (磨铁集团). Shen shared a post on WeChat Moments on May 31st, stating that Motie has completely stopped shipping to JD.com as it opposes the company’s low-price promotions. Shen said it felt like JD.com is “repeatedly rubbing our faces into the ground.”

Nevertheless, many netizens expressed confusion over the situation. Under the hashtag topic “Multiple Publishers Are Boycotting the 618 Book Promotions” (#多家出版社抵制618图书大促#), people complained about the relatively high cost of physical books.

With a single legitimate copy often costing 50-60 RMB ($7-$8.3), and children’s books often costing much more, many Chinese readers can only afford to buy books during big sales. They question the justification for these rising prices, as books used to be much more affordable.

Book blogger TaoLangGe (@陶朗歌) argues that for ordinary readers in China, the removal of discounted books is not good news. As consumers, most people are not concerned with the “life and death of the publishing industry” and naturally prefer cheaper books.

However, industry insiders argue that a “price war” on books may not truly benefit buyers in the end, as it is actually driving up the prices as a forced response to the frequent discount promotions by e-commerce platforms.

China News (@中国新闻网) interviewed publisher San Shi (三石), who noted that people’s expectations of book prices can be easily influenced by promotional activities, leading to a subconscious belief that purchasing books at such low prices is normal. Publishers, therefore, feel compelled to reduce costs and adopt price competition to attract buyers. However, the space for cost reduction in paper and printing is limited.

Eventually, this pressure could affect the quality and layout of books, including their binding, design, and editing. In the long run, if a vicious cycle develops, it would be detrimental to the production and publication of high-quality books, ultimately disappointing book lovers who will struggle to find the books they want, in the format they prefer.

This debate temporarily resolved with JD.com’s compromise. According to The Paper, JD.com has started to abandon its previous strategy of offering extreme discounts across all book categories. Publishers now have a certain degree of autonomy, able to decide the types of books and discount rates for platform promotions.

While most previously delisted books have returned for sale, JD.com’s silence on their official social media channels leaves people worried about the future of China’s publishing industry in an era dominated by e-commerce platforms, especially at a time when online shops and livestreamers keep competing over who has the best book deals, hyping up promotional campaigns like ‘9.9 RMB ($1.4) per book with free shipping’ to ‘1 RMB ($0.15) books.’

This year’s developments surrounding the publishing industry and 618 has led to some discussions that have created more awareness among Chinese consumers about the true price of books. “I was planning to bulk buy books this year,” one commenter wrote: “But then I looked at my bookshelf and saw that some of last year’s books haven’t even been unwrapped yet.”

Another commenter wrote: “Although I’m just an ordinary reader, I still feel very sad about this situation. It’s reasonable to say that lower prices are good for readers, but what I see is an unfavorable outlook for publishers and the book market. If this continues, no one will want to work in this industry, and for readers who do not like e-books and only prefer physical books, this is definitely not a good thing at all!”

By Ruixin Zhang, edited with further input by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

China Brands, Marketing & Consumers

Chinese Sun Protection Fashion: Move over Facekini, Here’s the Peek-a-Boo Polo

From facekini to no-face hoodie: China’s anti-tan fashion continues to evolve.

Published

2 months agoon

June 6, 2024

It has been ten years since the Chinese “facekini”—a head garment worn by Chinese ‘aunties’ at the beach or swimming pool to prevent sunburn—went international.

Although the facekini’s debut in French fashion magazines did not lead to an international craze, it did turn the term “facekini” (脸基尼), coined in 2012, into an internationally recognized word.

The facekini went viral in 2014.

In recent years, China has seen a rise in anti-tan, sun-protection garments. More than just preventing sunburn, these garments aim to prevent any tanning at all, helping Chinese women—and some men—maintain as pale a complexion as possible, as fair skin is deemed aesthetically ideal.

As temperatures are soaring across China, online fashion stores on Taobao and other platforms are offering all kinds of fashion solutions to prevent the skin, mainly the face, from being exposed to the sun.

One of these solutions is the reversed no-face sun protection hoodie, or the ‘peek-a-boo polo,’ a dress shirt with a reverse hoodie featuring eye holes and a zipper for the mouth area.

This sun-protective garment is available in various sizes and models, with some inspired by or made by the Japanese NOTHOMME brand. These garments can be worn in two ways—hoodie front or hoodie back. Prices range from 100 to 280 yuan ($13-$38) per shirt/jacket.

The no-face hoodie sun protection shirt is sold in various colors and variations on Chinese e-commerce sites.

Some shops on Taobao joke about the extreme sun-protective fashion, writing: “During the day, you don’t know which one is your wife. At night they’ll return to normal and you’ll see it’s your wife.”

On Xiaohongshu, fashion commenters note how Chinese sun protective clothing has become more extreme over the past few years, with “sunburn protection warriors” (防晒战士) thinking of all kinds of solutions to avoid a tan.

Although there are many jokes surrounding China’s “sun protection warriors,” some people believe they are taking it too far, even comparing them to Muslim women dressed in burqas.

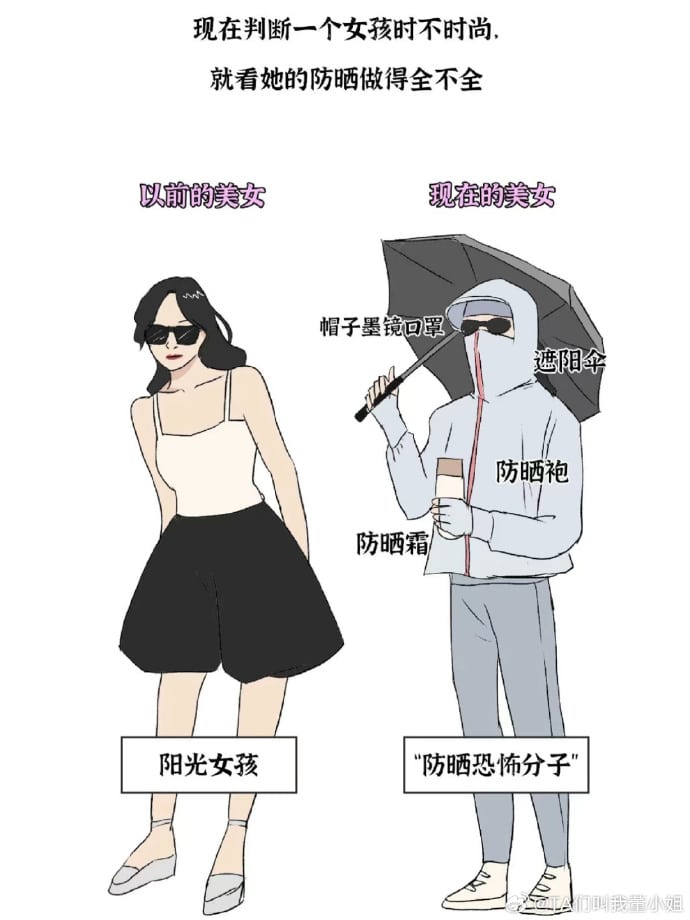

Image shared on Weibo by @TA们叫我董小姐, comparing pretty girls before (left) and nowadays (right), also labeled “sunscreen terrorists.”

Some Xiaohongshu influencers argue that instead of wrapping themselves up like mummies, people should pay more attention to the UV index, suggesting that applying sunscreen and using a parasol or hat usually offers enough protection.

By Manya Koetse, with contributions by Miranda Barnes

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Subscribe

Weibo Watch: The Future is Here

“Bye Bye Biden”: Biden’s Many Nicknames in Chinese

Enjoying the ‘Sea’ in Beijing’s Ditan Park

A Triumph for “Comrade Trump”: Chinese Social Media Reactions to Trump Rally Shooting

Weibo Watch: Get Up, Stand Up

The Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

“Old Bull Eating Young Grass”: 86-Year-Old Chinese Painter Fan Zeng Marries 36-Year-Old Xu Meng

A Brew of Controversy: Lu Xun and LELECHA’s ‘Smoky’ Oolong Tea

Singing Competition or Patriotic Fight? Hunan TV’s ‘Singer 2024’ Stirs Nationalistic Sentiments

Zara Dress Goes Viral in China for Resemblance to Haidilao Apron

Weibo Watch: The Battle for the Bottom Bed

About the “AI Chatbot Based on Xi Jinping” Story

China’s Intensified Social Media Propaganda: “Taiwan Must Return to Motherland”

Weibo Watch: Telling China’s Stories Wrong

Saying Goodbye to “Uncle Wang”: Wang Wenbin Becomes Chinese Ambassador to Cambodia

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight3 months ago

China Insight3 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music4 months ago

China Music4 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Digital10 months ago

China Digital10 months agoToo Sexy for Weibo? Online Discussions on the Concept of ‘Cābiān’

-

China Arts & Entertainment12 months ago

China Arts & Entertainment12 months agoBehind 8 Billion Streams: Who is Dao Lang Cursing in the Chinese Hit Song ‘Luocha Kingdom’?

Ed Sander

November 6, 2017 at 3:25 am

OnePlus is basically owned by Oppo.

I personally wouldn’t look at Weibo followers or online sales to determine the popularity of smartphones. As you mentioned, zombie-followers can be bought and ‘old followers’ do not necessarily have to use that phone anymore.

Online sales on specific platforms are influenced by promotions and do not take into account the offline sales, which are pretty important for brands like Oppo, Vivo and Huawei.

I would advise to look at figures by the IDC instead. Earlier this year, based on market share, the top 5 was: Huawei, Oppo, Vivo, iPhone and Xiaomi.

Another source, Gfk, showed the same ranking in May, while market research firm Counterpoint had Apple and Xiaomi switching places.

Ed

admin

November 6, 2017 at 3:37 am

It is true that popularity on Weibo does not necessarily represent sales figures. This is just a list we wanted to provide of the brands with most following on Weibo, of which the hashtags of new model announcements are topping the trending topics lists daily. If readers are looking for a different type of list they should certainly follow the lists you advice.

Compare phones side by side

January 9, 2018 at 2:32 pm

This is really one of the best post and great information about smartphones, I liked it and enjoyed reading it. Keep sharing such an important posts

mobile makr

January 30, 2018 at 11:48 am

oppo and vivo are no.1 stupid phones xxxxxxxxx 🙁

Srinivas

February 8, 2018 at 6:50 pm

Well, the article very much useful about top china mobiles. Also read about top 5 Indian Smart phones (Non-China) with price and specification

CLICK ON LINK

http://gstrendsnow.blogspot.in/2018/02/top-5-indian-brand-smart-phones-non.html